Who will watch the watchmen?

If most bitcoin end up being held by third party custodians, has Bitcoin lost?

Part II of a two part series answering the following question.

[Part I: Has Bitcoin lost its soul?]

“With the launch of Bitcoin ETFs do you feel like Wall St has co-opted Bitcoin? Has it changed how you feel about it? — HF

Bitcoin has always been for bankers

True power over Bitcoin is held and set by the economic majority — the swarm of bitcoin holders who define what is and is not "real" Bitcoin by what they choose to accept/hold and what they choose to reject/sell. Given the limits of scaling as we know it today the number of players that can participate directly in this definition is necessarily very small. The most thoughtful estimate I’ve ever encountered suggested the maximum was around ~50,000, perhaps even less. That’s roughly the same size as the population of Eagle Mountain, Utah.

Since Bitcoin blockspace is distributed by auction being one of those on-chain participants will inevitably become expensive. We don’t know exactly what future transactions that are able to pay for inclusion will represent, but it seems inevitable that most will be shared resources given the ~8B people in the world who may want to participate in the Bitcoin economy. That means in practice Bitcoin will almost certainly be dominated by custodial Bitcoin banks.

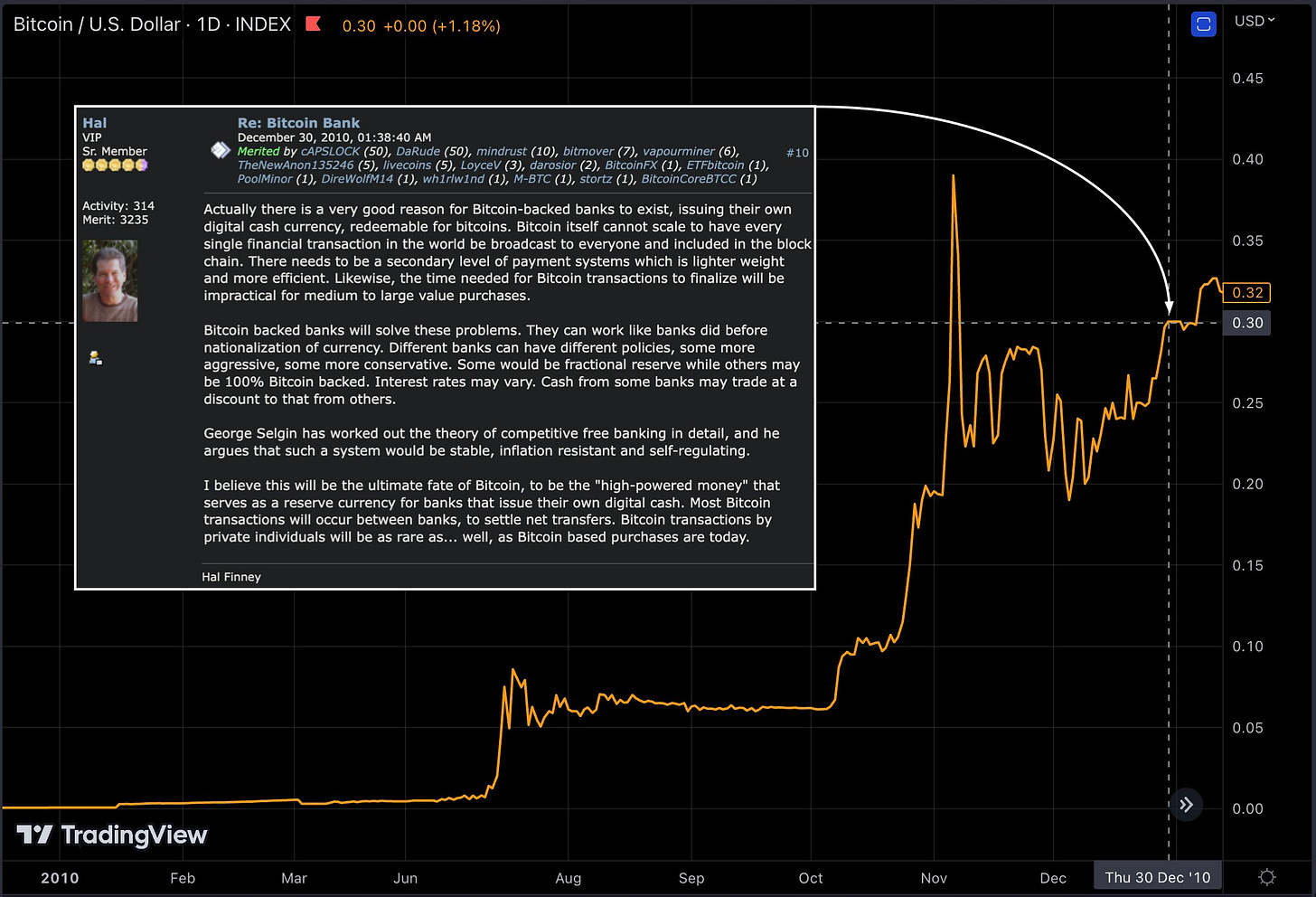

Many people view the purpose of Bitcoin as being to obsolete banks and absolutely do argue that Bitcoin becoming dominated by banks would be Bitcoin losing its soul. That’s a relatively modern conception, though — in 2010 Hal Finney wrote that the "ultimate fate of Bitcoin" would be "to be the 'high-powered money' that serves as a reserve currency for banks that issue their own digital cash." The price at the time was ~$0.30/bitcoin. A Bitcoin ETF would have been impossibly good news.

Early Bitcoin participants understood that it was inevitable (and ultimately good) for base layer transactions to become expensive (since that secures the network) and that an unfortunate but equally inevitable consequence is that most people will be priced out of participating on the network directly. It’s just math.

Does that mean Bitcoin is pointless?

Not at all! The people who think Bitcoin is anti-bank technology are making a category error. Bitcoin is not (and has never been) anti-bank technology — it is anti central bank technology. Bitcoin is money! Of course banks will use it.

Even if Bitcoin doesn’t eliminate banks it still puts pressure on them to provide better service. There is no government regulatory agency creating a competitive moat for Bitcoin banks to hide behind — anyone who can afford to finance a UTXO can potentially operate a Bitcoin bank. The market (instead of the government) will define the competitive requirements for a Bitcoin bank. More competition between banks means better banking services for everyone, even if not everyone can afford to open their own bank.

Using a Bitcoin bank also won’t necessarily mean going through a government sanctioned entity or process. Informal and unlicensed banks can offer Bitcoin services that government regulated banks may not be able to, like strong privacy guarantees or limited requirements for documentation. Bitcoin banks will offer the services their customers demand, exactly how any retail service offers the products that its consumers demand.1

The more we scale the network and the cheaper, easier and safer we make self-custody the easier it will be to open a Bitcoin bank and the fiercer the competition will be to retain Bitcoin banking customers. Incremental improvements to scaling matter without us ever needing to reach some magic threshold where everyone in the world is transacting directly on Bitcoin itself. In the same way that keeping a the marginal cost of running a node low keeps the network decentralized, keeping the marginal cost of using the network to transact low keeps the supply decentralized. But the end game isn’t about eliminating Bitcoin banks, it’s about making them better.

Free market capitalism isn’t exactly a utopia but I think it will be enough to create reliable Bitcoin banks. Contrary to our modern beliefs about banking, free market gold standard banks were historically fairly reliable. I expect the same to be true for Bitcoin banks once the market has a chance to establish itself.

Executive Order 6102.0

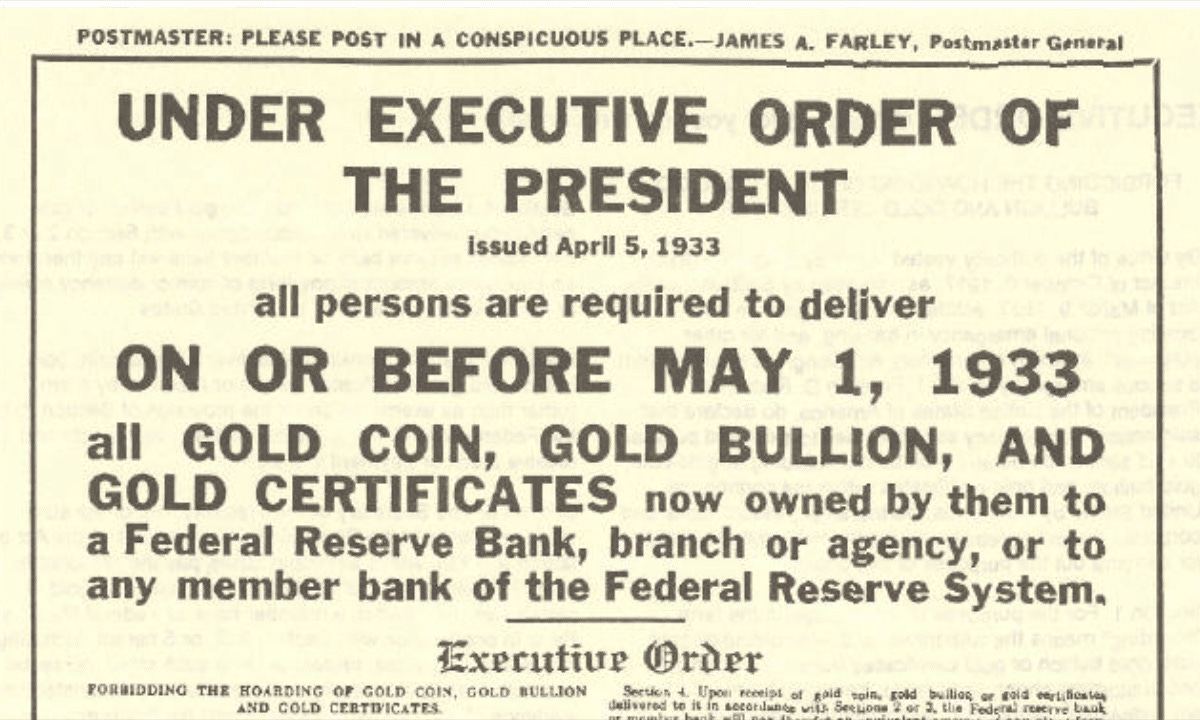

That raises an obvious question, though: if we think Bitcoin banks will (generally) be reliable because gold banks were (generally) reliable, shouldn’t we be worried that governments will seize all the custodially held bitcoin the same way FDR used Executive Order 6102 to seize all the privately held gold in America?

If governments did decide to attempt to confiscate the bitcoin held by various custodians, they would probably find it challenging. It is much harder to hide a warehouse of gold than a single gold bar — so large gold holders are much easier to find than small gold holders. That’s not true for Bitcoin, where it is equally easy to hide/secure $1B worth of bitcoin or a handful of satoshis. Finding contraband gold is orders of magnitude easier than finding contraband bitcoin. That makes gold fundamentally easier to control.2

It’s not immediately clear whether Bitcoin ETFs make a scenario like government seizure more or less likely. Blackrock holding onto everyone’s bitcoin for them makes the bitcoin in question very easy to find — just call up Larry Fink! On the other hand, Larry Fink is one of the most powerful people on the planet. If you call him up to steal his customers’ money he might not appreciate that. He might give some of his many remaining dollars to your political opponents.

If Bitcoin ETFs have grown large enough to control a significant share of the available supply of bitcoin it will be because a significant percentage of the world population has started investing in bitcoin. Maybe that will happen because they bought shares directly in a Bitcoin ETF — or maybe it will be because they invested in something like the Fidelity all-in-one ETFs that have started allocating a small percentage of their portfolio into bitcoin.3

Bitcoin diffusing into the broader financial system makes it orders of magnitude more difficult to interfere with. Large centralized custodians might make the bitcoin they custody logistically easier to confiscate — but they make it politically much more difficult. Realistically the best time to seize or destroy Bitcoin is before it gets embedded in the retirement accounts of millions of citizens, not after. Once people notice they own some Bitcoin they are much more likely to defend it.

So … has Bitcoin lost its soul?

No. Bitcoin has not compromised on its mission to deliver absolute scarcity and the arrival of the spot Bitcoin ETFs is unambiguously good news for the health of the network. The fear that Bitcoin ETFs undermine the purpose of Bitcoin is misplaced. ETFs expand the pool of potential Bitcoin investors and make the Bitcoin constituency larger and more politically enfranchised. More people using Bitcoin to save makes attacking Bitcoin more expensive and less appealing.

Bitcoin is money for everyone. That includes banks (and the customers of banks). Bitcoin ETFs are good for Bitcoin.

Bitcoin banks might not even turn out to be commercial entities as we know them today. They may end up being mostly cryptographic constructs like Fedimints or Cashu issuances. That would be more interesting tech and probably more censorship resistant than a traditional bank, but it wouldn’t really change the rest of the analysis here. A cryptographic bank is basically just a rogue bank that can never betray its customers or be shut down. All that would be cool — but it isn’t necessary for Bitcoin to fulfill its purpose.

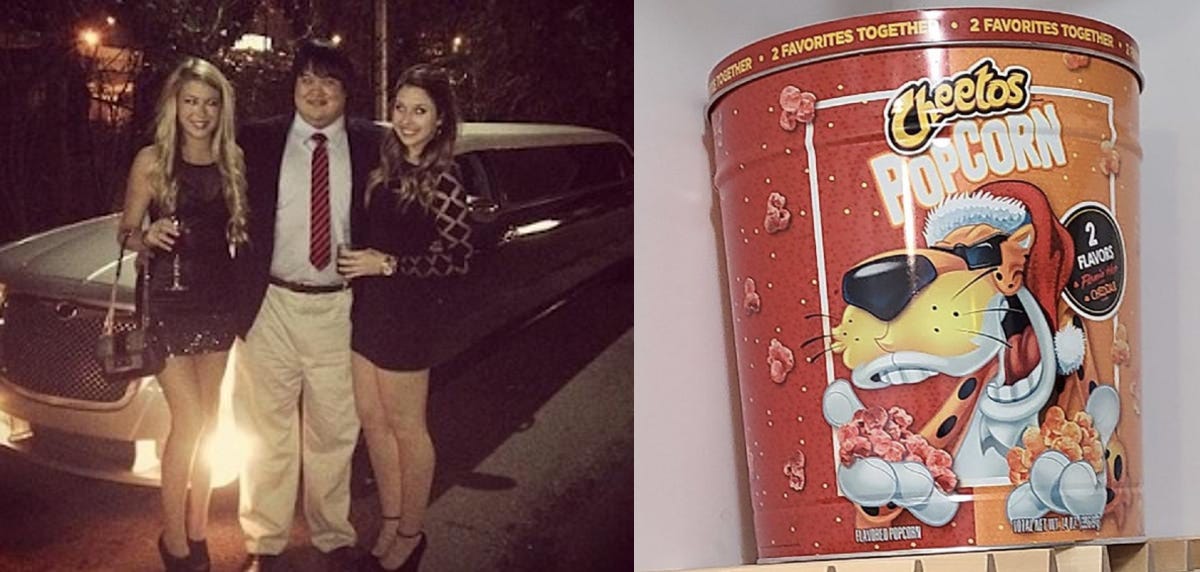

For example, here is a picture of a dude who stole ~$3.4B worth of Bitcoin from the Silk Road and then hid it for years in a Cheetos tin. He was eventually caught because he called the cops himself to report someone having stolen bitcoin from him. That same amount of value stored in physical gold would take up ~2.6 cubic meters — roughly enough to fill a six to eight person hot tub with gold bars.

Another amusing possibility is that Microstrategy could qualify for the S&P 500 or some of the existing S&P 500 companies could adopt their strategy of borrowing dollars to buy Bitcoin. If that happens every passive investor in the world will suddenly have leveraged Bitcoin exposure into their portfolio. Nothing to do with ETFs really but another way that Bitcoin might end up diffusing through the veins of the traditional financial economy.