[News] The Decentralization of Revenge

plus a Valentine from a central bank and Dogecoin is still too much plz stop

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

No seriously, don’t rely on DOGE

Bitcoin pauses at the cusp of $50000

Lindsay Lohan and the decentralization of revenge

No seriously, don’t trust DOGE

We’ve talked several times recently about Dogecoin, the cryptocurrency originally founded as a joke making fun of cryptocurrencies. The price of DOGE (the token of the Dogecoin network) exploded in the last three weeks - in part a result of overflow from the r/wallstreetbets community and in part thanks to some relentless shitposting from Elon Musk. Things seem to be cooling off but the price remains at staggering heights. As of writing the market cap of Dogecoin is ~$8B.

The problem is that Dogecoin is a joke. I know I keep saying that but it’s important to remember because it is very easy to disconnect the movement of the price from the actual underlying asset, which again, is not a serious endeavor. Let me be more specific.

In 2014 Dogecoin was essentially worthless, so no one wanted to mine it. Recall that miners are critical to keeping a cryptocurrency secure - as long as there are more honest miners (or rather more honest mining capacity) than there are attackers, a cryptocurrency is secure. Without a healthy mining ecosystem a cryptocurrency is vulnerable. To save the network Dogecoin developers at the time decided to pin Dogecoin to the Litecoin network through a process called merge-mining. Basically Dogecoin was free-riding off of Litecoin’s security. This was fine because DOGE was basically worthless anyway so nobody cared.

Now that DOGE is carrying an $8B market cap though the incentives have changed. The value of DOGE has disconnected from the level of security defending the Dogecoin network (which is now actually proportional to the value of the Litecoin network instead). In other words the upside for attacking Dogecoin has grown enormously but the incentives to defend it have not. A 51% attack is not just a hypothetical - several smaller cryptocurrencies have died that way.

Lucas Nuzzi does a good job of articulating how this attack would work:

Bitcoin pauses at the cusp of $50k

After jumping abruptly up ~15% on the back of the news that Tesla had acquired $1.5B worth of Bitcoin the price has been drifting slowly up towards the $50,000 milestone.

It is interesting to watch the resistance show up not at $50,000 itself but just before it. As is tradition Coinbase seems to be leading the market here - sell pressure there has lowered the Coinbase premium (normally positive) down to -$45:

Coinbase holders are typically smaller retail investors relative to the broader market, so this suggests that small holders are eyeing this range for taking profits in. My personal pet theory is this: in the early years of Bitcoin a common goal for holders was to accumulate 21 Bitcoin (i.e. 1/1,000,000th of total Bitcoin supply) to become a 'millionthaire.' As we crossed $47619/btc every Bitcoin millionthaire became a Bitcoin millionaire. It wouldn’t surprise me if that was a profit-taking moment for a lot of OG Bitcoiners - and that many of them took that profit at Coinbase.

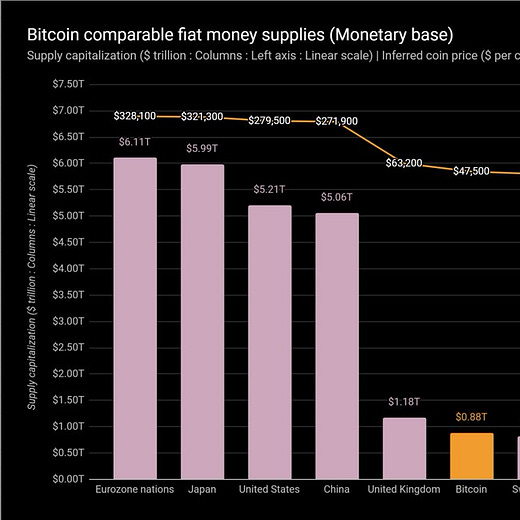

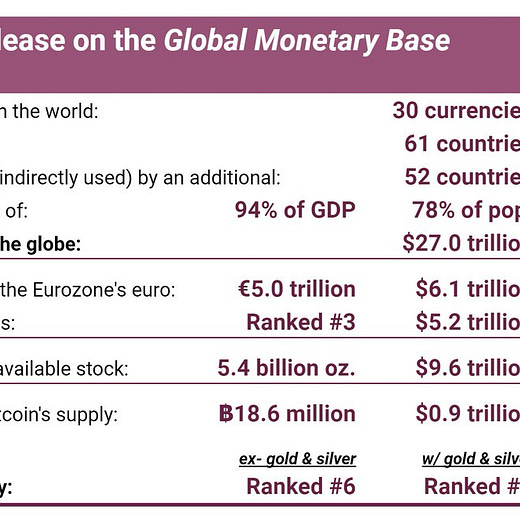

Even without crossing the symbolic $50k threshold the growth has been massive - Bitcoin is now the seventh largest currency in the world by monetary base:

Revenge is a dish best served conceptually

In early February Lindsay Lohan released a 1 of 1 collectible NFT called "Lindsay 'Lightning' Lohan" promising to award the proceeds to unspecified Bitcoin accepting charities that "empower younger generations in order for them to adapt and learn about this revolution that humanity is witnessing." I imagine the first grant will go to the Derek Zoolander Center for Kids. [1]

This is a bit weird because the piece celebrates Bitcoin and the Bitcoin Lightning Network but NFTs (including this one) are only possible today on the Ethereum network. But the market was still interested - the piece initially sold for 10ETH (~$17k at the time) and then immediately resold for 33ETH (~$50k at the time) to a user known as 0x_b1. For a brief moment all was well and the people were happy.

Unfortunately the next day Lindsay once again demonstrated unfamiliarity with the tribal loyalties of the cryptocurrency space when she was paid to tweet a promotional tweet on behalf of the Tron network, sworn enemy of Ethereum:

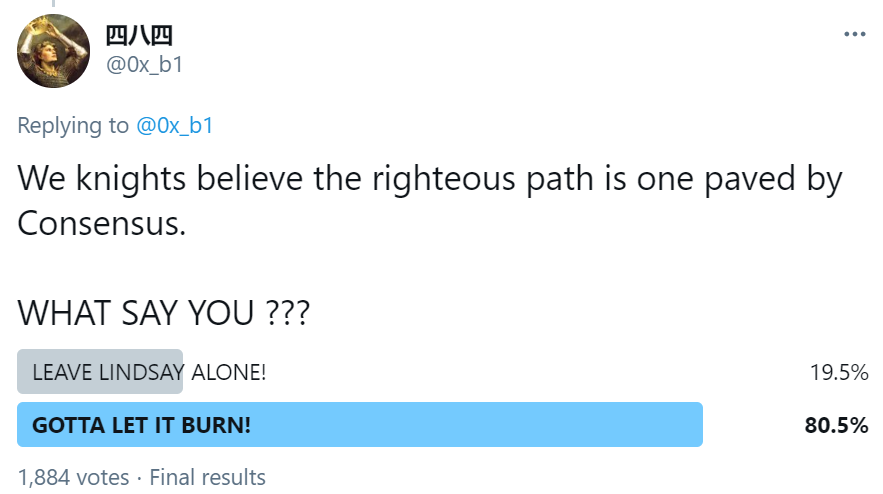

In an act of symbolic judgement the owner of the world’s only Lindsay Lohan NFT asked the Ethereum community to judge whether or not he should destroy it as a punitive gesture. The community chose vengeance:

So 0x_b1 followed through and destroyed the ~$50k NFT by sending it to an irrecoverable burn address. What an amazing way to affirm your tribal loyalties! Symbolic revenge by conceptually destroying an abstract representation of someone’s art. But it keeps going because there is a service called TokenizedTweets that automatically create NFTs to represent tweets, which this user used to claim an abstract representation of the tweet celebrating the act of symbolic revenge by conceptually destroying the abstract representation of someone’s art. If anyone would like to tokenize my commentary on the topic you should feel free.

This is the future we have wrought for ourselves! The best minds of my generation, something, something …

[1] I kid. She actually donated to Save the Children.

Other things happening right now:

BitcoinOrShit.com is a delightful website for emotionally anchoring the growth of Bitcoin in terms that are easier for human beings to grapple with:

A story in two parts: