Regulators annoy regulators, too

Plus the infrastructure bill grinds to a halt over cryptocurrency provisions and Megan Thee Stallion explains Bitcoin perfectly.

In this issue:

The best law would have been none at all

Regulators annoyed regulators, too

The Ethereum London fork passes without turmoil

The best law would have been none at all

We’ve talked an exhausting number of times recently about the sclerotic, halting progress of the infrastructure bill lumbering through Congress. Most of the bill is dedicated to important government infrastructure projects like making school lunches more environmentally friendly and increasing female representation in the long-haul trucking industry, but a portion of it is dedicated to raising funds to pay for the aforementioned programs. In the section dedicated to fundraising is a small adjustment to a definition in the tax code that casually outlaws the vast majority of cryptocurrency related business in America.

The changes proposed are meant to increase tax revenue to pay for the rest of the infrastructure bill - but they don’t do that by raising taxes. Raising taxes is politically unpopular. Instead they propose to raise tax revenue by increasing tax enforcement. Tax enforcement is actually quite popular. The obvious implication is that crypto is rife with tax-avoidance, but in practice that isn’t really true - nobody can stop you from moving your Bitcoin but everyone can see that you moved it. Bitcoin is a tool for evading censorship, not for evading detection.1

Anyway that’s not the real problem. The real problem is that it is impossible and legally requiring businesses do impossible things means they will either close the business, leave the country or become a criminal enterprise. Reasonable people can debate about which of those outcomes is most likely or most desirable, but none of them seem great for raising taxes to pay for infrastructure. That might make you reasonably ask how that provision ended up in an obscure clause in the tax-enforcement section of an unrelated infrastructure bill.

Senators Wyden (D-Oregon), Lummis (R-Wyoming) and Toomey (R-Pennsylvania) authored and pushed for an amendment narrowing the language of the bill and specifically exempting certain businesses - most notably wallet developers and cryptocurrency miners/validators. That seemed like a mostly livable compromise that was on track to pass - even the original author of the provision, Senator Portman (R-Ohio) seemed broadly amenable:

Of course, that was Thursday ago! It was a simpler time. By Friday Senator Portman had joined Senators Sinema (D-Arizona) and Warner (D-Virginia) in sponsoring a competing amendment to the infrastructure bill that took a similar but narrower approach - exempting only private key management tools and proof-of-work mining, leaving behind the strong implication that proof-of-stake and DeFi protocols should not benefit from the same exemptions.

I’ve made no secret of my distaste for proof-of-stake but I don’t think it is productive or useful to outlaw it. Exempting only proof-of-work miners also leaves out software developers, DeFi aggregators and anyone running a Lightning Node - all non-custodial services who literally cannot comply with the law. The government shouldn’t be picking technological winners and losers with legislation - both because it is wrong and because they are genuinely bad at it.

The Warner-Portman amendment is a bad law but it is good politics. It gives the administration the ability to say they responded to the concerns of crypto advocates without substantially reducing the newly claimed authority. The fact that Senator Portman is a Republican allows them to present the effort as bipartisan. Treasury Secretary Janet Yellen has been speaking with lawmakers behind the scenes to push for the Warner-Portman amendment.

If the amendment passes as written (and it looks like it might) it wouldn’t take effect until 2023, which leaves plenty of time to petition the courts. But the only reason to add a controversial and sweeping change like this as a last minute addition to a must pass bill is to avoid pushback or scrutiny.

The debate surrounding cryptocurrency amendments seems to have halted progress on the overall bill for now, which perhaps speaks to how significant an industry cryptocurrency has become. Needlessly setting back America’s strategic advantage in cryptocurrency would be an unforgivable sin - but the real betrayal here is forcing me to type the worst four words in the English language: Elon Musk is right.

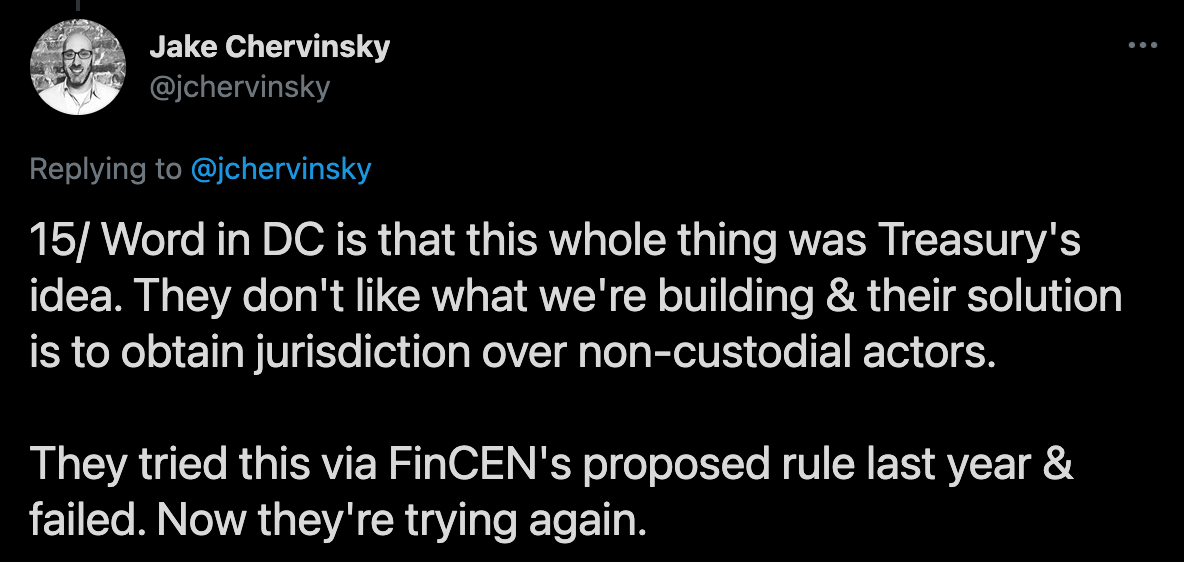

Regulators annoy regulators, too

We talked on Wednesday about SEC Chair Gary Gensler’s recent speech on cryptocurrency at the Aspen Security Forum. It will perhaps not surprise you to learn that the Chair of the SEC interprets the role of the SEC expansively. Mr Gensler’s view is that almost everything happening in crypto is some kind of security and should therefore be under the supervision of the Securities and Exchange Commission.

The SEC’s authority does not extend to everything - it extends specifically to securities. Very loosely (I am not a lawyer and this is not legal advice) a security is when you hire someone else to make you money. If you buy a pile of gold bars or a barrel of oil you might be hoping to make money but what you bought was not a security. On the other hand shares in a gold mining company are a security because you are relying on someone else to earn a profit and give some back to you.

These days it is widely agreed that Bitcoin is not a security - Gensler goes out of his way to emphasize "if you want to invest in a digital, scarce, speculative store of value, that’s fine." On the other hand, if you offer an account paying Bitcoin denominated interest that probably is a security. There are interesting gray areas. If you invest in a smart contract is that more like buying a Bitcoin/barrel of oil? Or is it more like owning part of an enterprise whose employees happen to not exist?

I don’t mean to give the impression that buying a barrel of oil or a pile of gold is unregulated, just that the regulators are different. Commodities like oil, gold and Bitcoin are regulated by the Commodities Futures Trading Commission (or CFTC). It will perhaps not surprise you to learn that the CFTC also has an expansive view of their own regulatory authority over crypto assets.

It’s possible that Gensler’s real audience with the speech to the Aspen Security Forum wasn’t so much the cryptocurrency industry as it was signalling a territorial claim to other regulators. Quintenz and Gensler are like dogs bickering over a hot dog. It doesn’t really matter who wins - it doesn’t end well for the hot dog.

Other things happening right now:

On Friday Ethereum activated its "London" fork a bundle of changes the most notable of which was EIP-1559 a change to fee management we’ve talked about before. The most interesting thing about the launch is that nothing dramatic seems to have happened. No news is good news in this case and Ethereum’s price has risen to almost ~$3k/ETH (at time of writing) in response. The EIP-1559 logic has burned ~8.4k ETH (~$25M) since the fork.

There are no coincidences. The fact that you are reading this means you are energetically aligned with me and this message.

This is an exceptionally good Bitcoin introduction on a variety of levels:

There are a handful of privacy-focused cryptocurrencies. We talked last week about how the US had arrested the lead developer of Monero, one of the more significant privacy coins. The majority of cryptocurrencies however are terrible tools for hiding money.