Selfless VCs hurl themselves into the Wormhole

Plus Universal Blockchain Income and an unsubtle metaphor for everything

In this issue:

Paper hands can’t hold us back

Selfless VCs hurl themselves into the Wormhole

Universal Blockchain Income

Does this mean Tether is backed now?

An unsubtle metaphor for everything

Paper hands can’t hold us back

The story of the Bitcoin market in the last three months or so has been the price falling while long term holders (>6 months) continue to accumulate. There are now ~11% more bitcoin held by long term holders than this time last year with the majority of them having emerged in the 6-12 month timeframe. The reason the price has continued to drop in spite of long term holder accumulation is because most of the selling is happening off-chain. People who actually use Bitcoin remain bullish. People who wanted to bet on Bitcoin are selling off.

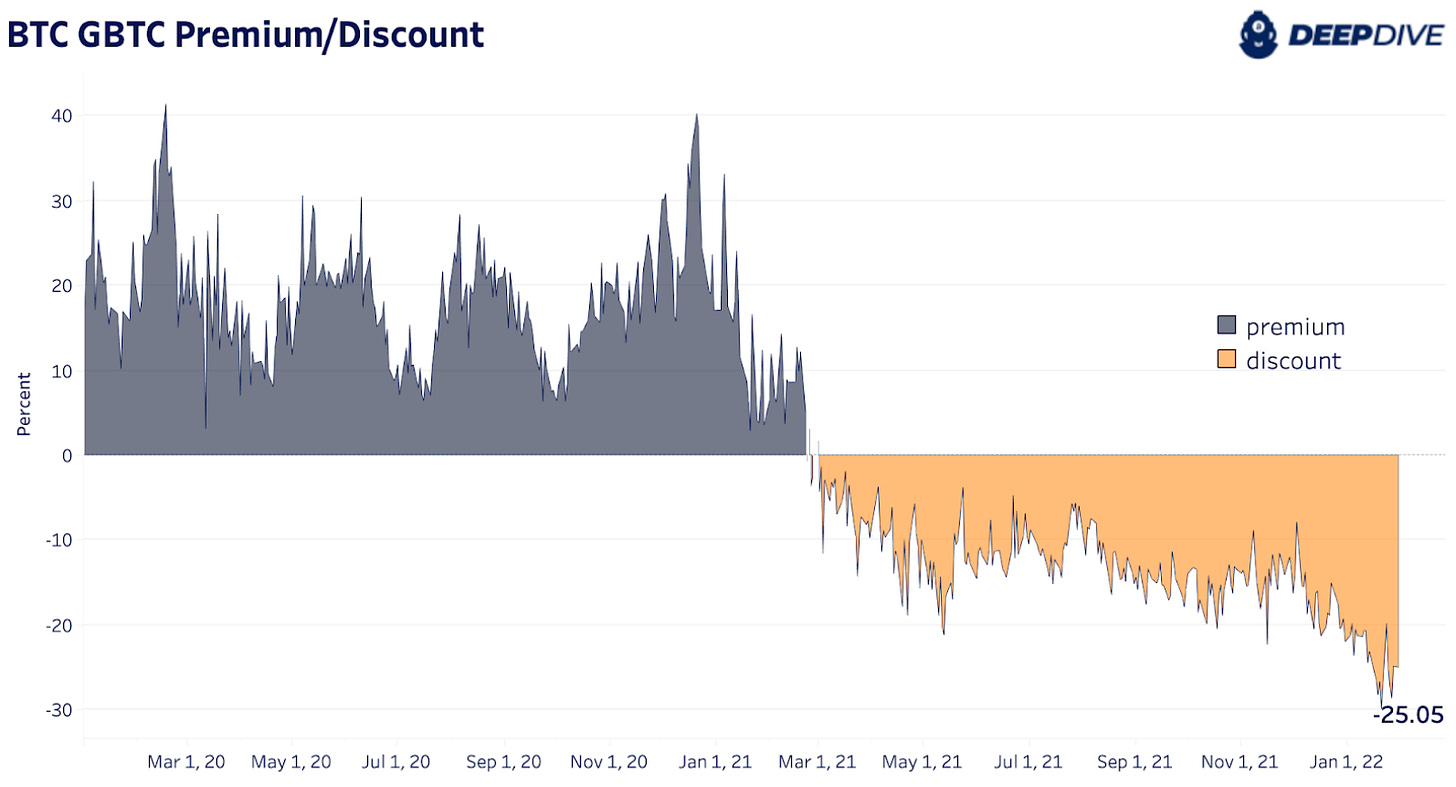

One way you can see this is by watching the discount on the Greyscale Bitcoin Trust (GBTC), which we’ve talked about many times before going back as far as the very first issue. GBTC is a kind of trad-fi wrapper around Bitcoin for institutions who want exposure but don’t want to actually own Bitcoin — so the premium (or discount) is a kind of proxy for how eagerly those institutions are stepping on each other trying to get in (or out) of the market. Here’s what it looks like these days:

This is probably the tailwind holding markets back right now. Institutions with weak conviction are selling too much for the price to go up and diamond handed hodlers are accumulating too much for the price to go down. Until one side or the other runs out of ammunition the price will keep slouching along between them.

Selfless VCs hurl themselves into the wormhole

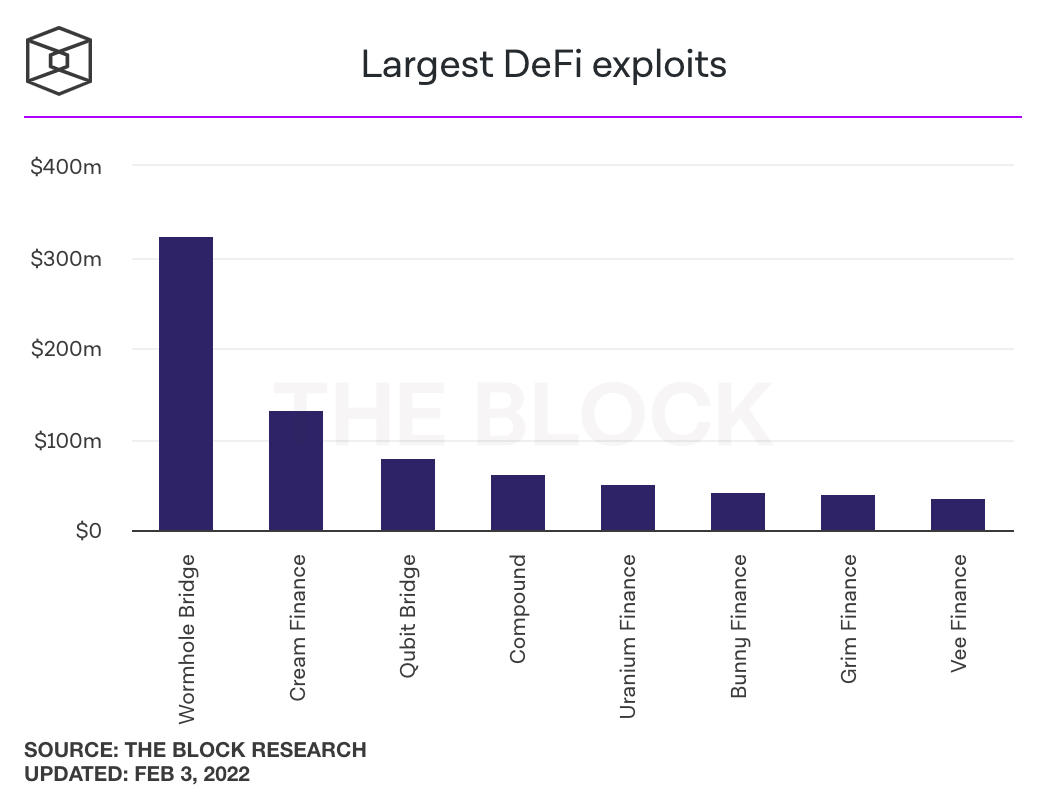

An attacker on last Wednesday drained ~120k ETH (~$320M at the time) from the Wormhole vaults, twice as much as was taken in the next largest DeFi exploit. Wormhole is a bridging service for allowing you to use one chain’s token (in this case, Ethereum) on another chain (in this case Solana). You deposit your ETH with Wormhole on the ETH blockchain and they give you wETH1 to use as collateral in various Solana DeFi applications.

Here is a technical explanation of the exploit if you are curious but for our purposes you can think of it like this: Wormhole bought and sold ETH denominated casino chips so that people could place bets in the Solana casino. Someone figured out how to make counterfeit chips and they cashed out enough counterfeits to steal all of the money backing up real chip holders. In practice the attack meant a substantial portion of the ETH in the Solana economy was suddenly worthless. Everyone still had all their chips but there was nothing to cash them in for.

This is obviously a bummer for those holding wETH but it was also a bummer for the entire Solana ecosystem. wETH was a key reserve collateral woven into everything — there was no way to unwind it. If Wormhole was allowed to go bankrupt the resulting contagion would almost certainly destroy the Solana economy. Wormhole investors Jump Capital stepped up to replace the ~120k ETH within 24 hours — quickly enough to stem the bleeding.

That is interesting in a multitude of ways. First, it is interesting because putting $320M into a system that was literally just hacked is putting a lot of trust in a developer team that was literally just hacked. I’m not trying to fault the Wormhole team, smart contract bugs happen — but normally one would scale back into untrusted, recently patched code more cautiously.

It is also interesting because if it was that easy to raise $320M in a day Solana and Wormhole must be exceptionally lucrative for the VCs who are paying to defend them. Or perhaps they are exceptionally selfless.

But finally and most existentially: if these systems were actually decentralized there would be no one to pay when an exploit like this happened. The fact that there is some organization that is ready and willing to solve this crisis means neither Wormhole nor Solana are actually all that decentralized. In which case why introduce smart contract risk at all?

Anyway, apropos of nothing in particular please enjoy this old tweet from Wormhole and Solana investor Kyle Samani:

Universal Blockchain Income

"Just a thought, but how challenging would it be to create a UBI system that's crowdsourced on the blockchain vs normal governance procedures? Kinda like selling bonds to promote adoption on blockchain." -JS

Great question! Universal Basic Income (UBI) is one of my favorite policy ideas. A world where no one ever went hungry or felt trapped by their circumstances would be a better world. We deserve that world and we can afford it.2

We could certainly build out UBI on a blockchain if we wanted to. A cool thing about blockchains is that they can enforce any rules you want. Satoshi uses that capacity to enforce the absolute scarcity of Bitcoin, but you can use blockchains to enforce all kinds of mind-bending rule-systems of various complexities and purposes.3 We can pay out a defined universal income according to any logic we like.

Paying UBI out to addresses is unfortunately not the challenging part. The challenging part is mapping addresses back to human people. There is no way (that we know of) for a decentralized network to know either when:

A single person uses multiple addresses to seem like different people

(i.e registering for UBI multiple times with fake names)Multiple people use the same address to look like the same person

(i.e. continuing to collect UBI for dead relatives)

Crypto networks don’t have struggle to connect addresses and people because as far as a crypto network is concerned there is no such thing as people — they only know about addresses. But if we want to pay people and not addresses we’ll need a way to connect the two. Today the only means we have to confidently connect people with addresses involve centralized institutions, so a blockchain wouldn’t really add anything. Solve that problem and everything else falls into place.

Unfortunately I am not convinced there actually is a solution. If there was we probably wouldn't need crypto networks in the first place.

Does this mean Tether is backed now?

In 2016 cryptocurrency exchange Bitfinex4 was hacked and lost ~120k Bitcoin(~$60M at the time). To keep their exchange afloat at the time Bitfinex socialized the loss among customers, taking a 36% haircut from every account regardless of whether or not it held any Bitcoin. It is not at all clear this was legal but perhaps Bitfinex held very still and regulators’ vision is based on movement. I am not a lawyer.

In any case, as an apology Bitfinex gave everyone they stole borrowed money from a new token called BFX which they pinky-promised to pay back eventually. It’s a bit technical but here is a diagram of how the system worked:

They also created a market for the token so those who doubted could sell their claim to those who believed — and so that they could collect fees on the trades, obviously. This was also clever because nobody actually believed they would ever pay the tokens back so they traded significantly below par. That made it much cheaper for Bitfinex to buy back the debt, which they eventually did in 2017 when they retired the token.

So Bitfinex converted their debt into a wager about whether they would pay their debt off or not and then bet that they would. In a sense they paid their debt partially with money and partially with other people’s skepticism and they took fees while they did it. Masterful trade! Hard to see how it was legal, of course. I am not a lawyer, etc etc.

Unfortunately it did use up the BFX token ticker, so when Bitfinex went to launch their exchange token in 2019 they had to name it LEO instead. LEO is a pretty standard exchange token with a large, fixed supply that Bitfinex has pledged to spend 27% of its revenue each month buying and burning. But as a sweetener that probably no one thought mattered at the time, the whitepaper includes this provision:

An amount equal to at least 80% of recovered net funds from the Bitfinex hack will be used to repurchase and burn outstanding LEO tokens within 18 months from the date of recovery.

Likely no one put much thought into this rider since it was years after the Bitfinex hack, but there is no statute of limitations on stupid. Husband and wife Heather Morgan and Ilya Lichtenstein were arrested this week and the Department of Justice seized ~90k BTC of the ~120k BTC that were stolen, now worth ~$3.5B. Here is Morgan, performing an original rap in which she rhymes 'sammich' with 'vag itch.' There are lots more where that came from.

Technically that video isn’t important, it’s just amazing. The important thing is that Bitfinex is now (or will shortly be) in possession of ~$3.5B worth of Bitcoin that it has promised to spend at least ~$2.8B worth buying and burning LEO. The price of LEO more or less instantly doubled on the news.

Even the iron-stomached lawyers of Bitfinex have to be a little nervous about how this digs up awkward past and puts an enormous present day price tag on it. If I was a victim of the original Bitfinex hack I would certainly be thinking about who to sue right now. Regardless it seems like it is probably bad news for the Bitcoin market. Someone is probably going to be selling ~90k Bitcoin in the next 18 months.

Other things happening right now:

KPMG Canada (one of the big four accounting firms) has officially added Bitcoin & Ethereum to their corporate treasury. They declined to share how much they acquired, so probably it was a modest purchase and it may very well have come from the marketing budget. But the fact that an old, conservative company with a reputation based business like accounting would want to market itself as being comfortable with cryptocurrency is pretty significant. It will be interesting to see if others follow suit.

In an effort to stall a deepening financial crisis in Lebanon the Lebanese government is proposing a plan that will devalue the currency ~93% and confiscate ~75% of foreign assets as they convert them into pounds at a government defined exchange rates. It plans to pay depositors back over the next 15 years. Bitfinex only took 36% and they gave out souvenir tokens, too.

An artist put a $12M gold cube in Central Park for a day. The cube is real gold but is mostly hollow. It comes with a corresponding crypto token and NFT auction. One of these things is probably a metaphor for the other but I am not sure which one represents which.

wETH of course stands for Wormhole ETH, which is not to be confused with wETH (Wrapped ETH) which is ETH on the ETH blockchain, only ERC-721 wrapped. I don’t know why people say DeFi has a UX problem, it all seems perfectly cromulent to me.

If you also support UBI consider donating to GiveDirectly, my favorite charity. They are incredibly efficient (97% of donations go directly to the poor) and they do A/B experiments with the donations to scientifically prove the efficacy of UBI and disprove common myths about the poor might misuse direct cash donations. Anyone who sends me a receipt of a GiveDirectly donation I will comp an equivalent amount in paid subscription time for you or for a friend.

Fun fact: 4 of the first 7 smart contracts deployed on Ethereum were provably fair pyramid schemes, transforming a timeless scam into a strangely honest gambling game.

Bitfinex is also known for their involvement with controversial stablecoin Tether but that isn’t especially important to this story.