There is always a bigger margin call

SBF bends the knee and surrenders FTX to the House of Binance

Inside this issue:

There’s always a bigger margin call

Nigerians don’t want the Nigerian CBDC

Justice Department seizes $3.3B in a popcorn tin

There is always a bigger margin call

We talked late last week about the Coindesk report on the alarmingly tenuous balance sheet of Alameda Research. Here’s what I said then:

"It’s not clear from the article what the nature of Alameda’s liabilities are but if they are USD denominated (which seems plausible) that would be pretty bad news for Alameda. If they borrowed a lot of dollars to go leverage long on crypto they could end up blowing up just like Three Arrows Capital. On the other hand Alameda is famous for shorting crypto tokens, not betting on them. It seems unlikely that a bear market would render them insolvent? Never say never, I guess."

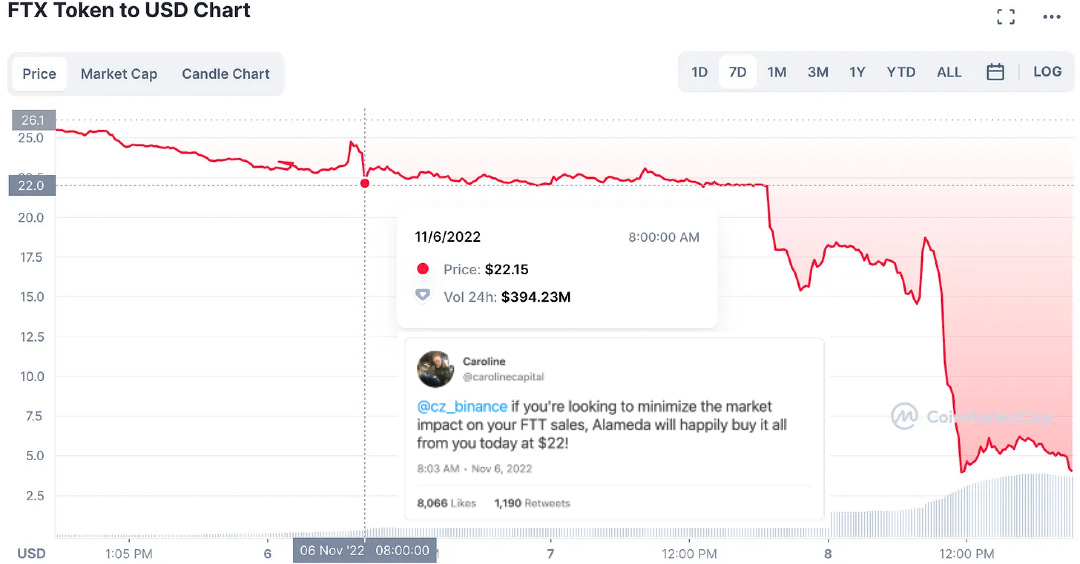

It was a simpler time. Since that post Alameda Research and the intertwined crypto-exchange FTX have unraveled. The first crack appeared when former investor and principal competitor CZ of world’s largest crypto-exchange Binance tweeted that they would be dumping ~$2.1B worth of FTX’s exchange token FTT:

It is not necessarily suspicious to want to sell their stake in a token, especially in light of the news about how precarious Alameda’s balance sheet was and how much FTT they held — but publicly announcing the plan to sell in advance seems more like a deliberate attempt to sabotage the price. Especially when he compared FTT to failed stablecoin Luna later in the day.

Recall from our previous story that much of the assets on Alameda’s leaked balance sheet were in FTT and it had a habit of using FTT as collateral when borrowing. If they borrowed USD against FTT collateral (as seems to have been the case) they were effectively margin long against FTT. That would mean a steep enough drop in the price of FTT could cause their loans to be liquidated and Alameda to go bankrupt.

Caroline Ellison, CEO of Alameda, was even helpful enough to share exactly where their liquidation threshold was:

That was not a good idea. Publicly announcing their willingness to buy made it obvious Alameda’s real goal was to pump the token price, not acquire more at a good price — but Alameda being visibly worried about the FTT token price only made everyone else more worried about them. As of writing FTT is trading at ~$4.5/FTT, down ~80% from when Ellison tweeted. Ellison no longer lists CEO of Alameda Research in her Twitter bio.

As confidence in the FTT market collapsed FTX users rushed to withdraw their funds from the exchange. By Monday FTX had started to throttle withdrawals, stirring even more fears in the market. By Tuesday, Binance had swallowed FTX whole:

In January FTX raised ~$400M at a valuation of $32B. They had endorsement deals with Tom Brady and Steph Curry.1 People were comparing founder Sam Bankman-Fried to JP Morgan and Warren Buffet. In October they were hinting that they might acquire Coinbase. Here is Brian Armstrong this week politely declining to explain why Coinbase declined the opportunity to acquire FTX:

The relationship between Alameda Research (a private trading firm) and FTX (a user-facing marketplace) has always been ambiguous — but there should have been a firewall between user deposits on FTX and the funds Alameda was borrowing against as its margin. But Alameda’s desperate scramble to defend FTT’s price and FTX’s obvious inability to satisfy withdrawals make it pretty obvious that wasn’t entirely true. Not much is known yet about the details of how this played out but it is hard to tell a coherent story that doesn’t involve fraud.

Fraud is likely why Alamada and FTX were so vulnerable and probably also why Binance is only offering $1, at least according to rumor.2 Even at that price it is not entirely clear why Binance would want to acquire the debt and legal baggage of a failing competitor when it could probably just hold still and acquire most of their migrating customers without any effort.

The optimistic answer is that CZ and Binance stepped in to forestall yet another massive liquidation in the industry — but a more worrying answer is that Binance is doing the same thing Alameda was doing a month ago: putting on a show of strength to shore up market confidence and defend its own shaky balance sheet. I don’t know of any reason to think that Binance’s finances are precarious but at the risk of repeating myself: never say never.

Other things happening right now:

Nigeria has the highest Bitcoin adoption rate of any nation in Africa (>20%). We’ve written before about the pressure this has put on the naira, Nigeria’s domestic currency. The government launched one of the first central bank digital currencies (CBDC) in Africa (the eNaira) roughly one year ago — but adoption of the eNaira is still struggling at ~0.5% even with active government support. Nigerians know the difference between CBDCs and Bitcoin.

In 2012 James Zhong stole roughly ~50k bitcoin from the original darknet market Silk Road by exploiting the primitive withdrawal system. He held that bitcoin for 10 years without selling through multiple market cycles. He stored it on a laptop in a popcorn tin under some towels in a bathroom closet. Then in a move so cunning no one could have predicted it, he called the cops on himself. The Justice Department announced the $3.3 billion seizure on Monday. Legend.

That’s quite a bit below the most recent valuation of $32B for those keeping score. Apparently investors and employees were not kept informed as this all unfolded. SBF himself lost around ~94% of his wealth. Most of what remains is his stake in Robinhood. Mercilessly CZ made him say thank you.