Why do numbers go down?

The launch of Bitcoin ETFs unlocked new sellers as well as new buyers – but the sellers turned out to be less patient.

Inside this issue:

Why do numbers go down?

The best cryptocurrency for crime is still the dollar

Donald Trump is anti-CBDC, pro-Ordinals

Casual devs don’t survive the winter

Why do numbers go down?

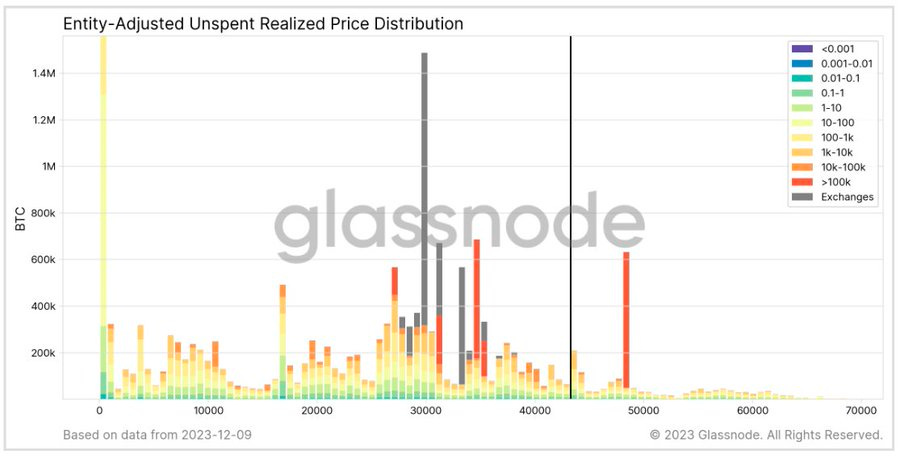

The graph above is a histogram of the amount of bitcoin that last moved at various Bitcoin prices. Since most (though obviously not all) bitcoin transactions represent someone sending bitcoin to someone else, the price of bitcoin at the time of the transaction is a decent proxy for the price the buyer paid. Looking at the on-chain data this way lets us estimate how many bitcoin holders are in profit and how many are still in the red.

The tall bar on the far left is all the bitcoin that hasn’t moved since the era before bitcoin had a meaningful price. The large gray blocks in the center are exchange addresses — they receive lots of bitcoin that they don’t own so they don’t help with this analysis. The interesting part of the graph is the large red bar at ~$48k/btc. The bar is red because it represents large transactions that contain >100k bitcoin.

So that bar is a single whale (or a small pod of whales) that acquired ~600k bitcoin at a price of ~$48k/btc, representing ~$28.8B worth of bitcoin purchased near the top during the 2021 bullrun and held for three years through a ~75% downturn. The graph above was from December 9th. Let’s check on how things look now:

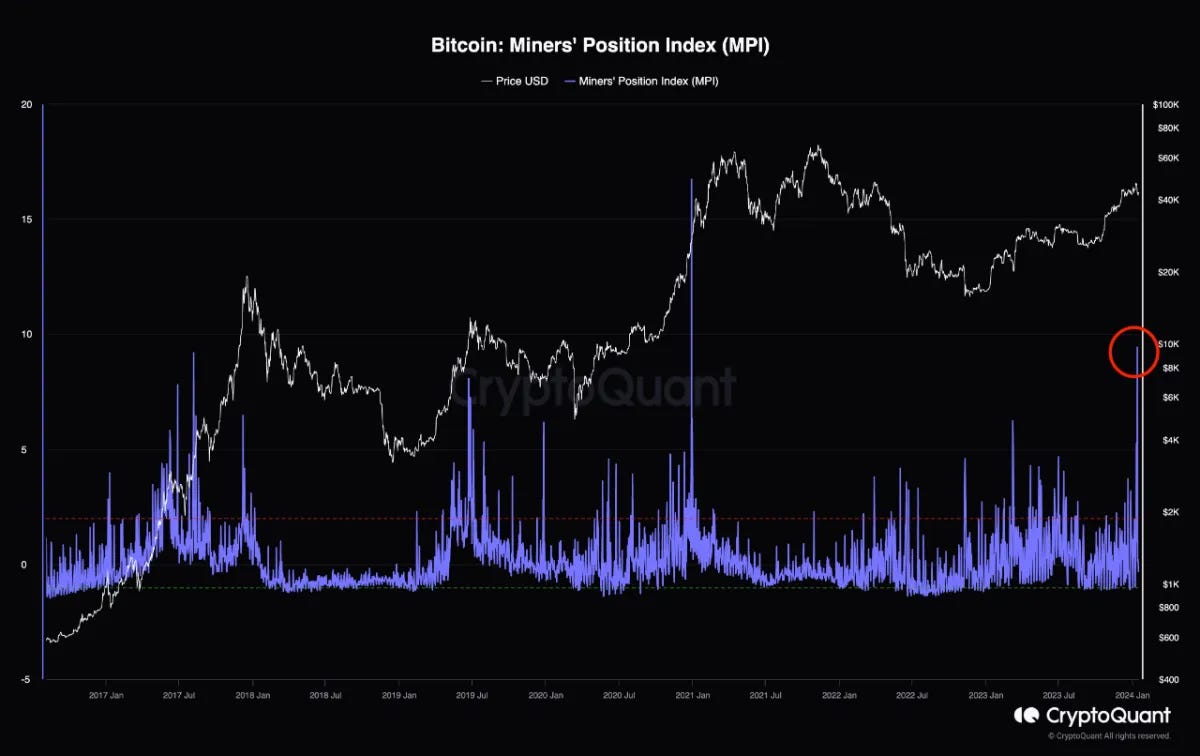

The bar is gone because those particular bitcoin have moved. My guess is that the reason Bitcoin’s price wicked up to briefly touch ~$49k/btc and then came crashing down is because this particular person sprinted for the exit as soon as they felt like the doors were open. Whoever this whale was, they aren’t alone — Bitcoin miners have been selling more aggressively now than at any time since January 2021.

Another group of motivated sellers is GBTC holders, who have been leaving GBTC at a rate of roughly ~$500-600M/day. We’ve talked already about how GBTC’s high fees will drive people into more cost efficient Bitcoin vehicles — but many GBTC holders may just want to exit Bitcoin exposure entirely. GBTC has been selling at a discount to the underlying bitcoin since February of 2021 (it got as low as -49% below par). Since converting to an ETF that discount has mostly disappeared (GBTC is now trading at only -0.5% below the price of Bitcoin). Some GBTC investors may feel like they can finally exit their position without paying a huge penalty.1

Much of the hype around ETFs has been about the idea that it would unlock new capital from retail and institutional buyers, but if that new demand does emerge it will take time. The sellers are already here and are much more impatient.

The best cryptocurrency for crime is still the dollar

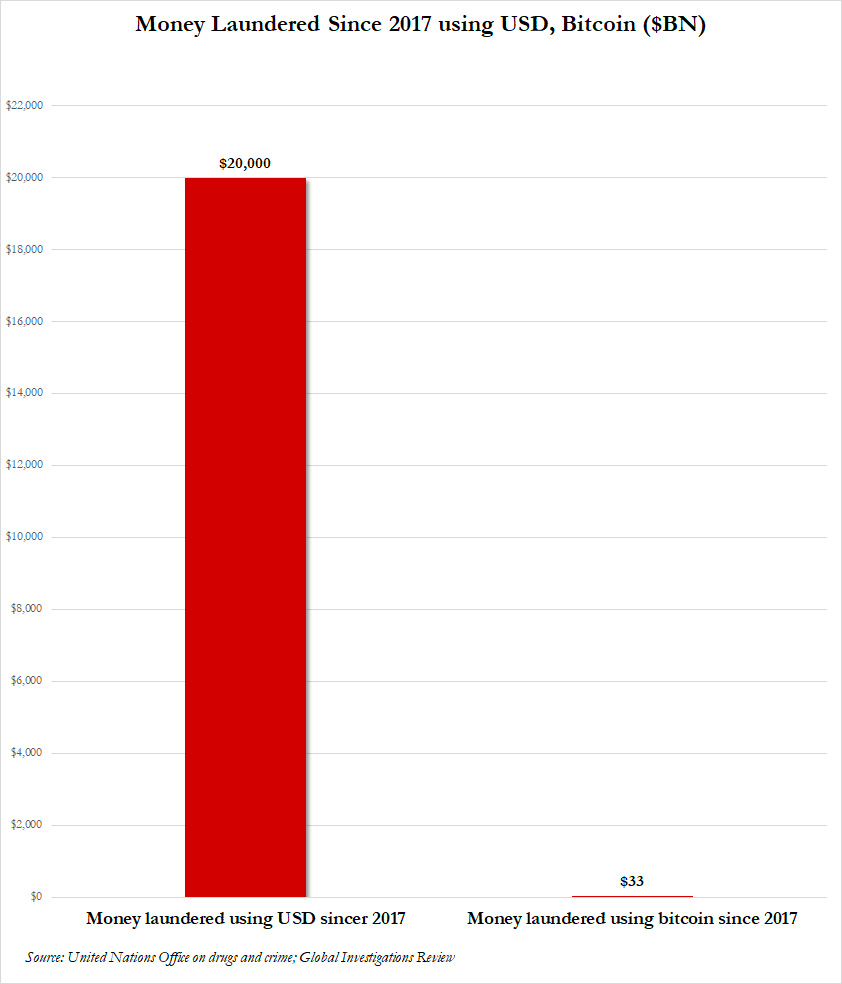

According to blockchain analysis firm Chainalysis’s annual crypto crime report there were roughly ~$24.2B worth of cryptocurrency transactions in 2023 used for illicit purposes like ransomware or evading sanctions. That’s ~0.34% of overall cryptocurrency transaction volume, down from ~0.42% in 2022. Roughly ~2/3rds of those transactions were done using stablecoins, particularly Tether (USDT) on the Tron network.

In other words, the vast majority of cryptocurrency activity is not criminal, the vast majority of criminal activity does not use cryptocurrency and even for criminals who do their crimes on a blockchain: the dollar is still their currency of choice. Someone should probably warn Jamie Dimon!

Other things happening right now:

At a stump speech in New Hampshire Donald Trump announced he would never launch a central bank digital currency (CBDC). Trump is however launching a new ordinals inscription collection based on his recent mugshot.

Here is a very interesting report from Electric Capital on the growth and shape of the developer ecosystem in the broader crypto industry. Particularly interesting to me was how the total supply of developers shrank (-24%) but the pool of experienced developers grew (+16%) — most of the attrition came from relatively new developers. This strikes me as amusingly parallel to the dynamics in bitcoin investing: those without conviction gets shaken out by the volatility — but anyone who survives their first bear winter is probably here to stay.

Here is a fascinating overview of the publicly disclosed bitcoin held by various world governments or companies, from BitcoinTreasuries.net. This represents around 2.1M bitcoin in total, or ~10% of the total supply.

Many GBTC investors may not have been seeking Bitcoin exposure in the first place — they might have just been betting on the discount disappearing after GBTC converted to an ETF. For those investors the trade is done and there is no need to move those profits back into a bitcoin denominated investment.