How to go bankrupt with risk-free investing

How British pensions got pounded and what it means for the world economy.

Inside this issue:

How to go bankrupt with risk-free investing (reader submitted)

The SEC ends the Kardashian menace

NFTs aren’t dead yet, I promise

TornadoCash on the other hand … 😬

How to go bankrupt with risk-free investing

"It seems like folks think there are scary things lurking in deep economic waters these days, but I haven't been able to keep up with the signs or theories of what they are. British pension margin calls, seemingly crazy eu energy policy, bond markets are doing weird things, I hear Credit Suisse is maybe bankrupt.... hard to follow it all. Maybe you could do a macro post, Knifefight?" — TM

It is wild times in the macro environment right now — I will do my best!

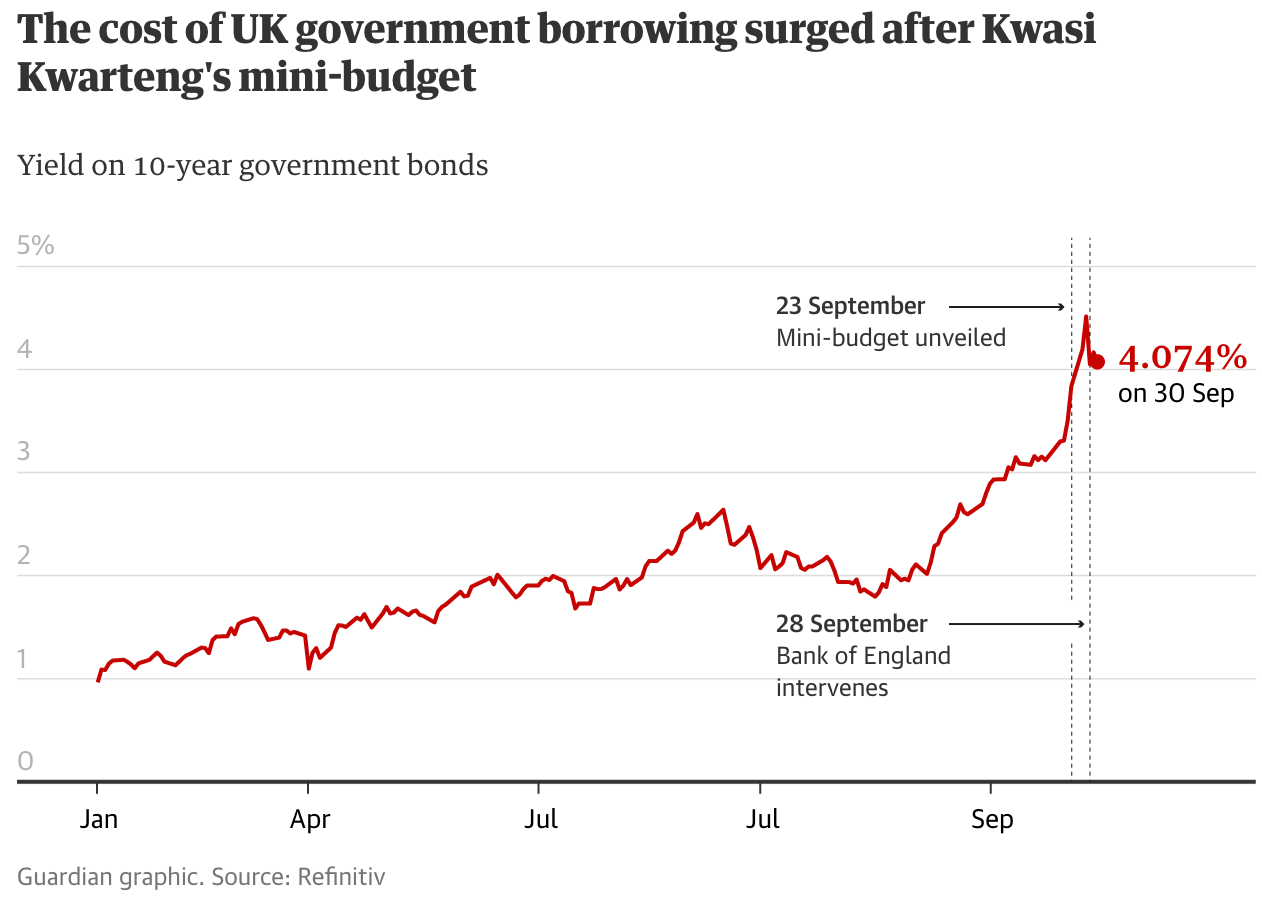

On September 23rd UK Chancellor of the Exchequer Kwasi Kwarteng announced a 'mini budget' which centered around increasing deficit spending to fund the largest tax cuts in 50 years, mainly for corporations and the very wealthy. The proposal to increase borrowing with inflation at ~10% and the post-Brexit economy already entering a recession was greeted with almost universal contempt — not only did the market recoil at the prospect of more borrowing they seemed to discount the overall competence of the administration for even having suggested it.

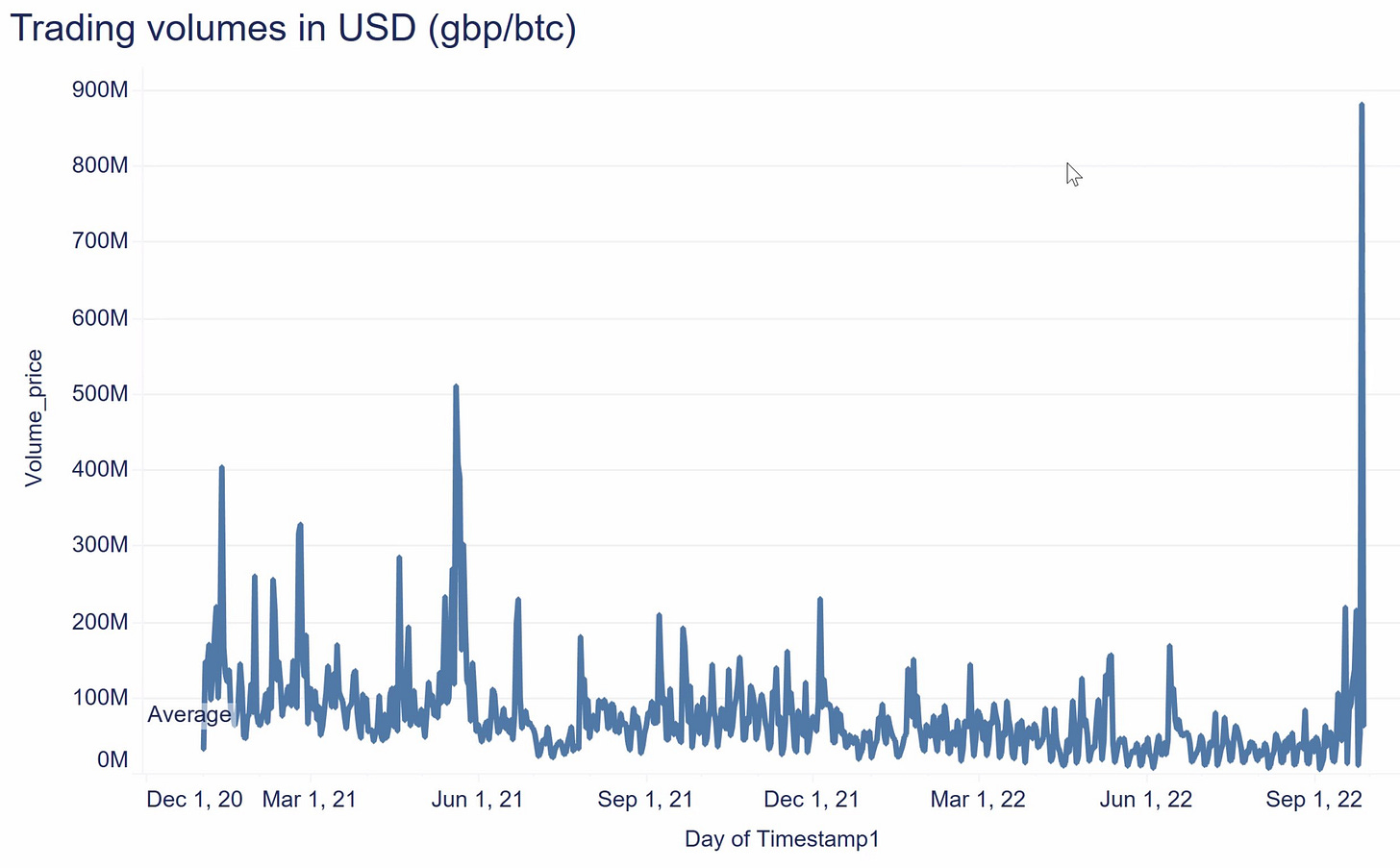

Several things happened at once in response. The borrowing costs for the British government (i.e. the interest/yield on UK bonds) spiked from ~3.5% to ~4.3% since the market knew more borrowing was coming. Simultaneously the value of the British pound dropped ~9% from ~$1.13/GBP to a record low of $1.03/GBP. If the British government was committed to greater deficit spending traders wanted to hold fewer GBP and wanted to be paid more for holding GBP denominated debt. Some of them also sold their GBP for Bitcoin:

This was a big problem for pension funds in Britain because functionally British pension funds are all leverage-long UK bonds.1 Government bonds were seen as so risk-free that pension funds felt free to load up on leverage risk. When the value of UK bonds dropped they all had to scramble to post more collateral or be liquidated. Unfortunately the main tool they had to raise money quickly was selling some of their existing liquid assets — which are mostly UK bonds. The sudden collapse in the value of UK government debt was essentially triggering a margin cascade.

One important aspect of sovereign bond markets is that there is a very limited supply of buyers who operate at that scale. One reason that the value of the UK bonds was dropping was the market placing a lower value on UK bonds — but another larger reason was that with every UK pension fund forced to sell at the same time the market had simply run out of buyers. The Bank of England was forced to step in and announce that it would act as the buyer of last resort for British government debt, pushing down yields and preventing the collapse of the pension funds.

The Bank of England’s intervention does seem to have calmed the worst of the crisis for now — the pound is back to ~$1.13/GBP and the 30 year UK rate is at ~3.8%. But only days ago they BoE was planning to start selling bonds and tightening monetary conditions — it seems likely that is off the table for now, in spite of significant inflation and a looming energy crisis. The credibility of any future plans to tighten monetary policy will be weaker now that the market has seen them blink.

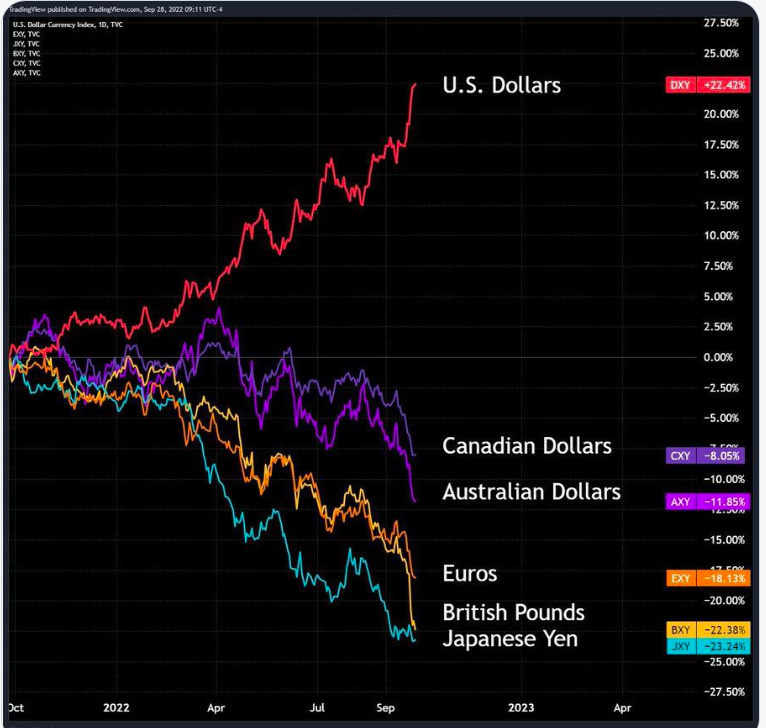

The gyrations in the UK bond market were attention grabbing but I personally think the main story is still the strengthening dollar stretching every other market to the breaking point. The dysfunction in UK pension funds is just one particular symptom of the broader story dominating every single market.

The challenge for the UK is that they are a major importer of energy and energy is mostly priced in US dollars. To raise the dollars they will need the UK will either need to reduce their energy use (unlikely), take on more debt (just rejected by the market) or print more money and further devalue the pound.

For some insight into where all this could lead it is interesting to compare the UK’s situation to that of Japan, where the Bank of Japan has been buying government debt to control domestic interest rates since 2016. Most of the world’s bond markets have followed the market for US Treasuries, but the Bank of Japan has successfully kept the interest rates for Japanese government debt at near zero, though at the cost of the Japanese yen falling almost 30% this year alone.

Likely the yen would have fallen farther if the Japanese government was not the world’s largest holder of US Treasuries (~$1.17T worth) and hence well armed to defend the value of the yen. But the problem is that selling US Treasuries lowers their price and raises their yield — and strong yield on US debt makes controlling the domestic yield curve even more difficult and expensive.

It’s not clear exactly how long Japan and Britain can stay afloat against a rising dollar but it is clear that it can’t be sustained forever. At some point the Fed is going to face a choice between standing down in the fight against inflation or trashing one or more allies’ economies in the cross-fire. The Fed would like to keep going until domestic labor markets cool off — but other things may break down first.

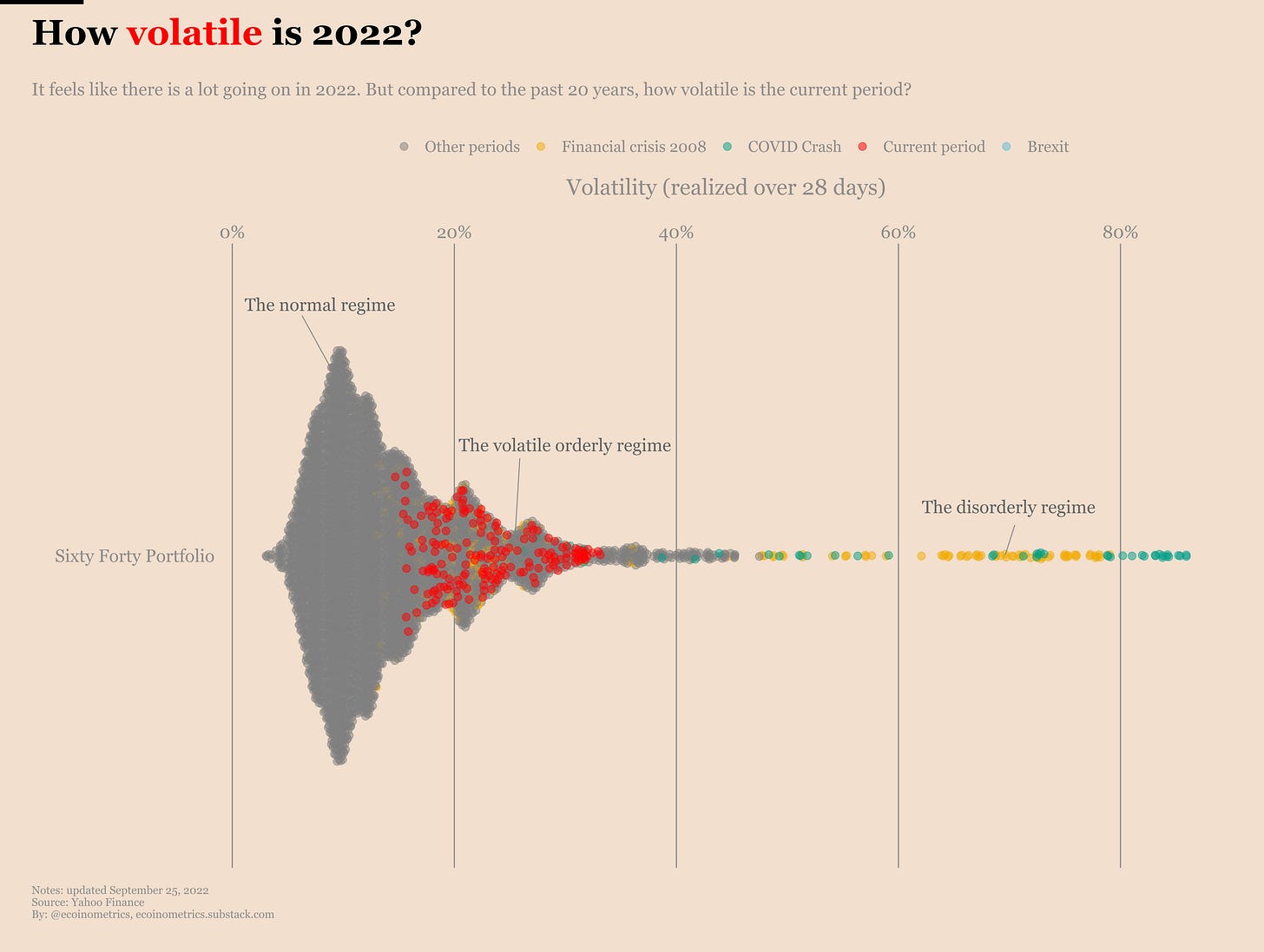

So how messy are the markets in 2022? Ecoinometrics did an interesting analysis comparing the current and typical volatility of a wide range of markets and the simple summary is that today’s markets (red dots) are straining but nothing has broken down yet — at least not the way things did in 2008 (yellow dots) or 2020 (green dots).

Other things happening right now:

A Bloomberg headline about how NFT trading volume was down ~97% got a lot of traction this week, but I wouldn’t count NFTs out just yet. The Bloomberg dashboard doesn’t filter out any of the platform-incentivized wash-trading and it doesn’t account for Solana NFTs. More realistic estimates of NFT activity show that it is down substantially but not drastically more so than comparable markets like overall DEX volume. I think what we’re seeing here says a lot more about the macro conditions affecting every market than about NFTs specifically. Major NFTs are still selling at eye-popping prices. I don’t know why people are so eager to prematurely celebrate the death of crypto phenomena.

SEC Chair Gary Gensler gleefully announced a ~$1.26M fine against Kim Kardashian for her role in promoting an unregistered security in June of 2021 (we mentioned it briefly at the time). Kardashian also agreed not to promote any crypto assets for at least next three years. Do Kwon is tweeting from a yacht somewhere and Richard Hart is still buying Instagram ads for the HEX scam, but at least the SEC has finally shut down the scourge of … (checks notes) … EthereumMax. Go off, king. 👑

Nature.com has released a new report comparing the environmental impact of Bitcoin to that of beef or crude oil. I’ve done a lot of environmental posts recently so I’m going to skip this one but if you’re interested in a teardown of the specifics this is a good one. The "pollution per coin" metric they introduce is just as perverse as the "pollution per transaction" metric I’ve complained about in the past — among other things measuring impact that way would imply that Bitcoin’s environmental impact is rapidly and permanently approaching zero as the last coins are mined. That’s obviously silly.

Gavin Newsom vetoed a cryptocurrency law modeled after New York’s Bitlicense that passed the California Assembly 71-0. Newsom cited incoming federal regulation and support for the crypto innovation that is native to the state — but an important subtext is that any new regulatory body would be expensive and distract from Newsom’s other budget priorities. My guess is the main thing he opposed about the bill was having to pay for it.

This is not crypto related and Something Interesting is not a legal blog but this amicus brief filed by The Onion in defense of the right to parody is a work of beauty worth stepping off the beaten path to read.

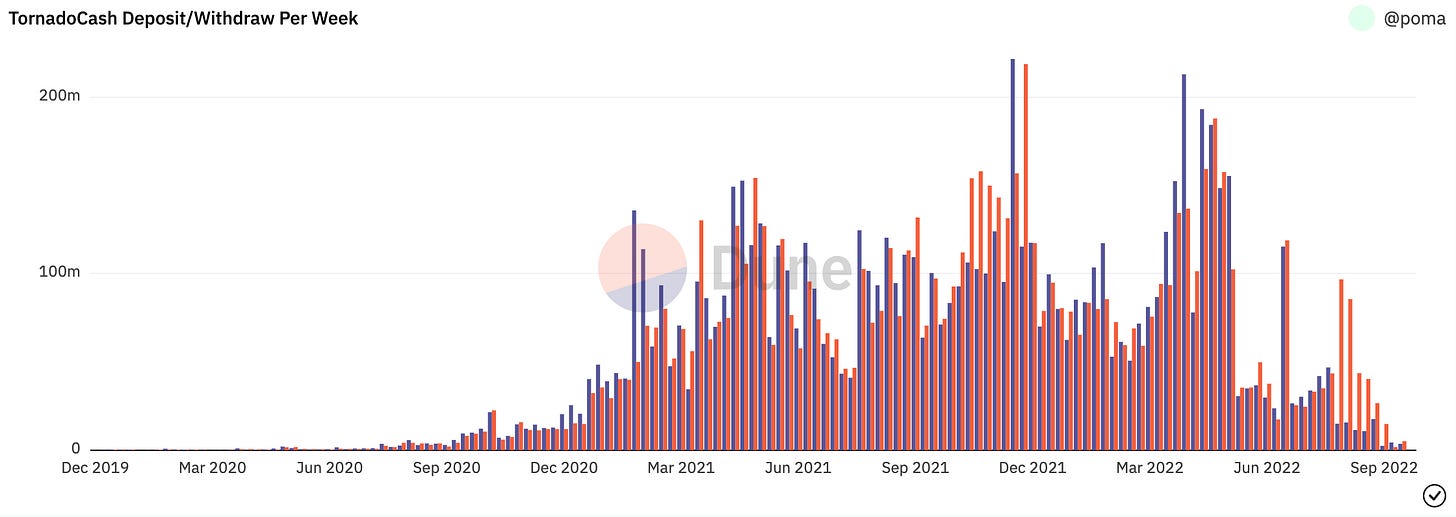

A lot of ink and tears were spilled over who would censor (or be forced to censor) TornadoCash transactions in the wake of the OFAC sanctions and Ethereum’s transition to proof of stake — but in the end it didn’t matter. The sanctions scared off the vast majority of users making the anonymity set too small to offer meaningful privacy to anyone else. The government killed Tornado Cash and all it took was a blog post.

If you are interested in the details of how this worked, Matt Levine had a good explainer.