Has Bitcoin lost its soul?

Do Bitcoin ETFs represent Bitcoin capturing Wall St, or the other way around?

Inside this issue:

Has Bitcoin lost its soul? (reader submitted)

Bitcoin reaches an all-time high in 15 countries

The ECB doesn’t know how to Twitter

Nevermind, AI must be stopped at all costs

“With the launch of Bitcoin ETFs do you feel like Wall St has co-opted Bitcoin? Has it changed how you feel about it? — HF

Has Bitcoin lost its soul?

In the almost two months since Bitcoin spot ETFs began trading in the US they have attracted more than ~$5.5B of net new capital, which is probably why the price has risen by ~28% over that same time. As I predicted, lower cost ETFs are also eating away at the assets under GBTC management.1 Here’s what that looks like so far:

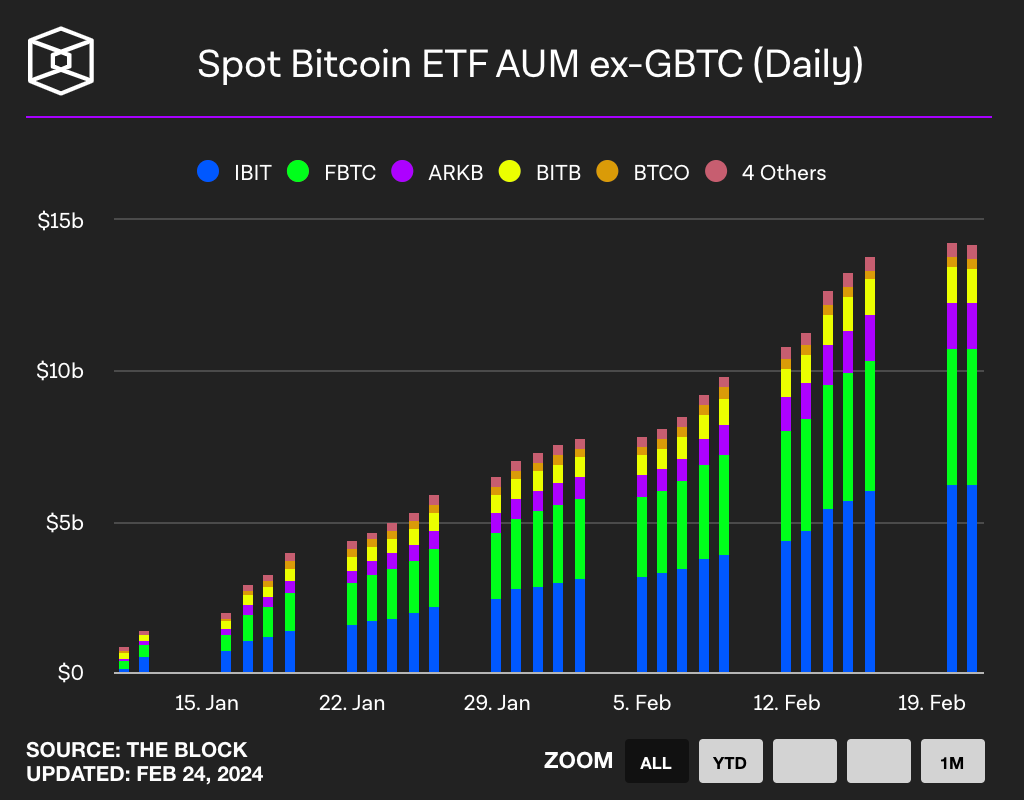

Or here’s another view, excluding GBTC and measured in US dollars.

It’s not clear how much of this growth is cannibalizing GBTC directly (i.e. investors selling GBTC and buying a lower cost Bitcoin ETF) and how much is indirect (i.e. one investor selling GBTC and another independent investor buying shares in a Bitcoin ETF). Genesis, for example, received permission from the bankruptcy court to sell ~$1.3B worth of GBTC to settle some of their debts — presumably most of that money didn’t end up moving directly back into Bitcoin exposure.

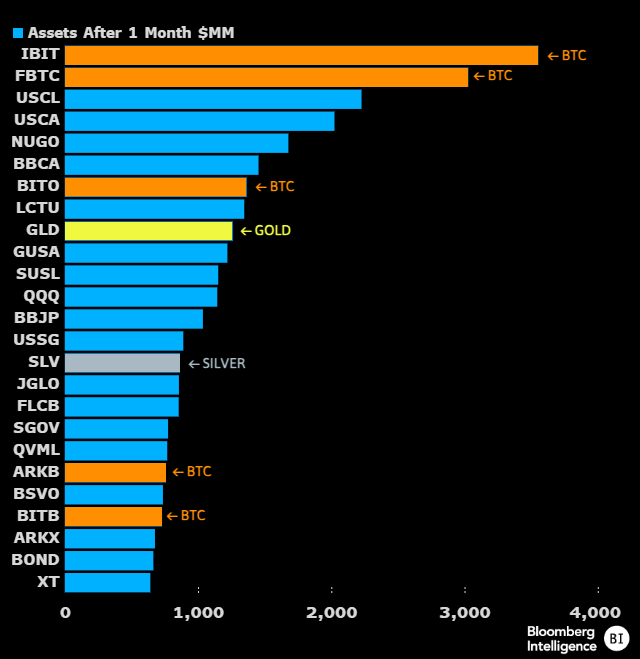

Any way you look at it, though, it’s clearly extraordinary growth. On the list of the fastest growing new ETFs off all time after their first month Bitcoin ETFs are #1, #2, #7, #20 and #22. Compare that with GLD (gold) at #9 and SLV (silver) at #15. It’s hard to say how much of that is a side effect of the SEC delaying approval for ~10 years, but it is pretty indisputable evidence of genuine demand for spot Bitcoin ETFs.2

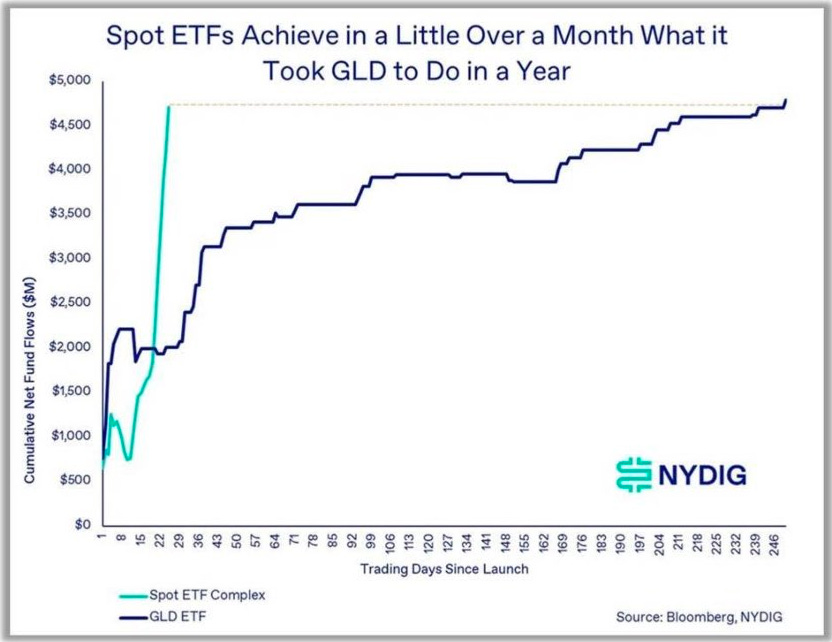

If we assumed the launch of a spot Bitcoin ETF will have similar impact on the price of Bitcoin that the launch of GLD (the gold ETF) had on gold, we would expect to reach ~$500k/BTC in the second half of 2025. Of course, collectively the Bitcoin ETFs attracted ~about as much assets under management in their first month as GLD did in its first year. Perhaps we should expect Bitcoin to reprice even faster.

The money we’ve seen so far is clearly people who are in some sense actively seeking Bitcoin exposure — but one of the fascinating things about the launch of Bitcoin ETFs that is that people who don’t think about Bitcoin at all may find themselves diversifying into bitcoin without realizing. Fidelity Canada just added small bitcoin allocations to their "all-in-one" general purpose ETFs — 1% in the conservative all-in-one, 2.5% in their balanced portfolio and 3.1% in their aggressive portfolio.

The mathematical case for an allocation of this size to dampen overall portfolio volatility is extremely strong, so this is probably a good investment on its own terms. But Fidelity also has its own skin in the game. The network effects in the competition for a commoditized service like a Bitcoin ETF are very strong — an early lead in volume could easily become a self-fulfilling prophecy. All the Bitcoin ETFs providers (Fidelity included) are heavily incentivized to encourage their existing customers to allocate funds to the new Bitcoin ETFs. We should expect more Bitcoin ETF operators to adjust parameters like this in their favor as Bitcoin starts to normalize.

Whether you view the success of Bitcoin ETFs as a success for Bitcoin is a matter of perspective. To some people bitcoin held in a custodial service like an exchange or a Bitcoin ETF doesn’t really count, because the custodian could seize it or steal it or surrender it to the government. The Bitcoin meme "not your keys, not your coins" dates back to the fall of Mt. Gox. If someone else is holding your bitcoin for you, you don’t own bitcoin — you own a bitcoin IOU. That’s not the same thing.

To self-custody purists, Bitcoin ETFs represent an existential threat to the network because they encourage centralization. A Bitcoin ETF is much easier and cheaper to use than actual Bitcoin. You don’t need to worry about transaction fees, there is no private key to lose or secure, inheritance planning is easy, you can use it as collateral to secure loans, etc etc. For people who don’t understand or care about the importance of decentralization (which is most people) the Bitcoin ETF looks like a strictly superior option. Realistically, most people probably will prefer to hold shares of the Blackrock Bitcoin ETF in their Charles Schwab account as opposed to secure their own UTXOs using private keys on a hardware wallet. The former is easy and cheap! The latter is expensive and scary.

Worries about the rise of Bitcoin ETFs tend to take three interlocking forms:

Innocent people will be sold counterfeit bitcoin. Some people worry that dishonest marketers will use the virtue of true bitcoin to advertise flimsy paper claims to bitcoin, akin to how stablecoin marketers advertise complex, unstable derivatives as basically the same as dollars. This fear is not for Bitcoin itself but for other people who might be trying to use Bitcoin and be deceived.

Paper bitcoin claims will come to dominate the Bitcoin market. Some people worry that custodied bitcoin will be endlessly rehypothecated means the supply of paper claims on bitcoin can grow past the 21M limit and effectively nullify Bitcoin’s guarantees about scarcity. Banks or governments could even create large quantities of paper bitcoin claims specifically to attack Bitcoin by crushing the price under an infinite supply of naked shorts.

Large custodians will control the network itself. Some people worry that if the economic center of gravity ends up being a handful of custodians, those powerful agents could form a cartel and control the network by agreeing to only honor coins belonging to network forks they liked. Such custodians would be holding their user’s wealth hostage and using it to demand changes to the network.

The first argument about customers being deceived I don’t find very convincing or interesting. There are lots of valid reasons to accept the custodial trade-offs of a Bitcoin ETF — it’s naive to assume everyone doing it is naive.3 Being paternalistic about a system of money whose whole purpose to reject authority is incoherent. The cultural allergy many Bitcoiners have to third party custody is a personal preference, not a moral imperative. Let people do what they want.

The second argument about the risk of paper bitcoin claims overwhelming the market is a bit more sophisticated, but ultimately still doesn’t worry me. Literally every asset can be rehypothecated, there is nothing specific about that to Bitcoin or to ETFs. It can be done with gold or oil or real estate or even dollars and it was already possible to do with bitcoin well before the existence of Bitcoin ETFs. Every bankrupt exchange from Mt. Gox to FTX has inflated the supply of bitcoin with paper claims as they scrambled to paper over their debts.

Distinguishing between a legal claim and actual possession of any asset is critically important — but Bitcoin actually makes that easier to do and Bitcoin ETFs don’t make it any harder. In my opinion we should certainly expect paper markets for Bitcoin ETFs to be larger volume than on-chain transactions because it is fundamentally cheaper to trade paper claims than to trade actual bitcoin. Exchange trade volume is already larger than on chain volume and some of those exchanges have later turned out to be fraudulent — it doesn’t follow that bitcoin itself was diminished in value. If anything, it’s the opposite!

The third fear is the most subtle. If we assume (as I do) the majority of the population will prefer to store their wealth in custodial options, it seems reasonable to predict that custodians will end up controlling the majority of the supply. Does that mean they will also control the future of Bitcoin?

I dive into that question in a companion post for paid subscribers:

Part II: Who will watch the watchmen?

Other things happening right now:

Bitcoin has reached or surpassed all time highs in fourteen countries: Argentina, Burundi, Democratic Republic of Congo, Egypt, Ghana, Japan, Laos, Lebanon, Malawi, Nigeria, Norway, Pakistan, Sierra Leone, Sudan, Turkey. Collectively those countries represent ~1B people. Bitcoin is the only currency in the world with a positive 10 year return against the US dollar.

In the wake of the launch (and success) of Bitcoin ETFs the European Central Bank tried to post about how Bitcoin was like the Emperor with no clothes. Their post got body slammed by community notes on Twitter. I’m honestly just embarrassed for them. Shouldn’t they be off printing money or something?

Google’s Gemini AI chatbot will offer advice on how to stake Ethereum but will offer cautionary advice against mining Bitcoin. Obviously, I have revised my previous outlook, AI must now be stopped at all costs.

As part of the ongoing lawsuit against an Australian con artist impersonating Satoshi a large body of emails were entered into the court record and are now publicly available. Here’s a thread with some screenshots if you are interested in a highlight reel. A screenshot where Satoshi appeared to endorse pineapple and jalapenos on pizza was widely circulated but was actually just a joke.

We poked gentle fun at the Bitwise Bitcoin ETF ($BITB) a while back using the outdated P2PKH address scheme to store their funds. Astute readers pointed out that since Bitwise was using the same Coinbase custody service as everyone except for Fidelity (who is self-custodying) that probably meant everyone was using P2PKH — Bitwise was just the only one to trying to share proof-of-reserves. Either way, Bitwise has since moved to a modern Segwit address. Hopefully that means they are using multisig now …?

The reason so many GBTC holders haven’t left GBTC yet is because selling GBTC to buy a competing ETF triggers a taxable event on any gains. That means every GBTC holder that bought within the last year is probably happy to wait at least a year before selling, to avoid short term capital gains taxes. A long term holder has lower tax rates but also higher gains to consider — they probably aren’t in any hurry either. A ~30% capital gains tax is the equivalent of ~26.3 years worth of ~1.5% annual fees.

It’s not slowing down yet, either! February 26th was the highest volume day for Bitcoin ETFs so far (~$2.4B) slightly more than the volume on the first day (~$2.3B) and roughly double the average daily volume (~$1.2B).

I actually own a few shares of IBIT myself as a way of conveniently getting Bitcoin exposure in a tax advantaged retirement account. It’s good to diversify custody strategies.