Letter to a Bitcoin Skeptic (Part I)

An explanatory resource for anyone who thinks Bitcoin is a scam.

You were probably sent this link by a friend or loved one who is hoping you will give Bitcoin a closer look. This two part essay is meant to speak to common doubts and concerns about Bitcoin. Part I focuses on the practicalities of Bitcoin (i.e. does it work) and Part II will focus on the ethics of Bitcoin (i.e. is it good?). If you’re looking for more of a getting started guide, check out this one here. Or if you’re more interested in a reading list to deepen your understanding of the space you can find that here.

There is baby in the bathwater

Let’s start by getting a few things out of the way: cryptocurrency is a dangerous and often ugly place. There are countless scams, hacks and exploits. It appeals to degenerate gamblers and criminals and fools. Motivated reasoning and sunk cost fallacy prop up bad ideas long after they should have collapsed. Con artists thrive in the open and ordinary people often lose their money. The crypto space is 95% bullshit by volume so it’s understandable why people conclude it must be entirely bullshit.

But mostly bullshit is not the same thing as entirely bullshit. Dismissing crypto because it is full of scams is like dismissing Twitter because the average Tweet is terrible. The problem is not that Twitter (or crypto) have nothing to offer. The problem is that it takes time and energy to learn how to dig through the bullshit and find the genuinely interesting ideas.

Rejecting cryptocurrency entirely is much easier and seems to offer a lot of moral clarity — but it leaves behind a nagging question: if cryptocurrency is so obviously awful, why doesn’t it just die?

Bitcoin is not going away

An interesting thing about Bitcoin is that almost no one believes in it right away. Bitcoin’s design is so ugly and counterintuitive that almost everyone rejects it at first as impossible. Personally it was around three years between when I first heard about Bitcoin and when I finally started to seriously investigate it. I studied game theory and mechanism design in grad school, so I knew exactly why Bitcoin couldn’t work. I just couldn’t figure out why it was still around.

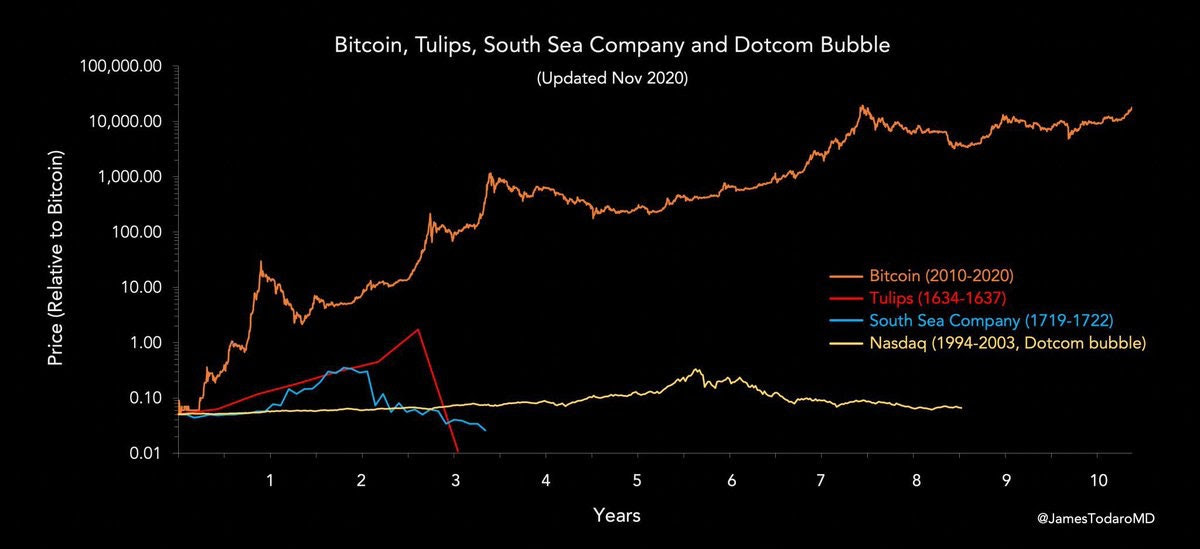

In theory I was confident that Bitcoin could not exist but in practice it did and when theory conflicts with observed reality it is theory that must change. I became skeptical of my skepticism. I read the whitepaper. I changed my mind. More than anything I can write or say the most compelling evidence that Bitcoin works as advertised is the history of its operation so far. The longer Bitcoin continues to exist, the more seriously you should take it.

The academic term for this is the Lindy effect, the idea that the longer something has survived the longer you should expect it to continue. We could all collectively decide tomorrow that gold is no longer valuable and we could decide to keep listening to today’s hit singles forever. But we probably won’t.

Gold has been valuable for a long time, so it will probably still be valuable a long time from now. Today’s top songs are mostly new, which suggests tomorrow’s top songs will probably mostly be new as well. The continued existence of something is evidence it will continue existing. That’s the Lindy effect.

That’s why governments around the world have stopped ignoring Bitcoin and started to develop formal policies to outlaw, regulate or adopt it. A policy of ignoring Bitcoin and assuming it will go away on its own is no longer realistic. If Bitcoin was going to go away on its own, it already would have.

Bitcoin has value because it is useful

A common objection to Bitcoin is that since they aren’t backed by anything they must not be worth anything. Since they don’t have any intrinsic utility they must be a greater fools’ game, where the only goal is to sell your worthless bags at a higher price to an even greater fool than you. It is true that the only use for Bitcoin is to transfer your bitcoin to someone else — but that doesn’t mean Bitcoin is useless. Transferring value is a valuable service. That’s why banking is so lucrative.1

“As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: - boring grey in colour - not a good conductor of electricity - not particularly strong, but not ductile or easily malleable either - not useful for any practical or ornamental purpose and one special, magical property: - can be transported over a communications channel If it somehow acquired any value at all for whatever reason, then anyone wanting to transfer wealth over a long distance could buy some, transmit it, and have the recipient sell it.” — Satoshi Nakamoto

Money is a technology for transporting value through space and time. Bitcoin is a vehicle for value that eliminates physical distance and cannot be diluted, seized or censored. It is the value of that service that "backs" the value of Bitcoin.

Bitcoin will not be stopped

Bitcoin does not have a central point of control so the only way to "stop" Bitcoin is to stop every person on the Bitcoin network individually. Even shutting down the entire internet wouldn’t work because you can connect with the Bitcoin network over radio or by satellite. By any realistic measure the network itself cannot be stopped.

Governments can of course outlaw cryptocurrency (several have) but making Bitcoin transactions illegal is like making drug use illegal — it doesn’t eliminate it so much as drive it underground. China is a powerful, authoritarian state that has repeatedly banned Bitcoin, but you can’t actually ban Bitcoin from China because Bitcoin has no concept of China. China can only choose to isolate themselves from the network.

But what if governments go farther and actually attack the network? They could secretly acquire or seize mining rigs and set them to mining empty blocks, slowing down the network and reducing revenue for honest miners. They could market sell the rewards they earn mining and open short positions to drive down the price of Bitcoin further damaging miner revenue and market confidence. As miners quit defending the network attackers will control more of it, causing a feedback loop / death spiral.

Attacks like this are easiest to picture with an abstract, monolithic world government. It is less clear how they would work in the context of actual world governments today. The two most obvious governments in practice that might launch such an attack are the US and China. China has been systematically working to expel all the mining rigs from its borders — so they aren’t exactly gearing up to launch a mining based attack on the network.

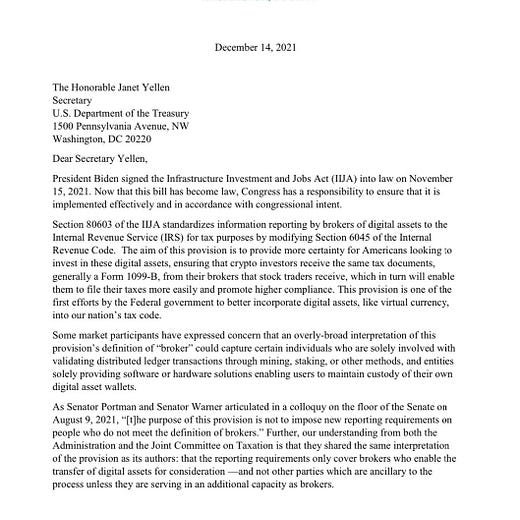

America also seems like an unlikely candidate to launch an attack on the network. Seizing private property like mining rigs outside the context of a conventional war would be an unusual and politically explosive precedent. More pragmatically, cryptocurrency has matured into an effective lobbying group. Sitting congresspeople in both parties own Bitcoin and have made support for cryptocurrency part of their platform. Some have even made it their signature issue.

A sufficiently powerful, ideologically motivated attack could suppress the Bitcoin network, but it would be expensive to maintain and wouldn’t prevent the network from resuming normal operation after the attack stopped. The game theory of what happens when motivated attackers and defenders clash over a blockchain is complicated and reasonable people can disagree about what it might mean. But the two most powerful governments in the world today are either embracing Bitcoin or systematically disarming themselves.

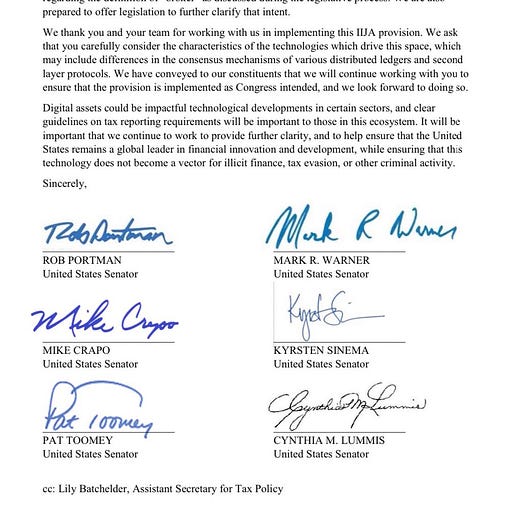

Bitcoin will not be replaced

Bitcoin is (by design) a very limited system. You can pretty much only use it to send and receive Bitcoin. It is very difficult to change (also by design) so it adopts new technology very slowly if at all. That can seem primitive and sluggish to outsiders but being resistant to change is the central value proposition of Bitcoin. You can’t make a better Bitcoin by making a Bitcoin that is easier to change.

Bitcoin is better understood as a social revolution than a technological one. No new cryptocurrency can achieve the same results as Bitcoin because the social context in which it was created is gone now. For the first year and a half of its existence Bitcoin was essentially free — there was a website called the Bitcoin faucet that gave users 5 BTC just for solving a CAPTCHA. Satoshi disappeared before the project hit major prominence and never collected any kind of special founder’s rewards for his efforts. Even if a new project could somehow recreate these conditions they still couldn’t recreate the history of proven operation since.2

Other cryptocurrency projects may still prove useful / valuable — but not by outcompeting Bitcoin to be the best money. If they are successful it will be because they optimized to serve a different use case. They won’t replace Bitcoin, they will exist alongside it.3

In short, Bitcoin works as advertised

Bitcoin has operated continuously outside of anyone’s control for more than twelve years now — that fact alone should merit serious attention even from skeptics. It has not been hacked, censored, halted or controlled. It has survived bubbles and crashes, attempts to commandeer it or to outlaw it or to obsolete it. That history of operation is a growing body of circumstantial evidence that Bitcoin really is what it claims to be: a perfectly scarce, sovereign asset.

The growing body of evidence that Bitcoin is real means that responsible people need to start planning for that possibility. What does the existence of a universally available, perfectly scarce asset mean for the world?

Part II: Bitcoin is good for the world

In the next post we’ll unpack the ethical case for Bitcoin — why Bitcoin is good for the poor, the disenfranchised and the environment — as well as why you should probably own a small amount of Bitcoin whether you believe in it or not.

The value of transfer is the same thing that backs the value of "fiat" currency.

c.f. the Lindy effect.

The most prominent competitor to Bitcoin at the moment is Ethereum — if you are interested in a more long-form exploration of Ethereum you can find one here.