Intro to Merge-watching

How to watch along as Ethereum switches to proof-of-stake

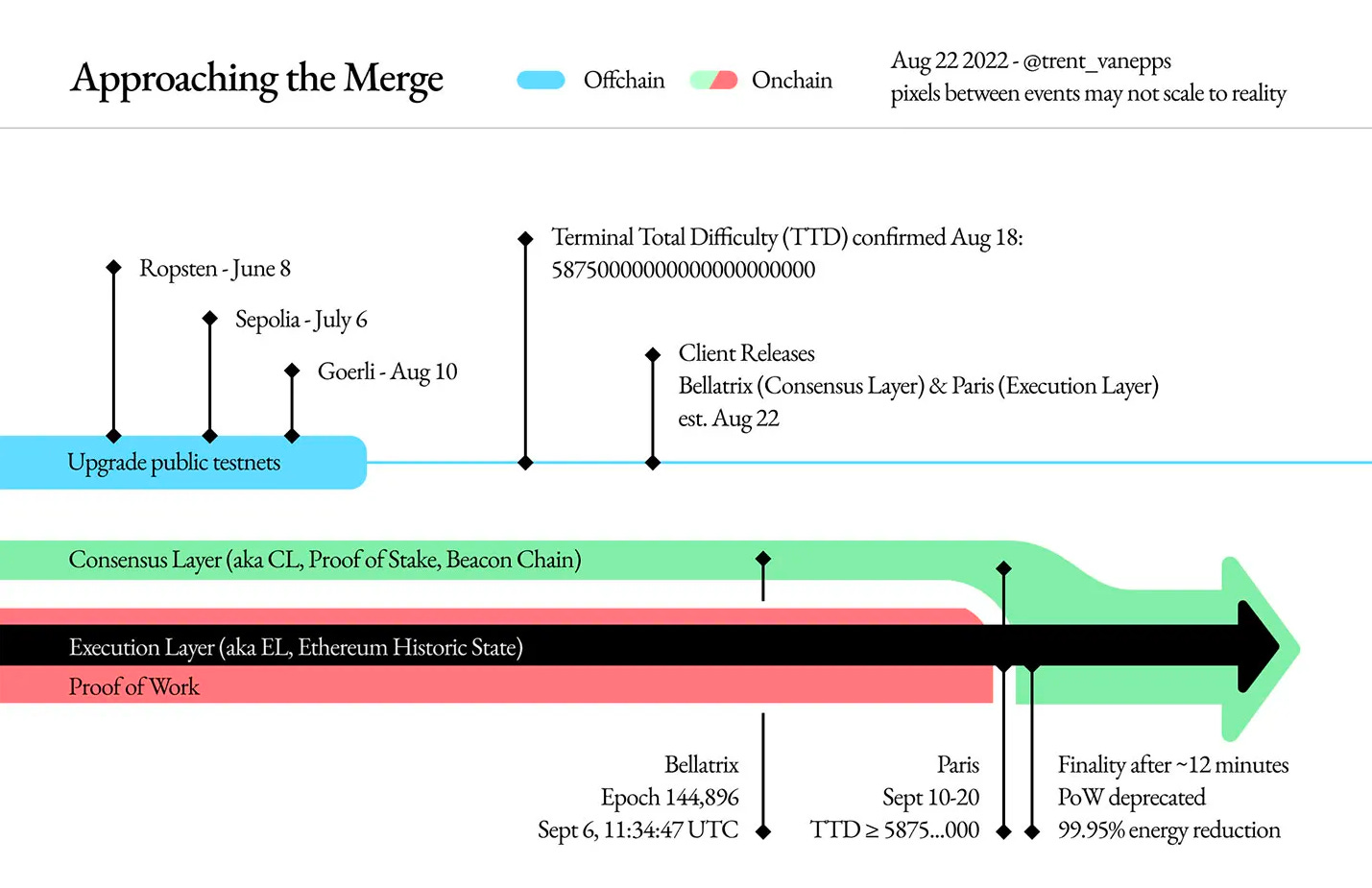

All eyes are on the Ethereum network this week as the much-anticipated ETH 2.0 update to proof-of-stake validation is scheduled to land sometime later today.1 Here is everything you need to know about the Merge and how to watch it happen.

In this issue:

What is actually happening?

What does it mean for Ethereum?

What does it mean for the market?

What should we be watching?

What is actually happening?

The Ethereum network is currently secured and updated by proof-of-work miners, in a manner broadly similar to the technique used to secure and update the Bitcoin network. After the merge there will be no more Ethereum miners and instead the network history will be secured and updated by proof-of-stake validators. Whatever one thinks of the decision to switch to proof-of-stake (I’m not a fan) the Merge is by any measure a Herculean engineering effort — a multi-year long massive undertaking with thousands of lines of code across over one hundred engineers. It’s genuinely impressive to see it actually launch.

What does it mean for Ethereum?

For users of the Ethereum network very little will change. Transactions will work the same, accounts will work the same. Those who run their own nodes will need to keep their software up to date but most Ethereum users don’t run their own nodes and their usage won’t be affected. They may not even notice.

For miners the news is a bit more grim — they are effectively being fired from the network. Their revenue stream will abruptly evaporate and they will be left with a large stock of idle GPUs. Used mining GPUs have lived hard lives and are often too worn down to be useful for reselling to the computer market. Miners can redirect them to other compatible networks (most notably Ethereum Classic) but those networks are much smaller and less valuable. The revenue miners can earn securing those networks is dramatically lower. A lot of those mining rigs will just become trash.

As a result some miners will likely band together and maintain a fork of Ethereum known as ETHPoW that will never Merge but instead continue to use proof-of-work mining. I’ve written before about the kind of chaos that fork could cause, but for a wide variety of reasons I do not think it is well positioned for success. In theory there are some interesting arbitrage trades that could be done across the ETH/ETHPoW forks but they would require considerable technical and trading expertise and the upside opportunity is much smaller than the downside risk. For most users the right answer to the ETHPoW fork is just to ignore it.

Exchanges that run their own nodes will need to pay much closer attention. The existence of an ETHPoW fork even briefly raises the possibilities of confusion for exchanges about which transactions are happening on which network. Past Ethereum forks have cost exchanges (and users of those exchanges) money as transactions on one network were maliciously redeployed to the other network. The technical complexity of the Merge is significant and the technical competency of the ETHPoW team is unproven so both forks are at significant risk of problems.

The Merge has been very thoroughly and admirably tested across multiple testnets for many months now — but it would be a mistake to assume that meant it was safe. For one thing, new bugs are still being discovered by users doing playful exploration like drawing cartoon porn on the Beacon Chain graffiti wall. But more importantly you cannot meaningfully battletest a cryptoeconomic system on a testnet because attackers have no reason to reveal their plans in advance. It is only after you put real money on the line that you learn if your security really works as advertised.

All of which is not to say that I am anticipating major bugs or major attacks in the immediate aftermath of the Merge. My personal guess is that there will be a few small technical hiccups that will be overblown and will shake the market but will also be small and easily resolved. But it is probably reasonable not to schedule any urgent ETH transactions for the second half of this week, just in case.

What does it mean for the market?

Good question! A successful Merge would be a major technical de-risking event for Ethereum and give greater credibility to their future roadmap. The rate of new ETH being created will also probably slow down (from ~4% inflation to ~0% inflation depending on usage), lightly improving the tokenomics for Ethereum holders in ways that aren’t all that material in a fundamental sense but definitely carry significant narrative weight.

On the other hand traders have been anticipating all of these changes for months, which means they may already be priced in. It is entirely possible that the number of people who care about the change in ETH issuance is smaller than the number of people who are betting that someone else cares about the change in ETH issuance. If everyone who bought ETH to speculate on the Merge decides to sell after the Merge the price may go down even if everything about the Merge goes smoothly.

The real question is whether new buyers will be enticed into the Ethereum ecosystem because of the Merge. I personally don’t think anyone outside the cryptosphere gives a damn about ETH issuance rates or the technical risks of the Merge — but I do think people outside the cryptosphere are interested in the environmental argument.

Supporters of the switch to proof-of-stake validation often advertise it as an environmental improvement compared to proof-of-work, either because they are naïve or dishonest. In reality proof-of-stake systems likely use materially more energy, they are just much harder to measure or understand. Proof-of-stake lowers direct electricity use which is not even remotely the same as lowering total energy use. But the difference is nuanced and most people are content to believe the simpler story that proof-of-work is wasteful (it’s not) and so removing it eliminates waste.

The strength of that narrative means trouble ahead for proof-of-work networks like Bitcoin. Proposals for outlawing proof-of-work mining have already started and they will likely gain momentum as Ethereum "proves" to the uninformed that mining is unnecessary waste (seriously, it’s not). That will likely prove challenging to Bitcoin for obvious reasons but it will also likely be a threat to many proof-of-stake Ethereum competitors (like Tezos) who relied on the environmental argument to differentiate themselves from Ethereum. I expect the Merge to be a deeply bearish event for medium-sized proof-of-stake cryptocurrencies.

On the other hand I expect the Merge to be quite bullish for Ethereum based NFTs since it defangs one of the most popular anti-NFT criticisms. Removing the judgement around environmental concerns will encourage previously hesitant people to join the NFT market and it will make existing NFT enthusiasts less worried about sharing their enthusiasm with a broad audience. I wouldn’t be surprised if the Merge eventually kicks off the next NFT bull market.

What should we be watching?

You can watch the countdown to the Merge on timers like Wenmerge.com or you can just google "when is the Ethereum merge" for a live-updating search result. CryptoTwitter will likely also erupt with celebration as soon as the Merge activates: @VitalikButerin or any of the other Ethereum core devs are good accounts to follow for updates on the Merge itself. For updates on the ETHPoW fork @ChandlerGuo is the leader of that effort and @Galois_Capital is an investor who has been closely engaged in the debate.

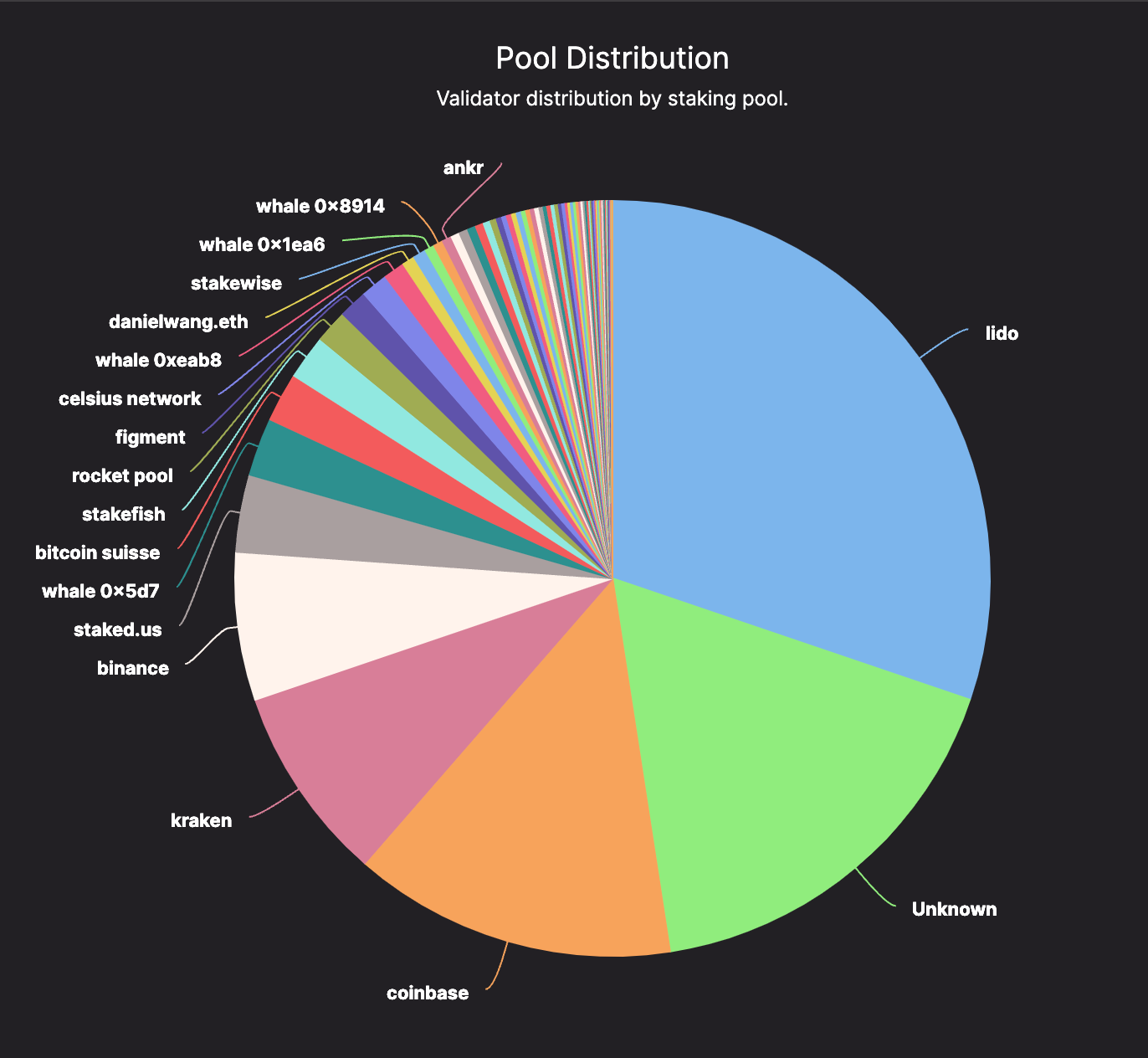

It will also be interesting to watch the price of liquid staking tokens like cbETH (Coinbase) and stETH (Lido). Right now those tokens trade at a discount relative to the ETH they represent. After the Merge users may decide staking is lower risk and want to start, which could drive the price of stETH/cbETH up. On the other hand many users may learn for the first time that their staked ETH still can’t be withdrawn even after the Merge and they may sell at a discount to get out. Users rebalancing their portfolio post-Merge may also shake up the leaderboard of proof-of-stake validators and hence who has control over the network:

A major open question we’ve talked about before is whether the shift to proof-of-stake leaves Ethereum more vulnerable to regulatory capture. It will be interesting to see whether any of the major validators (Lido and Coinbase, e.g.) censor or include Tornado Cash transactions in their blocks or attestations. At the moment validators have all communicated that they won’t be censoring, but it remains to be seen whether OFAC pressure will change or escalate after the Merge. I personally think the government would be well advised to act slowly and not spook the market, so I don’t anticipate any sudden changes here but you never know.

Assuming everything goes well and Ethereum avoids major technical challenges, competing side forks or sudden government overreach, the Merge itself is very likely to be a non-event. Unless you an Ethereum miner, not much changes — newly created ETH isn’t a large share of daily market volume and staked ETH is still locked until the next hard fork, scheduled in ~6-12 months. The changes to ETH supply mechanics are relatively modest — any changes in price will be driven by changes in demand. So in addition to the price of ETH it will also be interesting to watch the market for BTC, SOL and the major NFT projects.

Other things happening right now:

Presented without comment:

In an amusing coincidence, Bitcoin’s hashrate is reaching new all-time highs just as Ethereum’s hashrate is being retired and going permanently to zero.

Duly noted.,

Such an unfortunate turn of events for ETH, once you dig into the nitty gritty. Not only will Large entity staking providers compound control over time, it also has very little benefit for the environment as noted by yourself.

This leads me to think there has to be some aspect of future innovation that adds some variability in the way this beast moves forward. There just seems to be very little reasoning for the for hard fork in the first place - It is adding complexity in light of scaling, but in the process neglects all the aspects that blockchains was innovated for in the first place.

Just seems odd to me. Maybe you can shed some light here for me. Why the abrupt focus on scaling the network? Does lighting network not have similar if not better capability’?

Such great work, i compliment you enough as is 👌 so I just went ahead subscribed, this work is highly under rated.