The righteous anger of nocoiners

Plus (₺, ₺), Kazakhstan and the financial advice of a chess grandmaster

In this issue:

Internet blackout in Kazakhstan

Turkey introduces staking for fiat (₺, ₺)

The righteous anger of nocoiners

Internet blackout in Kazakhstan

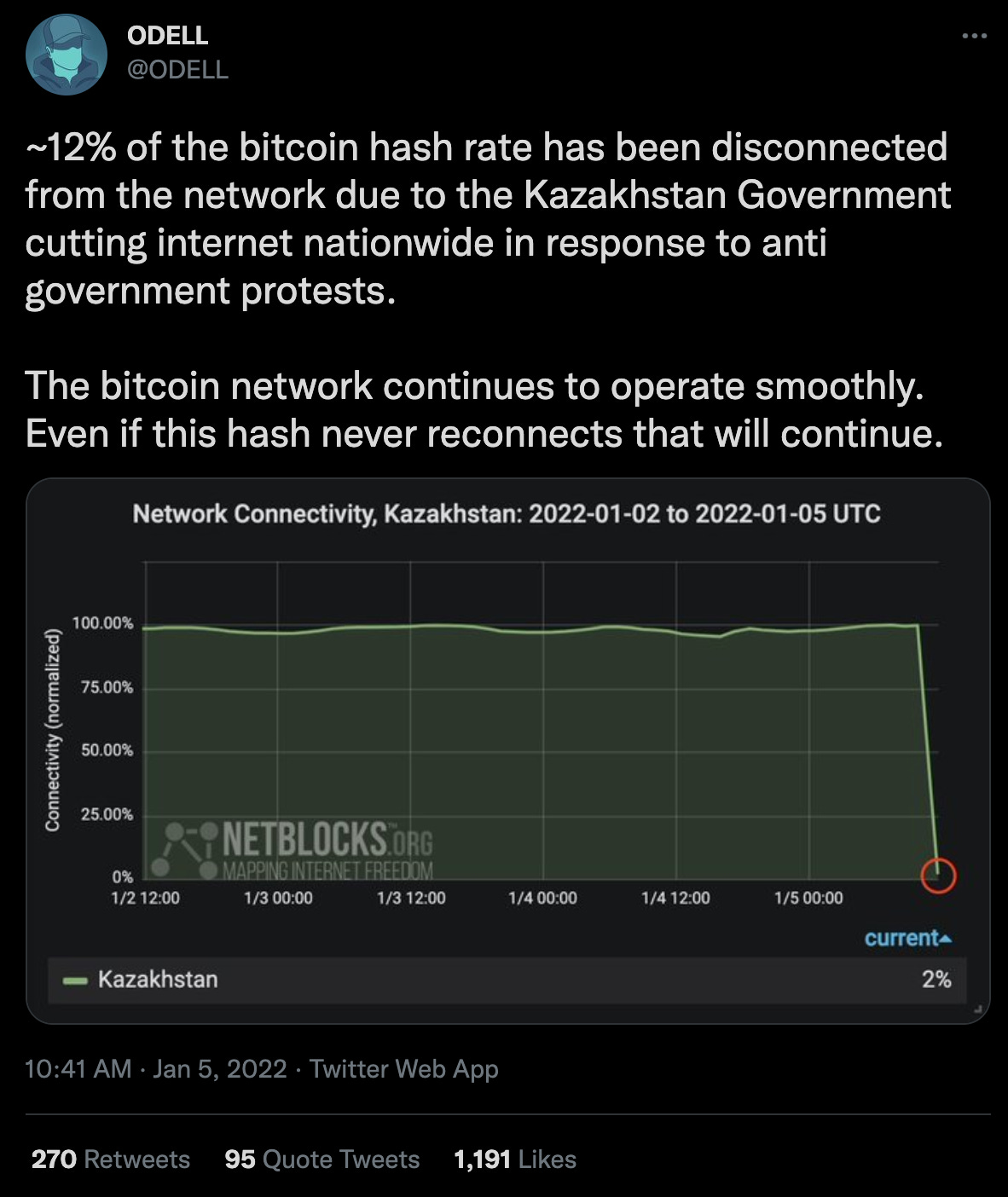

A nationwide protest over doubling gas prices in Kazakhstan has caused dramatic conflict between the citizens and the government, culminating in curfews, the government cutting the country’s internet, rioters setting the city of Almaty1 on fire and ultimately the government resigning on Wednesday. Around 12% of the Bitcoin hashrate is estimated to come from Kazakhstan — many having migrated out of China after the recent ban. Most were not ready for an internet blackout:

This turmoil is tragic for the Kazakh people and the outage is likely very expensive for the miners located in Kazakhstan but the harm to Bitcoin is negligible. The network already shrugged off a much deeper hit to hashrate when ~50% of all mining power was migrating out of China mid last year. Still it seems likely to have contributed to Bitcoin’s price drop at around the same time, down to ~$43k/BTC at time of writing.

When King Bitcoin sneezes, the whole market feels sick.

Turkey introduces staking for fiat (₺, ₺)

We mentioned Turkey’s currency crisis briefly in November when Bitcoin reached an all time high there against the lira, but the situation continues to unfold. Inflation has reached a 19 year high and confidence in the currency has been shaken. In December Turkey’s Prime Minister Erdogan introduced an emergency program meant to shore up confidence in the currency by encouraging citizens to convert USD into lira.

The system works like this: citizens can lock their lira into special depository accounts for between 3-12 months. During that time if the lira falls in value faster than the interest rates offered by the banks, the government will pay the difference. If the interest rate is 5% and the lira falls by 10% the government will pay an additional 5% interest to insure the purchasing power of the account.

So you have to keep your wealth in a currency of uncertain value for a long window of time but in exchange you get very high interest rates. As long as everyone keeps their money in the high-interest accounts and doesn’t do anything foolish like spend it or sell it for harder currency, everything should be fine. Erdogan is essentially placing a double-or-nothing bet on restarting confidence in the lira.

If this strategy sounds familiar that is because it is the trad-fi equivalent of the (3, 3) logic that we discussed in That’s not a real Ponzi, it’s just a sparkling scam.2 Erdogan is paying his citizens in lira to value lira as a way to earn more lira. I wonder if he got the idea from HEX or from OHM?

The righteous anger of nocoiners

Disclaimer: I worked for a number of years as a Product lead for the Chrome Browser team. I didn’t work on anything for Chrome that intersected with Mozilla but there were teams on Chrome that did. I still have a strong affinity for Chrome but I don’t have any strong feeling about Mozilla one way or the other.

On New Year’s Eve Mozilla made the relatively tame announcement that they had partnered with a third party provider to accept cryptocurrency donations. This wasn’t really an endorsement of cryptocurrency so much as a willingness to take donations from anyone who would give them. Mozilla wasn’t planning on keeping or even handling the cryptocurrency — BitPay manages the donations and sell the crypto for USD on their behalf. Mozilla just really needs cash and rich crypto enthusiasts seemed like a potential audience to appeal to.

Founder of Mozilla Jamie Zawinski and designer of precursor browser engine Gecko Peter Linss (neither of whom have any current relationship with the project) joined the conversation — not to support the struggling foundation’s fundraising efforts, but to condemn them. The level of anger that cryptocurrency inspires is always startling to me but I think it is useful to remember that it is fundamentally performative. Zawinski and Linss didn’t reach out through their private connections to Mozilla in an attempt to affect change — they publicly dunked on it to the Twitter equivalent of thunderous applause.

Hating on crypto is easy and popular so it attracts grandstanding. Some people end up devoting their entire online presence to hating crypto, like Stephen Diehl or Dave Troy (whom we’ve discussed before).3 Cryptocurrency is deeply confusing and when other people get rich in confusing ways it feels profoundly unfair. There is a ready audience eager to be told that their anger about crypto is justified — that their past investment choices were not financial mistakes but moral victories.

This isn’t debate so much as engagement farming. The goal is not to inform but to entertain. They are only seeking to reach people who already agree with them. But as crypto continues to grow that audience and their resentment will grow. There is likely more of this to come.

Other things happening right now:

On New Year’s Day the Boston Fed listed a job opening for a Director of Product Management to "work closely with engineering, operations, policy, and design to continue our efforts to build a hypothetical general purpose digital currency." I personally think America is better off regulating stablecoins than building a federal CBDC but I suppose it makes sense to explore that question fairly thoroughly.

NFT marketplace OpenSea announced a $300M round of fundraising valuing them at $13.3B. OpenSea had ~$3.3B in sales in December (implying ~$82.5M in revenue) and ~70 employees. They also raised $100M at a $1.5B valuation only last July. Given that burn rate I can only assume they use that money as paper for the paper-mâché their servers are made of.

Strategic genius recommends Bitcoin. Probably nothing?

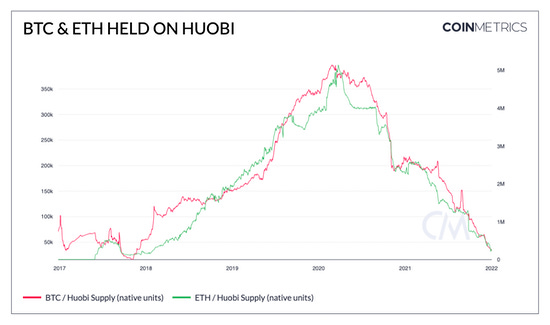

We talked late last year about the theory that China’s ban on Bitcoin mining and trading was suppressing crypto prices as customers on Chinese exchanges (like Huobi) were forced to sell or withdraw. As you can see in the chart below, the supply left on Huobi was depleted by the end of 2021. That particular market force should no longer be in play.

The article originally identified the city of Almaty as the capital of Kazakhstan but President Nazarbayev actually moved the capital from Almaty to the city of Astana in 1997.

This was probably my single favorite story all last year so if you are new to the newsletter (or if you missed that post) you should definitely give it a read.

A good rule of thumb is that all the best thinkers block @ replies in their Twitter threads in order to protect the marketplace of ideas from outside intrusion.