How to send a bank a nickel

Plus the Bitcoin ETF horserace continues and God told me to scam you

In this issue:

Inflows and Outflows

How to send a bank a nickel

SNL writers should subscribe to Something Interesting

It’s not my fault, God made me do it

Inflows and Outflows

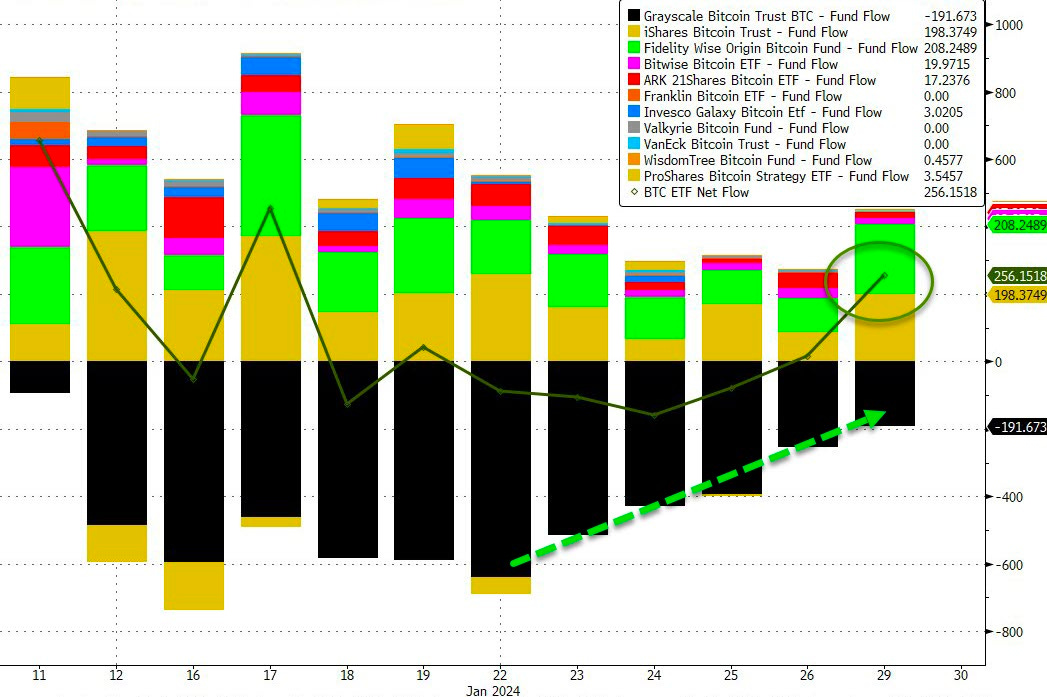

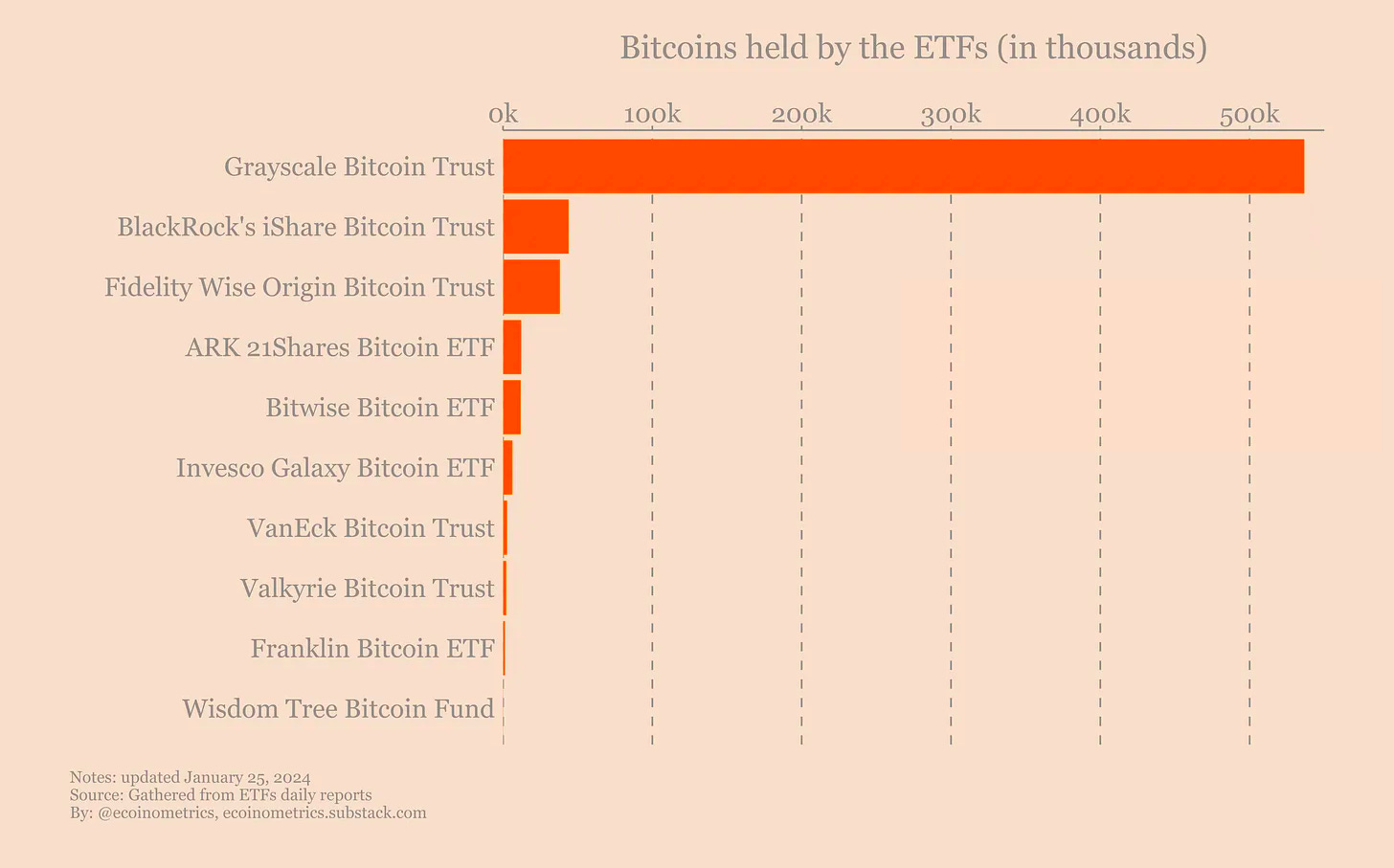

It’s now been three weeks since the goofy, stumbling launch of spot Bitcoin ETFs and by all accounts they’ve been a pretty massive success. Collectively they hold around ~637k BTC (~$27B) in assets under management, still mostly in Grayscale.

That represents ~3% of the total supply of Bitcoin – an amount fairly similar to the amount of total bitcoin held by GBTC at its peak. So collectively the ETFs have not taken very many coins off the market yet. In their first week of trading the ETFs collectively did ~$18B of volume, most notably in outflow from GBTC. Across all of the ETFs the total net flow so far has been +$824M. That’s approximately equivalent to ETFs investors buying all the new coins created by miners in that time.

Outflow from GBTC has been tapering off, implying that the pressure on Bitcoin price from people exiting GBTC may also be starting to ease. Fewer sellers would be good news for fans of number go up.

Collectively the Bitcoin ETFs have accumulated ~$27B of assets and are averaging a daily volume of ~$2-3B. By comparison the largest gold ETF has ~$55B of assets under management and a daily volume of ~$6B. That’s extremely impressive size and volume for such young ETFs, but it’s also hard to say how much their growth has been artificially juiced because the SEC dragged their feet on approval for 10 years. Volume may very well continue to drop off as the market settles into equilibrium.

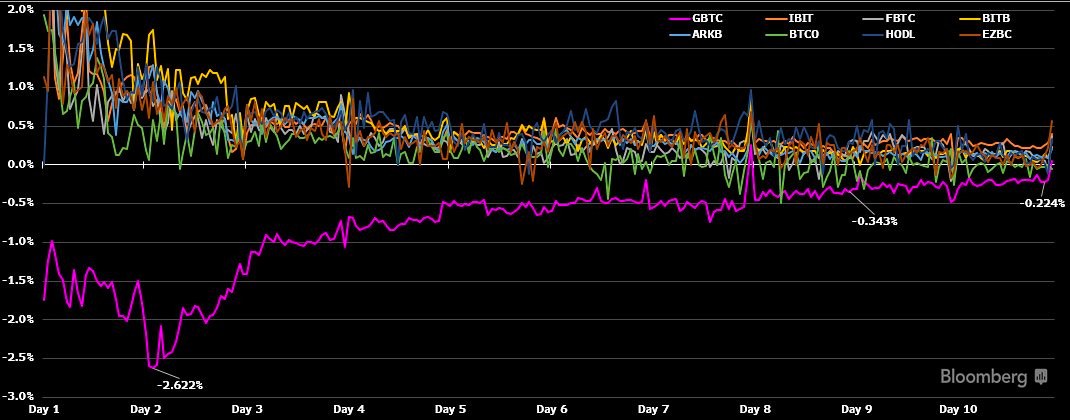

Another very healthy sign for the new ETFs is the collapsing discount/premiums relative to the underlying asset. The basic job of an ETF is to track the price of the asset it represents. The disappearing spread means it’s working as intended:

How to give a bank a nickel

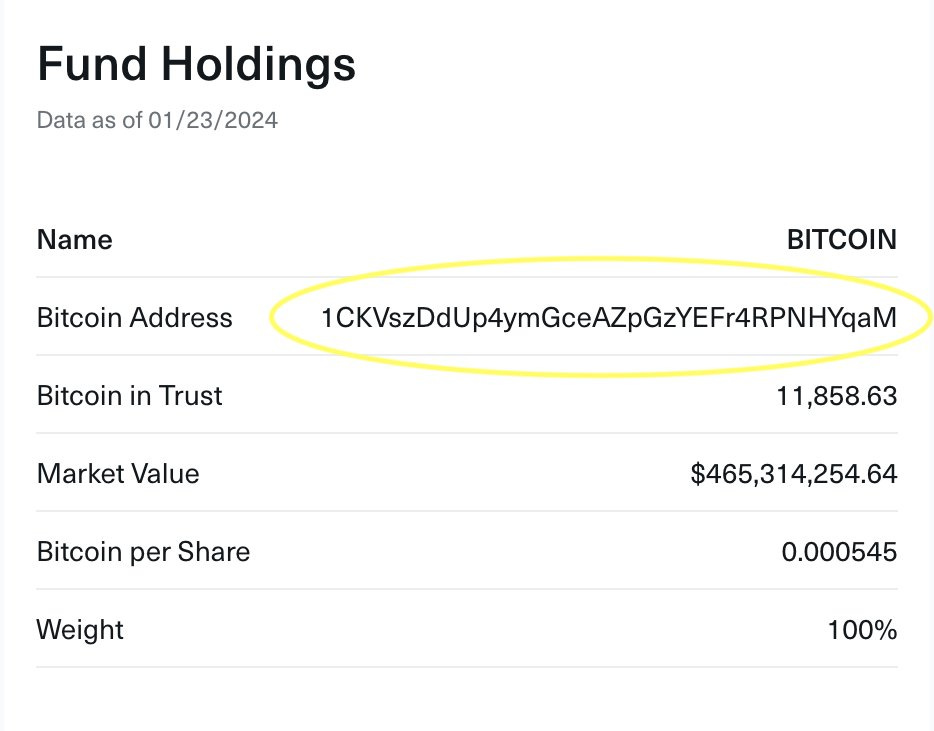

One of the interesting and unusual aspects of Bitcoin is its transparency. In traditional finance you have to either trust a company’s reports or trust the company they paid to audit their reports — but with Bitcoin anyone can audit the movement of assets for themselves. Everyone can peer into everyone else’s finances. Obviously that’s mostly a downside. Privacy is a major weakness of Bitcoin. But it can be useful.

One way that it is useful for example is when you want to prove that you really do have a certain amount of bitcoin, a practice sometimes known as proof-of-reserves. The Bitwise Bitcoin ETF (BITB) just published the cold storage address where their bitcoin is held, as a form of transparency intended to earn investor trust. You can be confident that Bitwise really does have all the bitcoin they say they have because you can count them for yourself — right here.

That level of transparency has some side effects. For example, the kind of address they are using (pay to public key hash or P2PKH) has been deprecated for several years now.1 It still works but it’s not as efficient and more importantly it doesn’t support multisignature — meaning the almost ~12k bitcoin Bitwise is managing are all secured by a single secret. So you can rest easy that Bitwise isn’t stealing from you but you should maybe worry about whether someone will steal from them.

More amusingly people are for some reason sending bitcoin to the Bitwise address unsolicited — which is a bit like finding out the mailing address of JPMorgan Chase and then using it to mail them a nickel. Some folks are chuckling at the idea of sending OFAC-tainted dust, but in Bitcoin incoming transactions are all individually separate, so any tainted payments can simply be quarantined and handled separately. That threat is much more interesting in an account-based system like Ethereum where distinguishing between individual units is much harder.

The worst case scenario for sending Bitwise tainted bitcoin is probably just some paperwork. I doubt they are worried about it.

Other things happening right now:

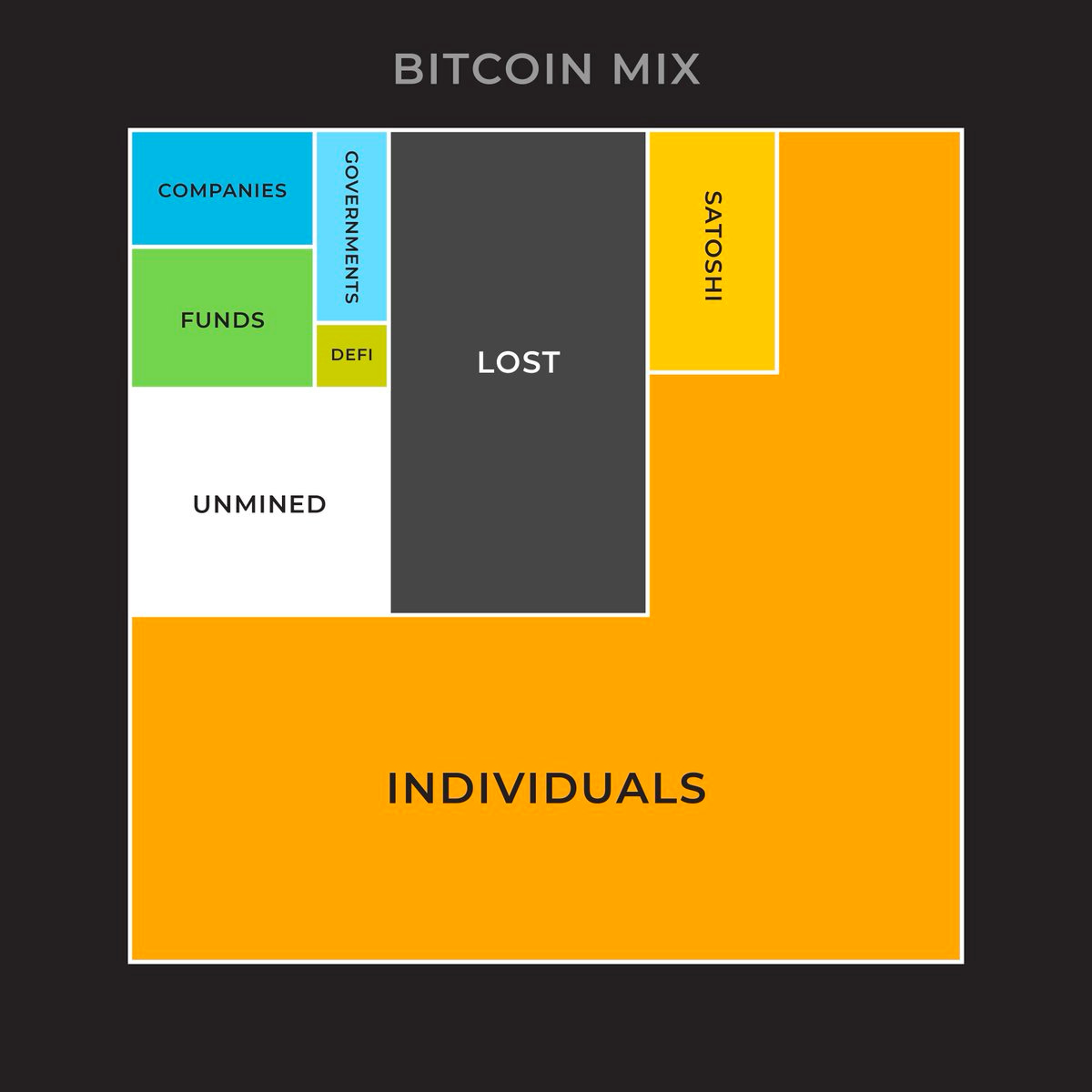

Last week I shared an interesting graph from BitcoinTreasuries.net showing the distribution of coins held by public entities like governments and corporations. Here is an interesting way of contextualizing that graph in a larger context. I don’t know the methodology they are using for "lost coins" but it matches my rough intuition.

SNL had a throwaway joke in Weekend Update this week making fun of Donald Trump for using the term debank. I’m no Trump fan but debanking is unfortunately very real (as we’ve talked about before) and Trump is using the term correctly in the clip. The Canadian Supreme Court actually just ruled that Trudeau violated the constitution by freezing accounts of protestors during the Freedom Convoy protests. Debanking is a bit like civil forfeiture: it’s so obviously evil that people can’t quite comprehend that it is real. It is, though.

An online pastor from Colorado has been charged with selling a $1.3M cryptocurrency scam token because God told him to do a home remodel. God also told him to hire a smart contract security firm to audit their code and advertise that audit — but not to mention the result, which was a security score of 0/10. Truly the Lord works in mysterious ways!2

If you are interested, here’s a good breakdown of the different Bitcoin address types.

God told me you should subscribe to Something Interesting.