How to barely eventually do your job

How the SEC dragged their feet on Bitcoin ETF approvals for ten years to the detriment of investors, the public and the agency itself.

Inside this issue:

The orderly formation of capital markets

How to barely eventually do your job

The opening battle in the price war

TradFi goes laser-eye

The orderly formation of capital markets

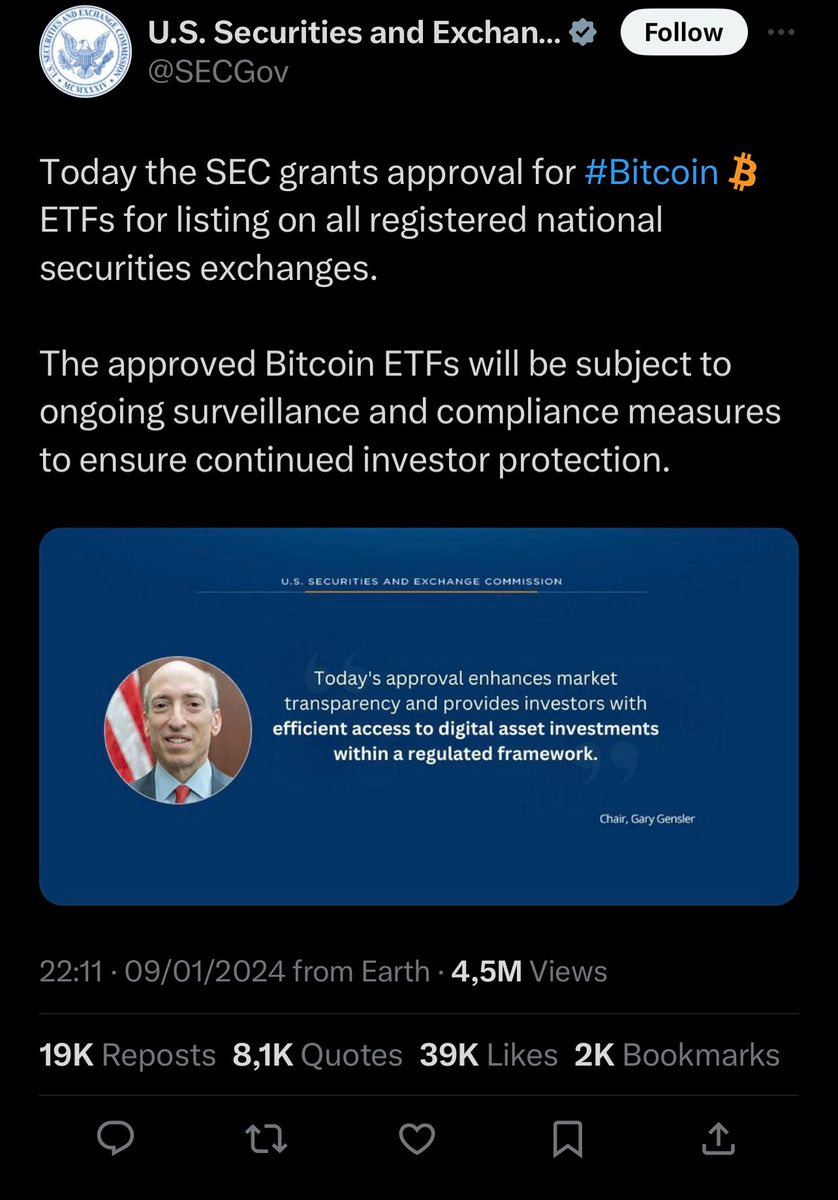

At 3:11pm on Tuesday January 9th the official @SECGov twitter account announced that they had granted approval for Bitcoin ETFs listed on all major exchanges.

Fifteen minutes later Gary Gensler tweeted that the SEC account had been compromised and that the SEC had not approved spot Bitcoin ETFs. Ten minutes after that the SEC regained control of their Twitter account and confirmed that Bitcoin ETFs had not been approved. Here’s what that looked like:

This was strange for a variety of reasons — the most obvious being, why would a hacker put out a fake announcement for something that was (a) true and (b) everyone already expected? If the goal was to manipulate markets an unexpected rejection announcement would almost certainly have created a lot more volatility to profit from.

Some people speculated that perhaps this was a draft tweet or perhaps a scheduled tweet sent at the wrong time. The scheduled tweet theory is entertaining but doesn’t strike me as likely. Twitter itself has confirmed the account was compromised, there are many subtle details that seem off and @SECGov also tweeted "$BTC" immediately afterwards which doesn’t exactly seem like standard SEC communications. It’s a shame the SEC didn’t follow this excellent advice:

Crypto being crypto there was an immediate rush to launch new SEC-themed meme tokens. The already existing $GENSLR token surged 145%. And scammers immediately started advertising a fake SEC wallet drainer:

The next day the approval went live on the SEC website with no accompanying announcement and then was taken down without explanation as soon as it was noticed. Over the next few hours various ETF websites and tickers went live in a halting, piecemeal fashion. Eventually the SEC announcement was made — although not on Twitter. The latest tweet from @SECGov is the one confirming that Bitcoin ETFs have not been approved.

No wonder the SEC was worried about the Bitcoin market being manipulated! Look how easily they were able to manipulate it.

How to barely eventually do your job

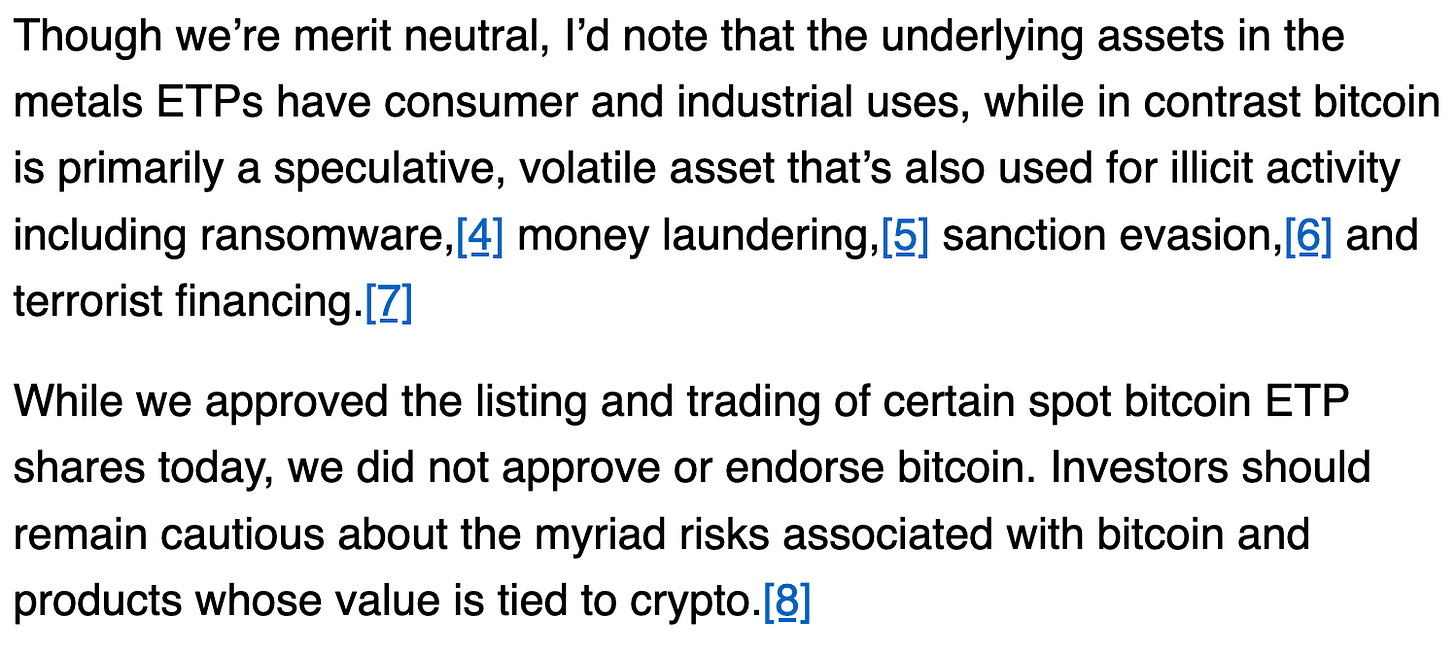

The final SEC vote to approve Bitcoin ETFs was 3-2, with commissioners Gensler, Pierce and Uyeda voting in favor and commissioners Crenshaw and Lizárraga opposed. Gensler wrote the formal statement of approval and went way out of his way to signal his reluctance and general opposition to the whole idea:

Commissioner Crenshaw wrote a dissenting statement in which she argued that Bitcoin ETFs are not in the public interest for all the usual reasons: Bitcoin markets are fraudulent, Bitcoin is only used for ransomware and terrorism, etc, etc.1 It’s a fairly generic statement — it mostly seems intended to advertise herself as politically aligned with Elizabeth Warren’s anti-crypto faction.

More interesting (to me at least) was commissioner Pierce’s sharply worded concurring statement where she accused the SEC of "squander[ing] a decade of opportunities to do our job … until a court called our bluff." It’s an extremely blunt critique of the harm caused by the SEC’s hostility to Bitcoin products, from damage to public trust to waste of agency resources.

The opening battle in the price war

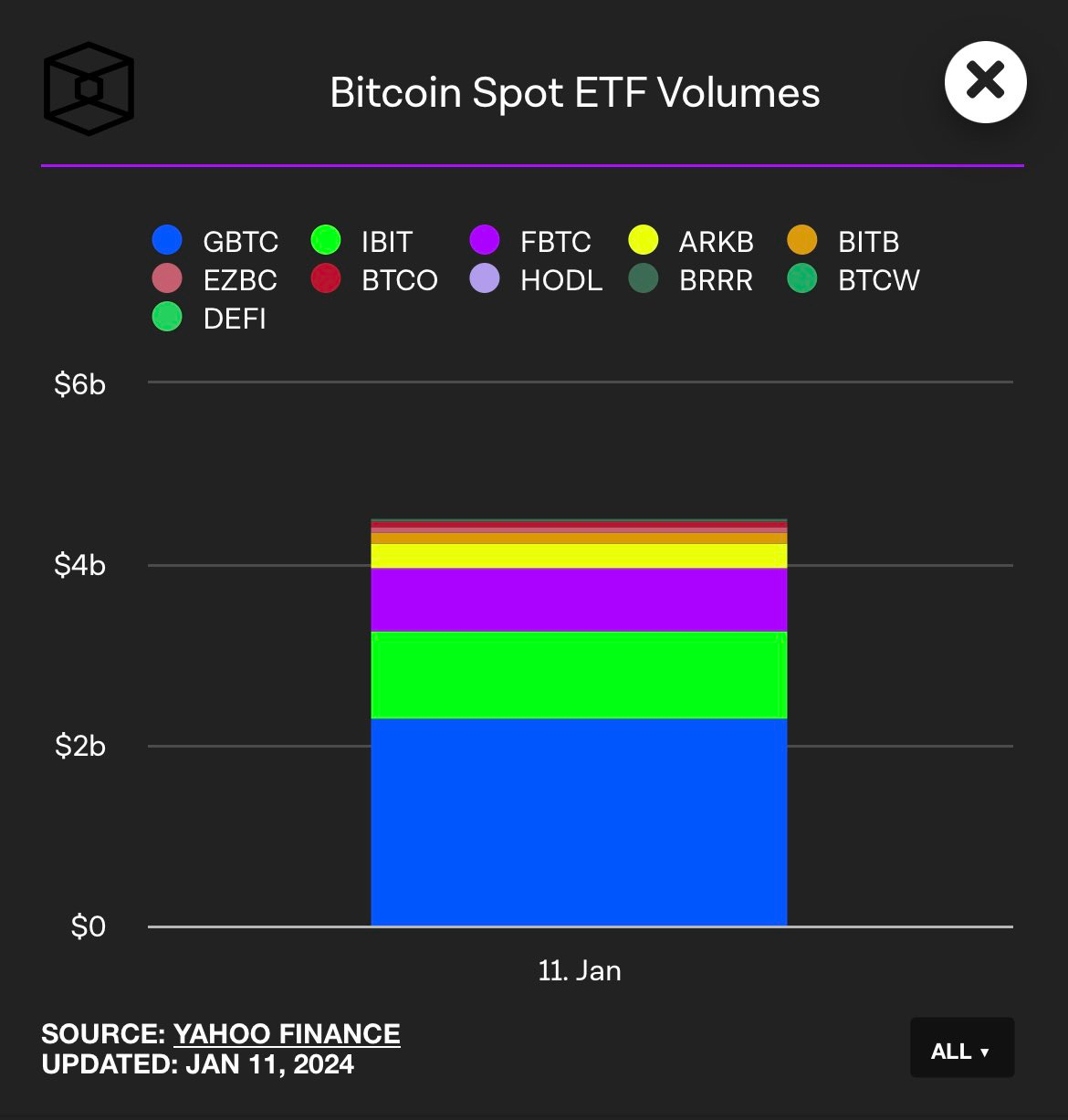

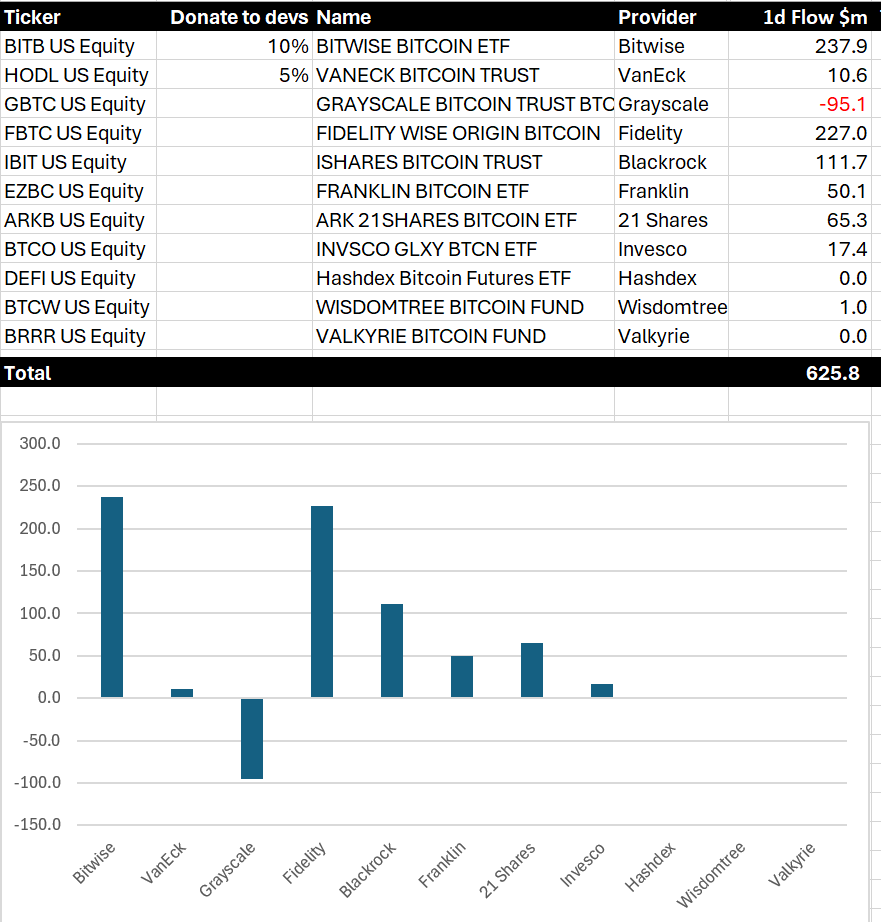

Eleven Bitcoin ETFs began trading on Thursday. Collectively they traded more than $4.5B worth of volume across >700k individual trades, making this comfortably the largest asset ETF launch in history. Most of that volume was people moving around between vehicles — only ~$625M worth of new capital entered the market.

Grayscale’s GBTC is the largest fund ($28B) and had the most trading volume, but it is also the most expensive (GBTC fees are ~1.5%, other funds are charging ~0.2-1%) which is why it shrank ~$95M in the first day of trading.2 GBTC can get away with charging a premium price (at least for now) in part because of the natural inertia of investors and in part because their head start in total assets give them a natural advantage in liquidity/volume. Short term traders who move in and out of positions quickly may appreciate the liquidity more than they care about fees.

It seems like Grayscale has decided they are better off aggressively monetizing the market today before it is fully commoditized than they would be trying to compete with Blackrock and others directly on price. Eventually they will bleed off enough capital that they will lose their liquidity advantage and be forced to reprice, but it remains to be seen how quickly that will play out.

Other things happening right now:

Crypto exchange Bitmex arranged with a private space company to send some bitcoin in a physical wallet on a flight to the moon. Unfortunately, the craft suffered a fuel leak and has "no chance" of making it to the moon. Bitcoin will have to get to the moon the old fashioned way.

Here is a 77 year old investment firm with $1.5 trillion in assets under management adding laser eyes to the portrait of Benjamin Franklin in their profile picture.

Yes, if you are wondering she absolutely does cite the compromised @SECGov Twitter account as an example of how Bitcoin markets are too easy to manipulate.

At time of writing, ~$579M worth of capital (or approximately ~2% of capital under management) has left GBTC so far.