Where we're going we don't need uptime

plus a former Fed Chair says Bitcoin price makes sense against weakening dollar

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Welcome to the party! Bitcoin brought the dip

Coinbase has some outages but investors don’t care

Some early warning signs of the market overheating

Mainstream attention hasn’t started to kick in yet

Early miner spooks the Bitcoin market

Seems like only last issue we were talking about how Bitcoin likes to shake out less committed investors with sudden, wild price swings:

The daily candle ended up being ~$7000 and the drop seems to still be unfolding (we are just above $30k as of writing). There is no way to know what moves the animal spirits of the market - but at least some of the movement can probably be attributed to a very early miner who decided to move 1000 bitcoin (~$40M at the time they moved) for the first time in more than a decade.

It seems likely that at least some of those coins have been (or are about to be) sold, otherwise why move them? Such a large sell from such an old stash can be an alarming signal and the market was spooked, dropping ~$5000 in a matter of hours. It’s pretty typical for Bitcoin to experience sudden, significant drops in the price - even in a bull market. We should expect more bumps like this moving forward.

Coinbase IPO futures hit all time highs

Just before Christmas derivatives exchange FTX launched a futures market for the highly anticipated Coinbase IPO. The market is very small (~$33k/day volume) and not open to US investors, but the investors it is open to are very bullish:

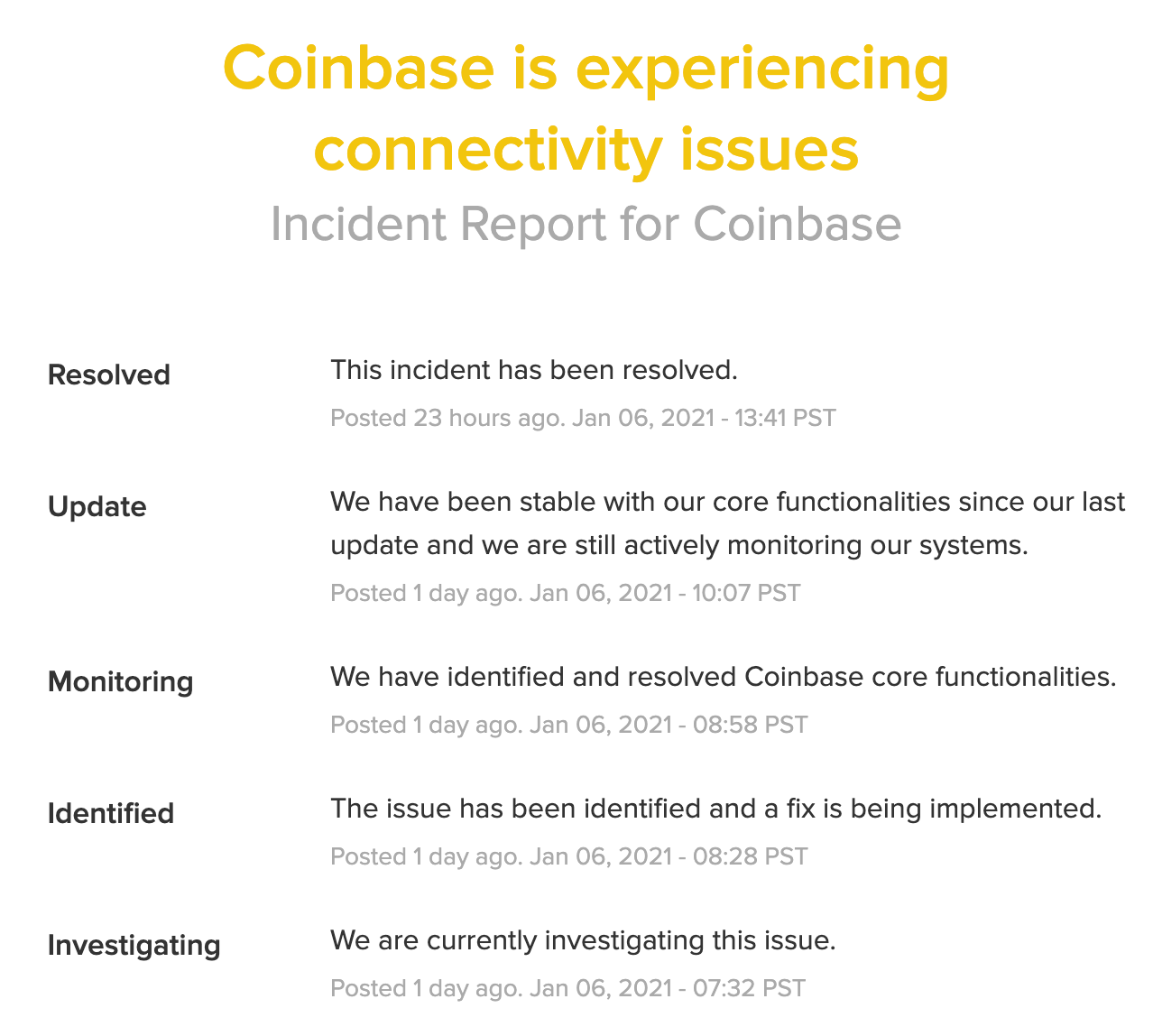

Coinbase for it’s part celebrated the Bitcoin bull run with the traditional outage:

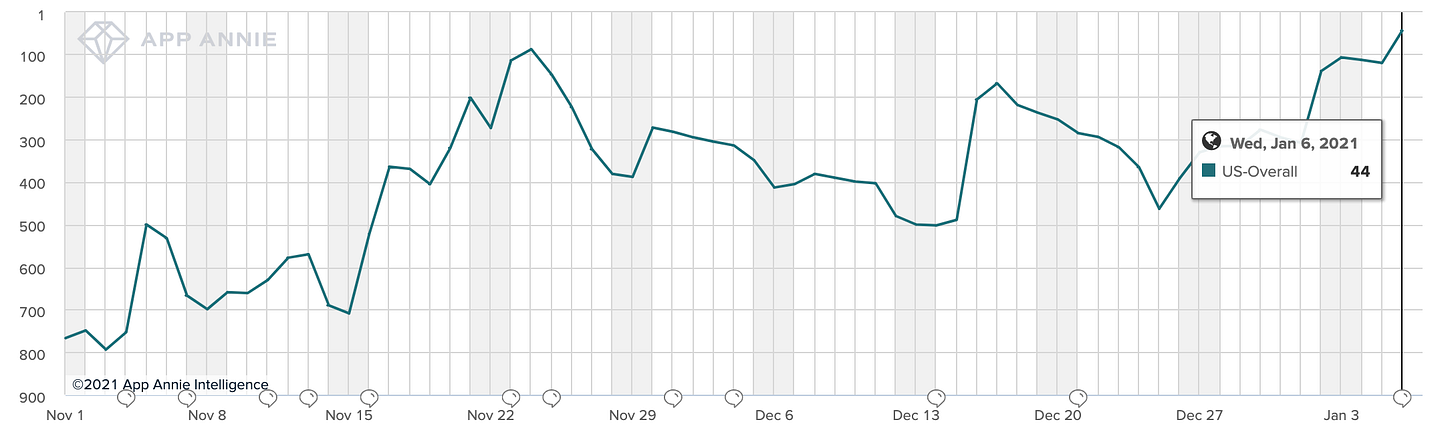

Here is how the Coinbase’s iOS App Store ranking over the last few months:

As of writing they are currently #34, behind Pinterest but ahead of Shopify.

Early signs that the market may be overheating

Editor’s note: This section was written before the Sunday dip. I’ve left it unchanged for posterity, since it is an interesting artifact of how quickly the crypto market moves. The metrics that it references have significantly moved since time of writing.

Even in Bitcoin bull runs don’t go on forever. This particular cycle may be starting to overheat. Glassnode.io tracks an interesting measure called the adjusted spent output realized profit (aSORP). It’s basically the ratio of how valuable every bitcoin was when it last moved compared to how valuable it was when it last moved before that (adjusted just means they throw out very short lived transactions).

You can learn more about it here if you are curious but the tl;dr is that when aSORP is above 1 bitcoins are mostly trading at profit and when it is below 1 they are trading mostly at a loss. In a bull market aSORP doesn’t stay below 1 for long (because people buy the dips) and in a bear market aSORP doesn’t stay above 1 for long (because people sell into the peaks). Right now we are decisively in a bull market - but more importantly we are seeing an all time high in aSORP. There have never been so much unrealized profit before - the last time we were this close was the top in 2017:

In general bull runs last longer when they go slower and have more corrections along the way. This surge upwards is exciting! But that excitement should probably temper our expectations a fair amount. There is still a lot of house money floating around in the market and it’s not clear there is liquidity to back it up.

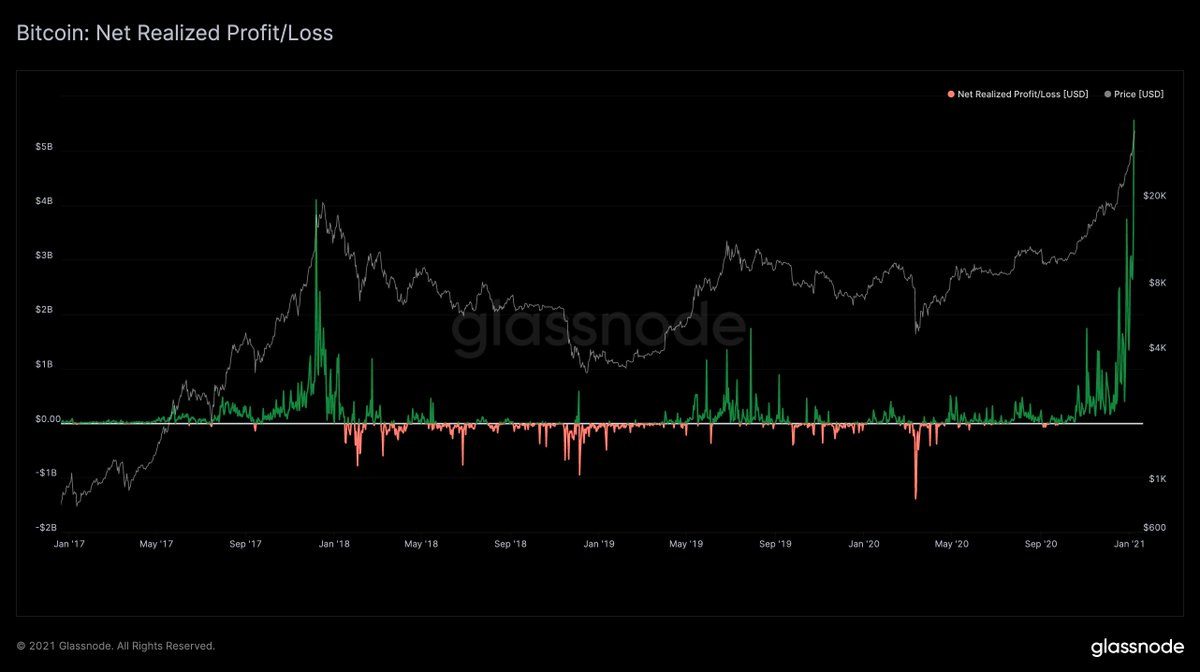

You can also use the same measure and sum it up over time rather than comparing ratios and the result is an estimation of the total amount of realized profit/loss, i.e. how much money have people already gained from or lost in trading bitcoin on chain.

In other words the total amount of money made from selling Bitcoin and the total amount of unrealized profit waiting to be taken are both at an all time high right now. There is no way of knowing how much further up we go without a correction, but it is wise to be prepared for a sizeable correction soon.

Retail demand hasn’t arrived yet

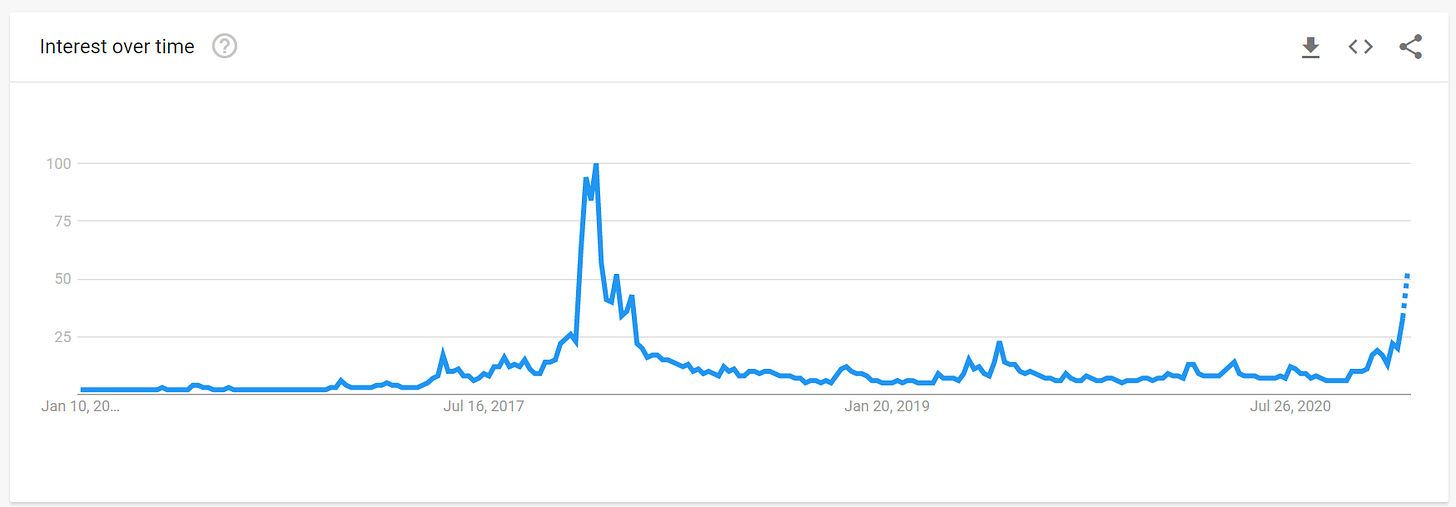

In spite of the indicators above that suggest a pullback, I still think we are relatively early in the bull cycle. One way you can gauge that is by looking for signs that the general public is (or is not) paying attention to Bitcoin. The final stages of a bubble tend to feature a lot of mainstream coverage of the price and a lot of new interest from casual investors (i.e. gamblers). You can see how many people are searching for Bitcoin on Google for example:

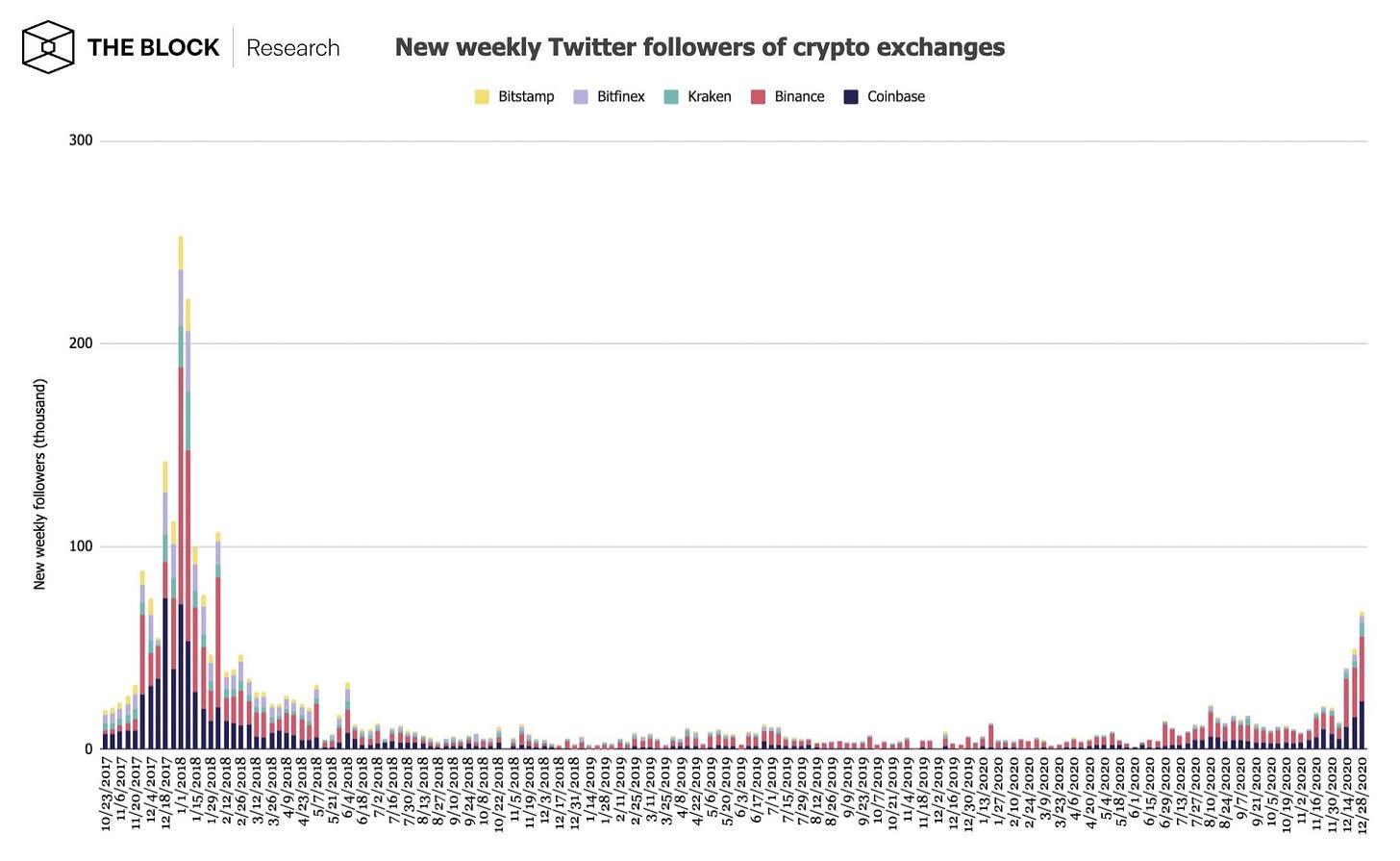

Interest is up but we are clearly not at 2017 levels yet. Another approach is to watch how many people are starting to follow the Twitter accounts of major exchanges. The same pattern shows up there - rising but still nowhere near the peak in 2017. The retail stampede has not yet arrived. Most people aren’t even paying attention.

Other things happening right now:

Bill Miller on the proposed FinCEN regulations for Bitcoin: “You can’t cut the head off this snake … to the extent the government tries it will just demonstrate the value.”

Former Fed Chair Kevin Warsh describes Bitcoin price as the beneficiary of loose central bank policies, particularly the US Federal Reserve: