Nobody outsmarts the market

Plus Visa makes a terrible Bitcoin and Justin Bieber overpays for NFTs

In this issue:

Nobody outsmarts the market

Visa makes a terrible Bitcoin (and vice versa)

Justin Bieber is not a bargain shopper

Nobody outsmarts the market

This week progressive magazine Jacobin Magazine published an op-ed calling on governments to ban cryptocurrency for the good of the land. This isn’t Jacobin’s first foray into crypto — previous examples include balanced perspectives like "The Dumb Money" or "Cryptocurrency is bunk." In fact, Jacobin has been rewriting and republishing the same basic complaints about crypto since 2015. Don’t get your investment advice from socialists.1

Honestly you could swap the dates around on all those posts and you would hardly notice the difference. Nothing has changed. Here is the basic recipe:

Crypto has no value and everyone knows it.

Because it has no value it is a waste and a scam.

We should ban cryptocurrency.

Stripped down to its barest elements it is easier to see how circular the reasoning is. The article opens with the blanket assertion that crypto is completely worthless and everyone who understands blockchains knows that. There are hundreds of millions of crypto users — the author is asserting that he is smarter than all of them. That is an incredibly dramatic claim! But he doesn’t stop to examine it.

Of course even a cursory attempt at research would make it obvious that for some people crypto is a lifeline. It is possible to believe that the benefits of cryptocurrency are not worth the costs but asserting that it has no value at all is just willfully ignorant. And I do mean willful because maintaining the belief that crypto has no upside is critical for the rest of the argument:

Given that cryptocurrencies don’t produce anything of material value, this enormous waste of resources renders the whole enterprise a negative-sum game.

If you start with the assumption that crypto is useless it is easy to conclude that it is bad. That isn’t how economics works, though! Jacobin doesn’t get to decide what things are useless and what things are desirable. People decide for themselves what they want to value and the market aggregates those preferences together into a price. Arguing that the price is 'wrong' is misunderstanding what it means. Goods and services don’t have a true intrinsic value. They are worth whatever people are willing to pay for them. The market sets the price.

The author’s argument for ignoring the market price is essentially that Bitcoin is mostly priced in Tether and Tether isn’t really worth a dollar so Bitcoin prices aren’t real either. This is just the same mistake with extra steps. The author doesn’t get to overrule the market about the value of Tether any more than they get to for Bitcoin. Tether is worth about a dollar because people will give you about a dollar for it.

This is a dusty old argument — I actually wrote about it in the second issue of Something Interesting and it was already old back then. It’s wrong in a bunch of ways but I don’t know that it’s worth rehashing them all here. Instead I think it’s useful to take a step back and ask a simple question. If crypto is intrinsically worthless, why hasn’t it collapsed already? What has changed?

Visa makes a terrible Bitcoin (and vice versa)

A pretty common complaint about the Bitcoin network is that it is less efficient than Visa, usually referencing the disingenuous energy-per-transaction metric popularized by the equally disingenuous Digiconomist. Energy per transaction doesn’t mean anything useful because energy is not used to process transactions, it is used to secure the network. Evaluating the network that way is like dividing the security budget of a bank by the number of times customers used an ATM.

Understanding the relative energy efficiency of Visa and Bitcoin is also difficult because it requires some agreement about how much energy Visa and Bitcoin actually use. We’ve talked before about how difficult it is to estimate Bitcoin’s energy usage but it is actually much easier than estimating Visa’s energy usage.2 Energy-per-transaction is just dividing a made up number (estimated energy use) by a specific, well-known number (# of transactions) so that the resulting number seems less made up. It isn’t useful.

There are interesting comparisons you can draw between Bitcoin and Visa however. For example in 2021 the Bitcoin network moved more value (~$13 trillion) than the Visa network did (~$11 trillion) and at a fraction of Visa’s cost. Users paid an average of ~0.01% on the Bitcoin network versus ~0.22% on Visa. Even if you expand to include the block reward as part of network fees Bitcoin miners still only charged ~0.13% of the value transacted on the network. Visa is extracting roughly twice as much revenue from its customers as Bitcoin.

But honestly this framing is more useful for explaining why comparing Visa and Bitcoin is unhelpful than it is for explaining anything about Bitcoin or Visa. Transaction fees aren’t lower on Bitcoin because Bitcoin is cheap, they are lower because the average transaction size on Bitcoin is larger. In some reductively literal sense Bitcoin is ~20x cheaper for its customers than Visa — but Bitcoin customers and Visa customers don’t look anything alike.

Bitcoin is a settlement network (optimized for security and finality) and Visa is a payment network (optimized for speed and efficiency). Comparing them is like comparing an armored truck to a electric scooter — you can’t know which one is cheaper until you know what you’re trying to do. For buying coffee Bitcoin is expensive and Visa is cheap. For moving $100M it’s the other way around.

Other things happening right now:

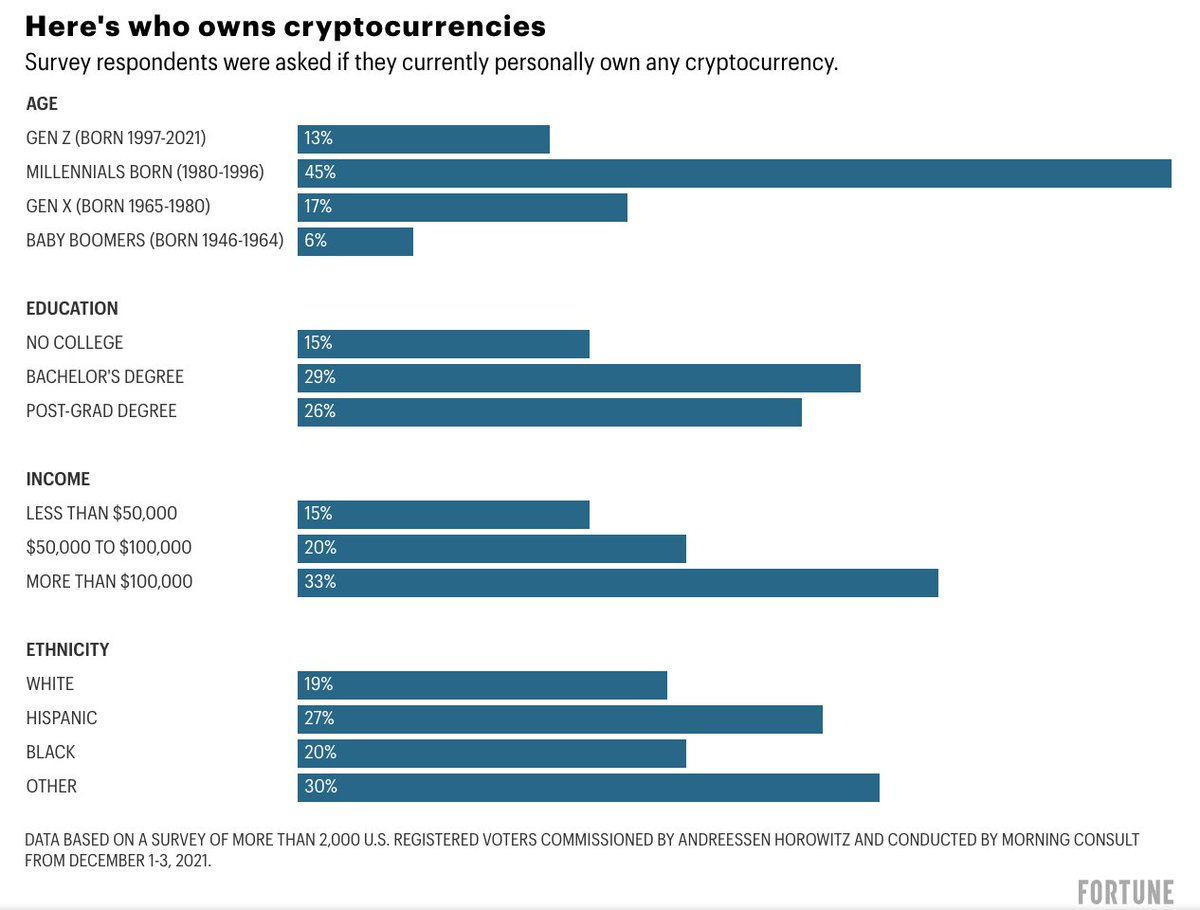

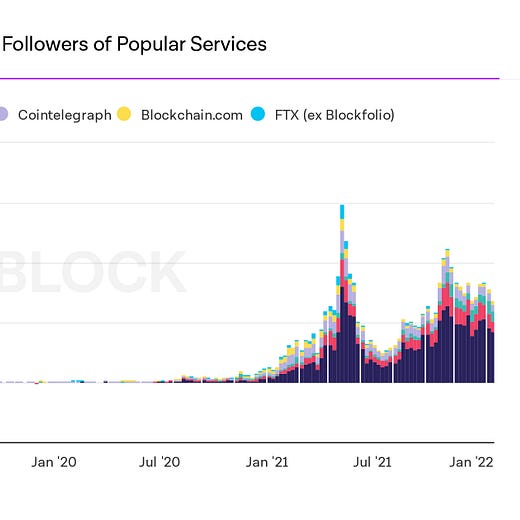

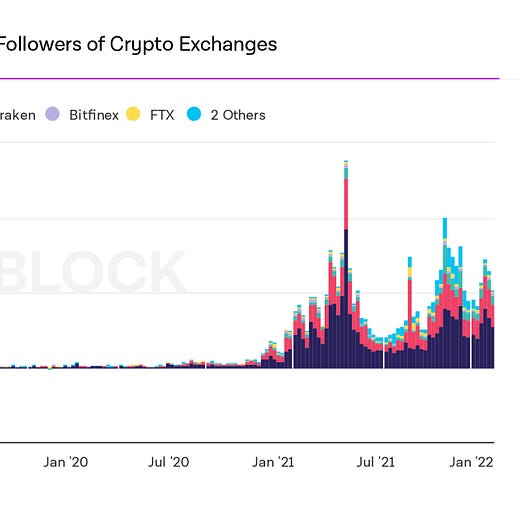

Crypto? In my demographic?! It’s more common than you think:

Last week we talked about how the world of cryptocurrency was encroaching on the world of traditional finance. Here is an example of the opposite: a classic corporate takeover executed on a decentralized organization. ApeDAO is an organization built to collect Bored Ape NFTs whose governance tokens were trading at a steep discount to the underlying assets they held. Outside investors saw an opportunity so they bought up shares and then proposed a vote to liquidate the collection and distribute the proceeds to investors. Since ApeDAO is not really a DAO it will be interesting to see if the owners of the multi-sig actually agree to abide by the vote to liquidate and dissolve.

The Biden administration is reportedly preparing an executive order assigning various government agencies responsibility for investigating or regulating cryptocurrencies, stablecoins and NFTs. Likely one goal is to reduce the infighting between agencies jockeying for authority but it may also be to expand regulatory authority in the space. Interestingly the order will be part of a larger national security memorandum. Not so long ago cryptocurrency was a fringe hobby — now it is a matter of national security.

Justin Bieber bought Bored Ape #3001 this week for 500 ETH (~$1.3M). Aside from the generally eye-popping price the interesting thing here is that the ape in question is not rare or expensive. It seems like Bieber may have wanted this ape because the number matches his home address. Fortunate windfall for the previous holder! But also interesting because wildly overpaying for a feature that will only ever matter to him suggests Bieber is not planning on ever selling his ape and views it not as an investment but as a collectible.

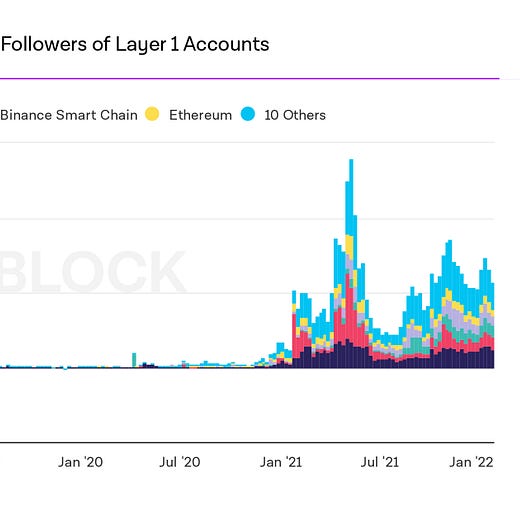

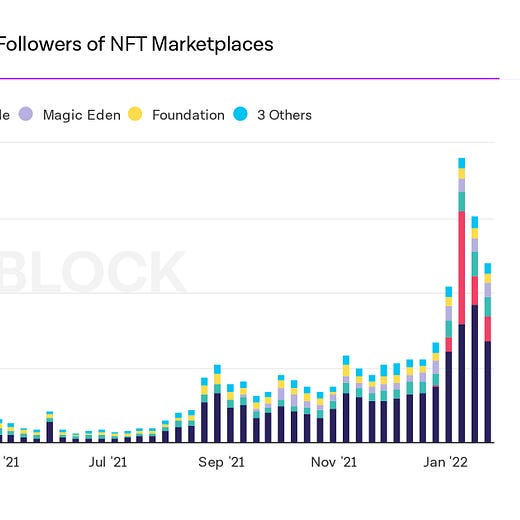

The broader crypto market has been in slow decay since last November but retail interest in NFTs is, if anything, picking up momentum:

Presented without comment:

In America Bitcoin is often culturally coded as politically right wing but I don’t think that’s true. My personal politics are moderately left-of-center. Bitcoin itself is neither liberal nor conservative, it’s just anti-authoritarian. American liberals do themselves a disservice by turning opposition to crypto into a tribal shibboleth.

The Digiconomist solves this problem by simply accepting Visa’s self-reported energy usage at face value.