What happens to the money when a country collapses?

Plus how Bitcoin is like an orange grove and what Britney Spears and the Taliban have in common.

In this issue:

What happens to the money when a country collapses?

How a Bitcoin is like an orange grove

What Britney Spears and the Taliban have in common

What happens to the money when a country collapses?

After a 20 year struggle the Taliban has seized control of Afghanistan, capturing the capital city of Kabul and forcing the US to evacuate several weeks prior to the planned withdrawal. The full strategic, geopolitical and humanitarian implications will take years to fully unfold - but some changes will happen more quickly. For example the Taliban now controls Da Afghanistan Bank (DAB), the central bank of Afghanistan.

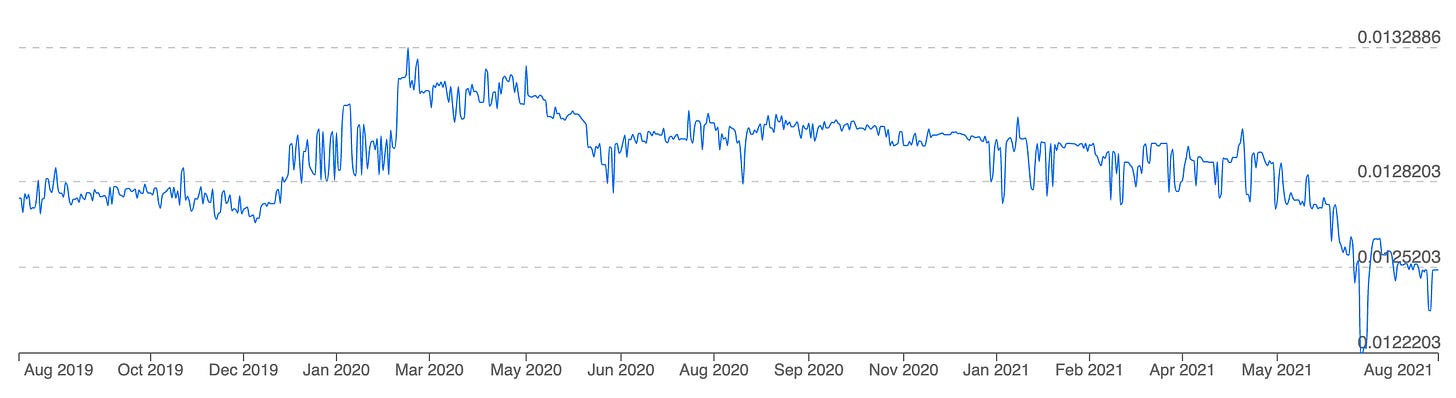

Until recently the official Afghan currency was the afghani and it was actually a relatively stable currency considering the fragility of its political system:

According to DAB governor Ajmal Ahmady as of last week Afghanistan had a pool of ~$9B worth of reserves in US Treasuries, gold and World Bank assets. The Taliban may have expected to seize control of those resources - but the DAB’s assets are not sitting in a government basement waiting to be looted like leftover US military equipment. They are held in accounts at international banks like the US Fed or the Bank of International Settlements. You can’t exactly call up the BIS and say "I conquered your customer, please send me their checkbook."

The US has already frozen the reserves held in American bank accounts and the IMF has halted access to Afghanistan’s Special Drawing Rights (SDRs). The Taliban has been on international sanctions lists for years, so it seems unlikely they will ever get access to any of these reserves. We wrote last issue about ordinary Afghan citizens discovering the money they thought was theirs wasn’t there when they needed it - this is essentially the Taliban having the same realization.

So the Taliban has the ability to print more afghani but not the ability to defend its value using the central bank’s reserves. It doesn’t take an economist to figure out what that means for the currency - it has already fallen to record lows.

How a Bitcoin is like an orange grove

We talked a few weeks ago about SEC Chair Gensler’s speech to the Aspen Security Forum and how it likely signalled the start of an era of greater regulator scrutiny over crypto and DeFi especially. That was one day after the SEC announced a ~$13M fine against the makers of project called the DeFi Money Market and a few days before announcing a $10M settlement with cryptocurrency exchange Poloniex for "operation of a trading platform that facilitated buying and selling of digital asset securities."

You might think the SEC would point out which of the hundreds of tokens Poloniex listed they considered securities but they did not. That’s not great news if you have issued a token or are running an exchange - in Gensler’s view "the probability is quite remote that … any given [trading] platform has zero securities."

Not every crypto asset is a security (the SEC has been clear that it does not consider Bitcoin a security) but it can be deceptively difficult to know where to draw the line. Poloniex apparently had a policy of requiring opinions from third-party law firms before they listed risky tokens. I’m sure at least some of those firms would be happy to bring those arguments against the SEC in court, provided someone was willing to hire them. Of course it is probably much easier and cheaper to just settle with the SEC and delist the offending tokens, as Poloniex chose to do.1

By making their hostility clear but their targets ambiguous the SEC is leaving various DeFi projects to interpret for themselves how the Securities Act of 1933 should apply to the kaleidoscopic dreamscape of DeFi.

Very loosely, a security is an investment where you hire someone else to earn the profit for you. To borrow a famous example from American securities law, an orange grove is not a security. You might expect to profit from it, but you are betting on the grove itself and not on anyone else’s ingenuity or labor. If however you contract out someone to manage an orange grove for you and send you the profits, that is a security. You are depending on the efforts of someone else to generate the profit.

The SEC says that Bitcoin is more like an orange grove than it is like a company. When a coin is "sufficiently decentralized" (their words) investors are no longer relying on any specific person or group to generate profits, so it is no longer a security. The big, conspicuously unanswered question is how do you measure whether a project is sufficiently decentralized or not?

If a developer writes a smart contract and someone else invests money in it based solely on the behavior of the code, has the developer sold a security? What if the project is open source and anyone can submit updates? What if the developer has moved on and disavowed the project? What if they actively release new updates but all users need to manually migrate themselves to each new version? What if they have an admin key but have promised never to use it?

What about Ethereum itself - do ETH holders own it because of the potential value of the codebase as it exists today or as part of a common enterprise under the leadership of Vitalik Buterin to profit by building something better? Is Ethereum an orange grove? Or an equity stake in Vitalik’s upcoming OrangeGrove 2.0?

Other things happening right now:

We talked back in April about EIP-1559, the Ethereum upgrade intended to (among other things) burn excess transaction fees and reduce the total supply of Ether. Since the launch of EIP-1559 with the London fork at the beginning of the month Ethereum has burned ~179k ETH, or about ~$537M at today’s prices. Only ~117k ETH have been issued in that time, which means that Ethereum supply is decreasing right now.

There is a rumor making the rounds that Britney Spears used Bitcoin to evade her father’s conservatorship. The rumor itself is based on a quote from an unnamed source, so it’s not especially compelling evidence of anything - but it is another interesting example of how useful unstoppable money can be when the banks won’t let you spend from your accounts. I guess that’s something Ms Spears and the Taliban have in common.

We’ve talked enough recently about the Poly Network hack so I don’t plan to dwell on it more unless something new and exciting happens, but still it is nice when a story has a happy ending.

Hal Finney predicted the rise of NFTs:

Regrettably, Etsy did not predict the rise of NFTs:

I am not a lawyer and this is not legal advice. Probably don’t get your legal advice from a Substack newsletter. (That is also not legal advice.)