Polite hackers & expensive socks

Plus Tom Brady gets laser-eyes but Bitcoin is still boring apparently

In this issue:

Crypto investors need their fix

Okay but can you wear them with sandals?

The DarkSide hackers are very sorry

Crypto investors need their fix

Since crossing the $1 trillion market cap back in February Bitcoin has been consolidating between ~$50k-$60k/BTC. There are healthy long term indicators (miners are accumulating, institutions are accumulating, realized market cap is at an all time high, etc) but price has stalled for now. Capital in the crypto markets is often impatient and three months of consolidation can feel like an eternity. Some of the money in Bitcoin is starting to migrate elsewhere in search of gains, fueling all time highs in Ethereum, Dogecoin and other more regrettable exotera.

One way you can see this pattern happening is by watching the movement of Bitcoin across major exchanges. The majority of Coinbase’s demand comes from US institutions and the supply of bitcoin available on Coinbase is still steadily dropping. Binance on the other hand specializes in offering retail investors access to hundreds of long-tail tokens - and their users have been depositing bitcoin even faster than Coinbase users have been withdrawing:

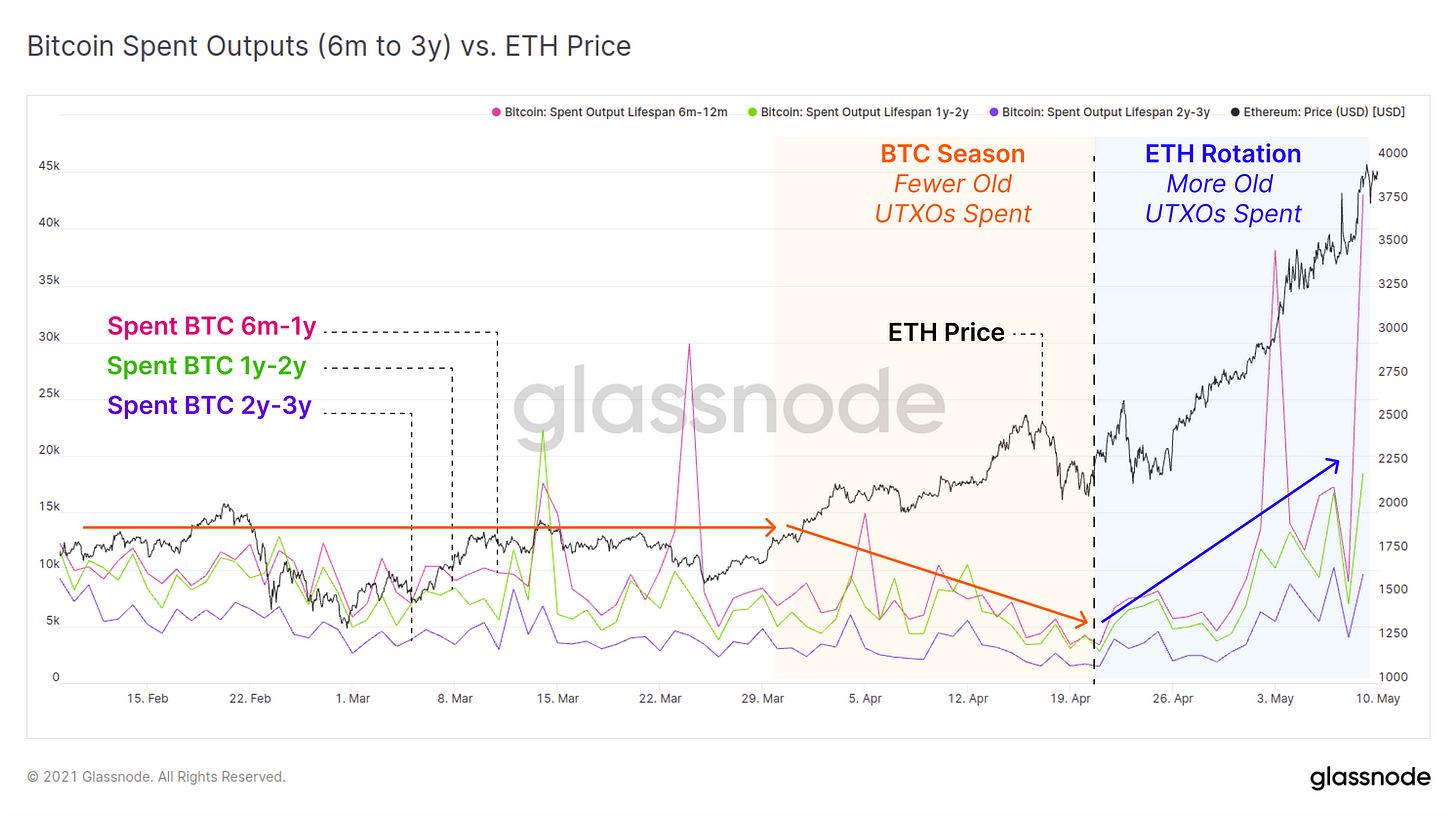

So institutions are entirely content to patiently keep accumulating bitcoin at these prices, but (at least a portion of) the retail investor base are taking their chips and moving to another table at the crypto casino where the action seems hotter. One likely beneficiary has been ETH. It is difficult to say whether capital leaving Bitcoin drove Ethereum highs or Ethereum highs drew capital out of Bitcoin but either way the correlation between Ethereum’s gains and older bitcoins being coaxed back into circulation is pretty clear:

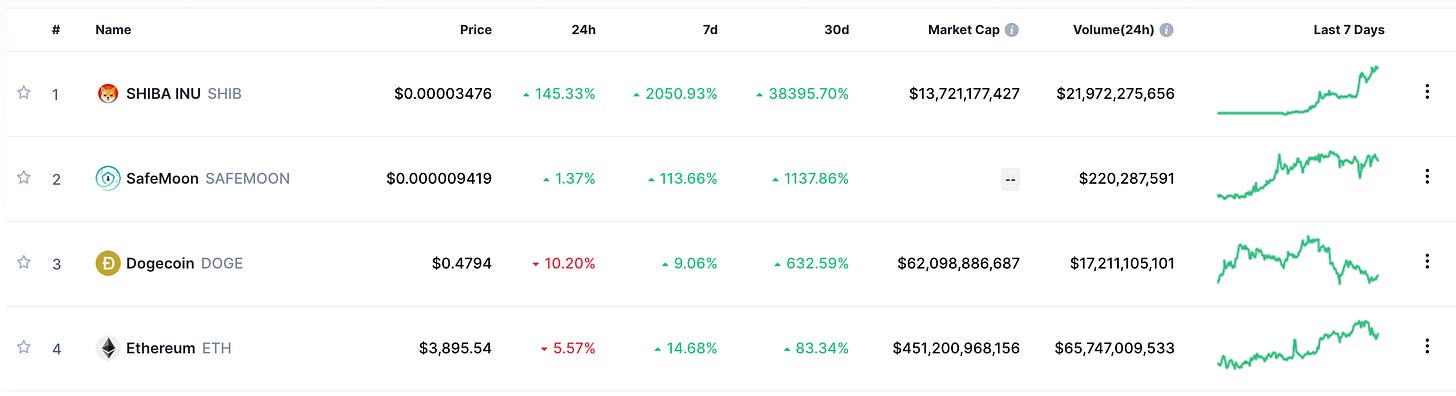

Another way to see the impatience of the market is to look at the "most viewed cryptocurrencies" on CoinMarketCap. The most eye-catching coins on the market today are a self-described Dogecoin killer, a coin which promises a "step-by-step plan to ensure 100% safety", Dogecoin itself (not yet killed) and then Ethereum. Bitcoin itself is 8th on the list. Boring!1

Okay but can you wear them with sandals?

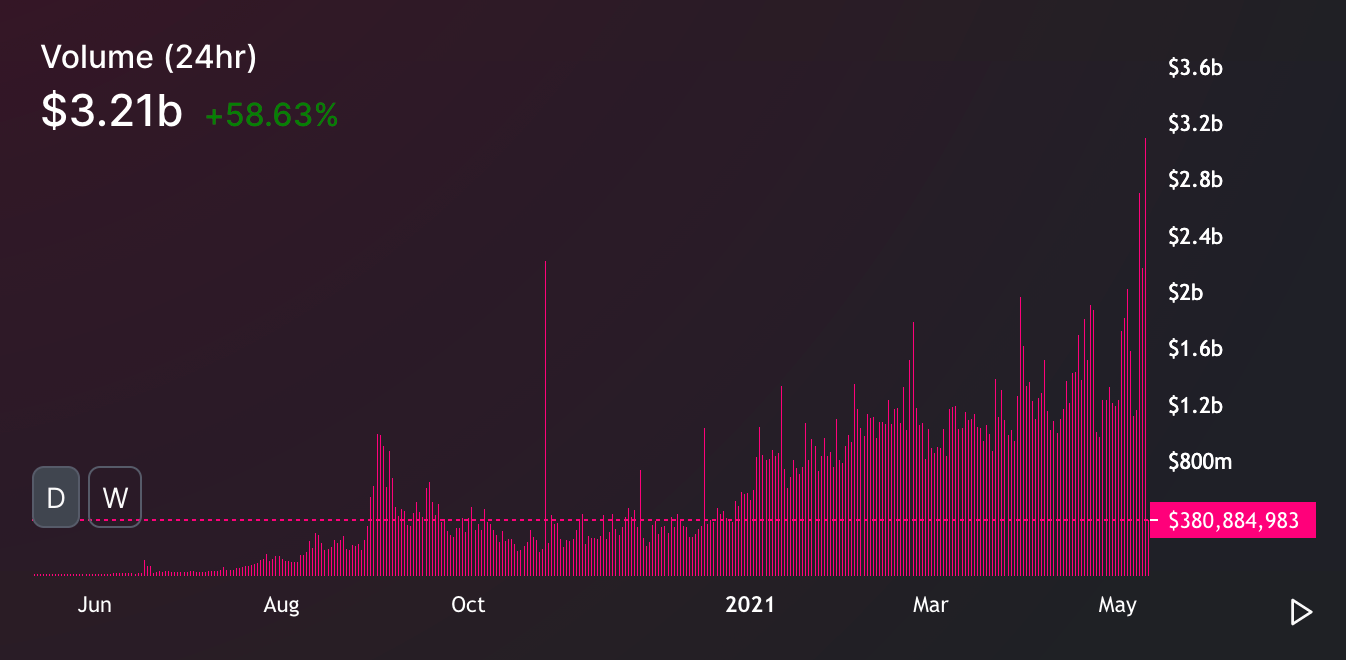

We’ve talked before about Uniswap, a decentralized exchange built on top of Ethereum where users can exchange arbitrary tokens. Uniswap launched in 2018, recently launched its v3 and is generally growing quite quickly. 24 hour trading volume now regularly exceeds $2B. By way of reference, Coinbase’s 24 hour volume is ~$10B.2

In May of 2019 Uniswap released a limited edition set of 500 socks sold via Unisocks.exchange. Uniswap sold 500 SOCKS3 tokens representing the socks and seeded a market for them with liquidity. You could do all the normal things with the SOCKS tokens like buy, sell or hold them - or you could redeem them, destroying your SOCKS token but receiving a pair of the limited edition physical socks and an NFT as a certificate of authenticity. Uniswap sold the first SOCKS token for $12 and the rest at an exponentially escalating price called a bonding curve:

Can you imagine paying hundreds of dollars for a pair of socks? It was a simpler time. Anyway, the price of a SOCKS token is now ~$93k/SOCKS, down somewhat from its peak of ~$157k/SOCKS in the beginning of March. Since conception 195 of the 500 SOCKS have been redeemed for actual socks by people who probably never expected the price of SOCKS to reach this high.

Yesterday some fancy-footed individual cashed in 9 SOCKS tokens (worth ~$92k) at the time to redeem them for 9 pairs of Unisocks:

Sure three-quarters of a million dollars4 may seem like a lot of money for a set of matching socks, but can you really set a price on putting off laundry day?

Other things happening right now:

This week Tom Brady joined the growing ranks of Bitcoin-activated NFL players. The laser-eyes meme is about Bitcoin hitting $100k, though I’m not sure that counts as an explanation, exactly. I’m pretty surprised we haven’t seen as much crypto activity among athletes of other major sports - particularly basketball given the success of TopShots. Seems like we are still very early.

The Russian hackers behind DarkSide (the ransomware that has disabled the largest oil pipeline in the US) have apologized for the attack. They only meant to do crimes, not politics! It makes sense they would apologize, people are much more forgiving of criminals than of politicians.

Presented without comment:

Although there is a hot new coin called $SATS I am hearing great things about.

Uniswap is still the largest decentralized exchange for now, but there are many others.

It was a nightmarish decision to pluralize the token name, IMHO.

If you are wondering how the math on this works out it is because SOCKS are a very illiquid market and each individual token sold changes the price substantially.