No! Bad Doge! No!

Plus Turkey bans crypto and Henry Ford's vision for currency

In this issue:

No! Bad Doge! No!

Turkey bans cryptocurrency (sort of)

The joys and sorrows of direct listing

No! Bad Doge! No!

On days like today I am deeply glad that I do not give investment advice. All is unknowable! Up is down! The gods must be crazy! We last talked about Dogecoin on Thursday when I compared it to the corpse in Weekend at Bernie’s. At the time it was trading at ~$0.14/DOGE until it of course tripled to ~$0.43/DOGE after which it settled down to a calm and sensible $0.26/DOGE at time of writing. By the time you read this it will either be $0.008/DOGE or $2.35/DOGE, I don’t know. I worry that the best way to invest in a market like this might be to put your dumbest friend in front of the Binance menu and buy whatever they are excited about.

I’m not sure there is a "reason" that Doge is exploding right now. Some shorts have been liquidated but not enough to explain this movement. The WallStreetBets mods briefly allowed discussion of cryptocurrency for the first time in years, but they banned it again almost immediately. The last update to the Dogecoin codebase was months ago so it wasn’t a tech upgrade. The Coinbase IPO obviously drew a lot of attention to the cryptocurrency space but Coinbase doesn’t even sell DOGE so it seems unlikely to be related.

No. The Dogecoin network is not worth 50 billion of anything. I’ve talked repeatedly and at length about why this is all a terrifying mistake, so I won’t bore you by repeating myself. Instead let’s all take a moment to remember the serenity prayer of John Maynard Keynes:

Turkey bans cryptocurrency (sort of)

Friday morning the Central Bank of Turkey announced that starting April 30th the use of cryptocurrency to purchase goods and services would be banned:

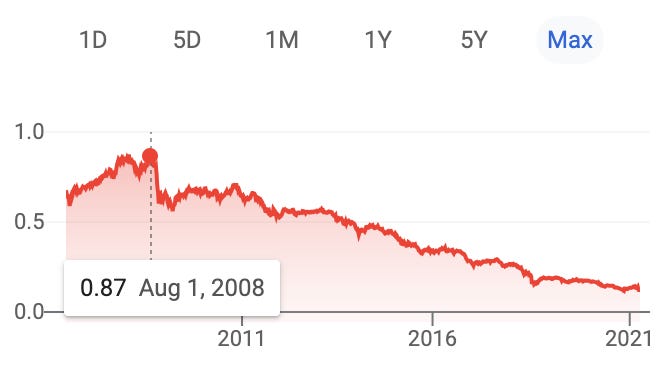

The stated reasoning is volatility and illicit activities, but it’s not hard to infer that the Turkish lira losing 87% of its value over the last 13 years is also at play. Inflation in the last five years has accelerated to ~14-16% annually. Turkey's Information and Communication Technologies Authority estimates that ~2.4 million Turkish people used crypto in 2021 (~3% of the population).

The obvious comparison that leaps to mind is Nigeria, where the central bank has been trying to ban cryptocurrency since 2017. Those regulations hampered businesses and drove Bitcoin use somewhat underground, but they don’t seem to have diminished demand for Bitcoin - Nigeria still has the largest Bitcoin trading volume in Africa. In some ways banning Bitcoin only affirms its power and advertises its intended use case, like a monetary Streisand Effect.

Interestingly, Turkey’s new regulations aren’t quite a ban on cryptocurrency. They prohibit using cryptocurrency to buy goods and services, but it is still legal to buy, sell and own crypto itself. It’s possible this pause is a prelude to a more nuanced approach to cryptocurrency like a crypto tax regime or a state issued digital currency. Or they might have been concerned an outright ban would be unenforceable and make Turkish authorities look weak.

Some people attributed Bitcoin’s move back down to ~$62k as being a response to the news from Turkey, but I’m skeptical. Turkey is only the latest in a long line of countries (China, India, Nigeria, Iran, Russia) to ban or threaten to ban Bitcoin and of those countries Turkey is among the least economically significant.

The joys and sorrows of direct listing

After our discussion about the Coinbase IPO several readers reached out to point out that rather than doing a traditional IPO (where the company lines up large investors to buy large stakes in the stock as soon as it is available) were instead doing a direct listing (where the company just lists the stock directly on public exchanges and lets anyone buy or sell it as they please). A direct listing is still an IPO but it is an unusual style that has been gaining popularity recently - I recommend Matt Levine’s Money Stuff if you’re curious to learn more or if you just generally like good things.

When you line up big investors for a traditional IPO you usually make promises to them that you won’t immediately dump your shares and leave them holding the bag. Thats called a "lockup" and it is basically an agreement that employees and insiders aren’t allowed to sell for some time after the IPO, usually six months. One advantage of a direct listing is that there are no big investors that are asking you to make uncomfortable promises - so you could use a direct listing to avoid doing a lockup.

On the other hand the purpose of the lockup isn’t really to satisfy the arcane superstitions of the big investors. The real goal of a lockup is to defend the price of the stock when it is fragile and making its first impression on public investors. That incentive exists for any IPO, traditional or direct listing. It is more common for direct listings to skip the lockup than traditional IPOs but it is by no means required. I don’t actually know if Coinbase employees were bound by a lockup - let me know if you do!

Either way there was a fairly significant amount of COIN that was sold by existing investors - somewhere between ~$3-30B worth.

Quoting Matt Levine:

“Coinbase has about 186 million shares outstanding; it registered almost 115 million of them for sale in its direct listing. About 81 million shares traded yesterday, at an average price of $366.87, for a total of about $29.7 billion of trading. Presumably Coinbase’s private shareholders did not sell 81 million shares yesterday; presumably most of that trading was new public shareholders trading among themselves. On the other hand, in the opening trade, some 8.84 million shares were sold for $381 each, for a total of about $3.4 billion of stock that definitely came from Coinbase’s existing private shareholders. That’s the minimum amount of stock that existing shareholders sold yesterday — the minimum size of the IPO, as it were — and the maximum is something less than 81 million. A broad range.”

Other things happening right now:

We talked last week about Bitcoin Taproot, the upgrade to Bitcoin’s cryptography library that will make Bitcoin transactions cheaper and more private. This week the Taproot speedy activation logic was merged into Bitcoin core. That means there is about three months of runway to complete the network rollout of Taproot or the speedy activation will short circuit and the devs will have to circle back and start from the beginning again. Since this is a broadly popular but strictly optional upgrade this will be a good test to see exactly how hard it is to upgrade Bitcoin even when things are uncontroversial. We'll check back in as things

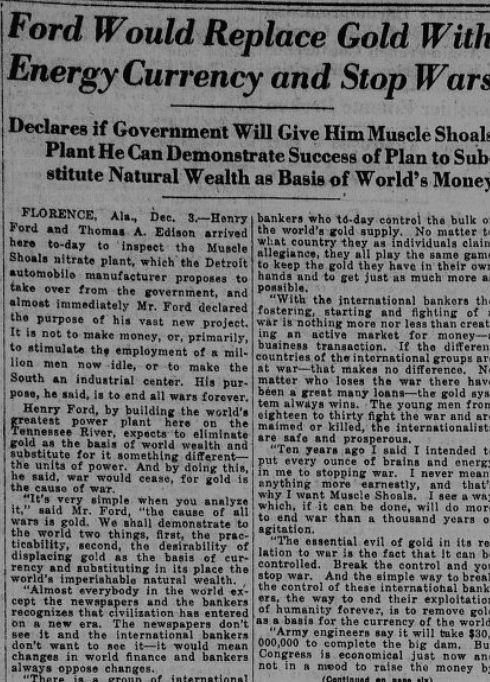

Henry Ford == Satoshi Nakamoto confirmed?!?

Miami is continuing its play to be the cryptocurrency capital of the country by putting forward a resolution to allow residents to pay their taxes in Bitcoin. If you pay your taxes in Bitcoin do you have to pay taxes on the gains? 🤔

Presented without comment: