[News] The DOGE team will meme the dream

also Bitcoin is a force for human rights, the YFI exploit and JP Morgan gets two for flinching

In this issue:

Bitcoin is a force for human rights

The DOGE team will meme the dream

Ethereum scalability + the YFI exploit

The DOGE team is here to meme the dream

Dogecoin is a joke. I don’t mean that in a derogatory sense but a literal one. It was founded as a joke. Its community is centered around memes and nonsense. They once found a bug in the code that meant that rather than having a hard cap on the total supply of DOGE it was actually perpetually inflationary. They just went with it! The Dogecoin community is very chill.

Here is the price of DOGE in the last month:

That first really big spike is when I wrote Dogecoin was the original meme asset. I sort of assumed that things would be settling back down again but I am glad that I never give out investment advice because so far I have been mistaken. At least part of this surge is probably because Elon Musk does (regrettably) offer investment advice:

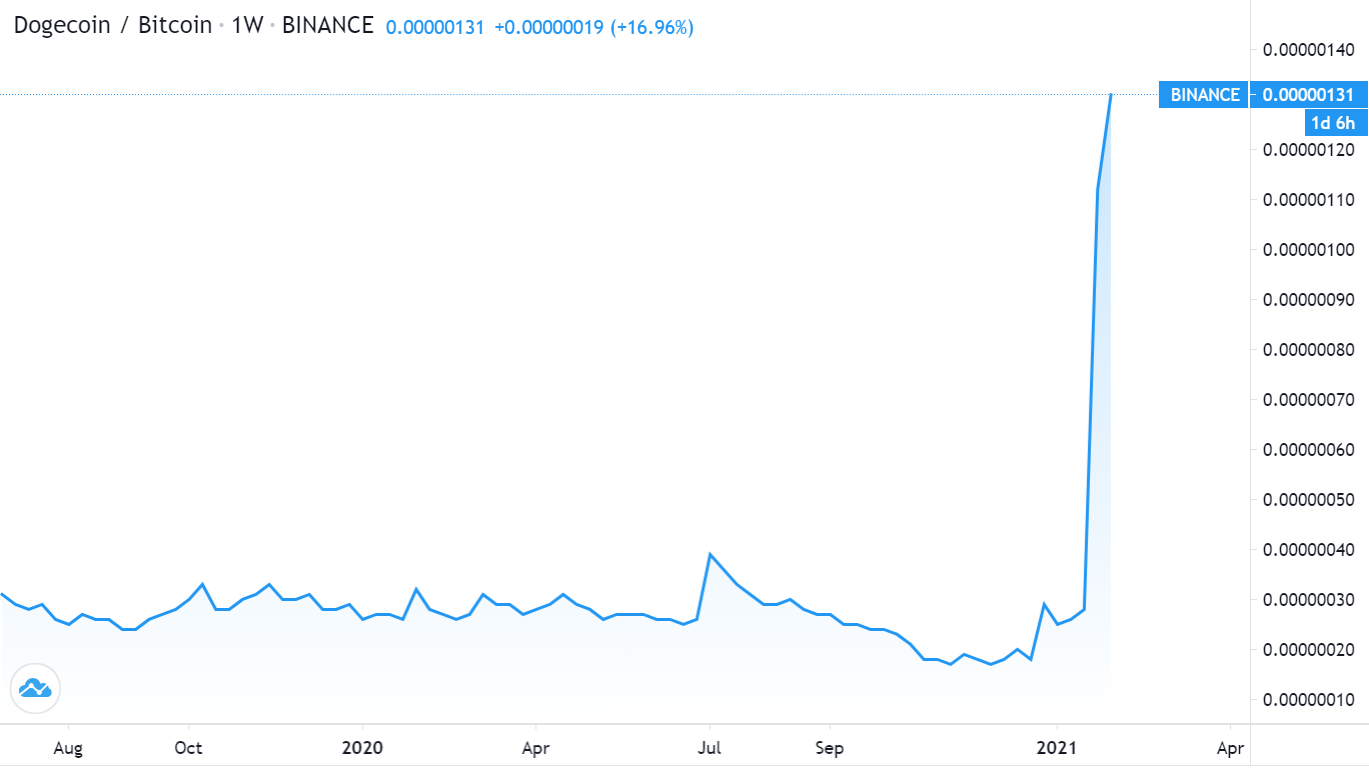

I often caution people to look at the price of cryptocurrencies in Bitcoin rather than in USD to try separate out the market’s confidence in cryptocurrencies generally. Here is the price of DOGE in Bitcoin.

Soooooooooo … yeah. I honestly have no idea. Nothing means anything anymore. Consider this cutting piece of financial analysis by Gene Simmons:

Bitcoin is already a force for human rights

I don’t have a lot of additional commentary to add to this video from Alex Gladstein of the Human Rights Foundation. It’s an excellent overview of the ways in which Bitcoin is already being used by dissidents/activists around the world:

The YFI Exploit and Ethereum fees

Ethereum’s innovation is at times a double-edged sword. One of the faster growing projects on the platform YFI was hit with a significant economic exploit leveraging flash loans and lending protocols to drain $11M of value from the smart contract and capture $2.8M of value for themselves. Here is a good explainer if you are curious about the details:

I am more interested in the side effects. First, the attackers transactions were complex and they needed to happen quickly, before anyone could intervene. So they spent a lot on transaction fees to make sure their transactions would be included first.

The actual contract that was attacked (the YFI v1 DAI vault) is the model for quite a few other related contracts any number of which might be vulnerable to similar exploits - so the developers of those contracts moved quickly to shut them down before they were attacked. They also wanted those changes to happen quickly (before any more attacks could happen) so they also spent a lot on transaction fees.

So did everyone who was trying to withdraw their own money before any more attacks. It was like a dozen bank runs in parallel, with everyone bidding against each other for space in the Ethereum blockchain. Ethereum fees (already at an all time high) were driven even higher - higher even than Bitcoin’s peak in 2017:

At time of writing fees on Ethereum are averaging ~$14.5/transaction. Fees to be clear are generally healthy - they mean people place a high value on using the network. But there are some complexities for Ethereum. The premise of Ethereum has always been flexibility - that story weakens if it costs too much to do the more interesting transactions.

Much of the value in the Ethereum ecosystem is also contained in the platforms, tokens and projects built on top of it. When Bitcoin fees rise it is impossible to escape because that is the only way to transact in Bitcoin. But when Ethereum fees rise it is possible for projects like YFI or Uniswap to migrate their smart contracts to other, less crowded blockchains - or their users can migrate to competitors on those platforms. Anyone who wants to traffic in ether specifically is a captive audience, but anyone who was just using ether to enable something else can potentially leave.

It’s hard to migrate ecosystem like that quickly or all at once, so Ethereum’s head start definitely gives it some breathing room - and the developers have stated plans to improve scalability (optimistic rollups, sharding, etc). But now that fees have risen to the point where meaningful use cases are getting crowded out, the clock is ticking.

Other things happening now:

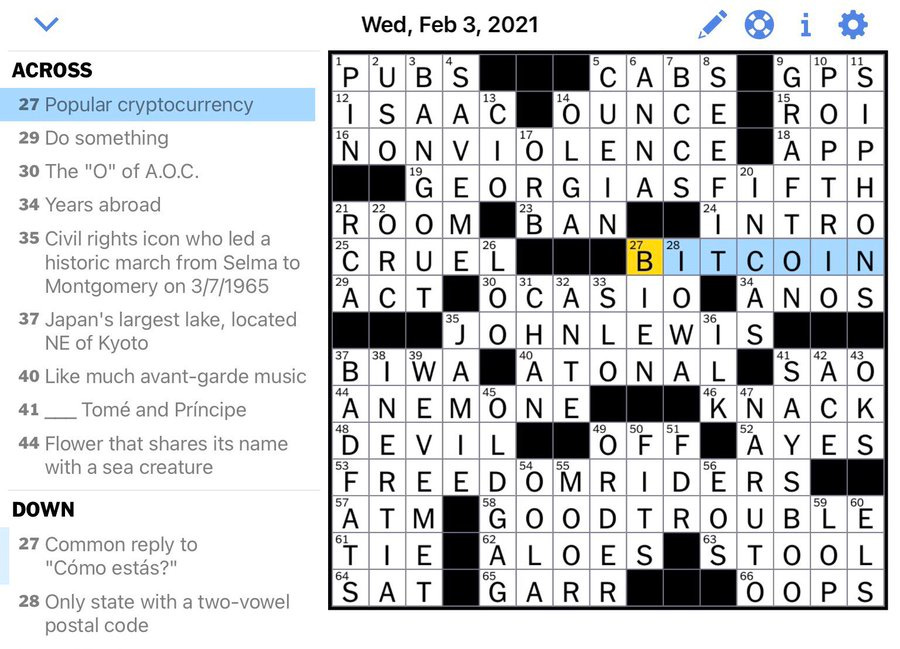

Here is a very fun (although not very meaningful) graph:

Bitcoin hit the NYTimes Crossword puzzle:

The German word for confiscated must mean something different?