I thought we all agreed up only?

Plus explaining EIP-1559 and win a free NFT with the power of your mind

In this issue:

I thought we all agreed up only?

Reforming the Ethereum fee market (reader submitted)

Own the concept of having been right (reader submitted)

I thought we all agreed up only?

On Thursday President Biden announced a plan to nearly double the capital gains tax from 20% to 39.6%. Combined with the 3.8% surtax for the Affordable Care Act the effective tax rate for capital gains would be 43.4%, the highest in American history. Markets were not pleased. The Nasdaq, the S&P 500 and the Dow Jones Industrial average all closed down ~0.9%. The cryptocurrency market was completely shredded - almost every asset was down more than 10% on the day.

If you sold part of your portfolio in response to the news, I’m sorry but that was probably foolish. Tax increases in America can and usually are implemented to be retroactive to the year the new tax law passes. The only way selling early will reduce your capital gains taxes is if selling lower reduces your capital gains. It was younger addresses (1-3 months) that sold into this dip. Older wallets kept buying.

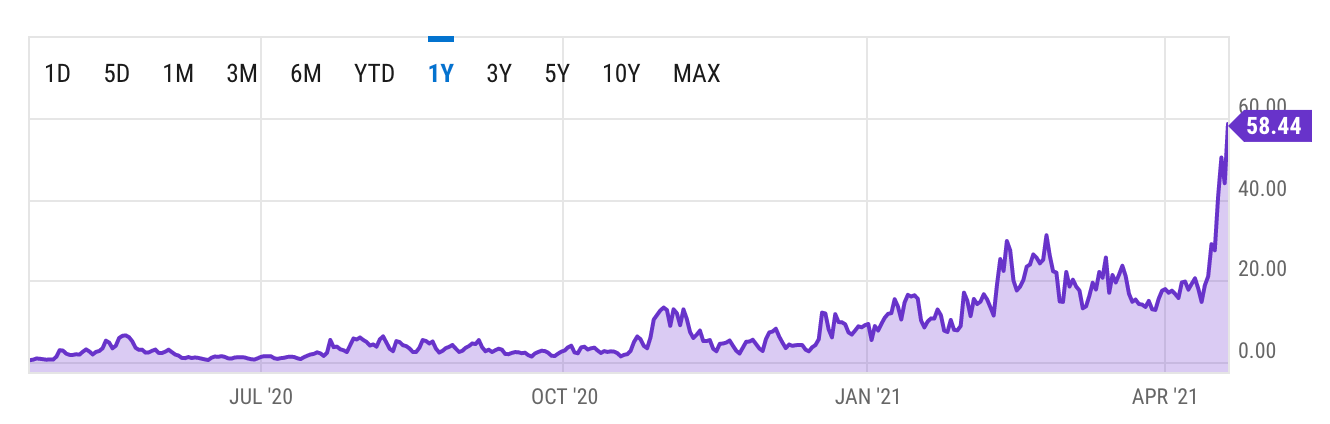

Still there are reasons to be concerned. This is the first time that Bitcoin has closed below its 50 day moving average since ~$10.5k, meaning that momentum is genuinely slowing. During roughly this time in the bullrun of 2017 Bitcoin’s price reached ~$2k/BTC and was stuck there until around August. The blackout in Xinjiang did not actually obliterate half the network, but it does look like just over ~20% of the hashrate was knocked offline. That slowed down block creation which means Bitcoin fees are skyrocketing - doubling to almost ~$60/transaction at time of writing.

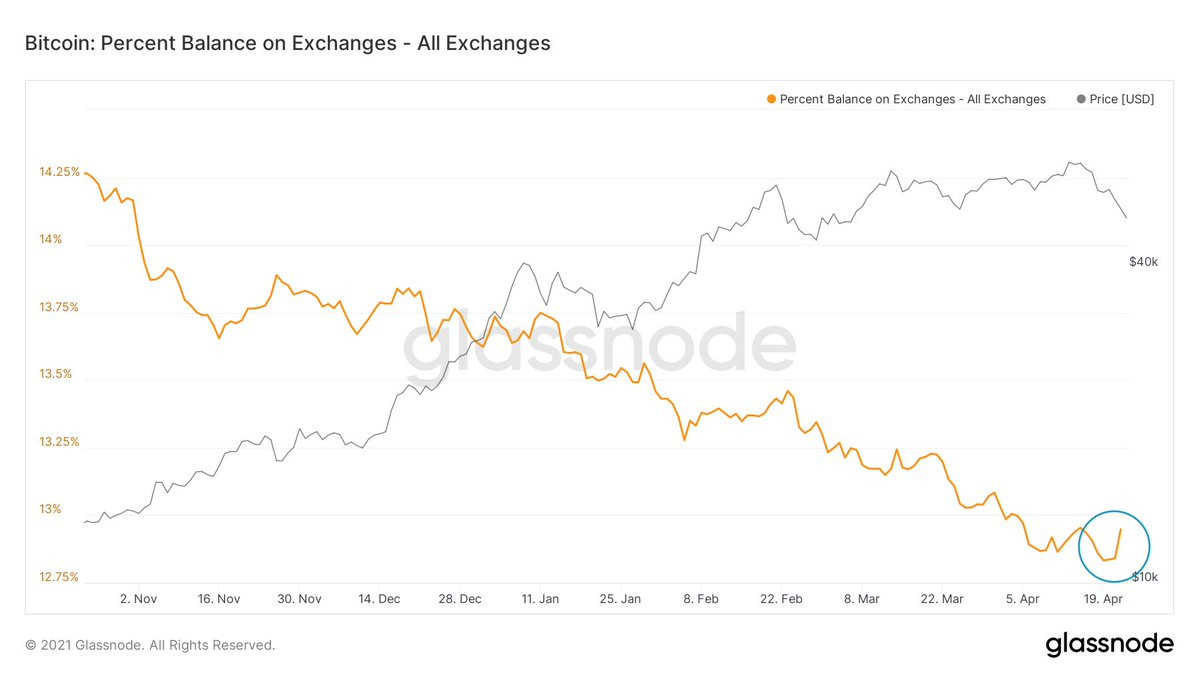

Another reason that fees spiked is because holders were rushing to get their bitcoin to exchanges, presumably with the intent to sell before the price dropped further. More than ~20k bitcoin were deposited on various exchanges, the most in a single day since the March 20th crash. That sounds pretty alarming but the trend of supply leaving exchanges is still very much intact. Here is the change in context:

To me this all feels like very short term movement. We’ve talked before about how corrections like this are a normal part of clearing out leverage in the bull run. In the 2017 bull run there were six major drops larger than 30%. This is only our third drop this cycle and none of them so far have reached 30%. It is another good reminder of why you can’t afford to put more in Bitcoin than you can afford to lose. If dips like this frighten you then you own too much Bitcoin.

Reforming the Ethereum fee market (EIP-1559)

“I just heard about EIP-1559 but the description was pretty wonky, so I thought I would ask you to help make it comprehensible. What is EIP-1559, and should it impact ETH value long term?” - IS

EIP stands for Ethereum Improvement Proposal, modeled after the Bitcoin Improvement Proposal (BIP) process. EIPs/BIPs are given numbers as a way of helping to organize debates about specific ideas and implementations for upgrades to the network. So EIP-1559 is a specific proposal for improving Ethereum that is being considered but hasn’t yet been adopted - something like a bill still working its way through congress.

EIP-1559 is an update intended to improve the Ethereum fee market, mainly by making it smoother and more predictable. Right now transactions on Ethereum bid for inclusion on a block by offering miners a transaction fee. Users (with help from their wallets) have to guess what fee they should offer and the penalty for a bad guess is steep. If they overpay they won’t get a refund and if they underpay they may never be included in a block at all. Since most users would prefer for their transactions to be included they are incentivized to overpay, which raises the prices for other users and creates a negative feedback loop. Fees are high, reliability is low. Bad user experience.

EIP-1559 replaces that auction with a different mechanism. First it doubles the hard cap on how many transactions can fit in a block but then it replaces the user-chosen transaction fee with a network-specified fee that goes up when blocks are above 50% capacity and down when blocks are below 50% capacity. Doubling its blocksize and aiming for half-capacity will mean blocks are the same size on average but with more flexibility. The variable blocksize acts like a buffer, absorbing some of the demand volatility before it creates volatility in transaction fees.

The end result is blocks with the same average size and the same efficiency, so this isn’t really a scaling solution. But since we know that users today are significantly overpaying for certainty about inclusion we can reasonably assume that making the fee market more predictable will probably make fees go down.1

The other major change in EIP-1559 is that part of the transaction fee (called the "base fee") will be destroyed rather than sent to Ethereum miners. The reasons for this are economically complex and outside our scope here, but the tl;dr is that this prevents miners from being able to easily manipulate the fee market to their advantage. Destroying ether makes the remaining ether more scarce, so you can think of burned ether as a kind of payment to every Ethereum holder.

There are basically two ways you can pay for cryptocurrency security: transaction fees (which charge people who spend) and new coins (which charge people who save). Paying for security with transaction fees penalizes spenders and subsidizes savers, which encourages people to hold your currency and increases its value. But the downside is that transaction fees can be volatile and hence your security budget may be volatile as well. New coins penalize savers but have the advantage that they will be issued reliably on the schedule the network determines.

EIP-1559 aims to get the best of both worlds by having holders pay miners (in newly issued coins) and then having spenders pay the holders (in burned transaction fees). If it works out Ethereum will have the continuity of security that new issuance allows while keeping the incentive to save that transaction fees create. It’s even possible more ether will be burned in transaction fees than are newly issued and the supply of Ethereum will become deflationary. Exactly how fees and issuance will balance out remains to be seen.

Ethereum miners are overall not excited about destroying money that might otherwise have been theirs and many have expressed opposition to EIP-1559. Ultimately I don’t think the miners have very much leverage - the only version of Ethereum that is valuable is the one that users want to buy. Given that EIP-1559 seems to be their clear preference my guess is miners will grudgingly accept it.

EIP-1559 is slated to be part of the "London" fork, currently expected sometime in July. If the changes to the fee market legitimately do ease fee pressure I would expect that to boost demand for ether in the short to medium term. If the burn rate turns out to be genuinely deflationary I would expect that to boost demand for ether in the long term. The big question is how well it delivers on its goals and whether there are any unexpected consequences. We’ll likely know soon.

Own the concept of having been right

Several of you noticed the math error on our last post where the phrase

Addresses that control 100-1000k bitcoin ($0.5M-$5.6M) …

was ever-so-slightly off by several orders of magnitude and should actually have read:

Addresses that control 100-1000 bitcoin ($5.6M-$56M) …

I fixed the post but sadly my shame will remain in your inbox forever.

As a thank you to readers who help me find mistakes, I am setting up a Something Interesting bug bounty. Whenever a reader helps me find and correct a mistake in a post I will mint an NFT representing that errata and give it to the first person who brings the fix to my attention.2

You can see all the Something Interesting NFTs here. Anyone can win an errata NFT by helping me learn to think good. Paid subscribers at the Patron tier are also eligible to win NFTs of specific issues of Something Interesting. Consider subscribing!

Other things happening now:

The last two bubble cycles compared to the current one. Past performance implies this cycle would top out in September around ~$300k-800k/BTC and then stabilize around $100k-250k. (h/t reader GO)

The next time someone tells you the government is going to shut down Bitcoin point them to Louisiana HR-33 (2021) commending "Satoshi Nakamoto for his contribution to economic security." To be clear this is a resolution, not actual legislation. It's not meaningful. Funny though!

EIP-1559 also has significant implications for Miner Extractable Value (MEV) which I hope to do a deep dive into at some point but is too much to get into here.

Assuming gas fees are reasonable I will also send it to them! But no promises about that until scaling is solved.