How to start thinking about Bitcoin

A handy introduction for anyone thinking seriously about Bitcoin for the first time.

A return to new all-time-high prices for Bitcoin means that Bitcoin is once again getting heavy coverage in mainstream financial news — which means that a new cohort of people are learning about Bitcoin for the first time. Below is a quick guide to some of the most common Bitcoin questions along with concise, straightforward answers and resources to learn more.

Sooner than you think people will start asking you how to learn about Bitcoin! When that happens to you, feel free to share this link with them, too.

Inside this issue:

Should you care about Bitcoin?

Is Bitcoin good for the world?

What does it mean to own Bitcoin?

Should you care about anything else in crypto?

Should you care about Bitcoin?

There was a long while where dismissing or ignoring Bitcoin was a reasonable strategy — but that time has pretty clearly passed. The longer that Bitcoin continues to exist the less realistic it is to assume it will just go away. The world’s most powerful governments and largest corporations have started planning for a future where Bitcoin plays an increasingly important role in the world economy. If Bitcoin really does have a credible chance of changing the nature of money, everyone who cares about money needs to care about Bitcoin. Everyone needs to learn at least a little about Bitcoin for themselves.

Here is a common list of questions people often start with:

Does Bitcoin really work?

Yes, it really does. There really are only 21M Bitcoin and there really is no authority in the world able to print more bitcoin or censor a bitcoin payment.1 There is no one in charge of the network and no secret backdoor in the code. Bitcoin is brand new and it could absolutely still fail. But it has been working for fifteen years and the most serious risk (that adoption would never catch on) has gotten considerably smaller. If you want to learn more about how Bitcoin works I genuinely recommend Satoshi’s original Bitcoin whitepaper — it’s only 8 pages long and it’s very readable. But if you are mainly interested in whether it works, Bitcoin’s history of operation in practice is the most important evidence.

Why is Bitcoin worth something instead of nothing?

Bitcoin has value because you can hold it without asking anyone’s permission and you can spend it without anyone being able to stop you. That makes it useful for anyone who has difficulty storing value (e.g. citizens of a country with unstable banks and a weak currency) or anyone who has difficulty sending value (e.g. anyone sending remittances internationally). Bitcoin has value because some people want to use it, to either save or spend their wealth. The more people who want to use Bitcoin, the more valuable Bitcoin is.

What is Bitcoin "backed" by?

Bitcoin is not "backed" by anything, because Bitcoin derives its value from other people who want to save or spend their wealth in the Bitcoin network. This is akin to how the U.S. dollar is not "backed" by anything except the shared belief that other people will very likely want those dollars when we want to spend them. Money is a network, not an asset. The ability to "cash out" to some fallback commodity is not an essential feature of money and indeed most modern money does not offer it. Bitcoin is no different in this way.

Is Bitcoin just a bubble?

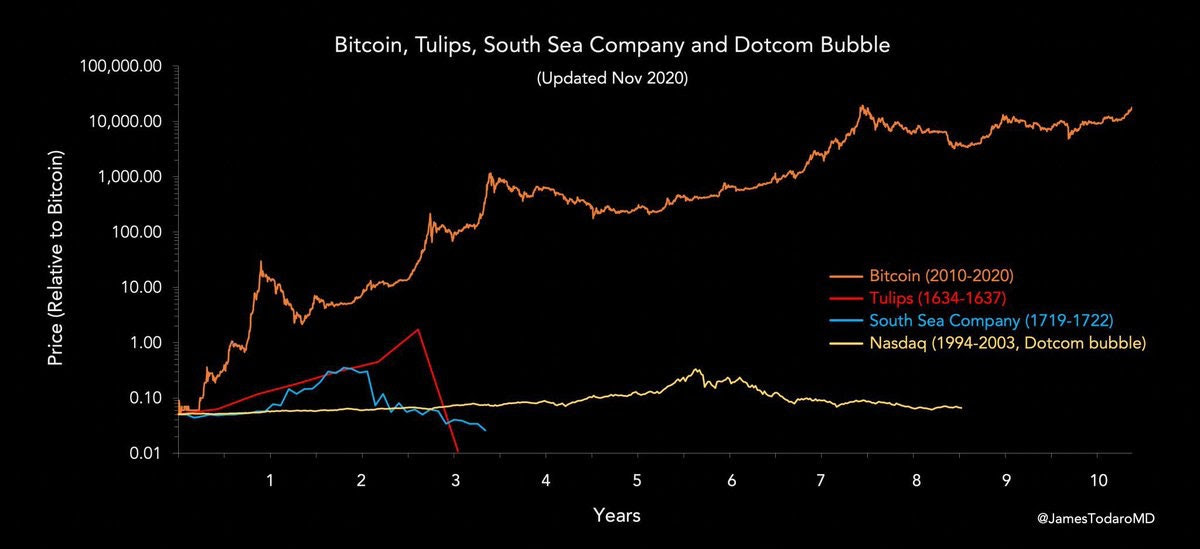

No, bubbles only break once. Bitcoin has survived greater than -80% drops at least five times so far and then gone on to greater highs. That’s obviously extremely volatile but it’s not a bubble in the classic sense because bubbles do not recover after collapsing. Comparisons to tulips or Beanie Babies or the dotcom bubble are all attempts to understand Bitcoin by placing it in a familiar category, but Bitcoin does not behave in a familiar way. That kind of comparison isn’t particularly useful for understanding it.

Won’t the government just shut it down?

China has banned Bitcoin mining several times and it’s been unsuccessful — both in the sense that total mining power has continued to grow and in the sense that roughly ~21% of Bitcoin mining still takes place in China. Hypothetically we could imagine America taking a similar stance but it would be an uphill battle constitutionally, since mining is essentially a form of speech and Bitcoin itself is a form of assembly, both of which are First Amendment rights.

More importantly the larger Bitcoin gets and the more intertwined with the rest of the economy and the wealth of its citizens, the more politically dangerous any attempt to ban Bitcoin will become. The conservative case for incorporating a small allocation to Bitcoin into a portfolio is extremely strong and Bitcoin ETF companies like Blackrock and Fidelity will be actively making that case to major corporations and large pension funds. Once companies in the S&P 500 start using Bitcoin that way every passive investor in America will effectively be a Bitcoin investor. The more people who are invested in Bitcoin, the more unlikely it becomes that politicians will try to outlaw Bitcoin.

If governments do want to ban Bitcoin, the clock is ticking.

Is Bitcoin good for the world?

Yes, Bitcoin is complicated but ultimately good for the world. It allows people in Nigeria (and Turkey and Egypt and Lebanon and many others) to save in a currency that isn’t collapsing. It also limits those governments ability to spend their citizens’ wealth through inflation — a stealth tax that weighs most heavily on the poor. Bitcoin allows women in Afghanistan to earn and save money without legal access to a bank account and it allowed war refugees to carry wealth with them as they fled Ukraine. For the people who need it, Bitcoin is a lifeline. It’s a powerful force for human rights.

Is Bitcoin mostly used for crime?

Cryptocurrency forensics firm Chainalysis estimates that only ~0.34% of cryptocurrency transactions were related to crime and ~2/3rds of those illicit transactions were stablecoins. Brian Nelson, the U.S. Treasury Undersecretary for Terrorism and Financial Intelligence testified to Congress that "terrorists still prefer, frankly, to use traditional products and services" over cryptocurrency.

Bitcoin today is mostly used for saving — the average bitcoin hasn’t moved for almost five years.2 Bitcoin is often accused of being a vehicle for crime and terrorism but that’s not actually true in practice. Most crime does not involve cryptocurrency, most cryptocurrency crime does not involve Bitcoin and most Bitcoin transactions do not involve crime.

Bitcoin is like the internet: criminals use it — but it’s not for crime. Bitcoin is for everyone.Is Bitcoin bad for the environment?

No. Bitcoin is a large consumer of energy but probably not as large as you’ve been led to believe and it’s certainly not as much energy as the banking sector uses to provide similar services today. More importantly, Bitcoin is a scavenger of cheap energy. Cheap energy is the energy no one else wants — that’s why it is cheap. Bitcoin is like a dog under the dining table — it might eat a lot of scraps, but it isn’t stealing anyone’s dinner.Because Bitcoin mining is very sensitive to energy price but indifferent to time and location it is very adaptable, which makes it uniquely well suited for renewable energy. ~54.5% of Bitcoin mining is emission free, such as the hydropower mining facility in Virunga National Park in the Congo that helps to pay for conservation in the park. Put another way, more than half the revenue of Bitcoin miners is a direct subsidy to renewable energy producers.

Bitcoin mining can also reach isolated sites like the methane flares on distant oil wells which means Bitcoin mining can convert waste methane into useful work and dramatically (~84x) less harmful emissions. Bitcoin is actually one of the only industries capable of being carbon negative.

Bitcoin stabilizes and subsidizes the production of power. It literally makes renewable energy more profitable. Far from creating a risk of energy scarcity, Bitcoin is a tool that can help us achieve energy abundance.

What does it mean to own Bitcoin?

Should you own some bitcoin?

Yes, you almost certainly should. Whether it ends up living up to its intended potential or not, Bitcoin is causing the entire financial world to re-examine the nature of money. Anyone who cares about money should be willing to spend time, effort (and yes, money) to learn about anything that significant to the nature of money itself. It’s worth buying a few dollars worth of Bitcoin just to learn with it. If you don’t own any bitcoin at all, you probably haven’t learned enough about it yet. Historically that’s been a very reasonable approach, but at this point Bitcoin is important enough that everyone should learn about it for themselves. That means everyone should own at least a little bitcoin.How much bitcoin should you own?

Look, I am not a financial advisor and this is not financial advice. But I do think you should sit carefully with this question.

The typical argument for investing in Bitcoin is that you should tolerate its volatility in exchange for its gains — sometimes it crashes, but other times it rockets up! Obviously it is good to own something you think will go up in value.

Perhaps less obvious is the argument that you should be willing to invest in Bitcoin exactly because of its volatility. Bitcoin has uncorrelated, positive-skew volatility — it’s most volatile days tend to be winners and it doesn’t move at the same time or in the same direction as other asset prices. That means even though Bitcoin is volatile, diversifying into a small Bitcoin allocation actually lowers the volatility of an overall investment portfolio.

The case for incorporating a small share of Bitcoin in a larger portfolio is mathematically very strong. Taken at face value the math suggests an optimal allocation of ~3-10%, depending on your risk tolerance. Even after assuming that Bitcoin will lose half its value during the time you are investing the optimal allocation is still ~3%. Bitcoin’s volatility is exceptionally useful.

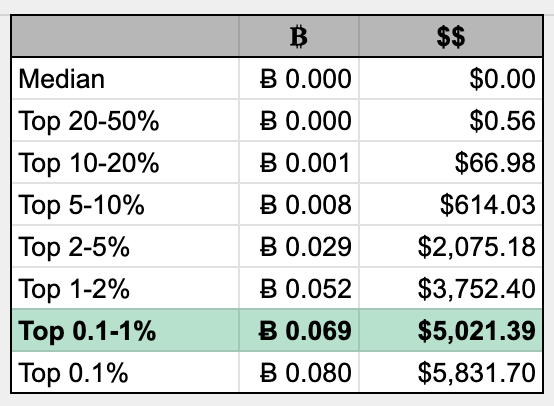

Another possible approach is to ask how much bitcoin you would need to own to be wealthy in a world where everyone measures wealth in bitcoin. You probably don’t need as much bitcoin as you think to be hedged against a Bitcoin future. The total number of bitcoin (21M) sounds like a lot, but across the ~8.1B people in the world that means there are only ~0.0026 btc per person, ~$189 worth of bitcoin at time of writing. If you own ~$375 worth of bitcoin today then by definition you own more Bitcoin than most people ever will.3

In the real world of course resources are never evenly distributed. If we assume the economy of the Bitcoin future has similar inequality to the global economy today, this chart shows how we might expect bitcoin to be distributed among the bitcoin wealthy. A little bitcoin goes a surprisingly long way.

Percentiles of Bitcoin wealth assuming bitcoin holdings have similar inequality curves to the global economy today. [details] Whatever strategy you choose when approaching Bitcoin as an investment it is important to be realistic about the volatility and the risks. All markets punish attempts to time the market but Bitcoin’s volatility punishes those attempts especially brutally. Investments in Bitcoin should have a multi-year time horizon and should use dollar cost average to minimize entry/exit risk. Above all else make sure your investment is small enough that you can ride out the inevitable waves of market chaos without fear. Bitcoin has crashed many times so far and it will almost certainly crash violently again in the future. Make sure your investment is small enough that you won’t panic when it does.

Should you care about anything else in crypto?

You might find other things in crypto interesting (I certainly do) but you don’t need to pay attention to anything else in crypto yet the way you need to pay attention to Bitcoin. There are other things being done that have interesting qualities or significant potential but nothing else has achieved escape velocity the way Bitcoin has or is even particularly close.

I think NFTs are fascinating and have enormous potential and I’ve written more about them here and here. I think Ethereum is fascinating but ultimately flawed and I’ve written about it here and here. I personally don’t think memecoins are all that interesting but I’ve written about them a few times as well if you are curious.

If you want to learn more about the space, I recommend subscribing to this newsletter! But if you are wondering how much you should feel obligated to go learn about, I think you can safely restrict your attention to Bitcoin for now.

Some of those bitcoin have been lost forever and some are holding still in an exchange address but changing owners on the exchange so we can’t take this average at face value. But it is enough to make it clear that Bitcoin has a very low velocity of money. That makes sense — if you believe in Bitcoin enough to own some, chances are you think it is still radically underpriced today.

If you are wondering why I sometimes capitalize Bitcoin and sometimes do not, the answer is that Bitcoin refers to the network as a whole and bitcoin refers to units of the token that the network tracks. You can own bitcoin but no one owns Bitcoin.

If you gave all 21M bitcoin to exactly 50.001% of the population you could give them ~0.005 btc, or about $375 worth of Bitcoin, assuming no lost coins and perfect distribution. So the most bitcoin that "most" people can hold is ~0.005 btc (~$375). One assumes in practice the population will probably keep growing, so this number will keep going down.