That’s not a real Ponzi it’s just a sparkling scam

Plus Novi is the Venmo of stablecoins and Crypto is a vibe.

In this issue:

That’s not a real Ponzi it’s just a sparkling scam (reader submitted)

You say Novi, I say what? (reader submitted)

Crypto is culture. Crypto is a vibe.

That’s not a real Ponzi it’s just a sparkling scam

“Your footnote about the pyramid scheme reinventing itself in crypto feels like the perfect categorization of HEX and how they explain staking and the interest you earn. Curious if you’ve heard of HEX.” — TS

HEX describes itself as a "Blockchain certificate of deposit" and advertises ~40% APY in a decentralized system as an easy, foolproof way to get rich. I assume this is obvious but just to emphasize: there are no easy, foolproof ways to get rich. Any time someone tries to tell you they have one you should be suspicious, especially if they are asking for your money as part of the recipe.

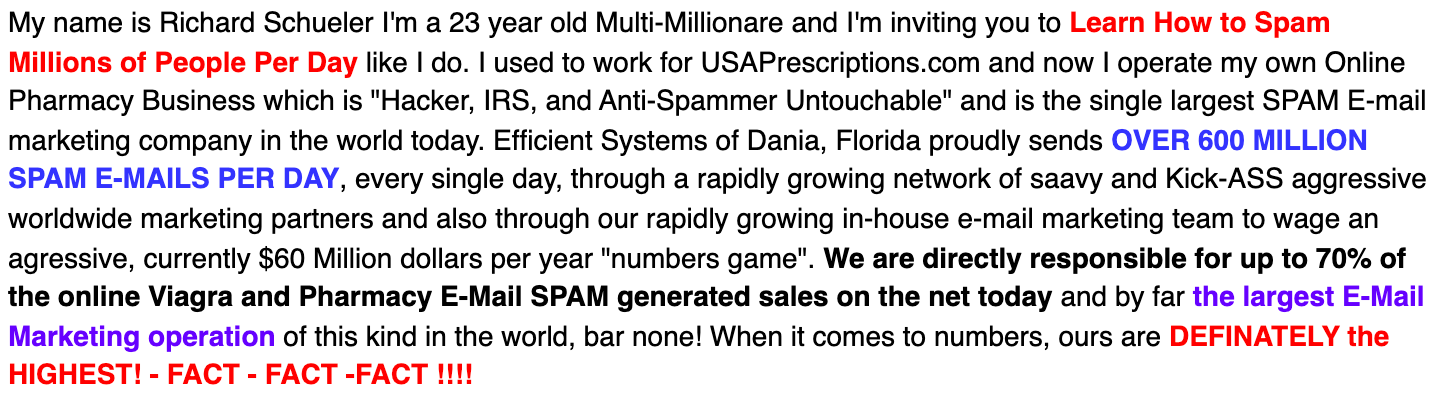

HEX was founded by Richard Heart (formerly Schueler) but HEX was not his first project. In the early 2000s he made millions spamming Viagra emails and then after he was successfully sued for it switched to offering courses teaching others how to master the trade:

Presumably Mr. Heart’s skill and experience are why HEX is so heavily advertised, especially in non-digital mediums like magazines, buses and billboards. For a decentralized project HEX has a very coordinated marketing department.

The way HEX works is you buy HEX tokens which gives you the privilege of "staking” those tokens for interest, with higher interest rates paid to tokens that commit to longer staking periods. I am using scare quotes around "stake" here because "staking" your coins doesn’t actually do anything. The HEX contract doesn’t use them to power or secure the network. It’s basically just a promise you won’t sell.

As far as I know the HEX contract actually works as advertised, in the sense that you really will get more HEX tokens at the end of the staking window. HEX is designed to prey on people’s unit bias — the intuitive assumption that more of something is better. You buy 100 HEX and then later you have 140 HEX so you have made 40% return on your investment! Assuming that your mortgage is in HEX that is. If your everyday expenses are in another currency things are more complicated. You will need to find someone who wants to buy your HEX from you with the money you actually need.

Because the HEX network isn’t doing anything of economic value it is hard to make the argument that it should be worth more just because new tokens were created. HEX holders have more HEX but each individual HEX token is a smaller share of the same network. It is like slicing the same pizza into smaller and smaller slices. The only thing supporting the price of HEX is the influx of new buyers attracted by the relentless marketing.

At the moment ~90.3% of HEX tokens are unstaked which is weird considering that anyone who holds unstaked HEX is being diluted by anyone who stakes. It makes a bit more sense when you learn Mr. Heart owns ~88% of all HEX tokens in existence. If he staked those coins he would get a large HEX payout but it would make the average payout for HEX stakers much lower. Forgoing that payment keeps the interest rate high and attracts new buyers. Mr. Heart doesn’t want more HEX — he wants more people he can sell HEX to.

So HEX is basically a Ponzi scheme but with extra steps — but that’s not really why it is so reviled. The main objection to HEX is that it is embarrassing. The ads are loud and unsubtle. The founder incentives are shameless. The referral program makes HEX investors unbearable. Richard Heart looks like this:

If you like the idea of astronomically high interest rates in a free-floating tokenomics system whose price is supported by investor lockups, the socially acceptable, high-class version of that is OlympusDAO (OHM). If you’ve seen anyone with (3, 3) in their Twitter name that is a reference to the idea that everyone should buy OHM and stake it for an interest payable in OHM — it’s the same story that powers HEX. As long as none of us sell, we’ll all be rich!

I’m being a tiny bit unfair, I suppose. OlympusDAO is more technically complex and allows investors greater flexibility to exit their position. It also puts staked capital to work offering liquidity in DeFi markets, so there actually is a revenue stream other than just new OHM buyers — although OHM tokens don’t actually represent a claim of any kind on that revenue stream. OHM is valuable because it is a way to earn more OHM which is in turn valuable because it is a way to earn more OHM.

HEX is for people who are attracted to pictures of yachts and Richard Heart’s expensive watches. OHM is for people who are attracted to complicated game theory and obtuse crypto memes. Marketing aesthetic aside they don’t actually differ from each other very much.

The pyramid scheme just keeps reinventing itself.

You say Novi, I say what?

“Hey KF — I’m hoping you will save me from hard thinking and write about Novi in an upcoming newsletter. Is it good? How does it compare/relate to ETH or BTC?” — TM

In May of 2019 Facebook (now Meta but at the time still Facebook) announced a plan to release a currency of their own, Libra (now Diem but at the time still Libra). Facebook also announced a wallet for users to manage their Libra, at the time called Calibra but now called Novi. Facebook is very into rebranding these days. Make of that what you will.

Libra was supposed to be a free-floating token backed by a basket of international fiat currencies similar to the bancor, the hypothetical international reserve currency proposed by John Maynard Keynes. The thing is that managing a free-floating currency with a reserve of currencies from other nations is basically the job description of a central bank — so what Facebook was really proposing was releasing their own sovereign currency.

That turned out to be unpopular.

Nation states (particularly the US) firmly explained to Facebook that, no, they would not be issuing a sovereign currency. In response Facebook scaled back their plans and rebranded. Libra became Diem and pivoted from a free-floating currency backed by a basket of international assets to a stablecoin backed by and pegged to USD. Theoretically, anyway, because Diem doesn’t actually exist yet. Novi actually does exist but it uses a third-party stablecoin called PAX (USDP).

The standalone Novi app is available as a limited trial in Guatemala and the United States and Facebook is promising an upcoming payment integration with Facebook owned messaging platform WhatsApp — but the ambition of the original project has been hollowed out. The executives associated with crypto at Facebook are leaving. I’m guessing Novi will stagger forward zombie-like for a few more years until it is eventually quietly cancelled. I’m not sure anyone will notice.

Other things happening right now:

I’m not generally fond of fortune-cookie VC Twitter but I have to admit this is an excellent framing:

Presented without comment:

HEX seems more like a Pyramid scheme rather than Ponzi. Profits (from HEX sales) go to Mr. Heart mostly, stakers get nothing unless they exit.