The Corporate Case for Bitcoin

Why every responsible company should have a Bitcoin strategy, including yours.

Every responsible company should have a Bitcoin strategy. Does yours?

For most of Bitcoin’s history the most common approach that businesses took to Bitcoin was simply to ignore it. Ten years ago that was still a perfectly reasonable strategy! But the longer Bitcoin continues to operate, the more likely it is to keep going. That’s why governments around the world have stopped ignoring Bitcoin and instead are developing formal policies to outlaw, regulate or adopt it. Responsible companies have a similar obligation to start investigating Bitcoin and deciding whether and how to incorporate it into their financial strategy.

Almost every company should own a small amount of bitcoin (the asset) as a component in their treasury portfolio. Most of those companies should be custodying at least some of that bitcoin for themselves and many of the companies that choose to self-custody bitcoin (the asset) will find it useful to use Bitcoin (the network) as a tool for making payments. But every company needs to plan for a possible future where Bitcoin continues to be increasingly relevant. Every responsible company should have a Bitcoin strategy. Does yours?

The case for owning bitcoin

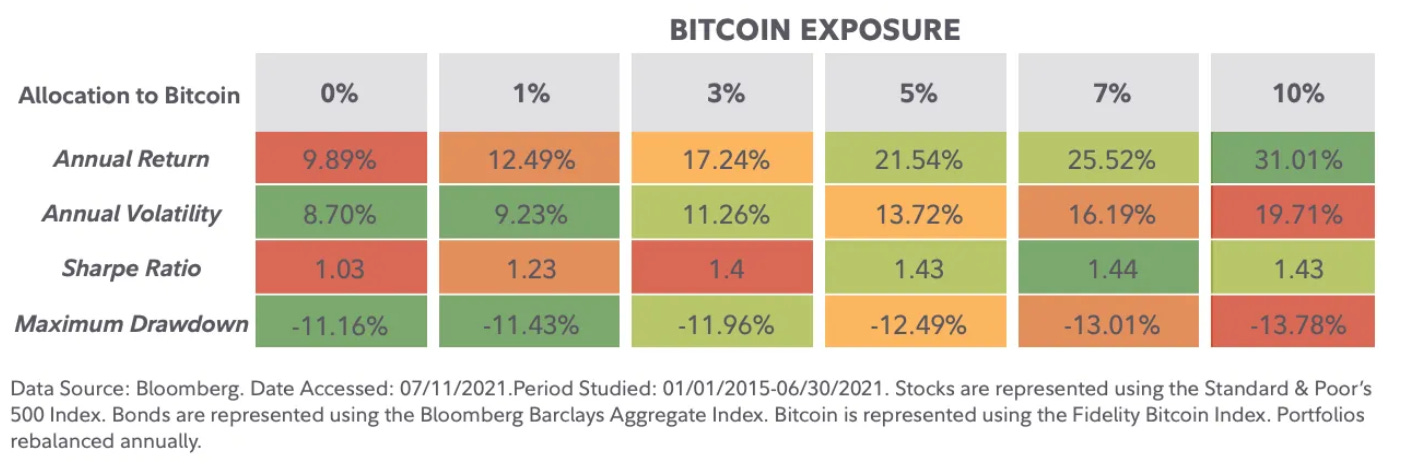

Most arguments for investing in Bitcoin look something like, “the volatility is tough but the gains are worth it” – which is not generally a good argument for most companies since they are usually investing conservatively to preserve purchasing power and not trying to maximize their return on investment. It’s also hard to believe that Bitcoin will continue to deliver the eye-popping historical returns going forward given how much larger the Bitcoin market cap is today. So it is easy to assume that Bitcoin has no place in a conservative corporate portfolio – but the counterintuitive truth is the opposite. Bitcoin is the perfect addition to a conservative portfolio exactly because of the volatility.

Bitcoin is a unique asset – both in what it represents in theory, but also in how it behaves in practice. The price of Bitcoin is largely uncorrelated with other major asset classes: Bitcoin moves to its own rhythms. That means Bitcoin’s volatility actually helps to dampen the volatility of your overall portfolio, because it has a tendency to move independently from traditional assets. Allocating a small percentage of a portfolio to Bitcoin and then periodically rebalancing actually lowers your portfolio volatility and improves the risk/reward ratio, letting you get the same returns with less risk or greater returns with a similar amount of risk.

Historically obviously the price of Bitcoin has risen enormously from effectively zero to tens of thousands of dollars. But it didn’t usually go up. On most days the price of Bitcoin actually goes down. It’s just that on the days when price goes up it often goes up explosively. That means Bitcoin is a high volatility asset with positive-skew – i.e. the most volatile days tend on average to be bullish. That’s very unusual for a high volatility asset, most of which have typically good returns with explosive potential downside risk. Most other high volatility, positive skew assets are either naturally illiquid (e.g. Venture Capital) or come with additional risks (e.g. investments in markets with unstable governments).

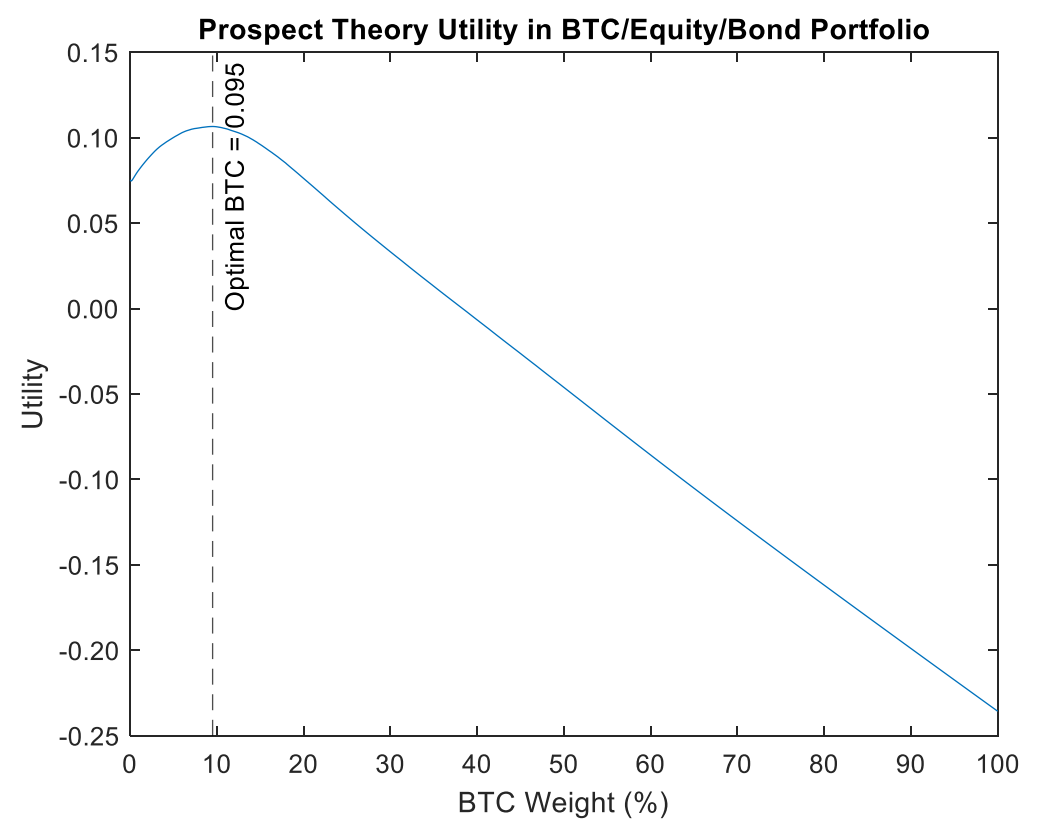

The unique distribution of Bitcoin returns means that a small allocation is actually a conservative, risk-reducing portfolio strategy. According to research from BlackRock investments the optimal Bitcoin allocation is roughly ~9.5% of a portfolio. What is more interesting, BlackRock found that even with the assumption that Bitcoin would lose half its value over the course of the investment the optimal Bitcoin allocation only drops to ~3%. Bitcoin volatility is so valuable that even a company with a confidently bearish outlook on price should still have a non-trivial Bitcoin allocation in their portfolio. Ignoring Bitcoin’s investment properties is taking on needless portfolio risk.

In short, responsible companies should be investigating Bitcoin even if they find it confusing and everyone should probably own some Bitcoin even if they are skeptical about its potential. Fortunately getting Bitcoin exposure is easier than it might seem. There is no need to have in-house expertise in cryptography or even handling private keys. It’s perfectly reasonable for a company to engage with bItcoin as an asset without being interested in handling it directly, just as a company might choose to invest in oil derivatives without any interest in handling physical oil. Companies might choose to invest in Bitcoin-denominated funds, Bitcoin-adjacent industries like mining or to own Bitcoin via a third-party custodial relationship.

Owning Bitcoin is also increasingly being de-risked in other important ways. Bitcoin is the only cryptographic token with a clear regulatory definition (as a commodity) and hence no risk of being declared an unregistered security. The United States Financial Accounting Standards Board unanimously approved new GAAP accounting standards, allowing companies to mark their Bitcoin holdings to fair market value. KPMG just released a report describing the positive environmental, social and governance (ESG) impact of Bitcoin investing, especially on renewable energy.

The entire financial industry is preparing to fully embrace Bitcoin as a meaningful new asset class. Every responsible company should be doing the same.