[News] Tesla acquires $1.5B of Bitcoin 💰₿💰

but 1DOGE is still 1DOGE unless you are in Nigeria where Dogecoin is illegal

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Tesla acquires $1.5B worth of Bitcoin

Much bamboozle! Very betray.

Central governments and Bitcoin

Tesla acquires $1.5B worth of Bitcoin

We first talked about the likelihood that Elon Musk was in the process of acquiring significant Bitcoin holdings through Tesla back on January 3rd in Elon Musk and the art of Whale-spotting - but on Monday morning we got official confirmation. Tesla issued a statement announcing that it had purchased $1.5B worth of Bitcoin. They also announced plans to accept Bitcoin as payment (although they will automatically liquidate any bitcoin sales revenue into USD for accounting reasons).

You know the rules - where Elon tweets, the market follows. Bitcoin jumped to ~$44k/bitcoin immediately on revelation (liquidating $365M shorts in the process) and then continued to rise over the course of the day as people concluded that no, this was actually kind of a big deal. As of writing the price is moving past ~$47k/bitcoin.

This is actually a big deal - not just because $1.5B is a pretty enormous market buy but because Tesla taking this step has drastically lowered the career risk for any other companies or financial managers who had been contemplating a similar strategy. Yesterday investing ~10% of your company’s treasury into Bitcoin was madness! Today it is the kind of cutting edge capital strategy employed by the world’s richest man and one of the world’s most valuable businesses.

Last week Michael Saylor (the CEO of Microstrategy and the man who showed Elon how to get Tesla into Bitcoin) held a conference called "Bitcoin for Corporations" where he walked the C-suite officers of thousands of companies through the steps necessary to acquire Bitcoin for their treasuries and the arguments for why to do it. Now that Tesla has carved a path the way forward will be easier. As of writing ~6% of all existing Bitcoin were held by public companies.

Much bamboozle! Very betray.

The realization that Elon was actively in the process of acquiring a massive stake in Bitcoin lately paints his already ill-advised Dogecoin antics in an unsavory light - but so far the price of DOGE seems unaffected by Tesla’s announcement:

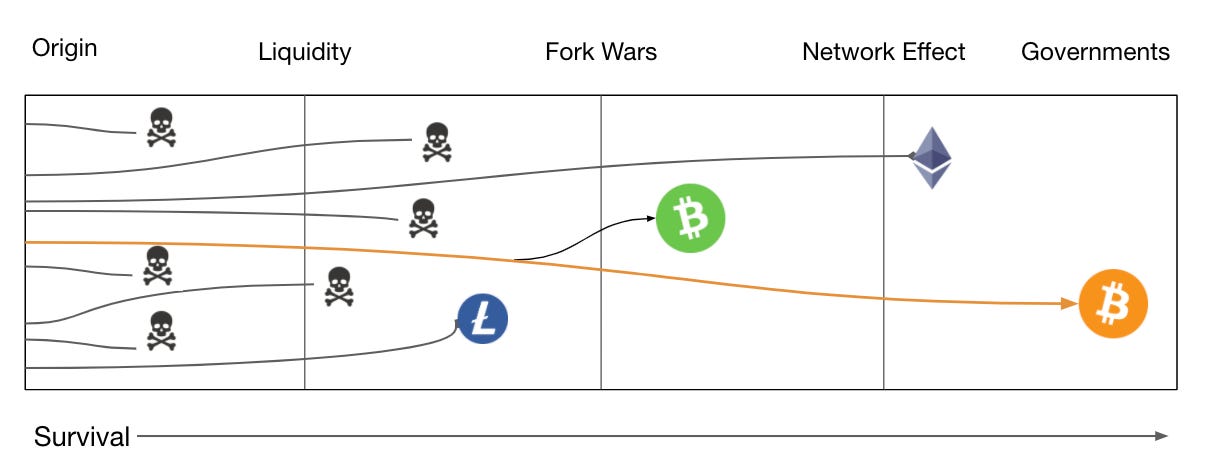

Perhaps Dogecoin fans are hoping that Musk will start acquiring DOGE next, but to be clear that is not going to happen. It is easy to forget that Bitcoin as a cryptocurrency is very battle-tested and has the scars to prove it.

Dogecoin is a joke. It is poorly maintained. The network is barely functional and the codebase has critical bugs that haven’t been fixed or exploited because there wasn’t enough value in the network to justify attacking or defending against the attack.

Under normal circumstances this isn’t really a problem because almost no one actually uses DOGE except as a gambling token on centralized exchanges. But with the value of DOGE suddenly and inexplicably rising back into the top ten cryptoassets the incentives to break the network are going to rise as well. If enough people start DOGE-paddling through dangerous waters the sharks are going to come out.

I have no idea how far up DOGE will go before something goes wrong but I am very worried for the people who will get caught in the aftermath. There are no hedge funds here to pillage. The only folks who get rekt will be naïve investors.

Government pushback is only just beginning

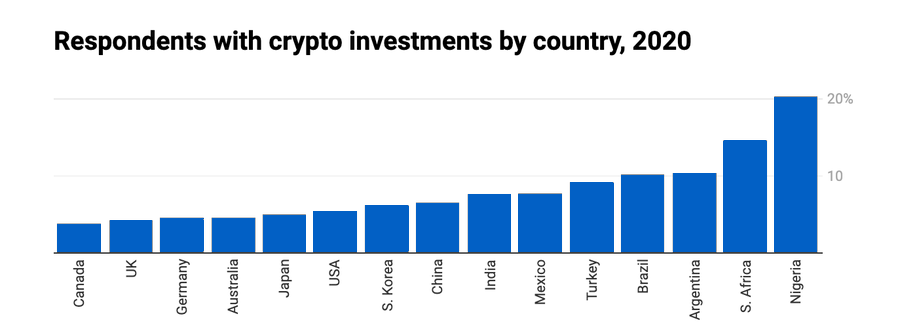

The Central Bank of Nigeria has formally banned Bitcoin since 2017. Cryptocurrency exchanges are forbidden in Nigeria and Nigerian banks are not allowed to facilitate payments to or from cryptocurrency exchanges outside the country. On Feb 5th they sent a letter reaffirming this stance that caused some news outlets to report that Bitcoin had been newly banned. In reality nothing had actually changed.

The ban has not particularly deterred Nigeria from becoming (and staying) a global hub for crypto trading. Nigerians have the highest self-reported ownership rate of Bitcoin of any country.

Maybe that’s why the Central Bank of Nigeria felt the need to reaffirm the ban. India is also currently working on a piece of legislation intended to ban sovereign cryptocurrencies and establish an official government cryptocurrency in their place. It’s hard for me to imagine people being excited about adopting a digital currency run by a government that demonetized 86% of the countries cash with four hours notice?

It isn’t necessarily the case that all governments will turn on Bitcoin. Balaji Srinivasan makes a good case here for why rather than banning Bitcoin India should be buying it. Meanwhile in America we have Cynthia Lummis, an avowed Bitcoiner, sitting on the Senate Financial committee.

As more and more companies follow in Tesla’s footsteps more and more Americans (politicians included) will find themselves owning Bitcoin indirectly through index funds and pensions. Given that Tesla is in the S&P500 most American pension funds are now effectively invested in Bitcoin. The political will for a government to oppose Bitcoin may be sapped before they are able to form serious opposition.

Other things happening right now:

Supply is drying up. Bitcoins are still leaving exchanges at a record rate:

Bloomberg did a stale retread of Bitcoin’s energy use, once again trotting out the faulty comparison to Visa: "One Bitcoin transaction would generate the CO2 equivalent to 706,765 swipes of a Visa credit card." I honestly don’t have the energy to revisit this weak, lazy argument but happily Nic Carter did:

One of the use cases for NFTs is to represent the deeds to virtual property in a virtual metaverse. One such project is AxieInfinity: a multiplayer game whose map consists of player-owned resource generating plots of virtual land. A bundle of nine plots just sold for 882.5 ETH (~$1.5M at time of sale).

"So where does your family’s wealth come from?”

"Oh, my great-grandfather was terrible at Starcraft."