The bull case for Bitcoin in 2024

Why Bitcoin ETFs are probably close and what it might mean for Bitcoin

Inside this issue:

How to make numbers go up

Turkey’s central bank chief moves in with her parents

The BONK on your SAGA pays for itself

How to make numbers go up

An exchange traded fund (or ETF) is — quite literally — a fund whose shares can be traded on exchanges. ETFs act as a kind of 'equity wrapper' that allows an asset (or collection of assets) to trade in the same markets and with the same infrastructure as traditional equity. GLD 0.00%↑ for example is an ETF that allows investors to add gold exposure into their portfolio without needing to manage the receipt, custody or delivery of actual physical gold. Very convenient!

You can imagine how a Bitcoin ETF could serve a very similar purpose, letting investors take positions on Bitcoin without needing to learn how to secure and manage private keys. The first time a Bitcoin ETF was mentioned on Something Interesting was in December of 2020 in the very first issue — but the idea had been around for years even before that. The first Bitcoin ETF proposal was submitted by the Winklevoss twins to the SEC in 2013. The price of Bitcoin at the time was $68.

Since then the SEC has successfully defended American investors from convenient access to ~632x returns by delaying and ultimately denying every subsequent Bitcoin ETF application. Investors have had to make do with substitute goods like Grayscale’s Bitcoin Investment Trust ($GBTC) which charges higher fees than an ETF and does not track the underlying asset as closely or Microstrategy (MSTR 0.00%↑) which in theory at least is a commercial software company but has slowly become a vessel for owning Bitcoin on behalf of its shareholders.1

The SEC has been rejecting Bitcoin ETF applications for basically a decade now but there are reasons to think things might play out differently now. Past rejections have cited concerns about market manipulation because of the large roles of international exchange Binance and stablecoin Tether, but Binance has since settled with regulators and agreed to supervision and Tether just announced a partnership with the Secret Service and the FBI. The two largest boogeymen of the Bitcoin market have both now clearly bent the knee.

In June, Blackrock investments and the Nasdaq jointly applied to the SEC for approval to create and list the iShares Bitcoin Trust. That was notable not just because Blackrock is the world’s largest investment manager, but also because Blackrock has filed 576 ETF applications with the SEC and has only been rejected once. If Blackrock thinks it is worth filing the application, it is probably because they think it will be approved. In the wake of Blackrock’s application a flurry of other financial companies moved to file (or re-file) ETF applications, including Fidelity, VanEck, WisdomTree, Valkyrie, Bitwise and others.

Assuming the SEC intends to finally approve a Bitcoin ETF, they will probably want to approve multiple funds at the same time to ensure a competitive market and avoid the perception of playing favorites. If so, that would suggest approvals may happen in mid-January (when the deadlines for next response on many applications line up) or mid-March (when the final deadlines for many applications line up).

When the first gold ETF (GLD 0.00%↑) was launched in 2003 the gold market went on an ~8 year bull run peaking at around ~5x in price. It turned out there were a lot of investors who wanted exposure to gold but didn’t actually want to handle gold. It’s not unreasonable to wonder if a Bitcoin ETF might have the same effect — unlocking a wave of new demand for bitcoin by giving access to investors who didn’t actually want the responsibility of handling bitcoin directly.

Anyone who wanted to buy bitcoin but was worried about hackers or seed phrases or taxes or sketchy exchanges would have an easy route past those barriers. Perhaps even more importantly, institutional investors often operate with strict guidelines about the investments they are allowed to consider — so it is much easier for them to buy shares in a new Blackrock ETF than to invest in novel digital assets. Bitcoin ETFs let investors get exposure to bitcoin without needing to run a node or learn how to use a hardware wallet. By lowering the barrier to entry, ETFs would create new demand.

Bitcoin ETFs will also create demand in the traditional way, by advertising:

Any new demand that does emerge will end up chasing a dwindling supply of bitcoin. In the years following the launch of GLD 0.00%↑ the production of gold rose by ~15% as gold mining became more profitable — compare that to the rate of bitcoin mining, which (regardless of price) will fall by ~50% in the next halving in ~April 2024. Existing bitcoin is getting harder to acquire, too — the percentage of existing bitcoin that has been held for at least a year is at an all time high (~71%).

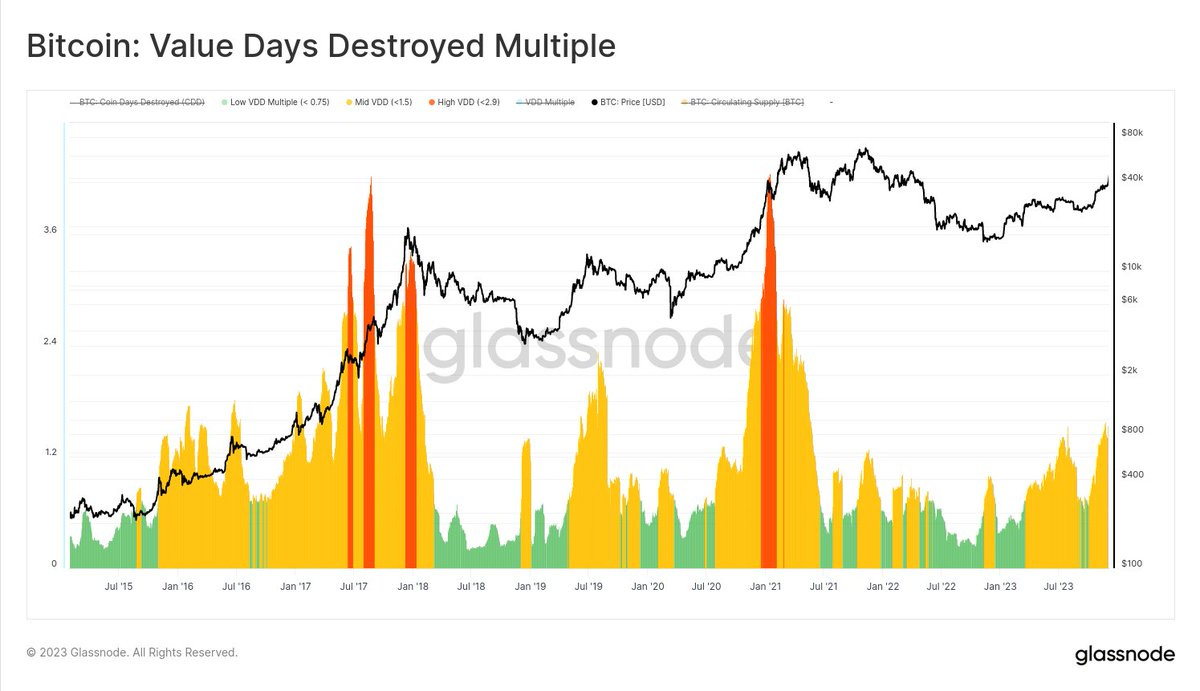

You can see the same pattern in another way by watching the movement of old coins. When the market is peaking many old coins wake up and are moved to exchanges, causing a spike in the "days destroyed" metric that tracks the age of moving coins. Old coins haven’t started moving yet this cycle:

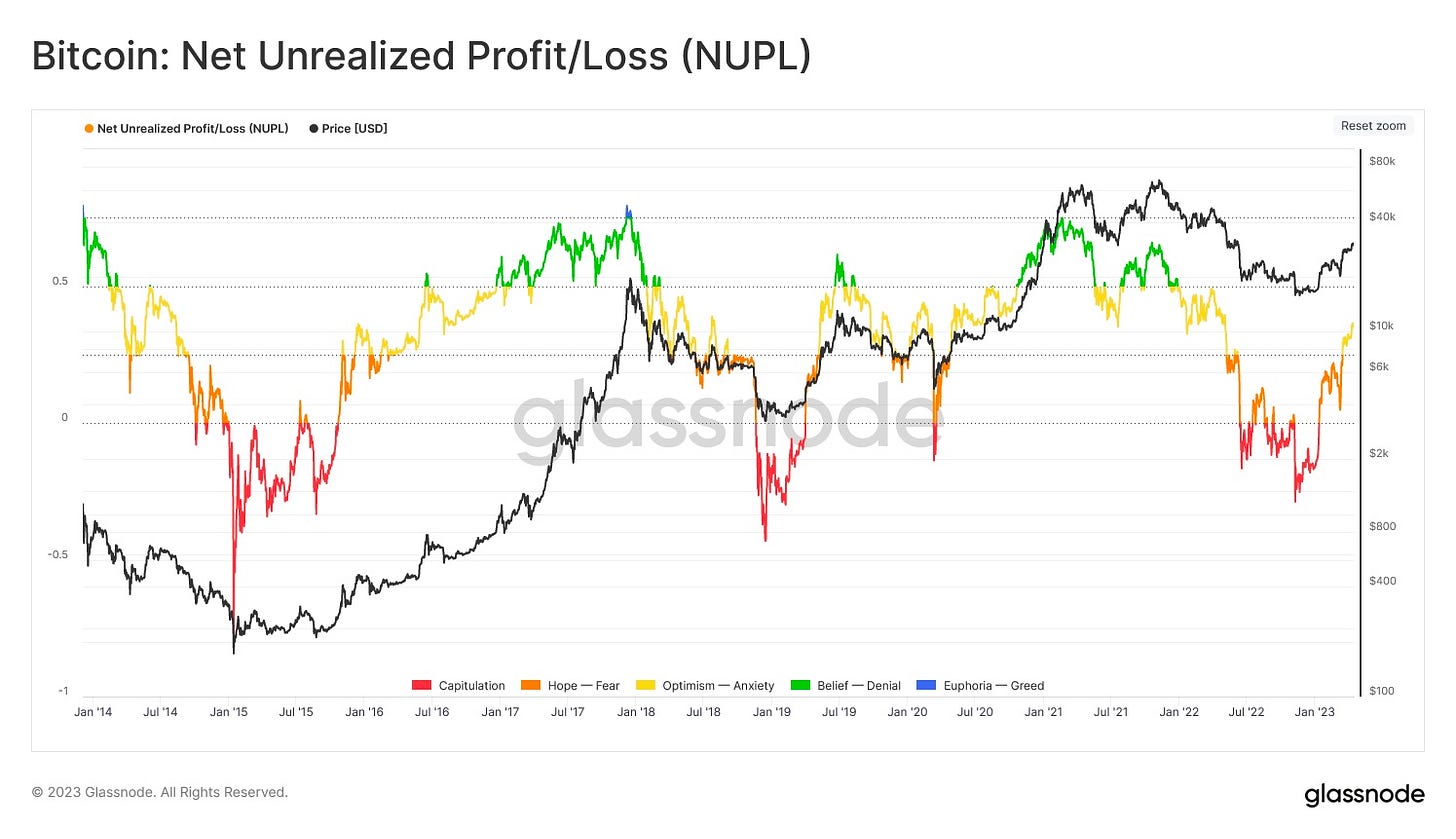

People tend to form their impression of the Bitcoin market by comparing the current price to the all time high, but the reality is that very few people actually bought their coins at that price and many of them already sold and left the market. Today the average Bitcoin investor is holding a ~30% unrealized profit.

The corporate world is carefully pivoting to accomodate a future where Bitcoin is a more mainstream investment. Google quietly updated its advertising policy to allow for cryptocurrency trusts starting in January. The Financial Accounting Standards Board (FASB) released new formal accounting guidelines to allow fair value accounting for crypto assets. Auditing firm KPMG released a report about the merits of Bitcoin for ESG investing. Segments on CNBC are comparing the supply of Bitcoin to the supply of gold. Gary Gensler doesn’t want to talk about it.

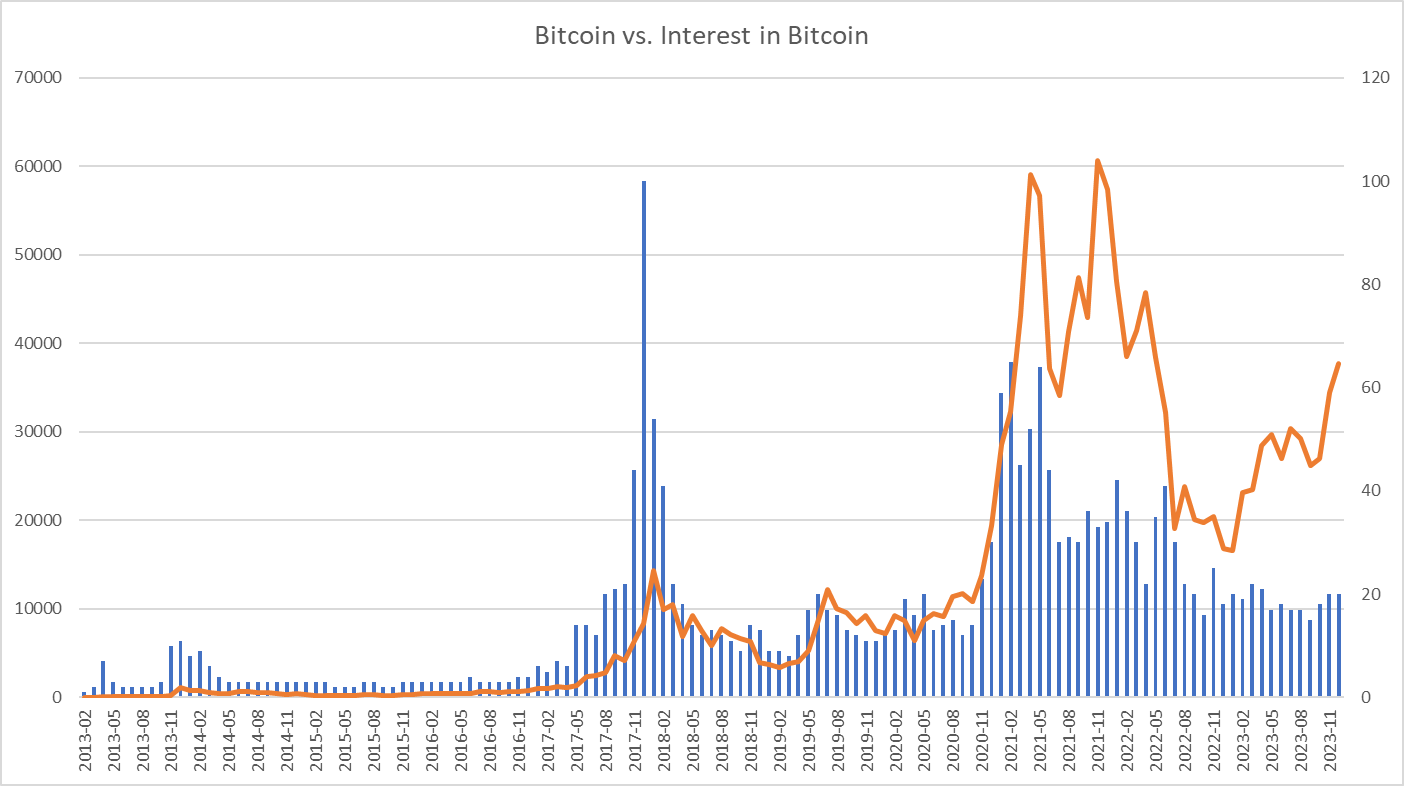

Most of the world learned about Bitcoin for the first time in 2021 and they are probably under the impression that bitcoin died in 2022. The price over the last year has risen ~2.7x but public interest remains flat. A lot of people are going to be surprised by what happens next.

Other things happening right now:

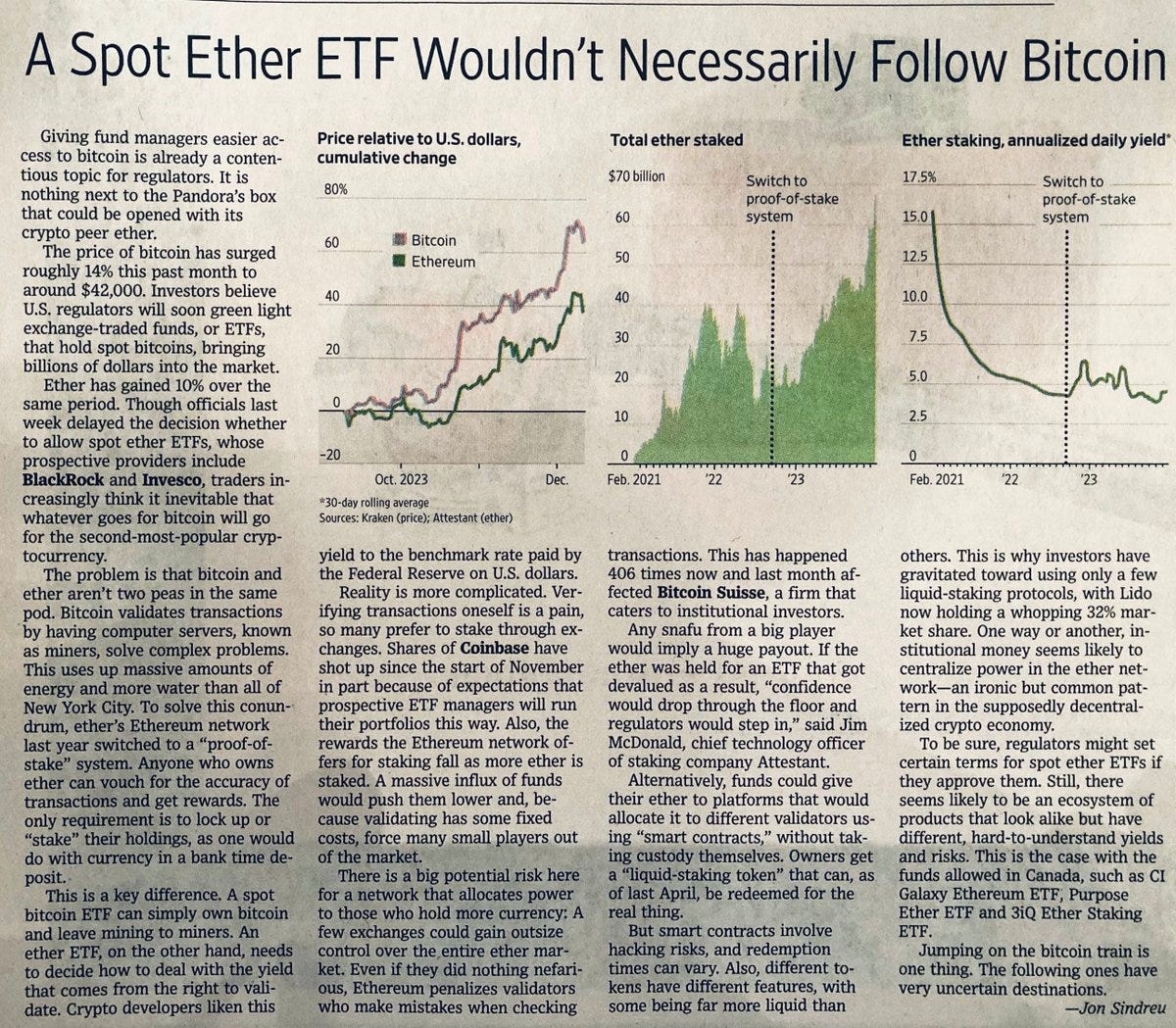

Sorry, ETH fans! The switch to proof-of-stake and the existence of ETH yield raises difficult unresolved questions about how an ETH ETF would actually work. It’s not clear that an ETH ETF naturally follows from a Bitcoin ETF approval.

The head of Turkey’s central bank Hafize Gaye Erkan has been priced out of Istanbul’s rapidly inflating property market and has been forced to move back in with her parents. These are the people managing the economy.

The Solana focused Saga mobile phone comes preloaded with 30M of a memecoin named BONK which is ~$634 worth of BONK at time of writing, more than the original $599 price of the phone itself. The Saga quickly sold out and is now trading on secondary markets for thousands of dollars, presumably because BONK investors are bad at math.

There is also a Bitcoin Futures ETF which was approved in October 2021, but as we talked about at the time a Bitcoin Futures ETF is a poor substitute for a spot market ETF:

If your main goal is to track the price of Bitcoin the best thing to do is to own Bitcoin. The next best thing is an ETF that owns Bitcoin for you. A futures ETF like ProShares is strictly worse. Unlike holding a stack of bitcoin, maintaining a futures position requires finding counterparties to trade with on a regular basis. Those counterparties will need to be compensated (so futures ETFs are more expensive) and they may not always be there when you need them (so futures ETFs are more volatile).

There is an actual spot Bitcoin ETF in Canada! So that’s nice for Canadian readers. 🙂

Awesome