Scarcer than Bitcoin

[Something Interesting Issue #2]

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Is Tether going to tank the crypto market? (reader submitted question)

The only thing scarcer than Bitcoin

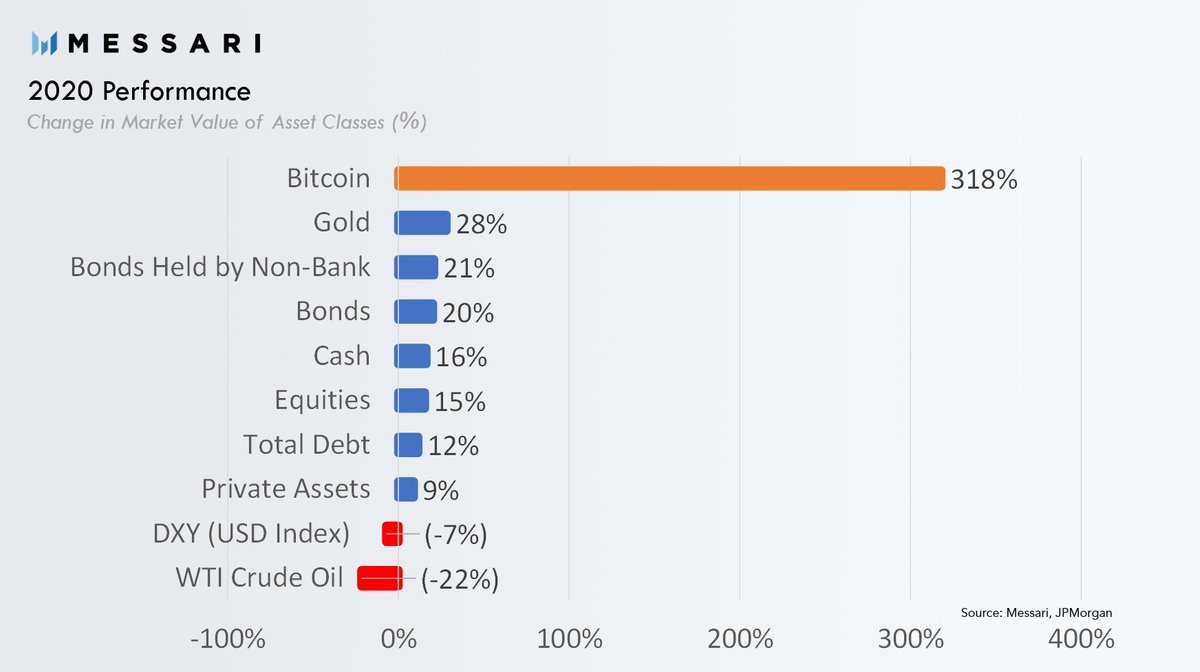

The year in a graph:

Is Tether going to tank the crypto market?

“What exactly is happening with Tether? Are they falsely inflating the market?” - MH

Let’s start by walking through what Tether is and the role it plays in the ecosystem.

Bitcoin allows people for the first time in history to store and transact in digital money without a third party or central authority. Pretty neat! Unfortunately Bitcoin only lets us to store and transact in one kind of money, which is bitcoin. Some people like using Bitcoin as money, but lots more people prefer to use US dollars (USD). Those people would also enjoy the benefits of digital cash if it were available denominated in USD. ‘Stablecoins’ are cryptocurrencies trying to satisfy this desire by creating digital tokens supposedly pegged to the value of USD. One of the most straightforward (and by far the most successful of these) is Tether (USDT).

Tether was created by Tether Limited, which is essentially a branch of the exchange Bitfinex, although they worked hard to hide that fact until the Paradise Papers leaked. The way Tether works is surprisingly simple! You give your dollars (USD) to Tether Limited. Tether gives you the same number of Tether tokens (USDT). They promise not to lose your money, not to print unbacked Tether tokens and not to freeze or confiscate your accounts, even though technically the platform allows them to do any of those things. You in turn promise not to commit any money laundering or evade any banking regulations, even though technically the platform allows you to do any of those things. You might be wondering how you turn your USDT back into USD and the answer is you do not. That is not one of the services that Tether offers.

As you probably guessed Tether the company does not always entirely live up to their own promises. Wikipedia has a good run down of all the shady dealings if you’re interested or there is a more detailed and also a more lurid/speculative history here. They are currently being sued by the NYAG, they had ~$880M of their reserves frozen by the US when their bank was accused of money laundering, and they admitted to only having $0.73 per Tether in actual cash reserves. According to their lawyer the remaining $0.27 was “backed” by liabilities to Bitfinex. Since Bitfinex and Tether are the same company that’s a bit like the briefcase of IOUs in Dumb and Dumber.

So that is Tether in a nutshell. It’s not for me personally but it is actually quite popular. There are ~$21B worth of USDT floating around and it does actually trade basically 1:1 with USD. Go figure. Sometimes how popular Tether is worries people, like this:

I kind of think this is concern trolling, to be honest. Tether is sketchy as hell but it is not clear to me why that should affect your opinion of Bitcoin. The basic thesis seems to be that Tether made up lots of fake money and used that fake money to buy Bitcoin, which artificially drove up the price of Bitcoin. But Tether and BTC don't exist in a vacuum. If you use counterfeit currency to buy BTC it follows that BTC is valuable, otherwise you would sell as soon as you bought and the impact would be price neutral. If you use counterfeit money to buy real estate in a fancy neighborhood and then later are arrested by the police, it doesn’t follow that real estate prices are inflated.

I suspect one reason the idea that Tether is somehow responsible for the price of Bitcoin is resonant is because of graphs like this one, which shows how the supply of Tether correlates with the price of Bitcoin:

Alas, correlation is not causation. This graph might seem like evidence that Tether is causing the rise in Bitcoin price - but it is just as easily explained by the fact that one of the main uses for Tether is to buy Bitcoin. It is not surprising that a tool for buying Bitcoin has increased demand right before lots of people start buying Bitcoin. No conspiracies required.

The true systemic risk of Tether to the crypto ecosystem is not to the blue chips like Bitcoin and Ethereum that already trade against traditional currencies directly. It is to the long tail of altcoins and minor exchanges relying on Tether to avoid the regulations of the US banking network. A collapse of Tether would mean a serious loss of liquidity for those markets because ordinary banks don’t want to serve them. That’s who should worry about systemic risk from Tether.

The only thing scarcer than Bitcoin

If you’ve ever read any story in the mainstream media that talks about Bitcoin, chances are the accompanying picture featured coins like the ones above: Casascius coins. Casascius coins were the first ‘physical bitcoin’ - behind the holographic tamper-proof stickers are private keys that control the corresponding amount of bitcoin. Coins can then be traded from person to person without needing to interact with the Bitcoin network directly. Then at some point when someone wants to convert the physical cash back into digital, they can ‘redeem’ the coins by peeling off the tamper-proof sticker and claiming the private key within.

There is one flaw with this otherwise elegant trust model - you don’t need to trust the person you are transacting with, but you both need to trust the creator of Casascius coins, Mike Caldwell. If he kept copies of the private keys or made a mistake when recording them it would invalidate the security of the coin. Mr. Caldwell was able to push past this limitation partially by being transparent about his identity but also by minting coins when Bitcoin’s price was much lower. At the time it was reasonable to assume stealing the value contained in the coins wasn’t worth the risk of legal consequences. As of writing no Casascius coins have ever been flawed or compromised - by all appearances Mr. Caldwell appears to have been trustworthy.

I use past tense here because in 2013 FinCEN (the Financial Crimes Enforcement Network, a department of the US Treasury) contacted Mr. Caldwell and let him know he would need to register as a money transmitter to continue minting Casascius coins. In other words Casascius coins are not being made any more. There are other folks making similar physical tokens, but now that Bitcoin is more obviously valuable it would be difficult for anyone else to bootstrap that same trust again. And every time someone redeems a Casascius coin it is destroyed.

There were 27,834 Casascius gold bars and coins created to store 90,683.9 bitcoins in total, about ~$2.6B worth in today’s prices. Interestingly, because the public keys of Casascius coins are known you can track the status of all Casascius coins in existence and whether they have been redeemed. This past month we crossed an interesting threshold: slightly more than half (51.3%) of all bitcoins stored this way have been redeemed and hence the corresponding Casascius coins destroyed.

Not many Casascius coins are bought or sold any more but browsing completed listings on platforms like eBay shows they generally sell for a significant premium above the price of bitcoin itself. Which makes sense, since they are scarcer.

Other things happen right now:

Bitcoin’s market cap ($544.9B) has now surpassed the market caps of VISA ($460.6B) and Berkshire Hathoway ($543.12B)

A thoughtful skeptic from Bloomberg changed his mind about Bitcoin.

Megan Thee Stallion gave away $1M worth of Bitcoin on CashApp

An excellent critique of Stephen Mnuchin’s proposed lame duck cryptocurrency regulation:

The keen-eyed among you will have noticed the off-by-one error in our issue numbering. Drafts changed order. #3 ended up coming out before #2. Whoops!