The US might outlaw Bitcoin mining by accident

Plus StonerCats copied the CryptoPoops is a real sentence you can never unread

In this issue:

The market is noticing the Bitcoin supply shock

The US might outlaw Bitcoin mining by accident

Gary Vee starts a CryptoPunk feeding frenzy

The market is noticing the Bitcoin supply shock

Bitcoin continued its upward trajectory from last week, completing ten consecutive days of closing at a higher price for the first time since 2017. At time of writing the price is hovering around ~$41.5k/BTC. Since crashing down from all time highs bitcoin have been flowing out of newer addresses and back into addresses with an established history of holding - so called "strong hands."

That is the shape of a supply shock on the Bitcoin market. People who were willing to sell have sold their bitcoin to people who are unwilling to sell and now there is less bitcoin available to buy. In the past movements like this have been precursors to major price increases as the market adjusts to new levels of scarcity. In the graph below red bars represent moments when most bitcoin was held by newer addresses, green bars when most bitcoin was in the hands of more established holders. We are in a similar green bar right now.

Make sure you and your loved ones have their Bitcoin Insurance policy ready.

The US might outlaw Bitcoin mining by accident

On Wednesday night the US Senate voted to advance the enormous infrastructure bill with a vote of 67-32, overwhelmingly bipartisan by modern standards. The bill includes provisions for bridge repair, rails for passenger train, public transit and clean water. It also includes a host of rafters and provisions intended (loosely) to pay for the bill by raising taxes, reducing expenditures and tightening down enforcement of the existing tax code. Nestled in the sections about tax enforcement is a new definition of "broker" expanded to include "any person who (for consideration) is responsible for and regularly provides any service effectuating transfers of digital assets."

'For consideration' is a complicated term - it can mean money, but it can also mean anything else of meaningful value, like data or brand visibility. Depending on how one interprets that particular clause this could imply that everyone from cryptocurrency developers to hardware wallets to miners would be considered a "broker" from the perspective of U.S. tax code.

Interpreted literally the new regulations would require Bitcoin miners operating in US jurisdictions to collect and share customer data for every transaction included in a block they mine and perhaps also those they mine on top of. Since that is functionally impossible to do, the law as written is effectively a de facto ban on cryptocurrency mining in the US.1

This is a terrible, terrible idea. For one thing, killing an industry is not a super intelligent way to raise tax revenue. The result will obviously be the opposite.2 More importantly the surveillance proposed would be incredibly burdensome to businesses and invasive to consumers. Imagine needing to submit your name, phone number and home address to buy a soda from a vending machine.

It is often safe to ignore crypto legislation - most of it dies on its own. But this provision is attached to is relatively popular bill with quite a bit of momentum. It is very likely to pass. To be clear, none of this is a risk to Bitcoin. Bitcoin has no comprehension of tax codes or infrastructure bills or reporting requirements. We cannot ban Bitcoin, we can only ban ourselves from reaping the benefits. Let’s hope Congress doesn’t squander America’s geopolitical advantage in Bitcoin mining.

Gary Vee starts a CryptoPunk feeding frenzy

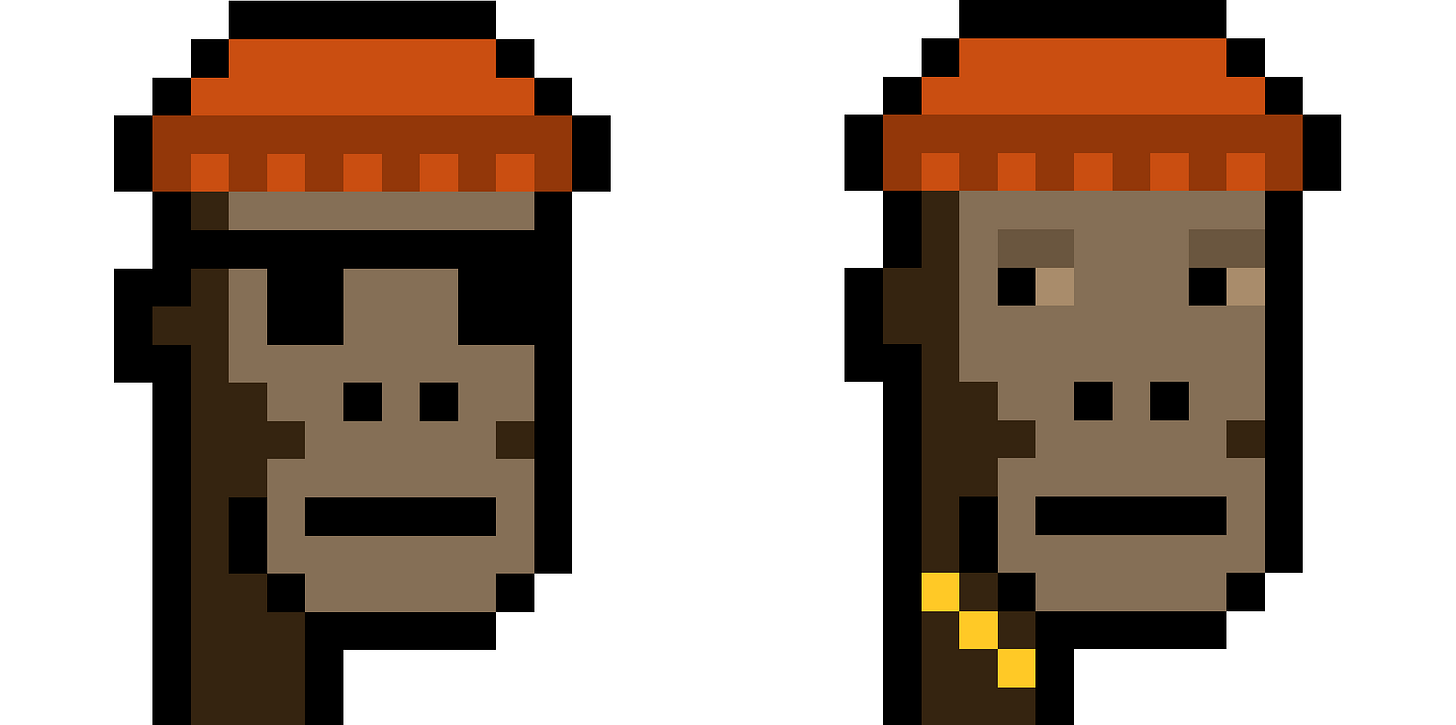

On Friday afternoon entrepreneur and influencer Gary Vee (creator of the VeeFriends) spent 1600 ETH (~$3.76M at time of sale) to purchase a CryptoPunk - specifically the ape on the left in the image below. It was for a brief, beautiful moment the most expensive CryptoPunk ape ever sold until a few hours later when the ape on the right sold for 2250 ETH (~$5.47M at time of sale). That has to have been a bittersweet outcome for Gary Vee, who almost certainly budgeted this purchase mostly as a marketing expense. Still a cool ape, though.

These back-to-back mega-purchases seemed to trigger a feeding frenzy where (relatively) cheap CryptoPunks were bought up en masse. One account spent ~$6M worth of ETH to buy 104 punks, paying miners a ~5 ETH (~$12k) bribe to include all their purchases in a single block so that no one would have time to react. They even did a small scale test run of their purchase on Thursday buying two punks in the same block to confirm the strategy worked. This was a well planned and carefully executed large scale investment, not an impulse purchase.

It wasn’t just a few isolated buyers that drove today’s action, though. The 3rd, 4th, 5th, 6th and 9th largest CryptoPunk purchases of all time (priced in USD) all happened in the last 24 hours alongside dozens of six figure sales - roughly ~$50.1M worth of CryptoPunks in total. The price of a floor punk rose from ~23 ETH (~$50k at the time) to ~28.5 ETH (~$70k at time of writing).

Other things happening right now:

Not everyone in the US Government is confused about Bitcoin.

Ashton Kutcher and Mila Kunis launched an NFT project called Stoner Cats to fundraise for a series of animated shorts featuring the same characters. The cats minted for 0.35 ETH apiece (about $800 at the time). The NFTs don’t come with any rights or royalties but they did still sell out under extremely competitive gas conditions. That was great for Ashton and Mila (they raised ~$11M) but it worked out pretty badly for some users: ~$800k worth of ETH was burned in failed transactions. The reason? They cribbed the code wholesale from a previous project called The CryptoPoops. Not to worry! The floor price of a Stoner Cat right now is 0.49 ETH, or roughly ~$1200 at time of writing. The market seems confident they will work out the kinks.

Presented without comment:

Interestingly being impossible does not disqualify a law because everything is dumb.

The analysis on the bill claims it would raise $28B of tax revenue, which is a baffling claim.