How to overthrow the government

Plus what makes a shitcoin?

In this issue:

How to overthrow the government

What makes something a shitcoin?

How to avoid a new crypto phishing attack

How to overthrow the government

In February of this year the military in Myanmar staged a violent coup overthrowing the elected government and resuming control of the country. The military asserts that the elections they lost last year were fraudulent which could cause "disintegration of the Union, disintegration of national solidarity, and loss of sovereign power" so the constitution gives them the authority to seize control. Most readers will probably most vividly remember this surreal video of a woman doing an aerobic workout in a surgical mask in front of the arriving military force:

We often talk about the relationship between cryptocurrency and governments as though governments are stable, monolithic organizations — but the truth is more complex. At the moment in Myanmar there are two governments: the military junta and the National Unity Government, an alliance of pro-democracy activists and military insurgents.

The junta controls the Central Bank of Myanmar, which manages the national currency the Myanmar kyet (MMK) and outlawed digital currencies in May of 2020. On the other hand the National Unity Government just declared that Tether is the official currency of Myanmar, at least for now. How the government feels about the role of cryptocurrency depends on which government you ask.

It is interesting that the anti-junta forces have settled on Tether as their resistance money as opposed to a more decentralized currency. Tether is not good at censorship resistance — it is controlled by a single, relatively small company. It has frozen accounts in the past and will likely do so again. If you are looking to exit the entire Western financial system you will need a weapons-grade currency — but if you only need to bypass local banks and America doesn’t care, Tether is enough.

We talk about Tether pretty frequently on Something Interesting and not usually to sing its praises — but in all fairness Tether has done a pretty decent job historically of always being worth ~$1. That makes Tether (and other similar stablecoins) really useful because for the most part US dollars are excellent money, often better currency than the currency people have access to locally.

Governments often deliberately try to restrict local access to USD to force businesses to transact in the local currency — but Tether and other stablecoins are easily able to route around those controls and satisfy the demand.1 Crypto lets people exit their local economies. They can exit into crypto (buying ETH or BTC, e.g.) but they can also migrate into the USD economy with stablecoins. If you came to crypto because you were fleeing an unstable currency, stablecoins are probably the obvious choice.

This is almost certainly why America has been looking the other way as Tether and other stablecoins create a functional alternative to the existing banking system: stablecoins undermine weak currencies but they strengthen the dollar. Stablecoins are just another way to export USD and harvest the exorbitant privilege. The more people using stablecoins, the more economic activity there will be to soak up new dollars as they are printed.

Cryptocurrency is both a threat to and ally of the government. It just depends which government you mean.

What makes something a shitcoin?

We talked recently about how I once identified as a maximalist but no longer feel as comfortable with term. The above thread is a great way to explore why in greater detail. Der Gigi is an excellent writer and the thread is short — I encourage you to read it first. He lays out the following argument:

Blockchains can only ever track their own native token

Blockchains need to pay for security, so native tokens need to be money

Energy / hashrate is finite, so all blockchains compete for security

Purchasing power is finite, so all money competes for liquidity

Bitcoin is the strongest money on the best defended blockchain and so will win the competitions for both security and liquidity

Therefore all other blockchains are unnecessary (i.e. shitcoins)2

I agree completely with points 1-5. All blockchains are locked in a zero-sum battle where their tokens compete for liquidity and their networks compete for security. I also agree that Bitcoin is near perfect money and that I have never seen a project even come close to competing with it on that front. The conclusion that all other blockchains are implicitly doomed is less convincing to me than it once was. It is possible to believe Bitcoin is the best money (it is) without believing that it is the best money for every use case.

USD is indisputably better money than Amazon gift cards but that doesn’t mean that Amazon gift cards are useless. Amazon gift cards are obviously better money than airline miles but that doesn’t mean airline miles are useless. Airline miles are better money than arcade tokens but that doesn’t mean arcade tokens are useless. In some sense they all compete with each other for liquidity but in other ways that is kind of a silly comparison. They are competing to serve different markets.

Bitcoin is money optimized to be an invincible savings vehicle — but saving isn’t the only thing we want our money to do. Being perfect money means sacrificing flexibility and cost to preserve independence — other networks might make different trade-offs that still offer a useful balance between functionality and resistance to control.

In other words Bitcoin might not be the only useful blockchain that ends up existing. Other networks will inevitably compete with Bitcoin for security and liquidity and they will be at a disadvantage because their native token will be an objectively worse vehicle for long term savings — but they would also presumably have other advantages in the form of speed, cost or functionality.

No other network will be able to compete with Bitcoin for decentralization but decentralization is inherently expensive and limiting — for many use cases perfect decentralization may be an imperfect fit. They may be better served by a blockchain that is just secure enough to be not worth hassling.

Other things happening right now:

Here’s a bit of hopium as we weather this downspell: small accounts (<1BTC) have been buying into this price dip at the most aggressive rate since the crash in March 2020 when Bitcoin’s price tumbled to ~$5k/BTC. In retrospect those turned out to be bargain prices.

When the price crashed in May of this year the supply of Bitcoin on exchanges rose as people rushed to sell their positions. When the price of Bitcoin crashed earlier this month the supply of Bitcoin just kept dropping to the lowest it’s been since November of 2020.

Just to level you out after all that optimism, here is a grim but entirely plausible story about the next few years and the carnage that likely awaits most projects:

Heads up about a new category of DeFi phishing attack where instead of tricking you into entering your seed phrase or submitting an authorization they trick you into merely signing a message. The message gives them permission to sell any ERC-20 or ERC-721 (i.e. NFT) tokens you’ve given OpenSea sales authorization for and they immediately sell everything to themselves for absurdly low prices. Make sure you (a) keep important and valuable assets in an address that never authorizes anything, (b) never sign messages from sites you don’t trust and (c) periodically revoke authorizations you have given in the past but no longer need, using a tool like Revoke.Cash. You can read more details about the attack in this thread:

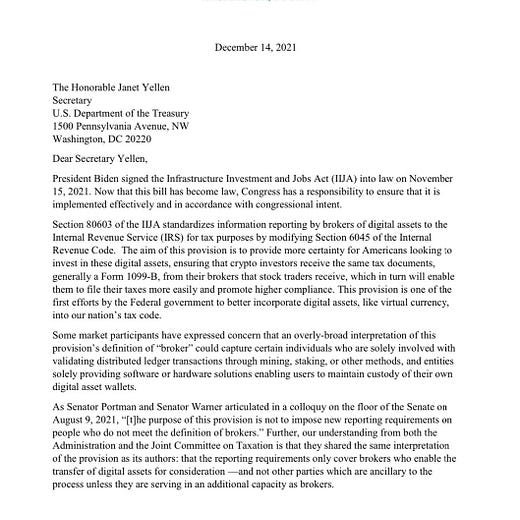

Senators Portman (R-OH), Warner (D-VA), Crapo (R-ID), Sinema (D-AZ), Toomey (R-PA), and Lummis (R-WY) wrote a joint letter to Treasury Secretary Yellen requesting clarity and guidance on the definition of "broker" that expanded with the latest round of infrastructure legislation.

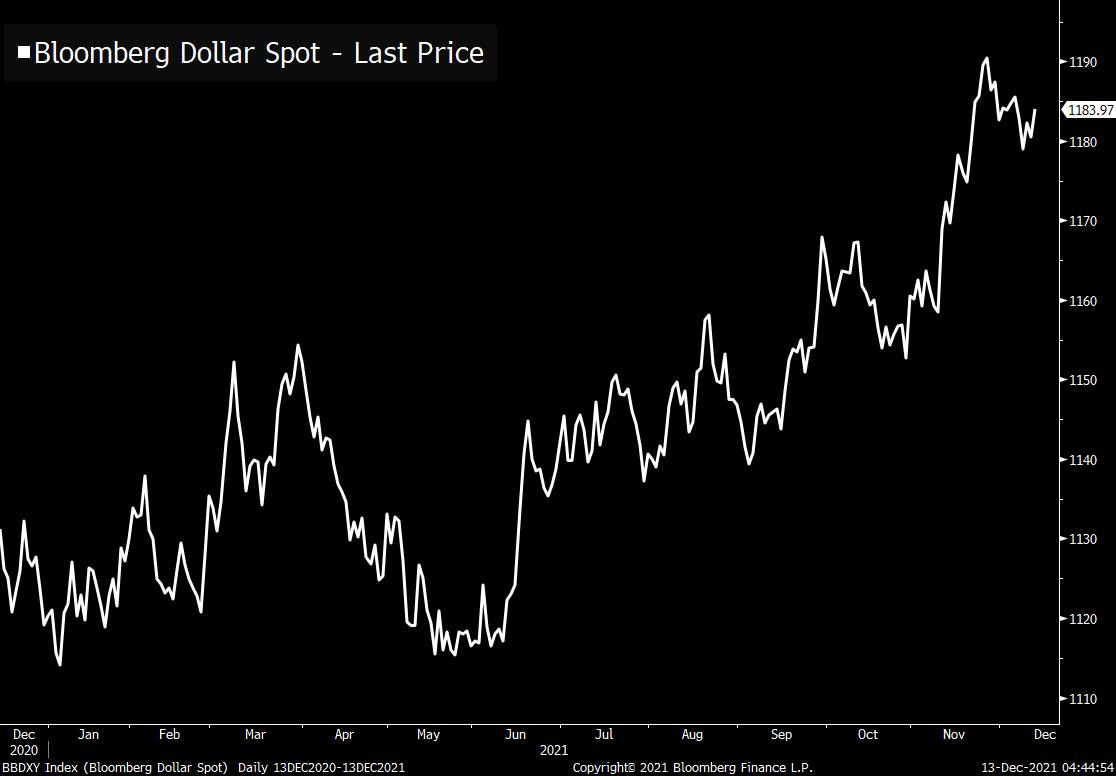

You might be surprised that there is strong demand for USD given recent news about inflation but actually the dollar has been gaining value against other currencies. U.S. prices have just been rising even faster.

Side note: Gigi throws in a postscript at the end about how he thinks proof-of-stake is a dead end. I completely agree with him about that.