The unsettling campaign to rehabilitate SBF

Sam Bankman Fried wants you to know this was all just a big misunderstanding.

The third and final post in a series on the rise, fall and fallout of Sam Bankman-Fried and his cryptocurrency empire. The first post described what happened. The second post discussed the causes and consequences. This post will talk about the conclusions we should draw.

The unsettling campaign to rehabilitate SBF

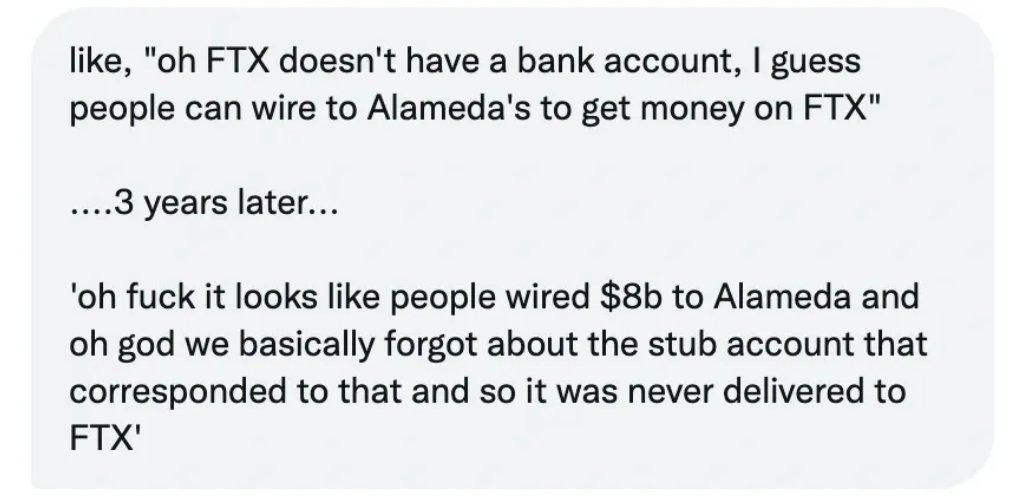

Ousted CEO of collapsed cryptocurrency exchange FTX and bronze-tier League of Legends player Sam Bankman Fried would very much like for you to think this was all a big misunderstanding. A clerical error! In technical terms, a whoopsiedoodle. Could have happened to anyone, really. You get it. In his words:

The main crime that SBF crimed is probably wire fraud, which is (loosely speaking) using electronic or physical mail as part of an enterprise that is knowingly deceitful or illegal.1 In this case he told FTX customers their assets were safe when he was actually sending them to Alameda to gamble with. That’s why he is so invested in the idea that this was all a big mistake: you can’t usually do wire fraud by accident.2

Considering the astonishing string of puff pieces that the media has produced in the aftermath of FTX it seems pretty likely to me that SBF has employed a crisis communication firm — and clearly a good one. WSJ wrote an article about how FTX failed because SBF’s supporters 'lost confidence' in him. The NYTimes wrote a profile that featured details about how SBF was sleeping well and playing video games but did not include any of the following words: fraud, crime, illiquid, stolen, criminal, backdoor. Dealbook wrote a profile about his philanthropic efforts without any mention of how that money had been stolen. Forbes wrote an article about Alameda CEO Caroline Ellison that called her "bright, focused and very mathy" and talked about her love of Harry Potter and her work as a camp counselor.

This isn’t a coincidence. In addition to making widespread political donations with his stolen funds SBF (he now says he was donating equally to both parties, just choosing not to publicize his Republican donations) was also generous to journalism non-profits like ProPublica and an investor in publications like Forbes and Semafor. SBF knew he was one day going to need a lot of favors from the media and he bought those favors in advance — with stolen funds.

Bernie Madoff and the various Enron executives were in cuffs days after their malfeasance was uncovered. At least Do Kwon and Zhu Su had the decency to flee into hiding! Sam Bankman-Fried spent Thanksgiving with his parents in the Bahamas in their $121M luxury beachfront property, paid for by FTX. Instead of appearing in court he is doing interviews with the NYTimes and George Stephanopoulos.

We’re all looking for the guy who did this

Another narrative that SBF is pushing is the idea that the ultimate responsibility for the FTX collapse lies with someone else. At times the villains in SBF’s story are various bankruptcy authorities who prevented him from rescuing the company in some mysterious undisclosed way. According to SBF they refused "out of shame" but I’m guessing what he really means is that the secret strategy to save the company was basically just "more fraud." You can either take the word of a serial liar scrambling to escape accountability or you can put your trust in some unnamed bankruptcy lawyer in the Bahamas. Choose your fighter.

Another villain that SBF likes to darkly hint at is CZ of Binance, who very publicly declared his loss of confidence in FTX and intention to sell FTT at a crucial moment at the beginning of this saga. If you are curious you can read more of the saga of bad blood between CZ and SBF — there is no doubt that CZ is a merciless competitor but blaming Binance for the failure of FTX is like shitting your pants and then blaming it on the first person to ask why it smells.

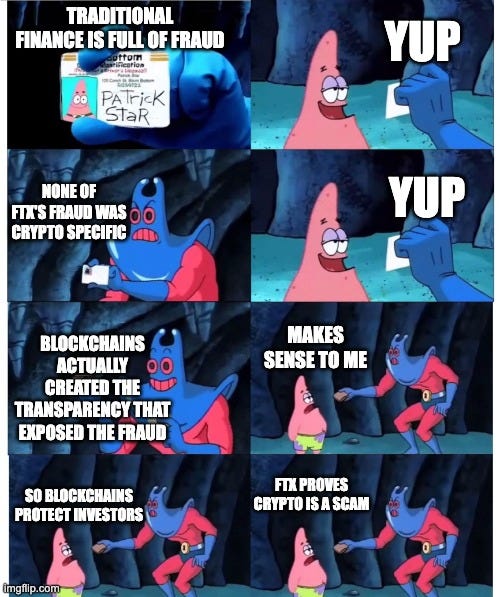

The villain of choice for politicians and the media is (somewhat unsurprisingly) crypto itself, which makes very little sense. To the extent this story is about crypto at all it is about how the natural transparency of the crypto economy made the FTX/Alameda ponzi easier to detect and to investigate after the fact. This money wasn’t lost in a hack or a smart contract bug or an esoteric market meltdown. It was just stolen in ways that were already very illegal.

The reason the FTX/Alameda ponzi grew as large as it did is not because crypto is naturally shady but because the SEC and other regulators effectively blocked less shady companies from participating at all. If we need a supplemental antagonist to round out the SBF story arc I think the obvious candidate is SEC Chair Gary Gensler who claims that the collapse of FTX validates his skepticism when in reality he created the void that FTX emerged to fill and was also working behind the scenes to provide regulatory loopholes for FTX. Gensler allowed one of the largest frauds in financial history to happen right in front of him because he was too busy prosecuting Kardashians and sneaking bad faith precedent into minor court cases.

Regulators will not save us. The problems of crypto are not caused by the presence of criminals but by the absence of grown ups. The main difference between FTX and the traditional banking economy isn’t that they were dishonest it is that they were sloppy. Those with a vested interest in the existing system are eager to take victory laps about how this proves crypto was doomed all along. Don’t believe them. Madoff was able to run his ponzi for decades, FTX fell apart in only a few years. This isn’t a story about the failure of crypto. It is a story about how regulators failed to protect investors and how crypto gave them the tools and transparency to protect themselves.

The third and final post in a series on the rise, fall and fallout of Sam Bankman-Fried and his cryptocurrency empire. The first post described what happened. The second post discussed the causes and consequences. Hopefully this will be the last post about FTX, at least for a while.

More or less. I am not a lawyer, this is not legal advice, don’t do crimes, etc etc.

I AM NOT A LAWYER.