How to start saving with Bitcoin

A practical, step-by-step guide to using Bitcoin to save.

This post is a practical guide for people who are new to Bitcoin and seeking portfolio exposure or to use the network for themselves for the first time.

If you are curious about Bitcoin but aren’t sure if it makes sense, start here.

If you are actively skeptical about Bitcoin, start here.

In this post:

Saving is not investing

The case against investing

Know your own pain tolerance

Make a plan (and stick to it)

Executing your plan

Saving is not investing

Most people today have a tendency to treat saving and investing as synonymous and interchangeable — but that wasn’t always the case. In the era when gold was money no one was confused about the difference. Saving was when you accumulated gold and stored it somewhere safe. Investing was when you spent your gold on something you hoped would give you more gold in the future.

In the era of modern currencies storing your wealth in money is no longer a reasonable thing to do. Even the "strong" currencies still aim for a target inflation rate of ~2%, which means anyone using them to save loses half their purchasing power every ~34 years. Anyone seeking to save now has to find a vehicle that will outpace inflation. U.S. Treasuries are the lowest risk way to do that — but even Treasuries have duration and liquidity limitations that money does not have. Treasuries are lower risk than most investments, but they are still investing because you can’t spend Treasuries directly. You need to sell them for money first.

There are people who use Bitcoin to save (i.e. use it as money) and there are people who use Bitcoin to invest (i.e. they plan to sell it later for money). I think saving with Bitcoin is generally wise and investing with Bitcoin is generally a bad idea. If you use Bitcoin as a way to store some of your wealth until you need it I think Bitcoin will serve you well. If you use Bitcoin as a way to buy low and sell high so you can get more dollars you will very likely regret it — even if you end up with more dollars.

Bitcoin is not an investment. Bitcoin is a nest egg.

The case against investing

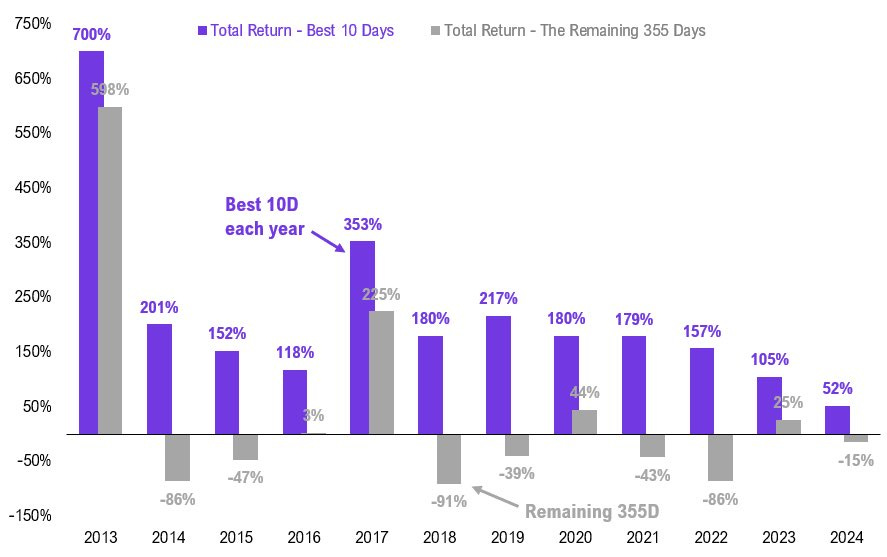

Historically, the price of Bitcoin has gone up a lot, so it might seem reasonable to think that the price of Bitcoin usually goes up — but it’s actually the opposite. When the price of Bitcoin does go up it goes up a lot — but what it usually does is go down. The graph above shows how the price of Bitcoin changed each year (in purple) and how it changed if you miss the ten best performing days of that year (in gray).

The experience of owning Bitcoin for the last eleven years has been roughly ~10 days of euphoria a year and ~355 days of watching those gains shrink by ~10.5% per year (before accounting for inflation). Bitcoin’s price action is brutally punishing to anyone who tries to time the market — you can hold bitcoin for 97% of a year when bitcoin’s price doubles and still end up down if you miss the wrong ten days.1

The down days aren’t all gentle, either. Bitcoin has fallen -80% from previous highs at least five times in its history so far. Bitcoin’s price volatility is trending down as the market gets bigger, but it is still much more volatile than other major currencies. That’s why using Bitcoin as a way to buy more dollars is fraught with danger — if you measure the value of your bitcoin savings in USD, the volatility of Bitcoin will constantly be tempting you to sell to protect your dollars.

The people using Bitcoin to save don’t worry about price volatility because they aren’t trying to sell their Bitcoin for more dollars. They are seeking to hold bitcoin, in case they ever need it. They don’t need to pay attention to price movements because the price does not affect how much bitcoin they hold. If anything, a price dip is an opportunity to accumulate more bitcoin cheaply.

To the saver Bitcoin is not volatile at all — everything else is.

Know your own pain tolerance

The most important rule of Bitcoin saving is to never save more in Bitcoin than you can afford to lose. Bitcoin is still very much experimental. There are things that can go wrong and destroy the entire network. Don’t put too many eggs in any one basket — Bitcoin included. You need to plan realistically for the small but non-trivial chance that all the wealth you store in Bitcoin could evaporate overnight.

Bitcoin also is and will remain volatile. Using it to save requires a long enough time horizon to ride out the market cycles and enough discipline to stay committed when the market is moving against you. If you are worried about Bitcoin’s price movements, you probably own too much bitcoin.

You should put a small enough amount of wealth in Bitcoin that you are more worried about being wrong than you are about losing money. That way when the market inevitably crashes you’ll sit still and hope for the best instead of panic selling at the worst possible moment. Making sure you never own more bitcoin than you can afford to completely lose will protect you from that panic.

Know your own personal pain limits and don’t go beyond them. That means not buying more bitcoin than you can risk owning — but it may also mean selling off bitcoin if the price grows faster than your tolerance for risk. Don’t be afraid to move some of your wealth into something less volatile to meet your own personal risk tolerance, and don’t renegotiate your risk tolerance in a bull market. If an abrupt crash would make you fearful, withdraw from your Bitcoin savings until the amount left no longer worries you. Don’t wait for the market to scare you out.

Make a plan (and stick with it)

Once you have established your limits you can start to establish your plan. In my opinion there are two sensible ways to approach saving with bitcoin (we’ll go into both in just a moment) but they both have the same thing in common: you shouldn’t change your plan because of changes in the market.

That doesn’t mean your plan is carved in stone forever — it’s normal for our finances to change when things our life change, for example. It’s also fine to establish a rhythm where you re-examine your strategy every few years to see if your risk tolerance has changed or if your circumstances are different. But if you change your strategy in response to movements in the market you are at enormous risk of overbuying in times of exuberance and overselling in times of despair.

Trying to match your plan to the market environment is just another way of trying to buy low and sell high but with extra steps to make it seem smarter. Timing markets is never a good idea, especially with Bitcoin. Instead, you should choose your saving plan independently of previous market movements and then stick with that plan regardless of how the market moves. Don’t adjust your bungee-jump harness while you’re still bouncing around.

There are two ways to make a plan for saving in bitcoin — you can decide how much bitcoin you want to own or you can decide what percentage of your savings you want to hold in bitcoin. There are advantages and disadvantages to either approach.

Targeting quantity: Bitcoin as wealth insurance

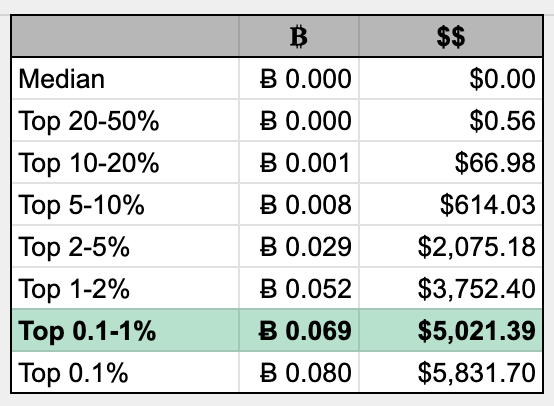

The simplest way to reason about saving with Bitcoin is to decide how much bitcoin you would need to never worry about Bitcoin again. It’s probably less than you think! 21 million seems like a large number but compared to ~8.1 billion people it is very, very small. A little bitcoin goes a surprisingly long way.

When I first started publicly recommending Bitcoin as wealth insurance in 2017 Bitcoin the price of Bitcoin was ~10x lower and there were around ~half a billion fewer people to compete with. Today the same level of "coverage" is more expensive and doesn’t buy as much bitcoin — but it is still relatively cheap. Even $1 worth of bitcoin is enough to buy significant protection. If you own the device you’re reading these words on, you can afford Bitcoin insurance.

The reason wealth insurance through bitcoin is worth considering is because if Bitcoin keeps working as intended, more people will start using it to store their wealth. More people moving their wealth into Bitcoin will cause the value of bitcoin to go up — but it will also cause the value of other assets people use to store wealth (e.g. gold, real estate, equity) to go down. Owning a certain quantity of Bitcoin works as a kind of "wealth insurance" against the possible worlds where Bitcoin absorbs significant value from every other store of wealth.

Quantity targeting is the right answer for anyone who would prefer to ignore bitcoin but is worried that it might be irresponsible. You can just acquire the appropriate quantity of bitcoin for your circumstances and then keep it safe and ready for emergencies, like an earthquake preparedness kit or a first aid kit for a car. Best case scenario you are ready for the emergency if it happens. Worst case scenario you spent an amount of money you can afford buying yourself peace of mind.

Remember that if you are using Bitcoin as wealth insurance that you should not have an exit price in mind. You don’t sell your wealth insurance when the price goes up for the same reason you don’t sell your flood insurance when the rain starts!

Targeting percentage: Bitcoin as a portfolio counterweight

The other slightly more complicated but still valid way to build a Bitcoin savings plan is to keep a certain percentage of your savings in Bitcoin. In this model Bitcoin is not a separate emergency savings cache but is just another component of your overall savings portfolio.

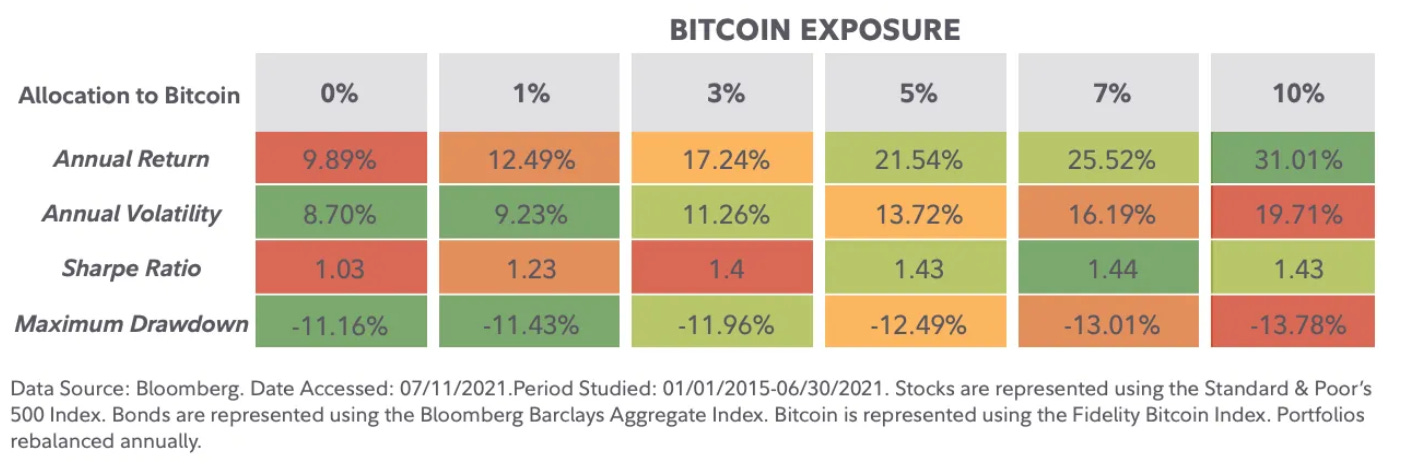

Targeting a percentage requires more attention than targeting a quantity (because you need to periodically rebalance your portfolio) and also more discipline (because staying on plan requires action instead of inaction, especially at volatile moments in the market). But done correctly periodic rebalancing can turn Bitcoin’s biggest disadvantage (volatility) into a significant opportunity.

The traditional argument for owning bitcoin is something like "the gains are so good, you should be willing to tolerate the volatility" — but that is an investor’s mindset, not a saver’s mindset. Anyone buying bitcoin "for the gains" is ultimately trying to time the market. Trying to buy low/sell high is a way of trying to grow USD denominated wealth, not preserve BTC denominated wealth. The argument for saving with Bitcoin runs the opposite direction: you shouldn’t be chasing future bitcoin gains, but bitcoin’s volatility can be incredibly useful.

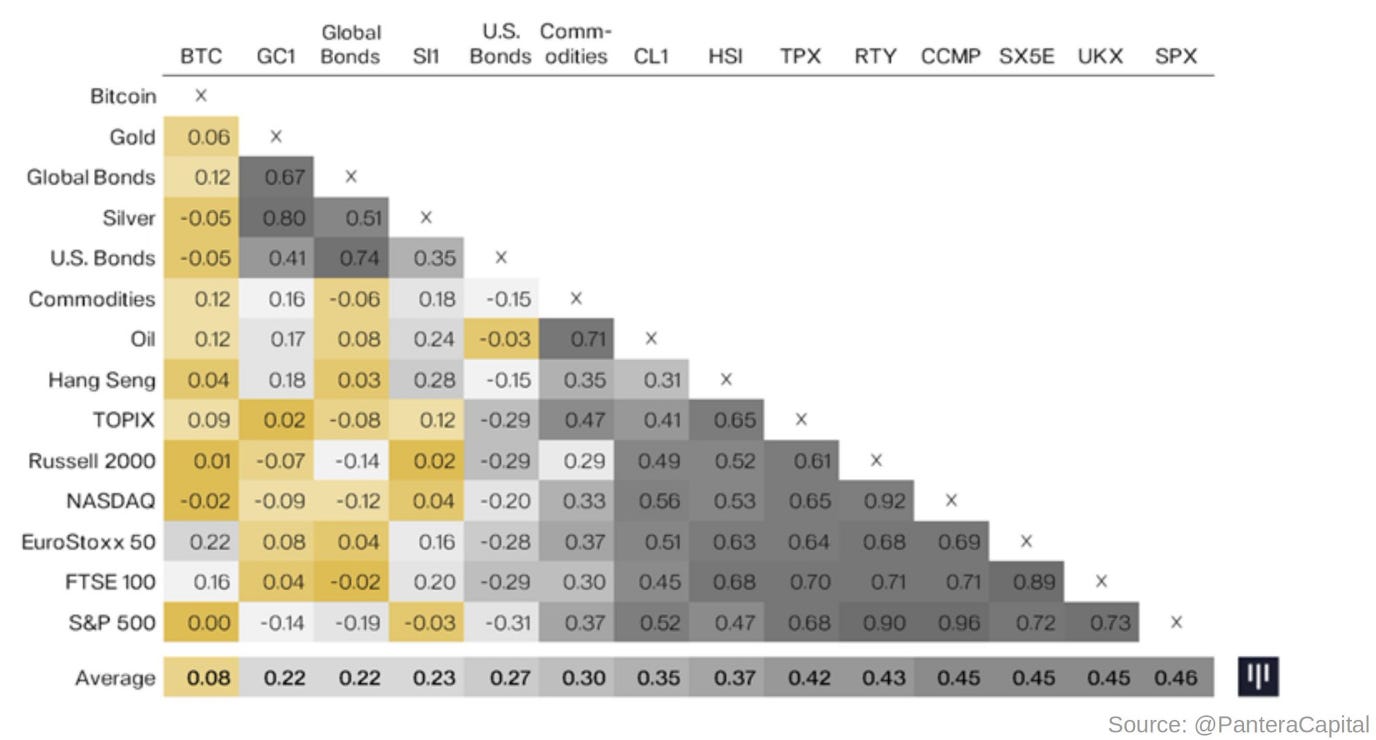

The price of Bitcoin is largely uncorrelated with other major asset classes: Bitcoin moves to its own rhythms. That means even though Bitcoin is volatile a small share of Bitcoin actually helps to dampen the volatility of your overall portfolio. Bitcoin acts like a counterweight, balancing out the swings in the value of your other assets. A small allocation into bitcoin (along with periodic rebalancing) actually lowers portfolio volatility and improves the risk/reward ratio.

Even more interesting, Bitcoin’s volatility is positive skew — i.e. the most volatile days in Bitcoin’s history tend to be bullish. This is the same observation we made with the graph at the top of the post about how most of Bitcoin’s yearly gains are clustered in the ten best performing days that year. On most days the price of Bitcoin goes down and on a few days it goes up (a lot).

Most high volatility assets have a negative skew — i.e. they perform well on a 'typical' day but have explosive potential downside risk. The few high volatility, positive skew assets that exist are either naturally illiquid (e.g. Venture Capital) or come with additional risks (e.g. investments in markets with unstable governments). Bitcoin is unique in offering uncorrelated, positive-skew volatility in a highly liquid investment. A small allocation into bitcoin is actually a conservative, risk-minimizing approach. Ignoring Bitcoin’s investment properties is taking on needless portfolio risk.

Just like using bitcoin for wealth insurance, using bitcoin as a portfolio counterweight means not having an exit price. There is no price at which bitcoin stops being useful for diversifying your portfolio. Anyone with an exit price in mind is implicitly still trying to time the market! That’s not saving.

Executing your plan

Once you have identified your personal limits and your savings goals you can start to actually acquire and hold bitcoin. Theoretically, you can earn Bitcoin in all the same ways you can earn money: working for a bitcoin wage, for example, or selling something for a bitcoin price. In practice however the easiest way to acquire bitcoin is by buying it. There are a few possible ways to do that, each with their own trade-offs.

The biggest distinction in practice is whether you plan to handle the bitcoin you own for yourself (self-custody) or pay a service provider to look after your bitcoin for you. Some Bitcoin purists recoil at the idea of a trusted bitcoin service provider, but reality is a bit more nuanced. Taking custody of your own bitcoin eliminates counterparty risk (i.e. the risk that the exchange steals or loses the money) but it introduces first party risk (i.e. the risk that you lose your money or get robbed or hacked).

In my opinion it is both safer and easier to use a blend of self-custody and trusted service providers — especially when you are just getting started.

How to buy Bitcoin*

The simplest way to start saving with Bitcoin is to buy shares in one of the newly launched Bitcoin ETFs. Shares in a Bitcoin ETF are not actual bitcoin in the same way that shares in an oil ETF are not literally barrels of oil — in both cases what you own is actually a legal claim on an asset sitting in someone else’s control.

That makes ETFs less useful for wealth insurance, because if Bitcoin has become explosively valuable your custodian might be tempted not to honor your IOU when you need it — but it does have some advantages. ETFs are traditional financial assets, so they are listed at traditional brokers and are easy to add to existing retirement accounts. That makes ETFs convenient to use as a portfolio counterweight, since it is easy to rebalance funds between Bitcoin and other assets.

ETFs are also good for people who find the financial case compelling but are intimidated by the risks or learning curve of handling Bitcoin for themselves. You don’t have to worry about losing your password or your laptop getting hacked. ETFs simplify inheritance / estate planning and tax reporting. ETFs do have annual fees, but right now competition has driven them all fairly low. You can buy Bitcoin ETF shares from most standard brokerage accounts — although not with Vanguard.

How to actually buy Bitcoin

The more advanced way to buy bitcoin is on a Bitcoin exchange — a marketplace where users buy and sell bitcoin to each other. Signing up for an exchange is a lot like signing up for a bank account and exchanges would like you to think of them as being like banks — but I think you are better off thinking of them as casinos. Not necessarily dishonest, but definitely not looking out for your best interests.

Technically you can treat the exchange like a bank and leave crypto (or government money) deposited on your account, but I generally don’t recommend it unless you are in the process of buying or selling. Leaving money deposited on an exchange is a bit like giving a free, unsecured loan to the startup that owns the exchange. Unlike ETFs there is no annual fee — but you are taking credit risk against the exchange. Generally I think the ETFs are a better risk, even after accounting for fees.2

The only major advantage that buying bitcoin on an exchange has over Bitcoin ETFs is that you can withdraw it! That makes Bitcoin exchanges the shortest and most convenient path to self-custody today. To really use Bitcoin as wealth insurance you will eventually need to master self-custody, since holding bitcoin yourself is the only way you can be absolutely certain it will be there when the time comes — otherwise your insurance amounts to an IOU from whoever is managing your bitcoin.

How to learn cheaply

Taking control of your own bitcoin means you don’t have to trust anyone else — there is no one else who can confiscate your bitcoin or misplace it. But it also means you have to trust yourself — there is no one else who can restore a lost password for you or get your money back if it is stolen. There is no Bitcoin customer support.

Start small. Don’t try to handle a large amount of bitcoin until you have learned to handle a small amount of bitcoin. Self-custody is something that anyone can learn to do, but it is extremely unforgiving to mistakes. When you are getting started you will likely make mistakes and lose coins. It is better to learn those lessons cheaply with toy amounts than to lose your entire stack.

As the amount you custody for yourself grows you will eventually start wanting to use more sophisticated strategies like cold-storage, hardware wallets and multisig. Just as with basic self-custody you should start with a small amount and get comfortable before doing anything with larger amounts.

Don’t drop the bag

The hardest part about using Bitcoin to save is not getting bitcoin — it is keeping it. Don’t try to increase your stack by gambling on memecoins. Don’t try to increase your stack by day trading. Don’t let crashes scare you away from your plan and don’t let bubbles convince you to put in more than you can afford to risk. Don’t use leverage and don’t try to outsmart the market.

Don’t use Bitcoin to chase dollars. Use it to save your wealth.

If you are wondering why I sometimes capitalize Bitcoin and sometimes do not, the answer is that Bitcoin refers to the network as a whole and bitcoin refers to units of the token that the network tracks. You can own bitcoin but no one owns Bitcoin.

Given that ~90% of all bitcoin held by Bitcoin ETFs are custodied by Coinbase you might reasonably wonder if holding bitcoin in a Coinbase account has equivalent risk to owning shares in an ETF (but with lower fees). I personally don’t think so — first, in the event of a Coinbase bankruptcy I think Blackrock (or any other ETF) will likely be able to negotiate better terms for their collective customers than you would likely get as an individual Coinbase customer. Second, in the event of a large Bitcoin theft Coinbase would almost certainly be bankrupt but Blackrock (or whoever) would likely still have a lot of money and an ongoing desire to continue good terms with their customer base. If you prefer an ETF that doesn’t custody with Coinbase, Fidelity does their own bitcoin custody.