How a (government) currency dies

Plus what worries the Fed, the FTX bankruptcy and the optimal % of Bitcoin.

Inside this issue:

What worries the Fed

How a (government) currency dies

The optimal percentage of bitcoin

What worries the Fed

Federal Reserve Chair Jerome Powell is characteristically mild in his delivery in the segment above, but I thought his message was still quite striking:

PELLEY: How do you assess the national debt?

POWELL: We mostly try very hard not to comment on fiscal policy and instruct Congress on how to do their job when actually they have oversight over us. […]

PELLEY: But is the national debt a danger to the economy in your review? […]

POWELL: […] In the long run, the U.S. is on an unsustainable fiscal path. The U.S. federal government's on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy. […]

PELLEY: I have the sense this worries you very much.

POWELL: Over the long run, of course it does. You know, we're effectively -- we're borrowing from future generations. […] It's time for us to get back to putting a priority on fiscal sustainability. And sooner's better than later.

[full episode transcript available here]

When Powell says "We mostly try very hard not to comment on fiscal policy" he’s referring to the polite but important fiction that the Federal Reserve is a politically independent body. It is important that everyone believes the Fed’s monetary policy is decided for Sensible Economic Reasons and not Frivolous Political Reasons. If people thought Powell was going to cut rates to juice the economy because it is an American election year they might lose faith in the management of the dollar. The Federal Reserve is supposed to be managing the business cycle, not pleasing an administration or a constituency.

That’s why traditionally the Fed doesn’t talk much about fiscal policy and the ruling administration doesn’t (openly) push for a specific monetary policy. The system works best if everyone stays in their lane, at least publicly. For Powell to comment this directly — even in his typically measured tone — is a strong message. When he says that he is worried, I take him at his word.

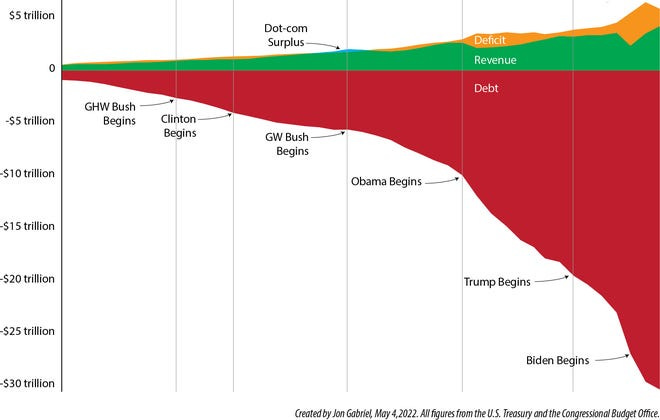

The challenge that Powell faces is that when he sets the interest rates for banks he is also setting the effective cost of government debt. Interest payments on federal debt are currently ~18% of the Federal budget and the fastest growing sector. When Powell says "the debt is growing faster than the economy" this is what he means:

The U.S. economy is actually running pretty hot (~3.7% unemployment) and we’ve only just recently gotten inflation under control, but the federal government is still operating with a significant deficit (~$0.5 trillion in 2024). When the economy is strong is exactly when America should be paying down debts, but instead the government is running up the tab faster than ever.

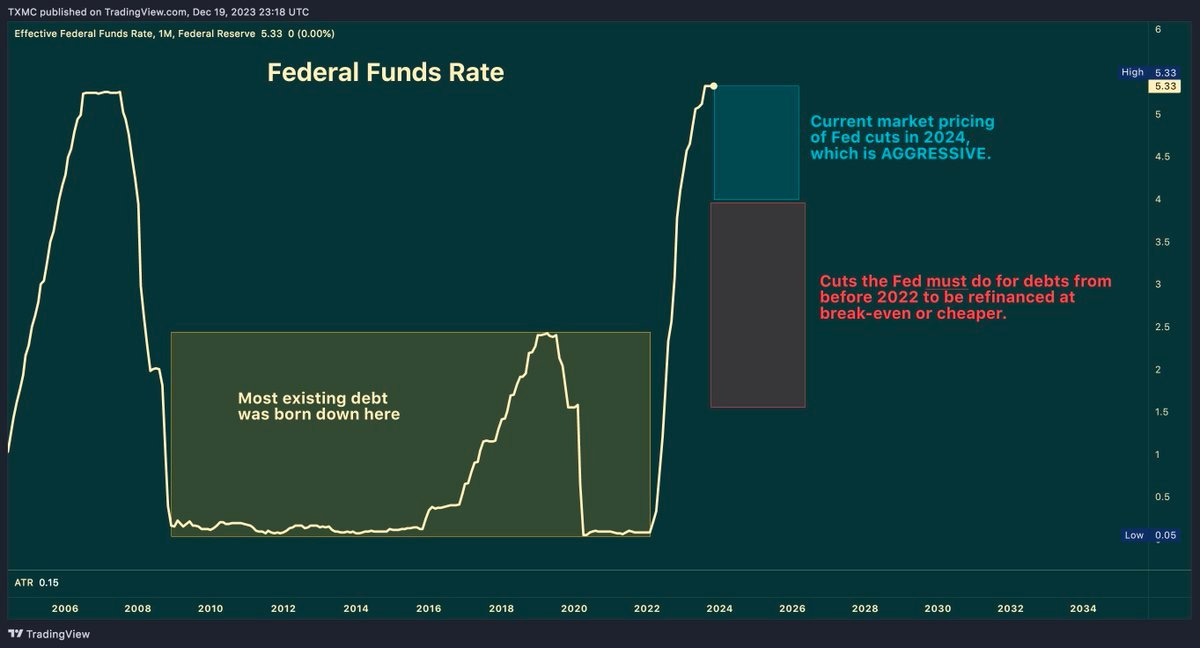

In his battle against inflation Powell has already overseen the steepest rate increase in history, but since most of the world’s debt was created during the near-zero interest rate era it will take time for that debt to rollover and start paying higher rates. Even if nothing else changes the cost of existing debt is on track to skyrocket in the coming years. The market is already pricing in significant rate cuts as inevitable — but the more the market views rate cuts as inevitable the more Powell needs to keep rates high in order to keep American monetary policy credible.

Powell’s worry is specifically that government debt will grow so large that the Federal Reserve will be forced to lower rates to keep the government afloat. Obviously that would limit their flexibility in fighting inflation, but more importantly it would damage their perceived independence. The main reason the dollar is such a strong and stable currency is because it is widely perceived as well managed. If people stopped believing rates were chosen to manage the business cycle and started believing rates were being set artificially just to prop up a spendthrift government, they could end up losing confidence in the dollar itself.

Anyway, here’s a totally unrelated story.

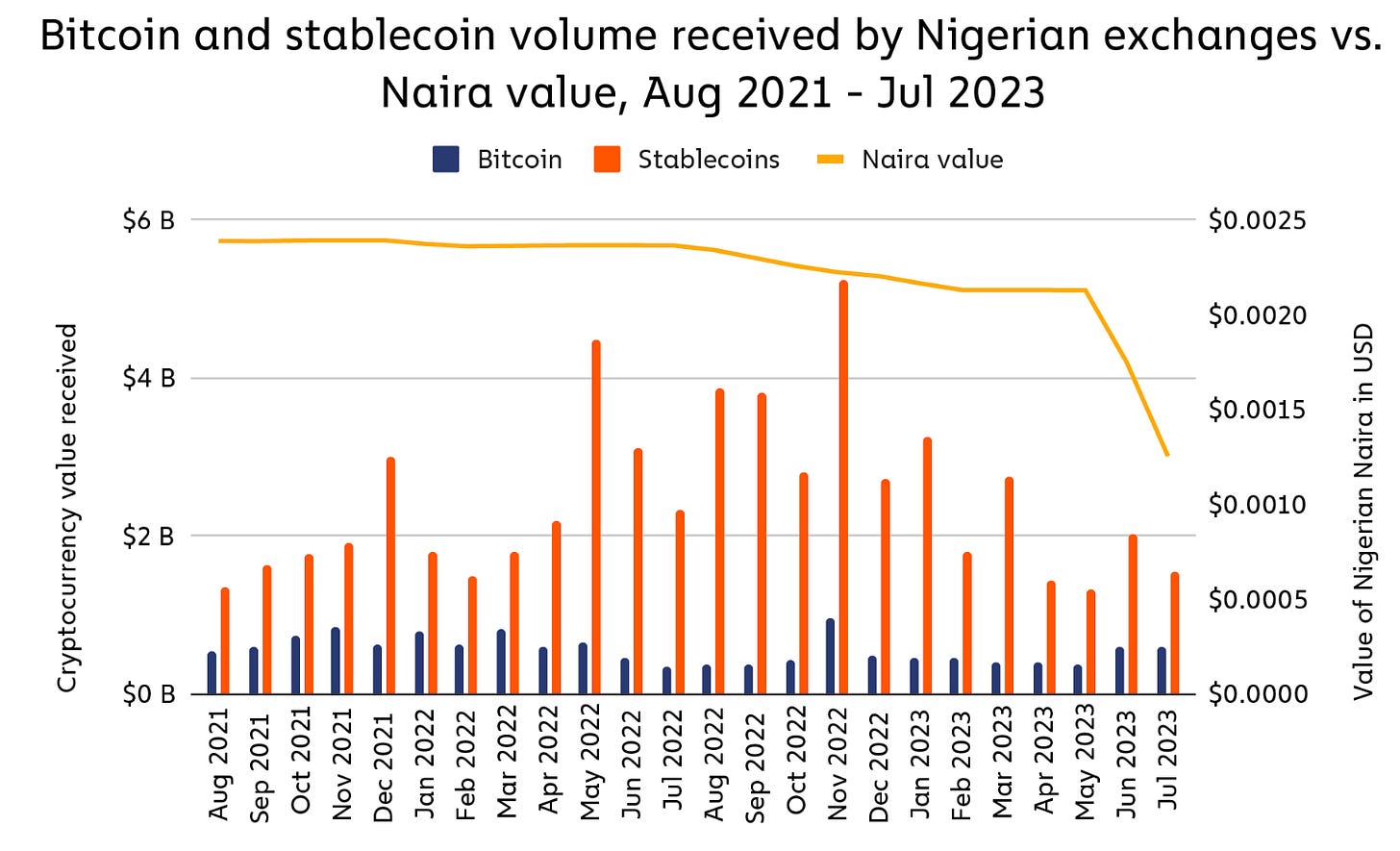

How a (government) currency dies

The first time I mentioned the Nigerian naira on Something Interesting was in January of 2021 in an answer to a reader submitted question about how people actually use Bitcoin in practice.1 At the time $1 USD could buy ~₦400 NGN. Last month we talked about the naira again when the government of Nigeria relaxed many of its previous restrictions on the use of cryptocurrency in commerce. By then $1 USD could buy ~₦900 NGN. As of writing $1 is currently worth ~₦1370 NGN.

Sometimes people who are lucky enough to live in a country with a strong currency and a reliable banking sector struggle to understand why Bitcoin matters. But this is the basic purpose of Bitcoin. Anyone who held their wealth in naira over the last year lost ~2/3rds of their buying power. Anyone whose wages are paid in naira will have to triple their salary just to earn the same amount. The people who wonder if Bitcoin has any real use cases? They aren’t Nigerian.

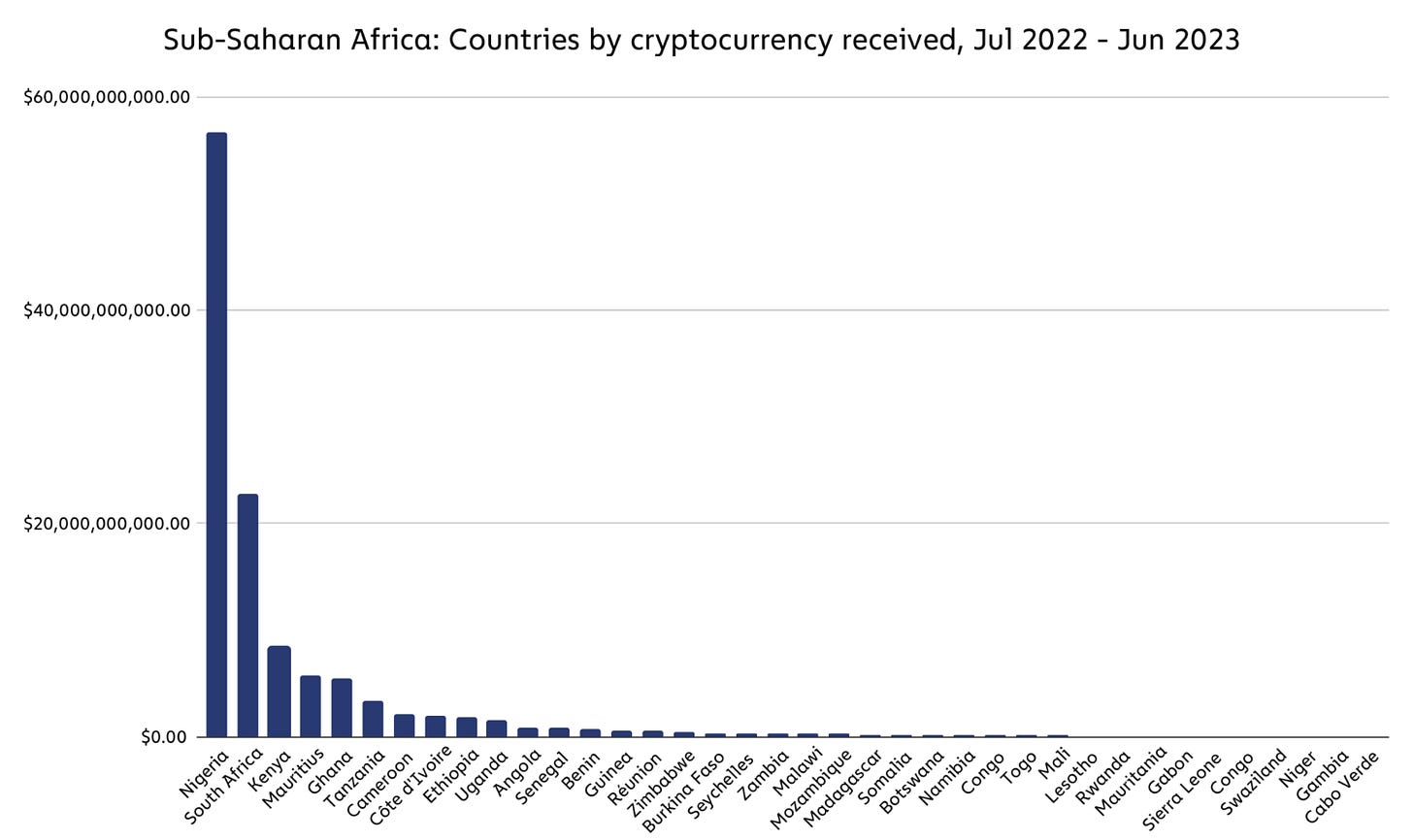

There are ~213 million people in Nigeria. According to Chainalysis their usage of crypto payments has been growing ~9% annually, the third fastest in the world after Saudi Arabia (~12%) and Vietnam (~11%). More than a third of all Nigerians have started using Bitcoin and stablecoins (mostly Tether). Compare that with the Nigerian government’s eNaira cryptocurrency, which has only ~0.5% adoption.

In the short run I suspect the Nigerian economy will likely dollarize (via stablecoins). The longer term will depend on whether anyone listens to Jerome Powell. If government debt continues to grow unchecked, eventually the dollar will walk the same path the naira is walking now.

Other things happening right now:

El Salvador’s Nayib Bukele has just been elected to his 2nd term as president with a landslide ~86.7% of the vote. Bukele is popular but controversial, having very successfully driven down gang violence but also having pretty clearly trampled the constitution in the process — he will be El Salvador’s first re-elected president, which the constitution previously banned. We’ve talked about Bukele a few times before, mainly because of his aggressively pro-Bitcoin policies. Bitcoin is legal tender in El Salvador.

Cathie Wood’s ARK published its annual Big Ideas report where (among other things) they estimated the optimal Bitcoin allocation in 2023 as ~19.4%. The same report estimated an optimal allocation of ~6.2% in 2022. Let’s just check how well ARKK performs using its own financial advice … ahh, well. Nevertheless.

The FTX bankruptcy has benefited from some windfalls recently, most notably a very successful investment in AI startup Anthropic. As a result it looks like former FTX customers will be paid back "in full" — where in full means the cash value of their assets at the time of bankruptcy, i.e. ~$16k/BTC. I seriously doubt FTX customers feel like they have been made whole. It seems to have worked out great for the bankruptcy lawyers, though.

Here’s a really cool animation from Wicked Bitcoin that shows how much time Bitcoin has spent at different prices over its history. Bitcoin has now spent more than four years above $10,000/BTC now, longer than the amount of time it spent between $1000-$10,000 or between $100-$1000.

I like answering reader questions! You should send me one. 🙂