What to expect when you're expecting (an ETF)

It's no longer fashionable to predict the end of Bitcoin, the Nigerian government bends the knee and don't worry the government investigated itself and there was no need to investigate further!

Inside this issue:

What to expect when you’re expecting (an ETF)

The Nigerian government bends the knee

How to avoid government investigation

What to expect when you’re expecting (an ETF)

Towards the end of last year we talked about the possibility of a flurry of spot Bitcoin ETF approvals in mid-January. Since then there have been a flurry of meetings between the SEC and applicants over the holidays followed by minor updates and amendments to the applications — the sort of small details that suggest the major questions have been answered and things are being finalized. This morning SEC Chair Gary Gensler tweeted a thread of cautionary advice for people considering investing in crypto.

Nothing is decided yet, but having teams (including SEC staff) work through the holidays and then rejecting the proposals anyway does seem unlikely to me from a personnel management perspective. SEC administrative staff have families, too.

Rumors about ETF approvals have continued to come into focus. Fox Business reports that Blackrock is expecting approval on Wednesday. The head of digital assets research at VanEck (which is also applying for a Bitcoin ETF) claimed that Blackrock had ~$2B worth of incoming capital arranged already. That would make it one of the most successful opening launches of an ETF in history, but then again most of those successful ETFs were Blackrock launches (iShares ETFs are also Blackrock):

It does seem a bit strange for there to be ~$2B of backlogged demand for Bitcoin exposure given that institutions already have access to a variety of alternative ways to invest in Bitcoin (self-custody, Coinbase custody, GBTC, Microstrategy or the existing Bitcoin future ETFs). But none of those alternatives are a perfect substitute for a true spot Bitcoin ETF and it’s conceivable that by delaying approvals for ten years the SEC has effectively been bottlenecking a certain class of demand.

If new demand does materialize my guess is that it is less about the technical details of the ETF as an investment vehicle and more about the traditional financial market using this moment to signal a narrative shift around mainstream attitudes to Bitcoin as an investment. It’s one thing to create an account on a new website to buy some anonymous internet token. It’s quite another to click a button on your usual broker to buy the newest Blackrock ETF. Recommending or considering exposure to Bitcoin in your portfolio will be a much less radical thing to do:

Bitcoin is being normalized in other ways. Google now allows advertising for cryptocurrency trusts. The new guidelines from the Financial Accounting Standards Board (FASB) allow fair value accounting for crypto assets. Auditing firm KPMG released a report about the ESG merits of Bitcoin investing. I’ve written before about the increasingly strong case for corporate investment into Bitcoin.

There are also far fewer people predicting the death of Bitcoin. In 2017 during the run up to ~$20k/btc announcing that Bitcoin had failed (or would fail) was a relatively common thing for pundits to do. But by now most people have read that prediction and watched Bitcoin shrug it off — and far fewer people are willing to make similar predictions today.

It is no longer fashionable to predict the death of Bitcoin. Instead conventional wisdom has flipped — rather than doomed, Bitcoin is now more frequently (and more accurately) described as unkillable:

Bitcoin ETFs may also end up creating their own demand by competing with each other — at least three television ads have already been released. More importantly, whatever demand there is will very likely find that the supply of available bitcoin is smaller even than it appears. More than >80% of all bitcoin did not move in the last 6 months even as the price rose from ~$30k to ~$44k. There is no sign that people who have held bitcoin through the long bear market are interested in selling yet.

The Nigerian government bends the knee

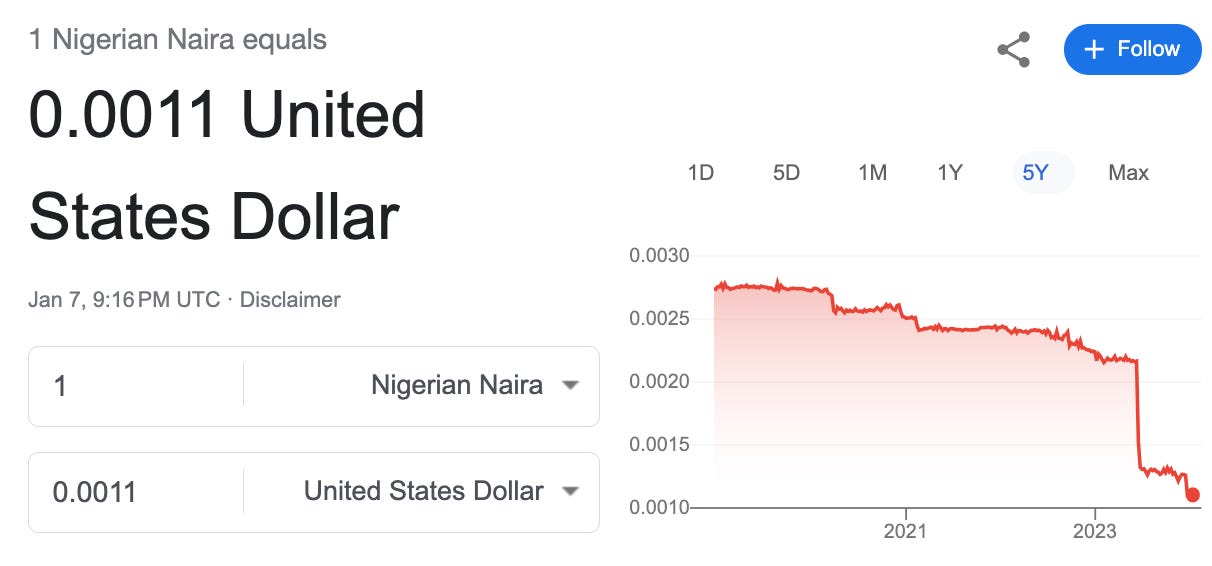

I’ve written before about the Nigerian government’s uneasy relationship with cryptocurrency. Nigeria has the highest self-reported rate of Bitcoin ownership of any country (~20%) in part because the Nigerian Naira has been failing — it has fallen in value by more than 50% since we last mentioned it in 2021.

Cryptocurrency has been heavily restricted in Nigeria since 2017 and then a more complete ban in 2021, but that hasn’t stopped the population from using it as a lifeline. Nigeria also tried competing by launching a CBDC known as the eNaira but adoption was extremely tepid. Now they appear to be surrendering to the inevitable, removing all restrictions on cryptocurrency trading for users and leaving only restrictions on the activities of banks themselves.

Implicitly this seems to be Nigeria acknowledging that the Naira has failed and that its main successors will not be government sponsored. The Nigerian economy will likely become 'dollarized' by cryptocurrency, with USD-pegged stablecoins serving as the primary medium of exchange and Bitcoin serving as a longer term store of value. This is broadly similar to the pattern playing out in Argentina and El Salvador right now — and possibly more places soon.

Stablecoins makes it relatively easy to migrate your wealth to the currency of your choice without having to leave your own nation. That’s good for individuals who want to preserve their wealth in stronger currencies — but it’s bad for weaker currencies that rely on captive audiences and capital controls to survive. We should expect weak currencies to continue to fall in the coming years.

Other things happening right now:

Good news! The government looked into the campaign finance charges against Sam Bankman-Fried and discovered there was no need to investigate further! The relevant charges are dropped, nothing to see here! What a relief.

The 6050l provision in the 2023 infrastructure bill (which we wrote about when it passed) went into effect on Jan 1. That means any business that receives >$10k worth of cryptocurrency must report the name, address and SSN of their counterparty to the IRS within 15 days or face felony charges. Fun fact: it’s not possible to refuse or reject a cryptocurrency payment! As a fun civics exercise, try anonymously sending $10k to a government official and see how they handle it! To avoid any risk of government scrutiny on your own cryptocurrency payments just label them "from Sam Bankman-Fried."