What took Bitcoin back over $40,000?

Plus a $166k nude the artist couldn't give away for free and BlockFi is the harbinger of things to come

In this issue:

What took Bitcoin back over $40,000?

BlockFi is the harbinger of things to come

A $166k nude the artist couldn’t give away for free

What took Bitcoin back over $40,000?

On July 20th the price of Bitcoin broke down below $30k/BTC for the first time since early January, hovered there briefly and then began to climb steadily back up until Sunday evening when the price whiplashed from ~$34.5k/BTC to over ~$40.5k/BTC. Price resettled but kept climbing - at time of writing we are back at ~$40k/BTC again. Here’s what that looked like:

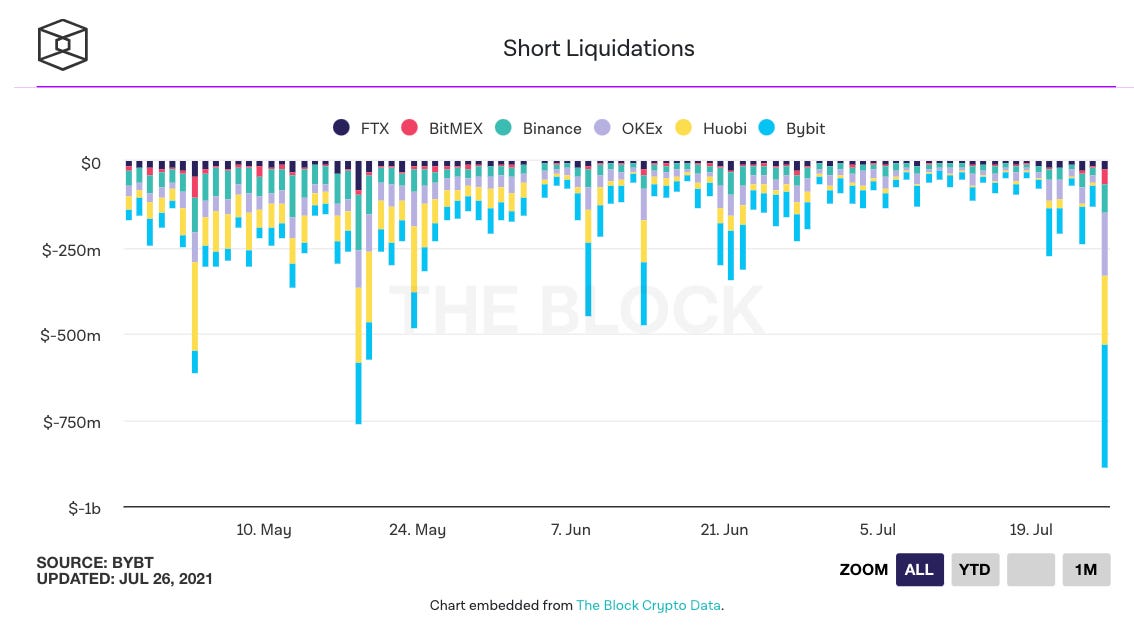

The simplest and most literal explanation for what happened is that someone(s?) bought a lot of Bitcoin. They bought so much, so quickly that the price shot up, which in turn caused an enormous number of margin-short positions to be liquidated. Traders who were short were forced to buy in at any price to close out their positions and drove the price up even higher causing a margin cascade. Around ~$880M worth of shorts were liquidated over ~12 hours.

The literal explanation has the advantage of being knowable and true but it is also somewhat unsatisfying. Generally people prefer more interesting but less provable narratives, so those are the stories that most people tell about the market. One such story, for example, involves Amazon - who last week posted a job listing for "Digital Currency and Blockchain Product Lead."1

Rumors about Amazon being on the verge of accepting Bitcoin have been floating around the space since well before I started to pay attention in 2014, but apparently these ones were getting enough traction that Amazon for the first time felt obliged to acknowledge the rumors and deny them, which is interesting. I don’t think Amazon is especially likely to embrace Bitcoin on the consumer facing front, though I can see it potentially being interesting to them for payments to international suppliers.

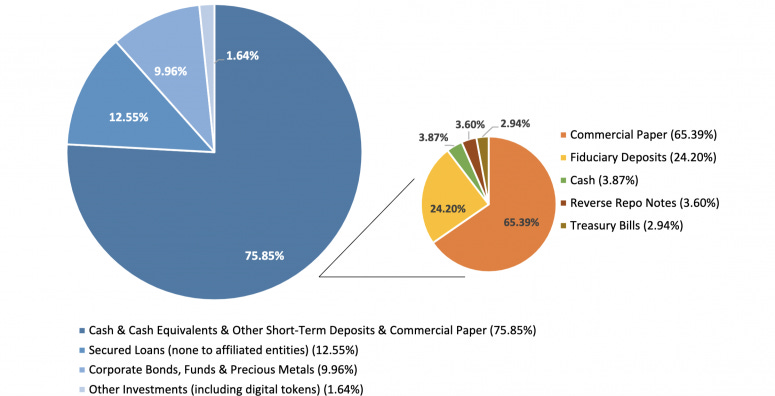

Another more intriguing story involves Tether Ltd, the company behind the stablecoin USDT. We’ve talked about Tether many times in the newsletter. Tether used to promise that for every USDT they kept $1 of USD in a bank account somewhere. You couldn’t actually trade your USDT for USD (Tether did not offer that service) but it was meant to be reassuring to know that someone else perhaps could. The USDT in the wild and the USD in the bank never traded but they were quantum entangled somehow so you could be sure it was basically just as good as USD.

Not everyone found this argument reassuring! Some people worried with all that money in a bank Tether might be tempted to loan that money to their friends or print new USDT with no USD backing it. Eventually Tether was sued by the New York Attorney General and forced to admit that no, they didn’t actually have all the USD they had promised to have. Most of the USD that was supposed to be backing the price of USDT was actually various forms of debt, and roughly half had been converted into unspecified international commercial paper (i.e. short term corporate debt.) Stick with me this comes back to the recent price movements, I promise.

Commercial paper is a suspiciously broad category to be leaving unspecified. It is as risky (or safe) as the company you made a loan to. Tether by their own disclosures is roughly the seventh largest holder of commercial paper in the world - but they don’t seem to have any relationship with the major providers of commercial paper in the western world. The obvious implication is that most of this commercial debt came from somewhere in China, but Tether refuses to say. Could be from anywhere.

As it works out there is a massive debt crisis is playing out in China’s private property markets right now where developers like Evergrande have acquired an astonishing amount of debt in the form of commercial paper and are almost certainly insolvent. Bummer for anyone who holds enormous amounts of Chinese commercial paper, especially if they were already quite busy being charged with bank fraud.

So the Tether story about Bitcoin’s sudden jump in price basically goes like this: Chinese private property companies tank and so Tether executives realize their commercial paper is worthless and soon USDT will be worthless, too. Eager to dump worthless USDT the executives hit the panic buy button and send the price of Bitcoin skyrocketing (especially on USDT exchanges). Here is a long Twitter thread that tells the story in an entertaining way with lots of details.

I do think Tether is knee-deep in terrible quality debt, may very well be insolvent and is probably guilty of the charges brought by the Department of Justice. But the story about dumping unbacked Tether into the market as a last ditch payday right before the law closed in seems pretty fanciful to me. It would be like robbing a bank, hearing police sirens and still sticking around to rob the ATM. Tether is not transparent but they also aren’t invisible. They probably understand the scrutiny they are under.

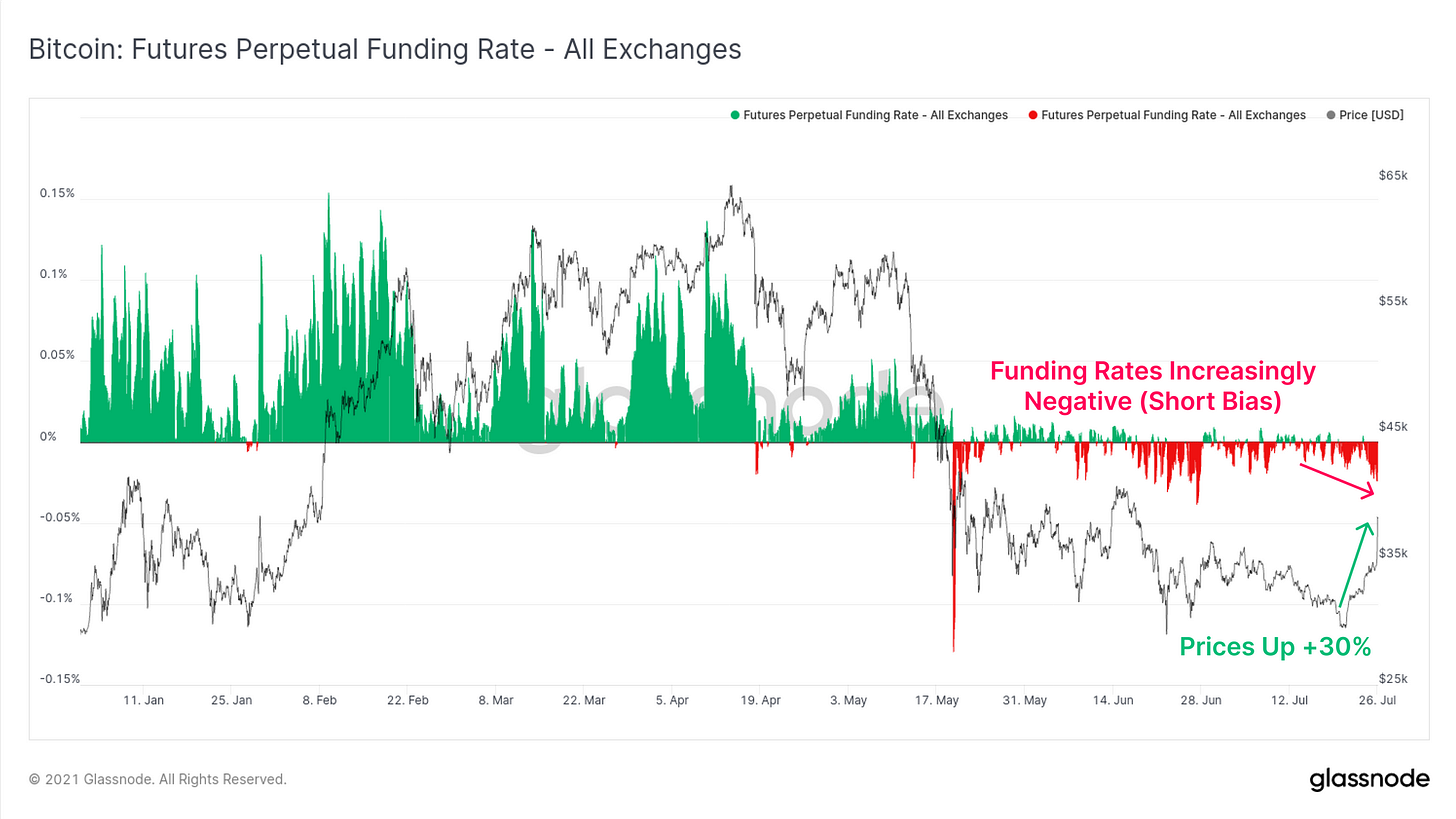

A more pedestrian but also more plausible explanation for the sudden surge of USDT eager to buy cryptocurrency is that recent regulatory pressure has caused two major USDT exchanges (Binance and FTX) to both dramatically lower the leverage available on their platform by ~5x. Less leverage means more collateral - in other words, Binance and FTX effectively forced their users to dramatically reduce or close their margin positions. At the time most positions were short:

We don’t need to imagine a mysterious buying spree that started the margin cascade. The exchanges shut the party down themselves just by turning off leverage.

BlockFi is the harbinger of things to come

Securities law is mostly about fraud, which means it was written knowing that it would be picked apart by accomplished liars. It is intentionally broad, simple and difficult to misunderstand. A good example is the Howey test, which says (roughly) that something is a security if:

Someone paid money

Expecting to profit

From someone else’s effort

A security is an investment in someone(s) rather than something. An orange (the fruit) is not a security. You might pay money for it and you might even hope to sell it later for a profit - but you aren’t counting on anyone else’s effort. Shares in an orange grove on the other hand are securities - you aren’t just investing in the oranges, you are investing in the work of whoever is tending the grove.

The distinction matters because securities (i.e. shares in an orange business) are more tightly regulated than commodities (i.e. oranges). It is pretty widely agreed at this point that Bitcoin is not a security. You might have paid money for it and you might hope to sell it later for more money but there is no specific enterprise or group that you are counting on to create that value. Owning Bitcoin is more like owning oil or gold. It isn’t a bet on someone else’s labor, it is a resource.

Giving your bitcoin (1) to someone else (3) so they can invest it for profit (2) pretty obviously passes the Howey test and is a security. Loaning someone Bitcoin at a floating interest rate is something of a gray area. BlockFi would very much prefer those be considered loans - securities law is much more serious and inconvenient. But BlockFi also says "the interest we are able to pay is based on the yield we’re able to generate." That sounds suspiciously like depositors investing money (1) hoping to profit (2) from BlockFi’s efforts to generate yield (3). In other words, a security.

It is not totally surprising then that BlockFi was hit recently with regulatory actions from New Jersey (where they are headquartered), Texas and Alabama accusing them of selling unregistered securities. The significance goes beyond BlockFi. We talked last week about how SEC Chair Gary Gensler gave a speech warning that “platforms - whether in the decentralized or centralized finance space - are implicated by the securities laws and must work within our securities regime.”

That perspective carries implications for a large portion of DeFi.2 Most of the DeFi market is in some way investing capital (1) in exchange for yield (2). Truly decentralized smart contracts fail step (3) of the Howey test - but many smart contracts are still effectively controlled by the original developer team. If there is a group able to pause or upgrade a smart contract it implies anyone investing in that contract (1) is relying on that group (3) for their profit (2). That seems to satisfy the Howey test, which would imply that much of DeFi might be (as Chairman Gensler suggested) subject to securities regulation.

We talked in our last post about how companies like Maker Foundation, Uniswap and Shapeshift are pursuing greater decentralization. In the next year or so I think we can expect both greater government pressure and more evolution in the types and levels of decentralization projects need to endure that pressure. We can also expect many projects not to survive that transition.

Other things happening right now:

One common attempt to measure the significance of the DeFi ecosystem is to estimate the amount of capital invested in DeFi smart contracts - often called the total value locked (or TVL). The problem with these estimates is that the tokens that users get for investing in one smart contract usually end up invested in another smart contract and so on. It is extremely difficult to get a fair estimate of actual TVL without enormously overestimating.

In 2018 algorithmic artist Robbie Barrat created 300 AI-generated "nudes" and gave them out as part of the gift bag to attendees of Christies’ Tech Summit. Of the 300 NFTs created only 12 were ever actually claimed. On Tuesday one of those 12 sold for ~72.5 ETH (~$166k at time of sale). I’m not sure if there is a moral here. Maybe check your gift bags carefully?

If Senator Warren was subscribed to Something Interesting she would already know that Bitcoin is not controlled by coders, it is controlled by code.

Pro tip: if a job listing includes "gain leadership buy-in" consider holding out for a job where the leadership hires people to do things they already want people to do.

It also raises questions for ETH 2.0 and the transition to proof-of-stake. Staked Ether derivatives like those provided by Lido Finance are probably securities - the CFTC already posed that question back in 2018.