VISA buys a CryptoPunk

Plus Mutually Assured Preservation and how to teach an old DOGE new tricks

In this issue:

Mutually Assured Preservation

Does Bitcoin actually help the unbanked? (reader submitted)

Generous donations to VISA’s digital art collection

How to teach an old DOGE new tricks

Mutually Assured Preservation

Here is an interesting post from Jason Lowery (Dir. of Operations, US Space Force) drawing an analogy between the use of military force by nation-states to establish property history and the use of proof-of-work by Bitcoin nodes to do the same.

Lowery’s argument is that nation-states as we know them exist not to defend territory but instead to defend wealth - that defending territory is merely a prerequisite to defending wealth, which prior to Bitcoin has always had a physical location. Storing wealth in the Bitcoin ecosystem instead of physical assets places them beyond the reach of even overwhelming military force, and hence reduces the incentive to engage in war. Why bother conquering your neighbor if they can just hide all their money on the blockchain?

So to the extent we migrate our wealth onto the Bitcoin network we can defend property rights with Bitcoin mining instead of with war. Not everyone is a fan of Bitcoin mining but I think reasonable people can agree it is better than war.

Lowery then pushes this argument further and describes Bitcoin mining as a "fourth leg" of the "nuclear triad" of US strategic deterrence. I’m not quite as convinced of this part of the argument. I do expect Bitcoin mining to be a matter of national security as a means of defending access to the Bitcoin network - similar to how defending access to the internet is a matter of national security today. But I don’t think Bitcoin will usher us into the post-war era.

Bitcoin does not magically move geopolitics into the metaverse. Countries still have population centers and Bitcoin mining at nation-state scale involves power plants of various types - both of those will have the same need for physical defense. No such thing as a free lunch.

Does Bitcoin actually help the unbanked?

"Crypto often prides itself in providing financial access to the unbanked, but I am skeptical as to whether crypto is currently helping the people it aspires to. If you don't have fiat already, how can you make use of crypto in the first place?" - VN

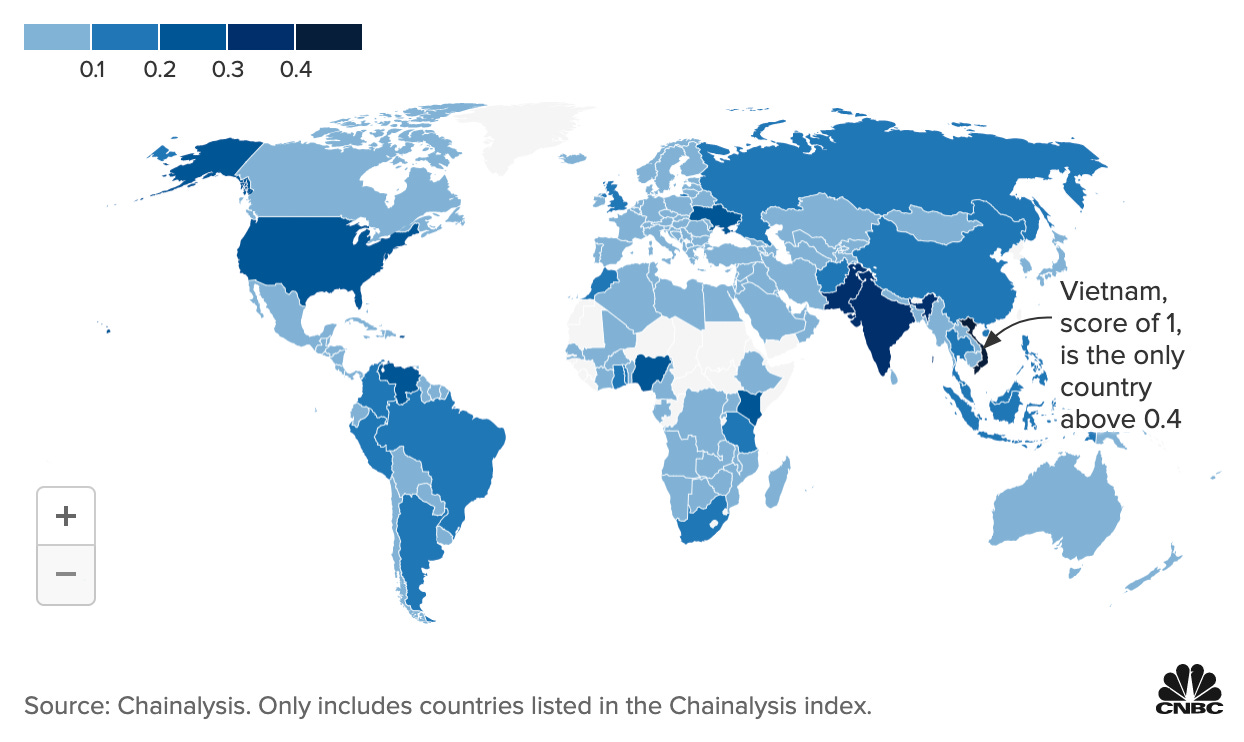

Those of us in developed countries with stable currencies often tend to see cryptocurrency as a plaything of the wealthy rather than as a lifeline for the desperate. Bitcoin users in developing nations with unstable currencies or untrustworthy governments tend to see it differently. Alex Gladstein (CSO of the Human Rights Foundation) has a good essay about this pattern: Check Your Financial Privilege.

We’ve talked before about how Bitcoin is used by ordinary Nigerians to avoid heavy capital controls and a weak local currency. Surveys by cryptocurrency analytics company Chainalysis suggest similar adoption is happening in India, Pakistan, Vietnam and Venezuela.

It is also worth remembering that unbanked does not necessarily mean poor. In Afghanistan women are not allowed bank accounts, so the charity Code to Inspire teaches them to use Bitcoin instead. That hopefully set them up well for the current situation - by all accounts bank services are failing throughout Afghanistan even for those who already have accounts.

In Russia Alexei Navalny’s party has been banned from Russian banks but still takes donations in Bitcoin. Even in in America banks will sometimes excommunicate the undesirable. OnlyFans just gave into pressure from credit card companies and banned sex workers from their platform. Sometimes being unbanked causes poverty but often it is actually the other way around.1

Generous donations to VISA’s digital art collection

The cartoon boulders huddled around the war room in the tweet above are from a set of NFTs known as EtherRocks. EtherRocks are utterly useless - they represent nothing, they do nothing, they are nothing. They vary slightly in color but are drawn with an identical sprite. The only two interesting things interesting about EtherRocks is that they were a very early NFT project (circa 2017) and there are only 100 of them. One sold today for 400 ETH (~$1.3M at the time). The current floor price is now a more modest and reasonable 305 ETH, i.e. just over $1M at time of writing.

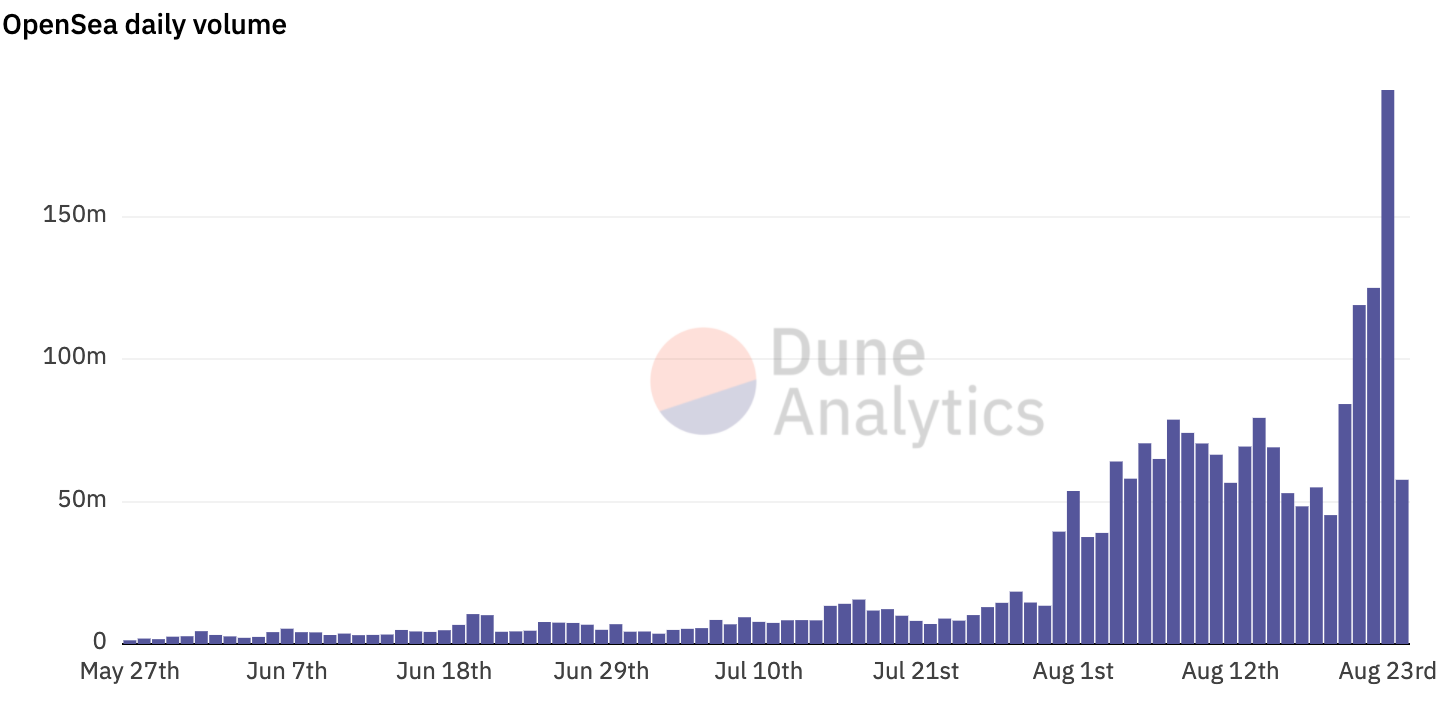

It isn’t just cartoon rocks. OpenSea (the leading NFT marketplace) saw more trading volume in the month of August than in all previous months combined.

It also isn’t just retail investors who are driving this movement. We’ve talked already about the sudden run on CryptoPunks in July led by an anonymous account that later turned out to be investment firm Three Arrows Capital. On Monday morning VISA announced they had acquired a CryptoPunk as part of their collection of "historic commerce artifacts." The floor on CryptoPunks skyrocketed from ~51 ETH (~$168k) to ~73 ETH (~$243k) at time of writing.

Amusingly one of the side effects of how blockchains work is that anyone who knows your address can send you things - ETH obviously, but also ERC-20 tokens or NFTs. There is no way to "refuse" a transaction. So as soon as VISA revealed the address that was holding their new CryptoPunk it was immediately flooded with dozens of timeless works of ageless beauty including this piece, presumably now legally included on VISA’s corporate balance sheet:

How to teach an old DOGE new tricks

Like many of the old school memes the photo behind the DOGE meme was made by its creator into an NFT and sold - in this case it sold to @pleasrdao, an NFT focused art fund for 1696.9 ETH (~$4.3M at the time). The creator also sold several other NFTs from the photoshoot including "Feisty DOGE" for 13 ETH (~$43k at the time).

The Feisty DOGE NFT eventually made its way into the hands of NFT influencer Cryptopathic, who used fractional.art to issue 100B tokens "backed" by ownership of the Feisty DOGE NFT.

As it works out, 100B tokens was the original supply cap for Dogecoin ($0.31/DOGE at time of writing). These shares are backed by the conceptual ownership of an image anyone can download for themselves for free. That’s not much, but it’s more that what backs Dogecoin - which is nothing at all. The existence of a fractionalized DOGE NFT raises existential questions Dogecoin even beyond those it raises for itself.

Investors bought up enough shares of Feisty DOGE to drive the effective valuation to ~$85M, briefly making it the most valuable NFT in existence (beating out Beeple’s $69M Everydays). The price has since settled back to an effective valuation of ~$52M at time of writing. That’s a long way from Dogecoin’s effective market cap of ~$41.4B but then again Feisty DOGE is not the true DOGE meme.

One wonders what would happen to the price of Dogecoin if @pleasrdao decided to fractionalize the original DOGE NFT?

Other things happening right now:

If cryptocurrency ever feels complicated just remember you can always go back to the simplicity of the USD.

It’s a shame Bitcoin didn’t live long enough to see how well Bitcoin is doing today. Bitcoin would have loved that. RIP Bitcoin.

In fairness to VISA it was technically Mastercard that pushed for OnlyFans to turn off porn.