Corporate America discovers NFTs

Plus why Bitcoin's price is struggling and RadioShack announces a DeFi token

In this issue:

The lingering effects of China’s Bitcoin ban

Corporate America discovers NFTs

RadioShack announces a DeFi token

Editor’s Note: After this post I am going to take the rest of the year off to spend the holidays with my family. I do have some posts queued up during that time so you won’t be entirely without content but I won’t be tracking the news as closely or as responsive over email or social media. See you again in a few weeks! — KF

The lingering effects of China’s Bitcoin ban

Bitcoin has continued its slow, intermittent grind down since the beginning of November. As of writing the price was ~$48k/BTC. It is pretty clear that the laser-eyed dream of $100k/BTC in 2021 is at this point probably out of reach. The price movements here aren’t particularly interesting by Bitcoin standards, but it is interesting that price movement is going down while on-chain metrics are arguably pretty bullish.

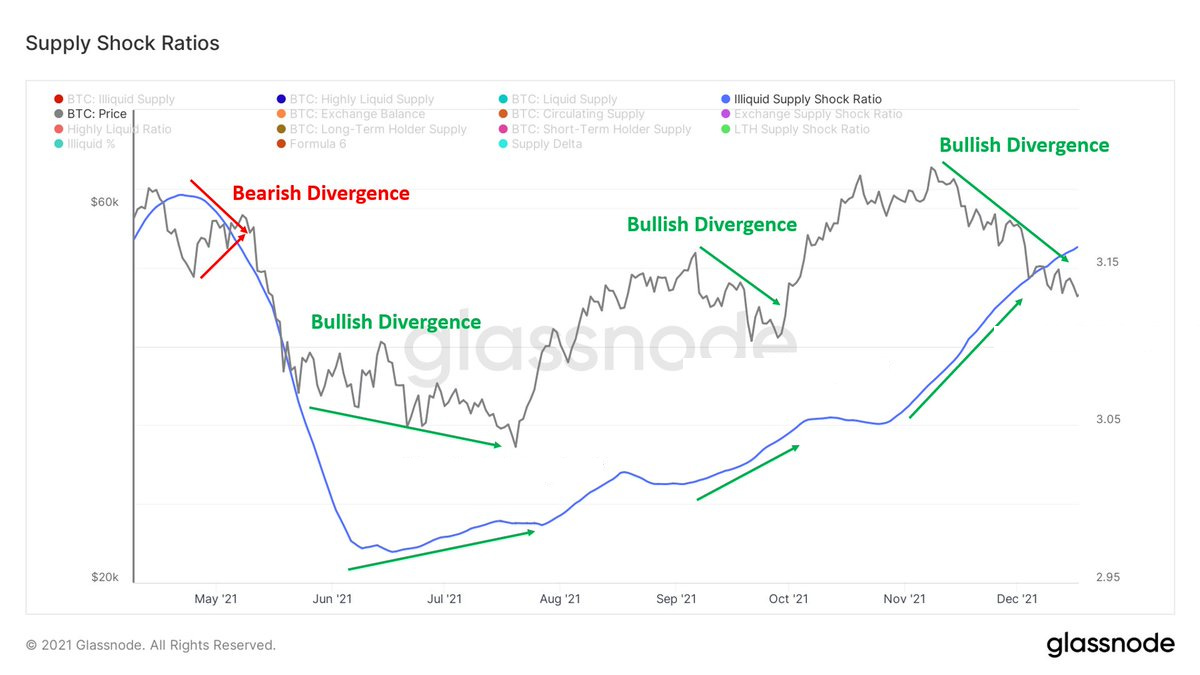

Consider for example the supply shock ratio which is basically the ratio between bitcoin held by addresses with a history of not selling (illiquid supply) and the bitcoin held by the addresses with a history of selling or no history at all (liquid supply). When the ratio goes up there is less Bitcoin available for sale. Price going down when the supply shock ratio is going up is called a bullish divergence:

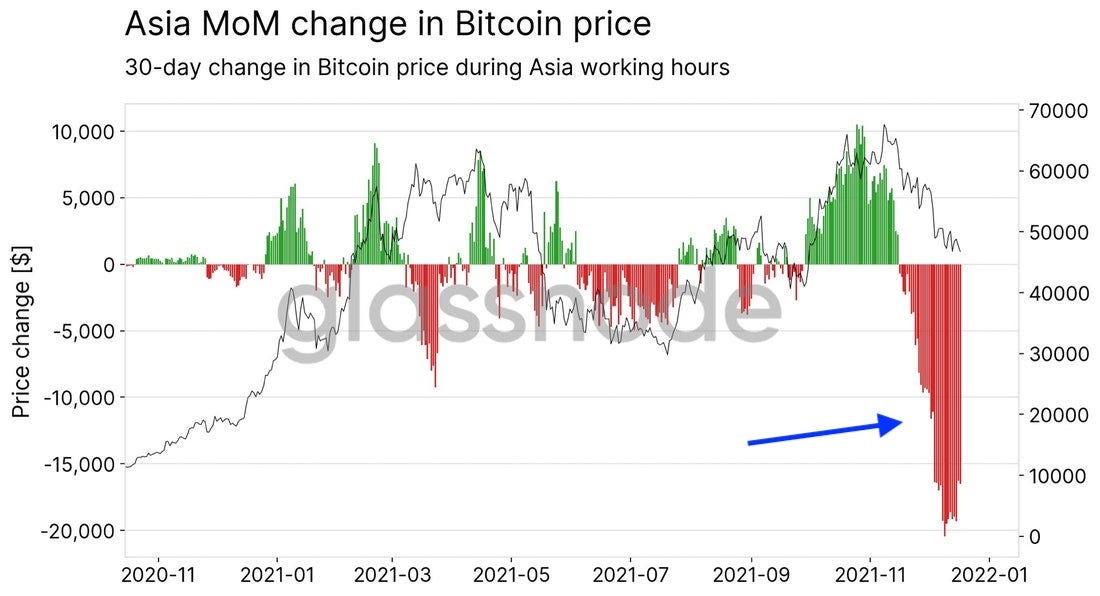

There are plenty of reasons to be selling right now: harvesting tax losses before the end of 2021, de-risking in anticipation of market volatility from Omicron or a more hawkish Fed policy. But one interesting way to tease out who is selling is to ask when they are doing it. Recently it turns out selling has been happening during Asian market hours:

The story here is that as part of China’s crackdown on cryptocurrency all the major exchanges are pulling out of China by the end of 2021. Huobi (one of the largest exchanges in Asia and originally founded in China) has already shut down purchases for Chinese users — they can still sell and withdraw for now, but selling is only available until the end of December and it is unclear whether and for how long withdrawals will actually be approved. Most users are understandably choosing to sell now while they still can.

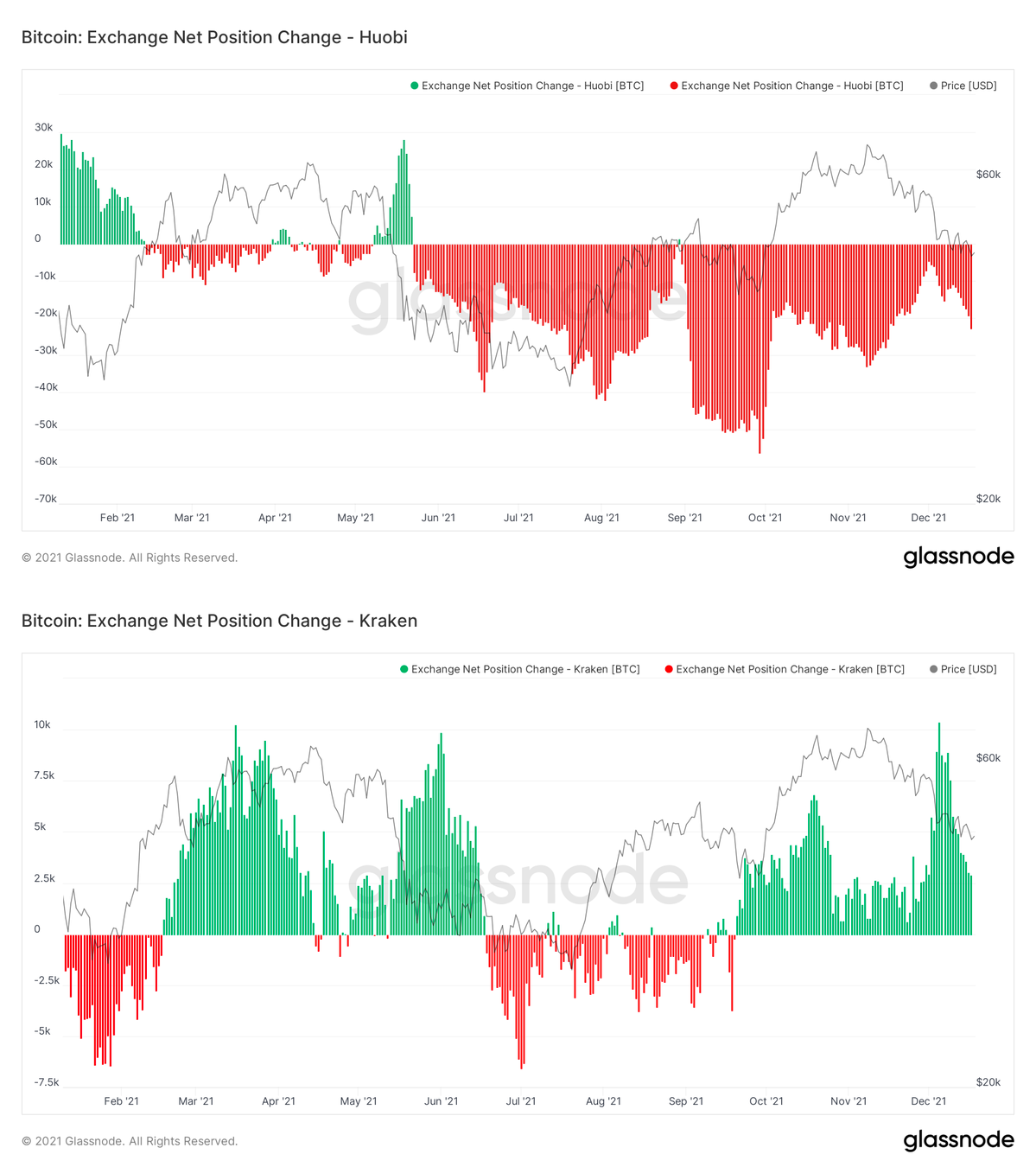

Compare the selling from Huobi (top) to the buying on San Francisco based exchange Kraken (bottom). From June to September both markets were bearish — but since October Kraken has been buying:

If recent movements are indeed mostly coming from Chinese users being pushed out of the network by exchanges as they exit the country, that would imply sell pressure should lessen significantly when Huobi and other exchanges finish fully exiting from China at the end of the year. Perhaps we will see the moon again in Q1.

Corporate America discovers NFTs

If you had "Melania Trump releases an NFT market dedicated exclusively to official Melania Trump NFTs" on your list of 2021 predictions then my hat is off to you. Personally it caught me off guard. Ms. Trump’s announcement closed by saying that she was working with concierge NFT buying service MoonPay. Here was the official response from MoonPay:

Oops! Must have been a typo. Melania is following an increasingly common commercial path recently. In the last few weeks we’ve seen official branded NFT launches from McDonald’s, Coach, Pepsi and Applebee’s. Budweiser released official NFTs and changed their Twitter handle to beer.eth (which they own). Stan Lee’s twitter account spoke from beyond the grave to announce a new NFT for sale. Even more ghoulishly the people who own the rights to Bob Ross’s paintings turned him into a combination NFT/Funko Pop.1

Corporations have also been buying NFTs. We’ve talked before about how Visa bought a CryptoPunk to use as a profile picture — back in August beverage brand Arizona Iced Tea bought a Bored Ape for the same reason. Arizona Iced Tea has since switched back to their logo for the profile pic but they still have the Bored Ape, which they bought for only ~17.8 ETH (~$53k at the time). It was a simpler time.

A bit further on the commitment scale, Shopify has announced a white-label NFT service allowing any Shopify merchant to mint and sell NFTs. Nike bought an entire NFT brand: sneaker / digital collectible group RTFKT (pronounced "artifact"), shortly after the successful launch of RTFKT’s CloneX NFT avatar collection.2 But it was Adidas that discovered the apparent synergy between buying and selling NFTs.

Adidas bought a Bored Ape for 46 ETH (~$156k at the time) — then immediately turned around and sold 6000 ETH worth of Adidas brand NFTs back to the Bored Ape community not to mention ~1000 ETH so far from the 10% royalty on secondary sales.3 Adidas probably won’t keep the ETH on the books which means this whole marketing promotion netted them ~$28M, minus whatever it costs to make the tracksuit, beanie and hoodies that accompany the NFTs.

Buyers also did well. The mint cost was 0.2 ETH/token and as of writing the tokens are trading at ~0.9 ETH/token. One assumes that ~5xing customers money will have some amount of positive brand marketing value, too. Win, win! You know, except for Nike. They’re probably asking some tough questions about why they bought an entire company and they didn't even get a JPEG.

Other brands have certainly noticed this promotion and are likely making NFT plans of their own as well. I predict we see at least one Bored Ape commercial among Super Bowl Ads this year.

(Disclaimer: I own Bored Ape #9456 and minted/sold an Adidas Metaverse token)

Other things happening right now:

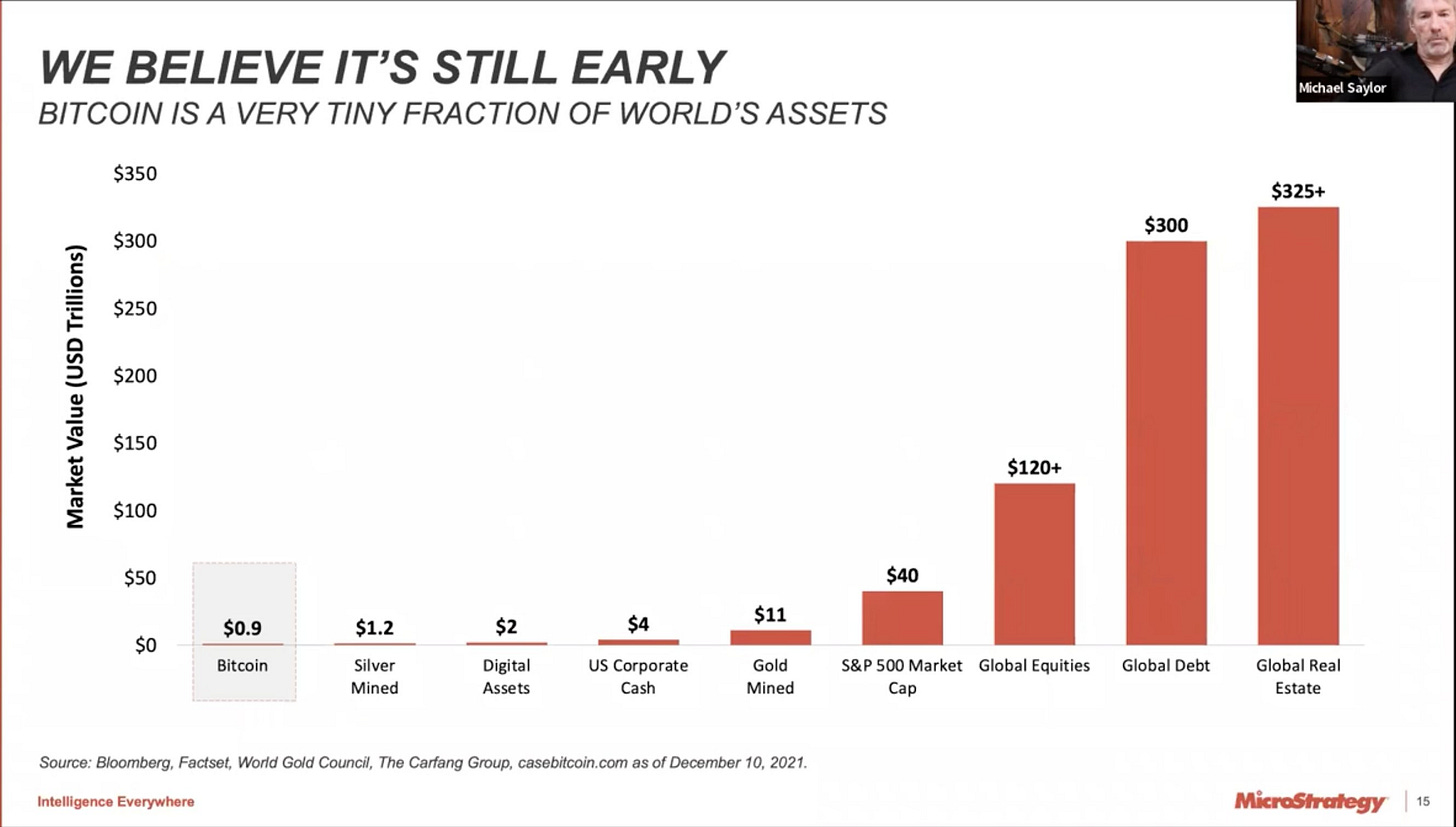

A nice reminder from Microstrategy of how tiny Bitcoin still is relative to the markets it competes for. I don’t really buy the comparison to global debt, but I definitely think Bitcoin will capture significant market share from gold, equities and real estate.

South Park offered some gentle observations on NFT culture:

This is — and I cannot stress this enough — 100% real. Each day we stray further from Satoshi’s light.

Something Interesting pro tip: don’t use the likenesses of dead celebrities to sell merchandise. It’s fucking gross.

The Nike acquisition was probably why RTFKT’s CloneX launch had weird, unpopular terms forbidding off-market trading of the NFTs.

Technically in practice the Adidas tokens are not unique tokens but rather a collection of 30k indistinguishable tokens. Since they are fungible they are not non-fungible, which means they are not non-fungible tokens (NFTs). I don’t think the public will actually notice the distinction, to be honest.