What to expect when you're expecting (a bubble)

plus efficient market hypothesis and the Iranian power grid

This is Something Interesting, an independent, ad-free roundup of interesting Bitcoin and economics news along with my commentary and perspective. If someone forwarded you this newsletter, you can get it for yourself by clicking here.

In this issue:

Bitcoin mining strains the Iranian power grid

What to expect when you are expecting (a bubble)

Tether FUD rises from the grave (reader submitted)

Bitcoin mining strains the Iranian power grid

Over the winter as home heating needs have surged the Iranian power grid has come under increasing strain, eventually culminating in blackouts across the country. The government has been forced to compensate for natural gas shortages by burning low grade fuel known as "mazut" or dirty oil. The result has been a sharp increase in smog, especially around the capital city Tehran. In response to public pressure about the power outages and pollution the government has blamed … Bitcoin?

Basically the Iranian government is claiming that "thousands of illegal crypto farms" have sprung up around the country, particularly in places like schools and mosques where the electricity is free. I agree with Eric’s analysis further in the same thread:

I have difficulty believing that there is enough Bitcoin mining taking to overwhelm the Iranian power grid but it somehow also manages to elude government detection. Either Bitcoin mining is a total distraction or it is probably happening with at least some amount of tacit government approval. The latter possibility is especially interesting because it seems likely that any large scale mining operation would have been built in collaboration with China, as they are by far the dominant producers of mining equipment.

Perhaps China and Iran are cooperating to explore a post-dollar future?

What to expect if you’re expecting (a bubble)

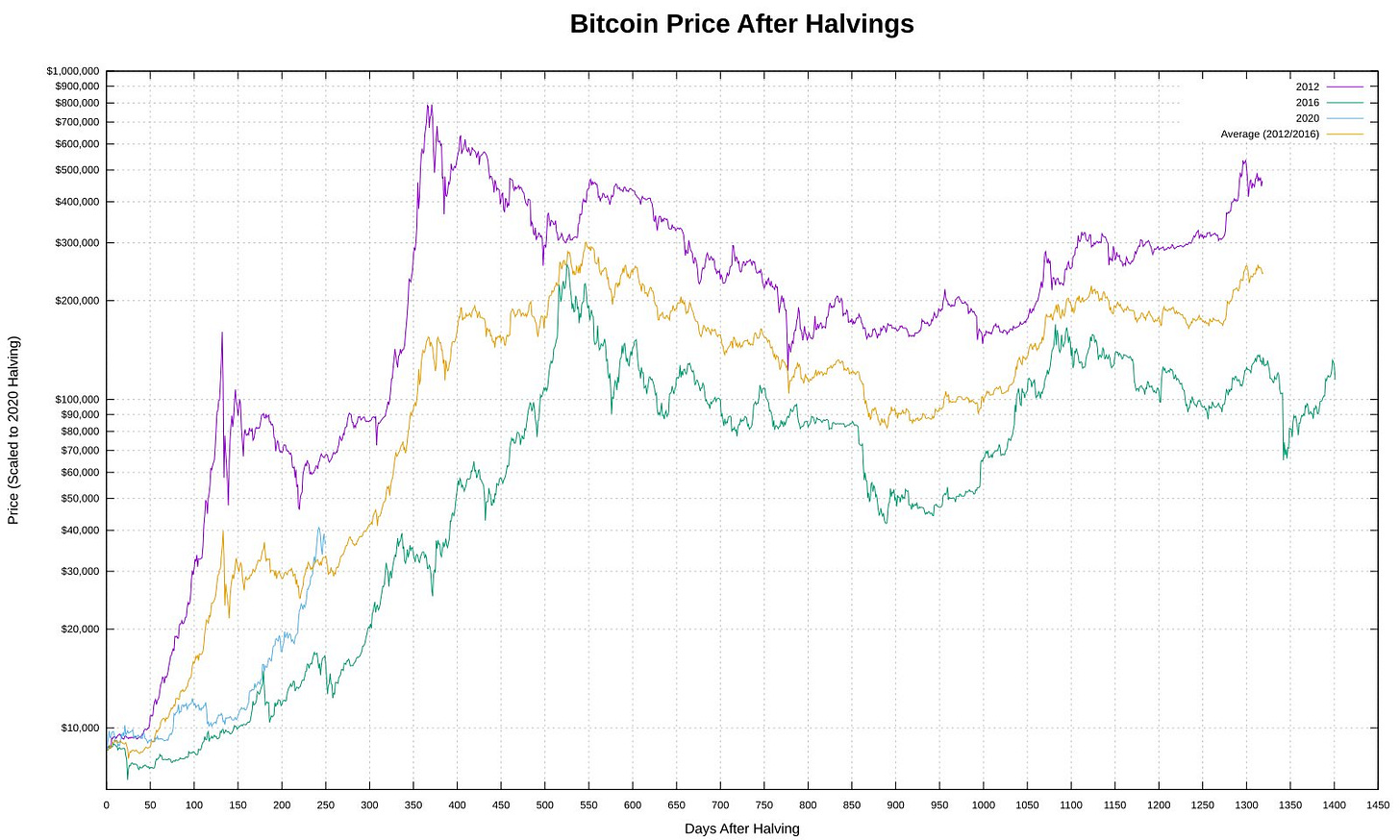

Most price theories about Bitcoin tie back in some way to the four year halving cycle in mining rewards. That’s the central element of the stock-to-flow theory that we talked about a few issues ago. It’s easy to see why - the block reward is like a totally price-blind market seller dropping new coins on the market every ten minutes. Cutting that flow of new coins in half essentially means there is less sell pressure on Bitcoin. On May 10th the Bitcoin network was auctioning ~$1.5M/day worth of Bitcoin to miners - on May 11th that number dropped to ~$750k/day. It makes sense that the price would rise when there are fewer coins being sold.

There have only been three halvings in the history of Bitcoin but the first two were both followed by significant bull runs. If you assume a similar pattern will play out this time you would be projecting a peak between $250k/btc and $800k/btc sometime between April and September of 2021.

On the other hand many would dispute this analysis! Economists have a theory called the efficient market hypothesis that argues anything the market knows about is already "priced in" and so the only events that can actually move the market are surprises when new information is uncovered. In other words the halving can’t be responsible for a price increase because it is not a surprise. Everyone who knows about the 21M supply has already decided what they think about Bitcoin’s scarcity. There is no new information being learned when the halving takes place. Nic Carter has a good long form essay where he makes that case:

Personally I am skeptical that the crypto market is efficient. We still regularly have huge price swings inside of a single day. TV anchors still chuckle in bemusement when Bitcoin stories come up. Dentacoin (the coin for dentists) still has a $64M market cap. Whatever the Bitcoin price is doing I don’t think it’s rationally incorporating new information in a level-headed and consistent way.

Return of the Tether FUD

“Have you seen, The Bit Short: Inside Crypto’s Doomsday Trade? Are you concerned?” -IS

We first discussed Tether in the second issue of Something Interesting, but it tends to resurface in various forms from time to time so it’s probably not the last time it will come up. Tether is a stablecoin meant to represent USD in a bank account that you can trade as though it were dollars in various places that dollars are difficult to bring. Let’s walk through the argument in the linked medium post:

Tether is super shady

Most Bitcoin volume is denominated in Tether

The largest exchanges by volume are denominated in Tether

More Tether is printed whenever the Bitcoin price goes up

When Tether is uncovered as a fraud the crypto market will collapse.

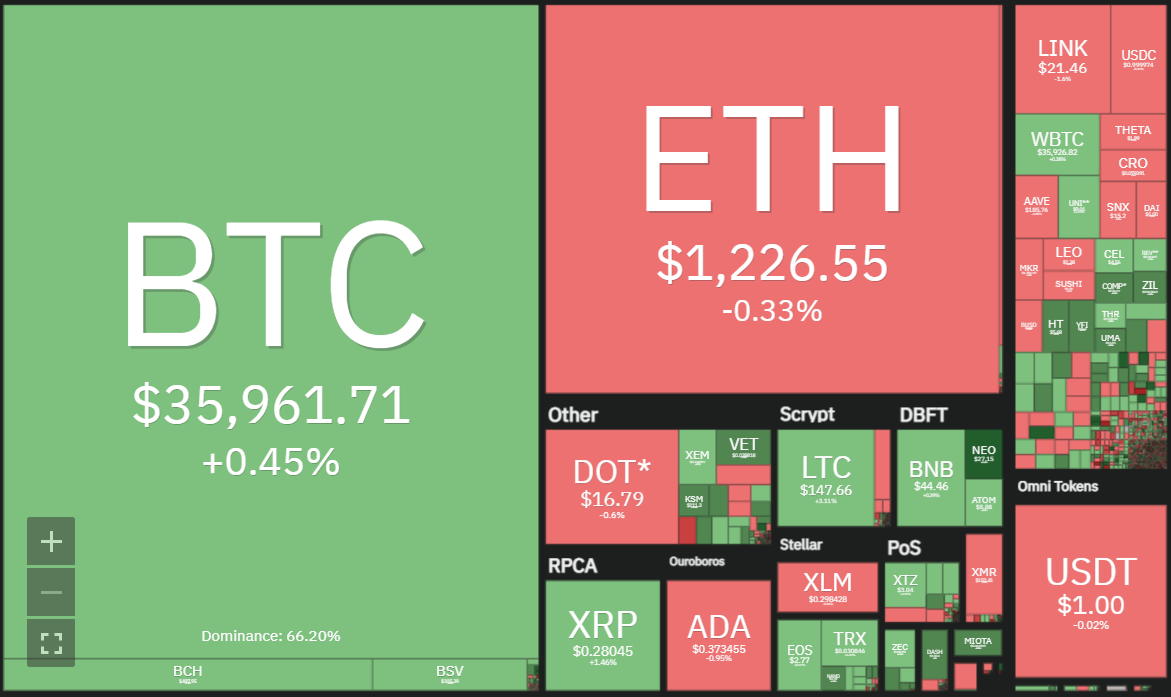

I went into more detail in the last post about it, but I don’t find this fear very convincing. If a casino in Vegas is lying about whether their poker chips are fully backed it doesn’t invalidate the prices of the restaurant next door. Tether is simply not that relevant to the destiny of Bitcoin. For one thing, Tether is a much smaller part of the ecosystem than the above post implies. You can compare their relative market caps in this graphic. BTC is the green square on the left, Tether is the red square in the lower right hand corner:

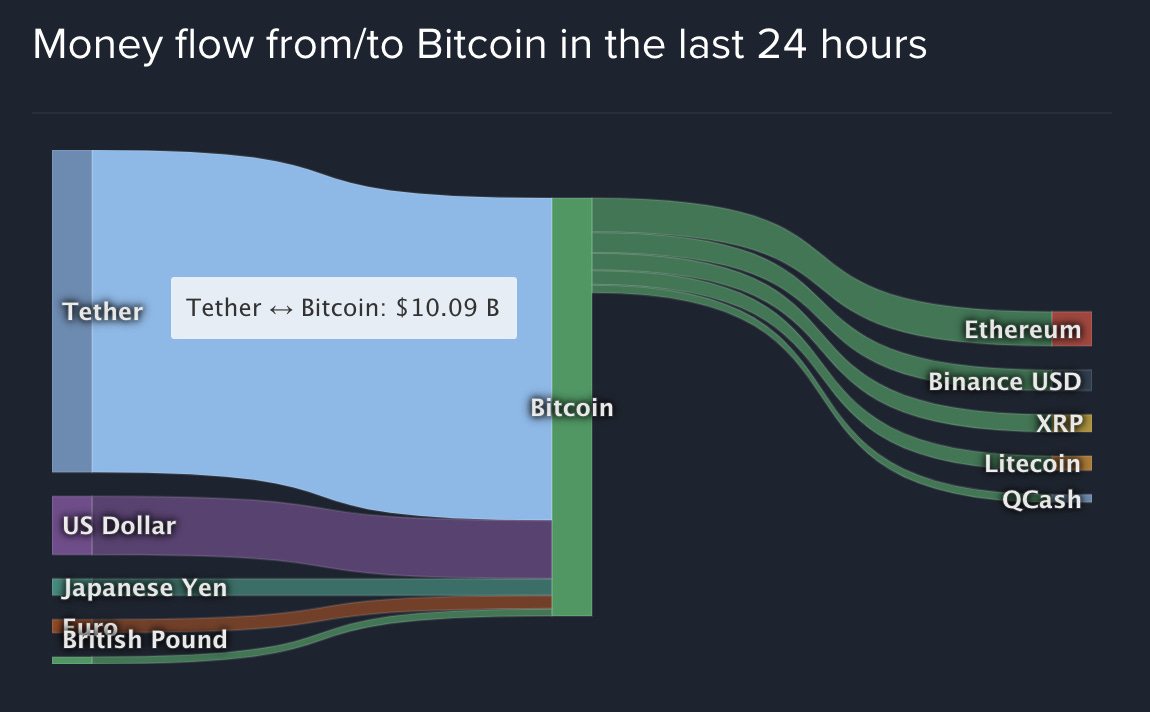

Bitcoin is ~10x larger than Tether by market cap. So the OP has to use trade volume instead to imply that Tether is the primary driver of the price of Bitcoin:

That is either a really ignorant or more likely a really dishonest way of framing the data. Everyone who is familiar with the crypto space is aware that offshore exchanges rely on Tether because they aren’t able to interface with the US Banking system and that they offer extremely high leverage to compete with other more regulated exchanges. They also routinely straight up lie about their volumes in order to appear more relevant than they actually are. So taking their stated volume at face value is naïve and then comparing it apples-to-apples to Coinbase volume is ridiculous.

Tether might genuinely be distorting prices for the longer tail of cryptocurrencies that don’t trade against the dollar at all, but there is no argument here about why the existence of Tether on offshore exchanges is corrupting the nature of price discovery between users on Coinbase where no Tether is used at all. My guess is that the majority of Bitcoin holders don’t actually even know what a Tether is. It seems more likely the rising price of Bitcoin creates more Tether than the other way around.

So let’s talk about the article itself. I think there are some really interesting things to note about it. For one thing, why is the author anonymous? Supposedly they are calling out a fraud as a public service:

This isn’t a game: the human pain will be immense. And the longer the fraud goes on, the more that pain will grow.

I wrote this to stop it.

Why hide? Isn’t it noble to oppose fraud and prevent suffering?

There are other questions worth asking. Why does this argument about Tether open with a tangent about what a good Bitcoin trade they made, or close with an anecdote about their friend Bob the hapless crypto trader? Why is the article so long and so packed with redundant and partially relevant details? Is it to obscure authorial motives, to create a sense of affinity and then to provide a useful blank slate character for the reader to project themselves into?

To be honest a lot of the details of this article strike me as a fairly direct attempt to scare Bitcoin holders into selling their position into the waiting arms of whoever wrote it. Personally, I’m not selling.

Other things happening right now

Larry Summers says Bitcoin (or "something like it") is here to stay:

Unfortunately, Nazis use Bitcoin, too. Not very competently so they are still pretty easy to track right now. Presumably they will get better at it.

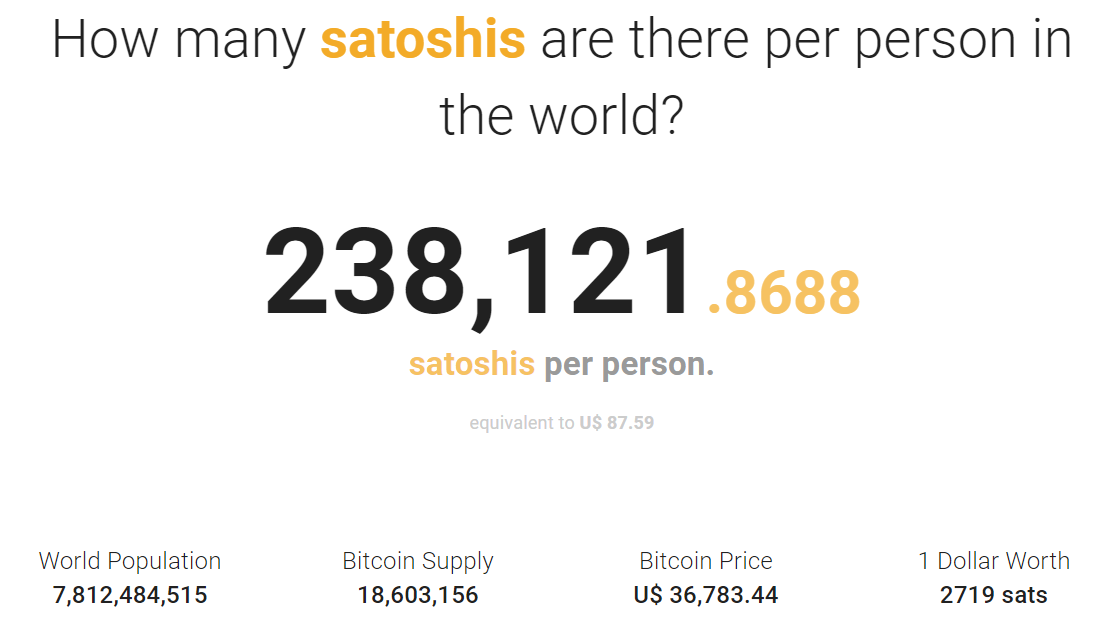

Here is a neat little site that helps contextualize how rare Bitcoin is by estimating the current number of satoshis per person in the world. At time of writing that was 0.000238 btc/person - roughly ~$87 worth. If you own $90 worth of Bitcoin you probably own more bitcoin than most people will ever own.

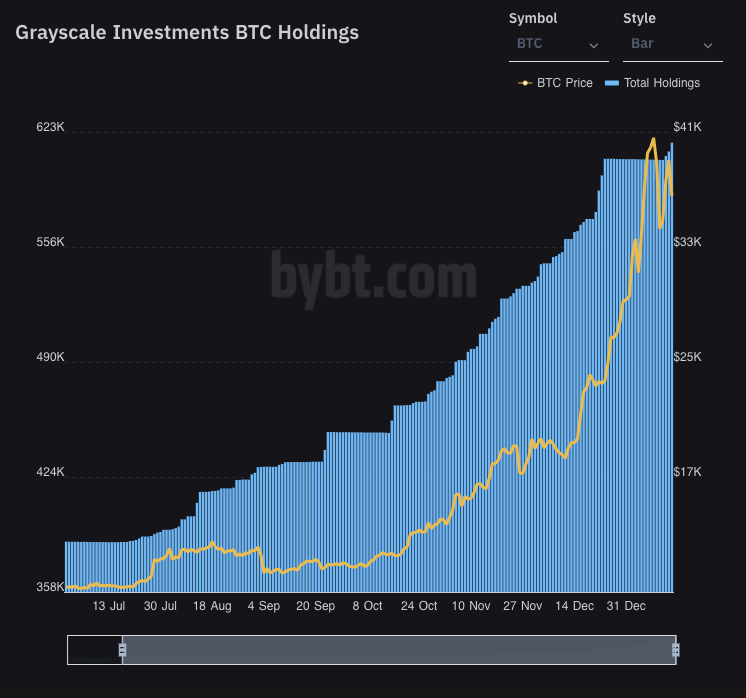

The Greyscale Bitcoin Investment trust has started accumulating again. On Saturday they picked up 5,132 btc (~$189M) or approximately six days worth of mining rewards. They now manage just over $22B of assets.

Comparing the market cap of Bitcoin vs Tether doesn't say much. Market cap is by itself a very flawed way to approximating value. Just because there is a handful of individuals willing to buy the next Bitcoin at 35k doesn't mean all Bitcoins are worth 35k apiece.

Approximately only 1/5 of all Bitcoin is liquid while Tether is pretty much liquidity itself. Tether's impact on Bitcoin's price is undeniable, when new Tether is introduced, Bitcoin's price goes up because there is an increase in purchasing power for Bitcoin.

However, I think Bitcoin will be unaffected if or when Tether is revealed to be a massive fraud.

Suppose Tether suddenly becomes worthless, or suppose it is revealed to be only worth a fraction of a dollar, for simplicity, lets say a Tether is backed only by a dime. What happens?

Bitcoin's exchange rate against Tether will go 10x. Bitcoin's price will go up, not down. Bitcoin is not the one revealed to be fraudulent, Tether is. Tether's value plunges, its 1:1 association with USD will be severed, BTCxUSD will not be affected.

In fact, BTCxUSDT will go even higher as Tether holders scramble to liquidate their holdings amidst fears of further fraud.

Longer term however, if BTC demand does not recover, prices could tank, but Tether will simply be replaced by another stablecoin.