How to survive a bear market

Plus NFTs make everyone angry and Bitcoin is seeping into Trad-fi

In this issue:

How to survive a bear market

Bitcoin is seeping into Trad-fi

NFTs are like Yanny vs Laurel except everyone is mad about it

How to survive a bear market

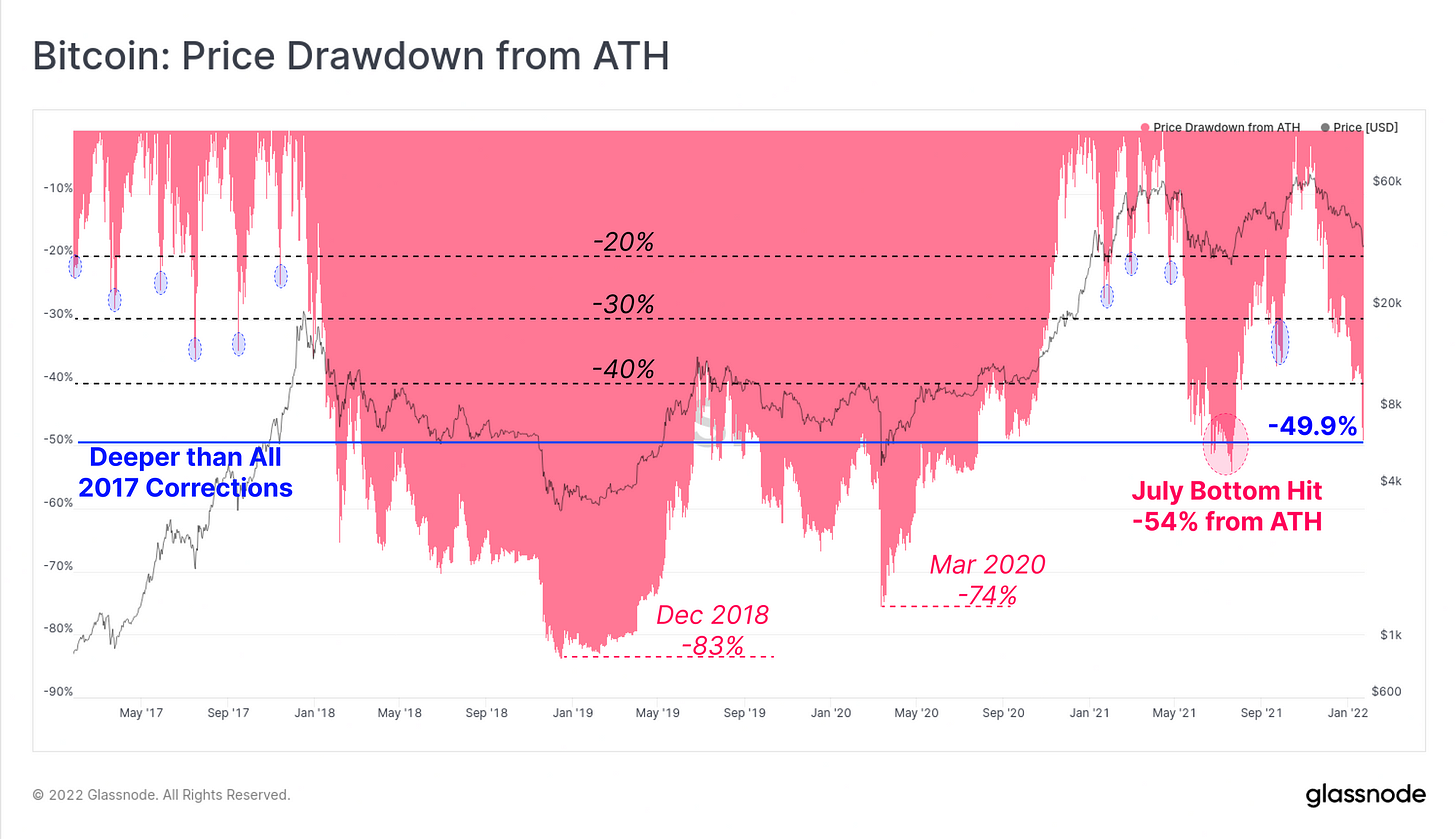

At time of writing the price of Bitcoin is ~$37k/BTC, up ~12% from its recent lows of ~$33k/BTC but still down ~44% from the all time highs of ~$67.5k/BTC. Ethereum has had a similar trajectory, back to ~$2.4k/ETH at time of writing but still down by ~50% from recent highs. For Bitcoin the drop to ~$33k was the worst correction since July and deeper than any correction in the 2017 bull market:

The macro backdrop these movements are unfolding against is bleak. Inflation is at 30 year highs and unemployment is nearly back to pre-pandemic lows. As a result the Fed is publicly signaling they intend to raise rates soon, finally dialing back the flow of easy money. It is easy (and reasonable) to be skeptical of the Fed’s ability to follow through with the intention of raising rates, but even openly discussing rate hikes is already itself a hawkish position.

An increase in the price of money would be hardest on high-risk, high-growth assets that have benefitted from easy money: Tesla, ARKK, FAANG, meme stonks, dog coins, etc. That doesn’t bode well for the businesses that offer trading in dog coins and meme stonks to investors, either. Consider Robinhood:

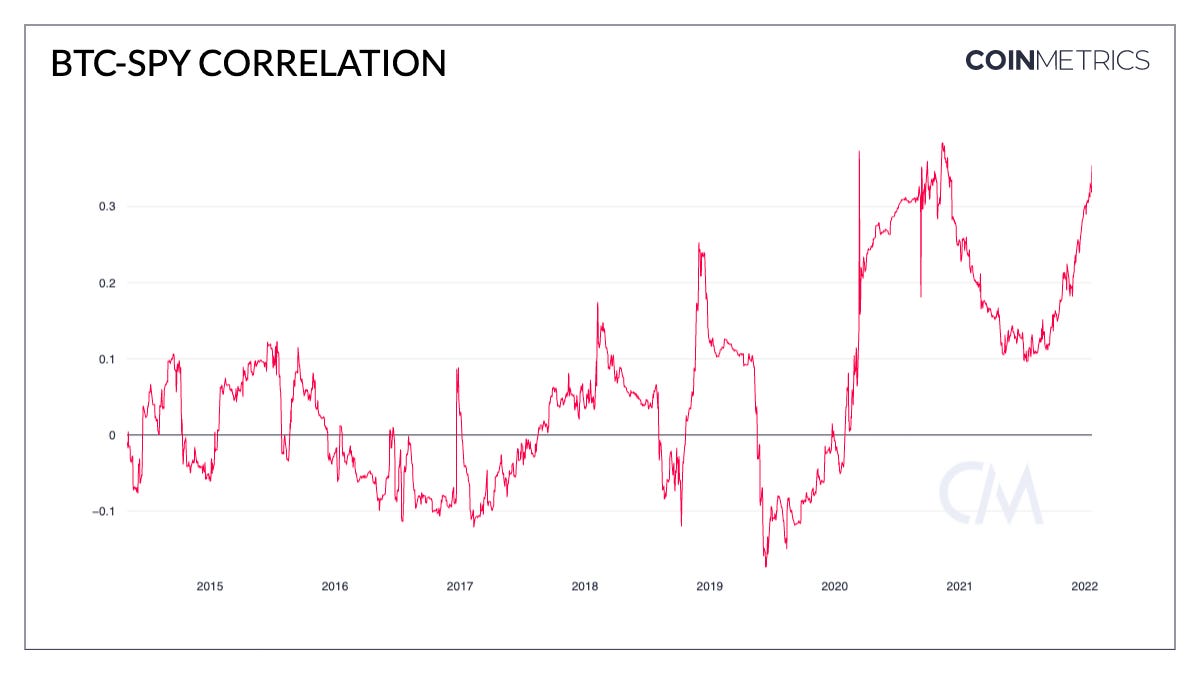

The big question facing the market is whether Bitcoin will respond to the macro changes by following the market or doing something else. Historically Bitcoin and the stock market have been pretty independent but since the pandemic they have started to move together and that correlation has risen again recently:

That’s a bummer in two ways: first, because equities are going down right now but more importantly second because one of the important arguments in favor of owning Bitcoin (especially for institutions) was that it was uncorrelated. Portfolios can use uncorrelated assets to improve their risk-weighted returns even if they are not believers in the asset itself — but if Bitcoin rises and falls with the stock market that weakens the argument for holding it. Some institutions may sell.

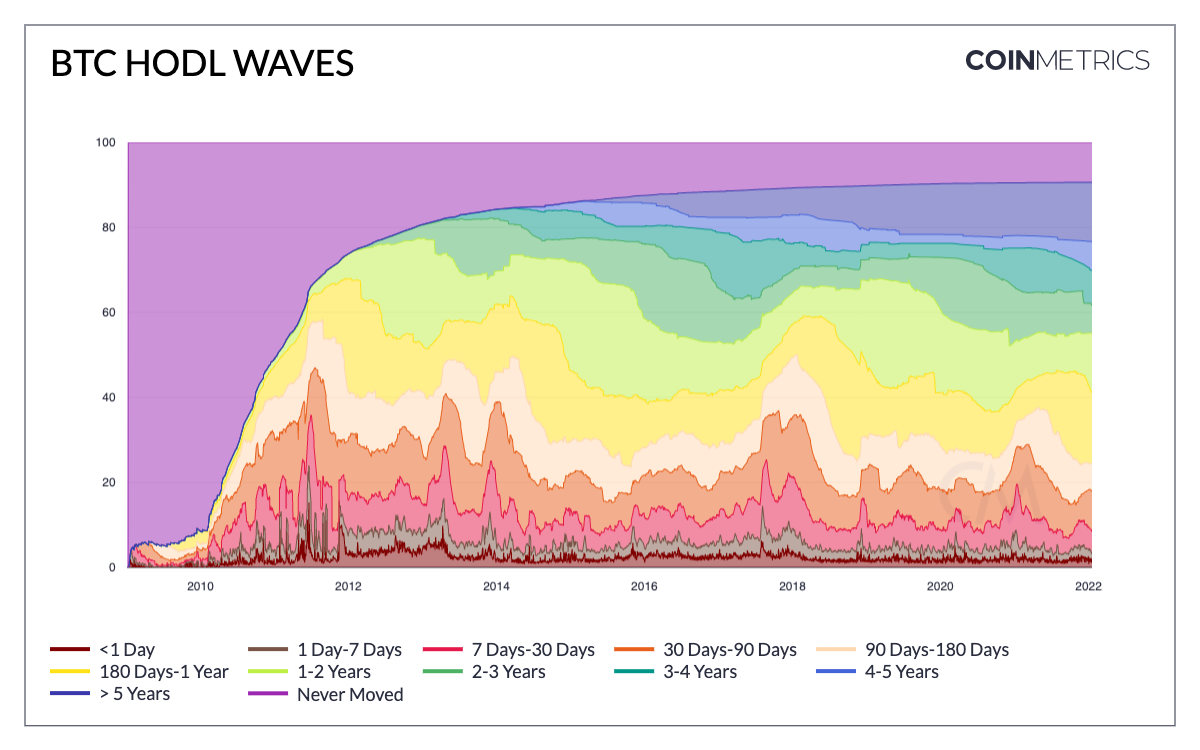

In spite of this long term holders seem unperturbed. The supply of Bitcoin held in addresses with a long term history of holding continues to reach new all time highs. Just over 60% of all Bitcoin have been held for at least a year. If long term holders were selling we would see a spike in "young" coins like the ones in 2012 or 2017. Instead it seems like experienced holders are just waiting out the storm.

Bitcoin is seeping into Trad-fi

In January blockchain infrastructure and analytics firm BTCS announced that they would be paying the 'first ever Bividend' an investor dividend payable (on request) in Bitcoin. BTCS have set up a site at Bividend.com laying out their supposed rationale for doing a dividend this way but I think it is pretty clear that the rationale is "maybe this gimmick will make people notice our stock."1

To actually receive your Bividend in bitcoin you need to request it by filling out this form and register to have your shares held by BTCS’s transfer agent (Equity Stock Transfer). By default your Bividend will be paid in ordinary US dollars. In part that is because your broker has no idea what your Bitcoin address might be — but mostly it is because you do not actually own any stock.

To a first approximation all stock is owned by the Depository Trust & Clearing Corporation (DTCC). Brokers have accounts with DTCC and investors have accounts with brokers. What you actually own is an entry in the broker’s database. So when a company pays out a dividend it doesn’t actually go directly from the company into the accounts of investors. Instead companies send money to DTCC which splits it up and passes it along to brokers who then credit it to user accounts.

A true Bitcoin dividend would require every part of the traditional finance stack to handle bitcoin and every investor in the company to have a Bitcoin wallet. Even more problematically (and amusingly) it would require anyone who had borrowed and sold BTCS stock to also acquire bitcoin so they could pay back the dividends they owed on borrowed shares. Overstock.com actually considered doing that back in 2019 as part of founder and CEO Patrick Byrne’s crusade against short sellers.

The thought provoking thing here is not so much that a small-cap stock made a bid for relevance by offering to buy its investors a nickel’s worth of bitcoin, but rather that the increasing size of the Bitcoin economy is making the intersection with the traditional economy larger and more interesting. For now the fact that traditional finance is ill-equipped to manage bitcoin is holding Bitcoin back — but it is not hard to imagine a world where the reverse is true and traditional finance companies are scrambling to support Bitcoin so they aren’t left behind.

Other things happening right now:

If you like your hopium graph flavored you will enjoy this excellent thread full of pictures of numbers about how the number will go up. I am skeptical of the precision and the timetable, but the numbers are useful for getting a sense of the massive potential scale.

Folding Ideas is one of my favorite content producers on the internet so watching him spend ~2.5 hours dragging NFTs felt a bit like getting in a fight with a friend. Still if you are wondering why intelligent lay people are so virulently hostile to NFTs/crypto in general this video is an exceptionally good window into their views. At some point I will try to do a more detailed breakdown but for now I am going to take a moment to grieve. NFTs are like the Yanny/Laurel debate except everyone is unreasonably angry about it.

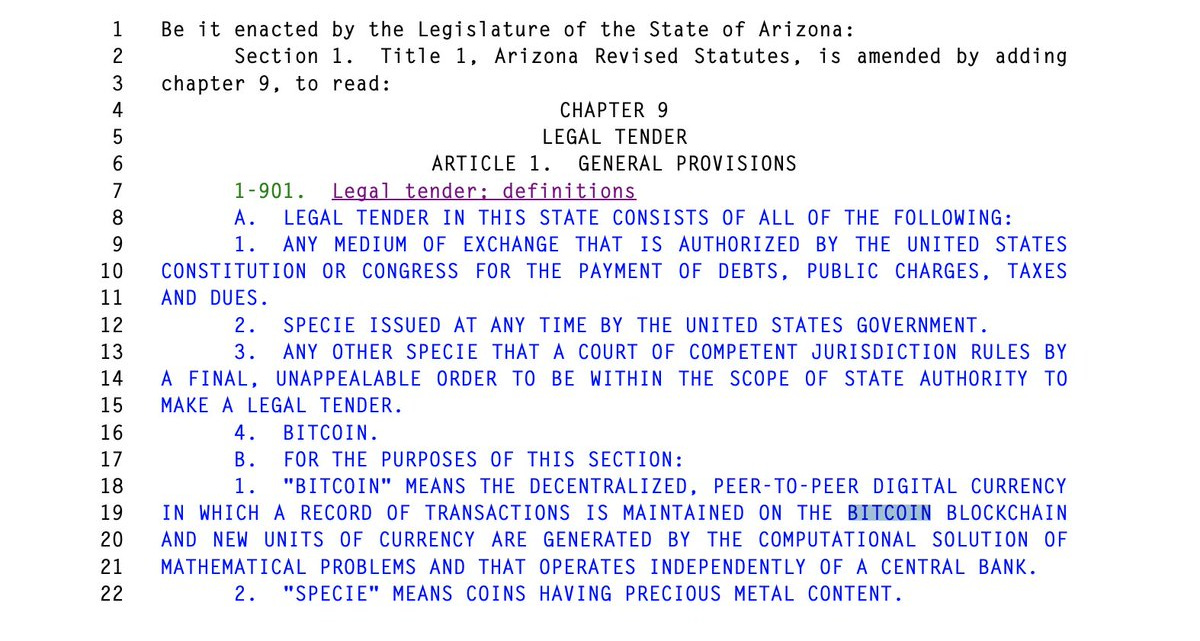

Senator Wendy Rogers (R) of the Arizona State Legislature introduced SB1341 this week to make Bitcoin (and precious metal coins) legal tender in the state. I like the energy! Unfortunately Senator Rogers may want to skim the constitution, especially Article I, Section 10 where it says: "No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts."

According to Google China leads the world in search interest for the term NFT. The Chinese government is famously anti-Bitcoin but they apparently still think NFTs are cool. A state-sanctioned platform for trading NFTs launched this week. They should check out this cool project celebrating the Beijing Olympics by Chinese artist Badiucao.

A cool visualization of Bitcoin’s supply schedule:

Presented without comment:

BTCS’s stock went from ~$3/share to ~$5/share at time of writing so I suppose it worked? If you are keeping score at home the average cost of a Bitcoin transaction right now is ~$1.50 and the Bividend is for $0.05/share. Hopefully everyone who signs up to be paid in bitcoin owns at least 30 shares.