Money is not a team sport

beeple sells his ether, plus how many bitcoin are lost forever?

In this issue:

Money is not a team sport

How many bitcoin have been lost forever? (reader submitted)

Money is not a team sport

We talked last issue about how I don’t think merchant adoption is particularly necessary for Bitcoin to "succeed” as a currency. That’s because I think Bitcoin’s success is more likely to cause merchant adoption than the other way around. Today even the stores that do accept Bitcoin are generally using a service like Bitpay to automatically convert it to their preferred currency. Spending at a store like that is basically just selling your bitcoin but with extra steps.

The distinction here goes back to the different use cases for money. Cryptocurrency holders are using crypto as a store of value (money you save) and most merchants today are using crypto as a medium of exchange (money you spend). Take perhaps the most famous crypto merchant in the world right now - record setting artist beeple who just auctioned a piece at Christies for ~$69.3M worth of ETH. He did exactly what most merchants in his position would do: he immediately sold the ETH for USD.

“Boom, fifty-three million dollars in my account. Like, what the fuck,” he said. The money was in Ether, and its value immediately started fluctuating. Spooked by the volatility, Winkelmann quickly converted it to U.S. dollars. “I’m not remotely a crypto-purist,”

Chaika, Kyle. “How Beeple Crashed the Art World”, New Yorker

So in one sense beeple’s record breaking NFT sale was good for Ethereum - it generated a lot of attention and publicity. But in another sense it was bad, because a large amount of ether moved from someone who valued it highly to someone who didn’t, and so was a natural seller. In the end a lot of ether changed hands but the set of people who valued ether didn’t change at all. Ethereum was a tool beeple was willing to use, not an asset that he valued.

The disappointment among Ethereum holders is understandable but also misplaced. Money is not a team sport. You can’t "sell out" if you were never "bought in" in the first place. For a merchant to have a material impact on the health or future of a currency they need to use it as both a medium of exchange and a store of value.

For example:

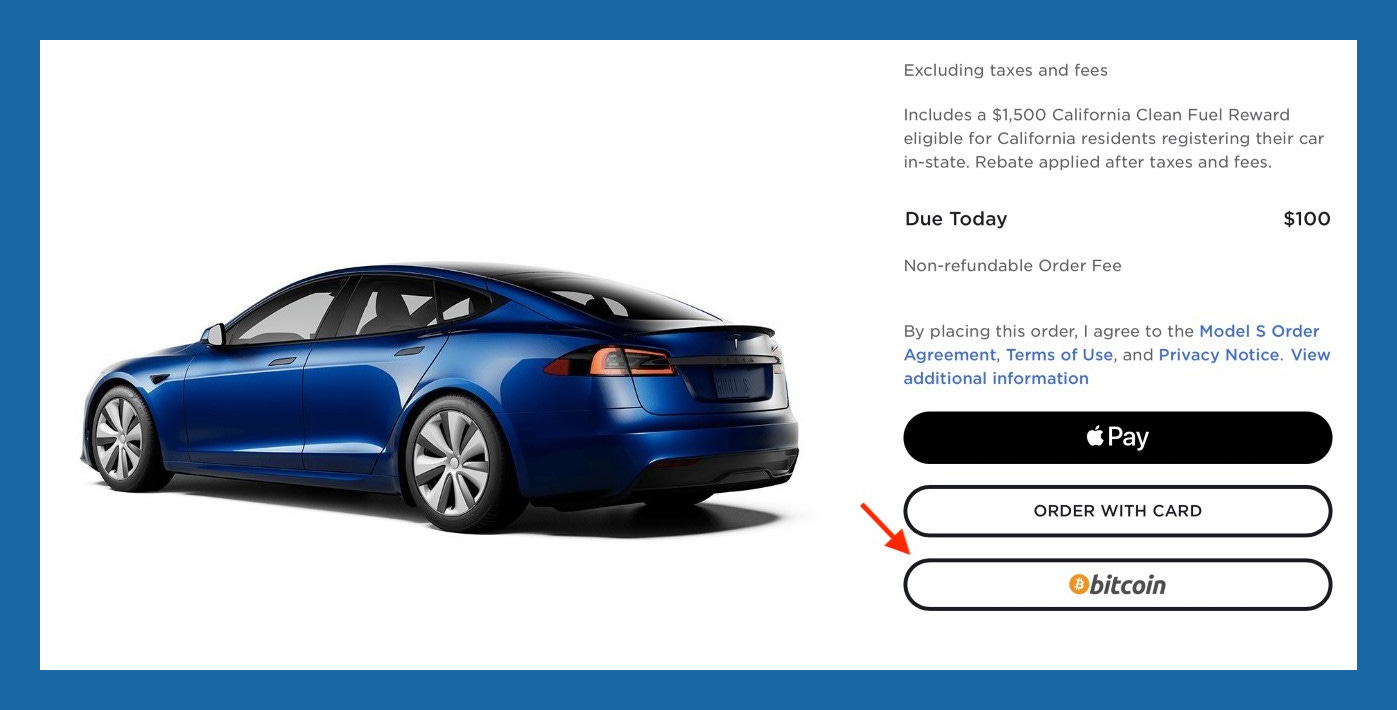

That last sentence is the critical difference - ether used to buy NFTs from beeple were immediately sold and recirculated, adding to the available supply. Bitcoin used to buy vehicles from Tesla will exit the market to be held in Tesla’s treasury, reducing the available supply.

Tesla is adopting Bitcoin, beeple is only using Ethereum.

How many Bitcoin have been lost forever?

"Is there any way to estimate the number of Bitcoin that have been lost for good?" - BB

Not with precision, unfortunately - but we can make some intelligent guesses. The reason it is hard to know for sure is because it isn’t actually possible to lose Bitcoin. They are all still accounted for and will be forever. What is possible is to lose the private key that allows you to control your Bitcoin - kind of like losing the keys to a safety deposit box or the combination to a safe. The coins are still there, they just can’t ever move again. So the 7500 BTC James Howells famously threw away on a hard drive isn’t really lost as far as Bitcoin is concerned. It just isn’t moving.

There isn’t any difference on the blockchain itself between coins that have stopped moving because the owner lost the private key and coins that have stopped moving because the owner has not decided to move them yet. Most of the estimates that I have seen of the number of lost bitcoin are downstream of a Chainalysis report published in 2020 estimating ~23% of all Bitcoin were lost (~3.79M bitcoin).

I don’t think the number they arrived at is unreasonable, but I do think the methodology is pretty weak. Chainalysis basically assumed that all Bitcoin that hadn’t moved in more than five years was lost. That’s weird for two reasons: (1) it assumes no one in Bitcoin saves with longer than a five year time horizon and (2) no one has lost any Bitcoin in the last five years. Both of those assumptions seem weak to me.

There are some things we can know. There are certain Bitcoin addresses known as "burn addresses" where the private key is unknown or may not even exist. Collectively just under 3000 bitcoin have been sent to various burn addresses - likely a very small share of the overall lost coins but the only ones we can know for sure are lost.

We also have pretty good forensic evidence about which early Bitcoin were mined by Satoshi that suggests he was at least at one point in control of ~1.1M bitcoin, a little over 5% of the total supply. We will never know if Satoshi still has access to those coins but I am firmly convinced they will never move again - just as Satoshi knew that his identity as a founder could damage decentralization, I think he would also have forseen the dangers of the founder appearing to lose confidence and cash out. Instead I believe he chose to abandon the Bitcoin associated with the Satoshi persona both for OpSec and to prevent the market being panicked by them moving.

Glassnode has an interesting analysis of long dormant miner coins:

So there are ~1.78M bitcoins that have literally never moved, and since most of them were mined in an era when Bitcoin was worthless it is totally reasonable to suspect that many are lost. But it was only just earlier this year that a batch of 1000 bitcoin worth of decade-old dormant mining rewards woke up and transferred for the very first time. There is just no way to know which addresses are truly lost.

Other things happening right now:

Remember the Taco Bell NFTs we talked about a while back? The collection has been out on the market for long enough for some price discovery to have taken place. None are currently listed for sale but several have offers the owner has not accepted, so we know the owners think they are worth at least 0.56 ether for the cheapest up to at least 2.5 ether for the most expensive. So a digital Taco Bell taco is worth between ~750 and ~3300 physical tacos. Now you know.

We also talked recently about Jack Dorsey selling his first tweet as an NFT. It has now sold for $2.9M to Sina Estavi, the CEO of a Malaysian company focused on providing oracles for Tron. Of the purchase Mr. Estavi said "I think years later people will realize the true value of this tweet, like the Mona Lisa painting." Interestingly the Mona Lisa really only became valuable after it was stolen. Not sure that’s what Mr. Estavi had in mind.

The decentralized platform Uniswap just launched its v3, with a host of interesting new features. Most interesting to me was the decision to restrict open source use of their source code for two years. It is hard to sue anonymous devs - but it would also have a chilling effect on anyone who did have a legal presence from integrating with an unauthorized fork. On the other hand, hard to claim decentralization in one breath and exclusive copyright in the next. It will be interesting to see how this strategy plays out over time.

This downturn has hit the Bitcoin price (-12% from peak) and has been pretty tough on Ethereum (-20.8% from peak) but it has been absolutely brutal on the longer tail of DeFi coins. As we’ve talked about before, I expect several more downturns of this magnitude before the larger bull cycle concludes.