The real government is the one you don’t see

Plus SEC Chair Gary Gensler is coming for DeFi and the final chapter of BSV

In this issue:

The real government is the one you don’t see

The SEC is coming for DeFi

Death of a Shitcoin

The real government is the one you don’t see

We talked last week about the "bipartisan" infrastructure bill and how a small change to the definition of 'broker' in the Tax Code might inadvertently outlaw Bitcoin mining in the United States. The changes are only a few dozen words buried in over 2700+ pages but presumably members of Congress are elected because they known to be careful readers.

Sadly, not everyone is a careful reader:

To be clear, Mr. Singer is indeed reading this wrong. The text of the bill in question does not affect anyone’s taxes. It does affect who is under financial surveillance and who is responsible for it. It also affects whether we can pay for the infrastructure bill, since it would kill the industries it was trying to tax. The language has narrowed since earlier drafts but it is still a bad law, which is why it is embedded deep in thousands of pages of tedious, unrelated legislation. It does not stand up to scrutiny.

Senator Rob Portman (R) of Ohio drafted the original amendment and has publicly stated the intent of the law is not to include cryptocurrency miners or software developers, and has offered to make a speech so that intention is clear in the "legislative record." But US Courts are clear that they do not interpret the legislative record, they interpret the text of the law. That makes sense! Senator Portman’s speeches are not subject to a vote. If the goal is to exempt cryptocurrency miners and software developers, the law should say that in the text.

Leaving regulatory definitions open to broad interpretation does not ensure that governments will do the right thing. It just pushes responsibility for interpreting the law onto regulatory officials - and regulatory officials can generally be counted on to interpret regulatory authority broadly. Most of the power this bill creates would be wielded by unelected officials with no public accountability.

There is still some hope of avoiding the damage - Senators Pat Toomey (R) of Rhode Island and Ron Wyden (D) of Oregon announced a plan to work together to fix the actual language of the bill. Bitcoin is bipartisan!

The SEC is coming for DeFi

On Tuesday SEC Chairman Gary Gensler gave a speech at the Aspen Security Forum where he emphasized that he agreed with his predecessor’s view that "every Initial Coin Offering (ICO) is a security" and therefore subject to the SECs regulatory supervision. He described crypto as a "wild west" in need of stronger investor protections. In particular his remarks seemed to be aimed at decentralized exchanges and lending protocols:

"I believe we have a crypto market now where many tokens may be unregistered securities, without required disclosures or market oversight … A typical trading platform has more than 50 tokens on it. In fact, many have well in excess of 100 tokens. While each token’s legal status depends on its own facts and circumstances, the probability is quite remote that, with 50 or 100 tokens, any given platform has zero securities" - SEC Chair Gary Gensler

We talked last week about how Uniswap recently decided to delist certain tokens from their website - it was almost certainly in response to this kind of increased government pressure. It seems increasingly clear that the SEC plans to take a harder line with DeFi projects than it has in the past.

As a side note, he did note a possible path forward for a Bitcoin Exchange Traded Fund (ETF). We’ve talked before about Bitcoin ETFs but the basic idea is that a Bitcoin ETF would make it easier to invest in Bitcoin from traditional finance platforms without needing to handle actual Bitcoin. The ETF proposal that Gensler hinted at was not one based on actual Bitcoin but instead on Bitcoin futures. I think the people calling this "a pathway to a Bitcoin ETF" are being overly optimistic but he did make it clear his concerns were less about Bitcoin and more about scrutinizing the rest of the cryptocurrency ecosystem.

Death of a Shitcoin

Bitcoin Satoshi’s Vision (BSV) is a fork of Bitcoin Cash (BCH) which itself is a fork of Bitcoin (BTC). We’ve talked about forks in cryptocurrencies before but the easiest way to think of them is like schisms in a church. Originally there was only one truth and the truth was Bitcoin. Then the faithful argued about the blocksize and believers in large blocks left and formed BCH. Disagreements among the BCH camp eventually lead to a group splintering off to form BSV.

We generally avoid discussing BSV on Something Interesting because it is a scam and I have no desire to give it airtime. The BSV community is a cult of personality surrounding serial liar and tragicomic clown Craig Wright, who claims to be Satoshi Nakamoto and sells BSV as a way of profiting from that lie. BSV is worthless both as a technology and an investment. But that doesn’t mean we can’t learn from it.

When you fork away from an existing chain you face a difficult choice - do you make mining the new chain compatible with mining the original chain or not? You can choose a new proof-of-work algorithm and hope that you attract new miners to defend your chain faster than you attract attackers hoping to exploit it - but that’s like firing your entire security staff and trying to hire replacements before any criminals notice. Most forks so far have opted not to do that. Staying compatible with the original chain has its own dangers, though - particularly for the minority fork.

Miners (like any mercenaries) are just as capable of attacking as defending and are always weighing the relative profitability of each option. A fork that doesn’t change proof-of-work algorithms has a pre-existing workforce of potential defenders it can draw from - but also a pre-existing array of potential attackers it is vulnerable to. Hashpower is like military strength - you aren’t protected if you have a lot of it, you are protected if you have more of it than the other side.

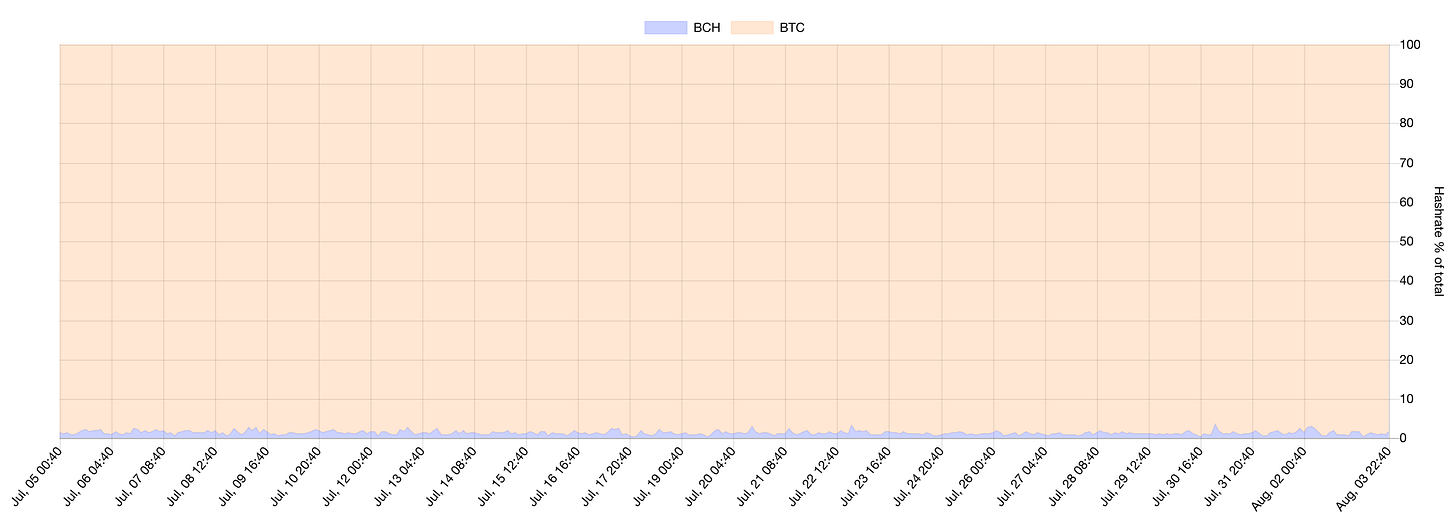

This is the distribution of mining hashpower among various forks of Bitcoin. The strip of blue along the bottom is BCH, which ranges from ~1-2% of total hashpower. If BSV were on the chart it would represent ~0.25% of total hashpower.

That means the reason BSV hasn’t been attacked up to this point is not because it was well defended but because it was more profitable to ignore BSV and continue mining Bitcoin. With the recent downturn in the price of Bitcoin however some miners have become more willing to hunt for their meal:

The main victims of 51% attacks are exchanges. Attackers make large deposits and then use the attack to rewrite history and undo those deposits - a high-stakes digital version of the old coin-on-a-string vending machine trick.

A 51% attack has to be more profitable than the hashpower it cost to execute, so only users who are accepting extremely large payments are at risk from them. But since the users who accept the largest payments are typically exchanges and market makers that can still be fatal to the network.

Most exchanges (notably Coinbase and Binance) delisted BSV in 2019 after a series of frivolous lawsuits by Craig Wright, but you can still trade it on a number of exchanges today.1 This is the second 51% attack BSV has endured in recent weeks forcing exchanges to pause withdrawals and deposits. Eventually they will decide it is not worth the hassle and delist BSV. So it goes.

Other things happening right now:

Christie’s announced they will be auctioning a set of Bored Ape Yacht Club NFTs this September with details to be announced this Friday. The floor on BAYCs jumped from roughly ~8 ETH (~$19k) to ~14 ETH (~$35k) in response to the news. Below is a picture of a modest starter ape (~12.65 ETH, ~$31k) and an expensive aspirational ape (~1,368 ETH, ~$3.4M). I leave it to you to decide which is which.

Founder and erstwhile lead maintainer of privacy focused cryptocurrency Monero (XMR) Riccardo Spagni (also known as FluffyPony) was arrested on Tuesday and is being held without bond pending extradition to South Africa. The charges relate to failure to appear at a South African court date regarding a decade old fraud case unrelated to Monero - but it is hard to believe the sudden interest in pressing this particular case is a coincidence.