Justin Trudeau joins the Bitcoin marketing team

Plus Super Bowl ads, ewaste from Bitcoin mining and please don't eat paste.

In this issue:

Justin Trudeau joins the Bitcoin marketing team

Worthless trash you can sell for cash (reader submitted)

Bitcoin bull runs give companies FOMO

Justin Trudeau joins the Bitcoin marketing team

A thing that you have probably already noticed sometime in the last few years is that there is a global pandemic. It’s sort of a big deal. Overall everyone agrees that the pandemic has been bad for business and morale and is generally undesirable but there is some amount of disagreement about how best to handle it. Some people think we should use life-saving vaccines to protect the vulnerable, reduce the risk of hospitalization and control the spread of the disease. Others think we should eat horse paste in case the vaccine makes you magnetic.

In October of last year America and Canada established vaccine mandates for all truckers crossing the US/Canada border. They also established a four month grace period to allow truckers to become vaccinated. By the end of January that grace period had elapsed and an estimated ~85% of Canadian truckers had been vaccinated. The rest were no longer allowed to legally cross the border. That meant there were lots of angry truckers stuck in Canada with lots of free time and lots of big trucks.

Some of those truckers chose to express their frustration by driving to nearby bridges and parking their trucks there, forming multiple blockades along the US/Canada border. Politically these protests are a little hard to pin down. They are functionally a labor movement but they are generally seen as right wing. The truckers are Canadian but many are flying confederate flags. There are multiple distinct factions within the movement with different goals and priorities.

The protests have been largely peaceful — but they have been exceptionally disruptive to supply chains and hence bad for business. A good rule of thumb is that when a protest is bad for business it is illegal. Traditionally governments would simply go arrest the protestors — not for the protest itself but for illegally inconveniencing businesses. For example, it is illegal to park your truck on a bridge so police could arrest protestors for traffic violations.

Unfortunately arresting a trucker does not move their truck and most of the people who are licensed to move trucks are not excited about helping to arrest truckers. So largely the government has been unable to actually do much — it isn’t even entirely clear they could meaningfully satisfy the demands since the rule in question exists in both countries. That puts everyone in an awkward and expensive stalemate.

So Prime Minister Justin Trudeau decided to try something more aggressive:

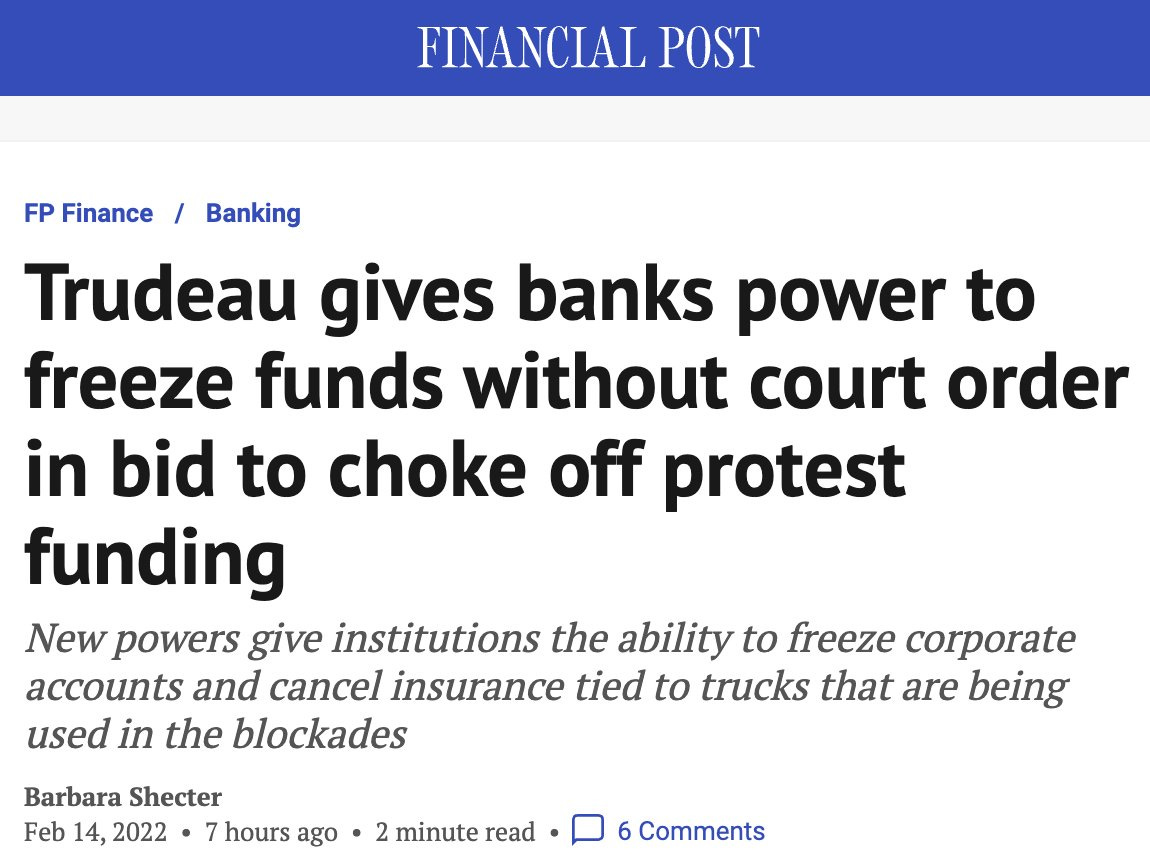

Specifically Trudeau invoked Canada’s Emergencies Act, which gives him enormous war-like powers for a short time. This is the first time the law (written in 1988) has ever been invoked.1 Technically the law gives Trudeau the authority to call in the military to evict the protestors by violent force — but he has promised not to do that. Instead he is directing banks, payment processors and crowd-funding platforms to freeze all payments/accounts suspected of involvement in the protests. No court order will be required and banks will be shielded from any civil liability.

To be clear this is an extraordinary step. Canada already has a legal procedure in place for blocking traffic and it does not involve freezing their bank accounts. Freezing money does nothing to move trucks off of bridges. It is simply a way of making it difficult for protestors to continue protesting while also buying food, paying rent and generally staying alive. It is a naked and unambiguous threat.

A frustratingly common misconception about Bitcoin is the idea that it only serves wealthy gamblers. I’ve written many times about how this isn’t true, how Bitcoin is already used by activists in Nigeria and Belarus, dissidents in Russia, unbanked Afghani women and journalists in Hong Kong. To people who live under stable governments with strong currencies these examples can seem distant and foreign, perhaps even a little forced. Canada using martial law to seize the wealth of otherwise peaceful political protestors is much harder to dismiss.

The banking system is a weapon that can be turned against you.

Worthless trash you can sell for cash

“This is being shared around as 'one of the best bitcoin/crypto critiques ever' but I can't figure out why. It's just .. more of the same old rehashed counterarguments. Not all of them are wrong, but nothing in there seems particularly groundbreaking. Do you get it?" — SO

I think there are a combination of factors that give this particular article momentum. It is written by the former Chief Scientist of graphics card manufacturer Nvidia. It is the transcription of a lecture given at Stanford. It was widely shared by the CTO of Microsoft. It is long and academic and has a lot of graphs and footnotes and citations. It carries a lot of weight of authority.

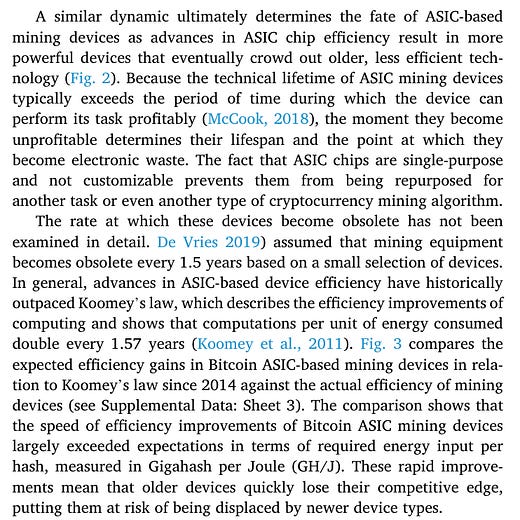

It is also, as you point out, pretty much just a laundry list of every anti-crypto argument of the last three years stapled together. A lot of it is stuff we’ve discussed many times on Something Interesting — Bitcoin’s energy use, problems with proof of stake or with Ethereum, etc. There are some pretty amusingly dated arguments like transaction rate or concentration of ownership. One thing I did want to highlight was this passage:

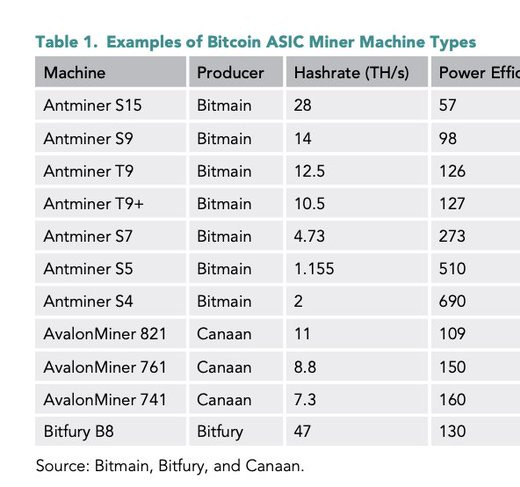

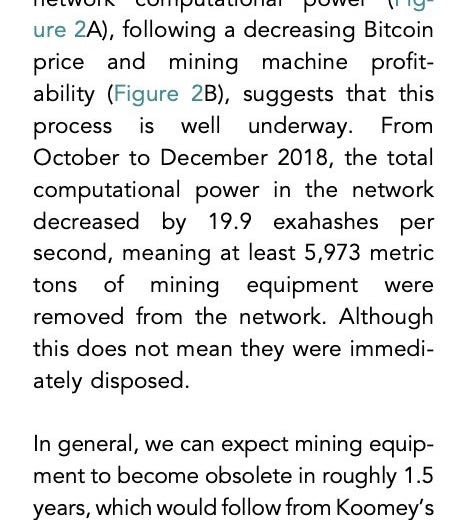

“Bitcoin's annual e-waste generation adds up to 30.7 metric kilotons as of May 2021. This level is comparable to the small IT equipment waste produced by a country such as the Netherlands. That's an average of one whole MacBook Air of e-waste per "economically meaningful" transaction. The reason for this extraordinary waste is that the profitability of mining depends on the energy consumed per hash, and the rapid development of mining ASICs means that they rapidly become uncompetitive. de Vries and Stoll estimate that the average service life is less than 16 months."

Longtime readers of the newsletter will recognize the name de Vries. He goes by the Digiconomist. His estimate for the lifetime of Bitcoin mining equipment is completely wrong and it is frankly very easy to see that. AntMiner S9s were released in 2016 and still account for ~25% of the mining network. Looking on eBay right now I can find used S9s for $500-700. 16 months is a complete fiction.

Public mining companies record their depreciation for mining infrastructure over 3 years and report that in practice it is usually longer. After that mining equipment that becomes uncompetitive isn’t retired it is sold to a miner with access to cheaper power (this is known as life-cycling). Finally mining equipment is almost entirely aluminum and contain no batteries and few toxic metals — so they are generally fairly easy to recycle and there is strong financial incentive to do so.

We can’t have a grown up conversation about the real environmental implications of cryptocurrency until people stop being content believing and repeating obvious lies.

Other things happening right now:

Here is a scary story about an impressively sophisticated social engineering attack aimed at stealing the treasury of a DAO. The resourcing and commitment of the attack are impressive but honestly I think the moral of the story is maybe don’t keep 42,000 ETH on the same ledger you use for testing new NFTs from friends? Just a thought.

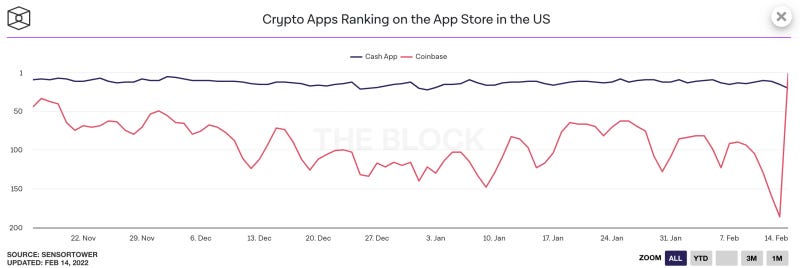

The Super Bowl was full of cryptocurrency advertisements including Coinbase’s floating cryptic floating QR code. The link was to a new user promotion but to make sure users knew what to expect from Coinbase they immediately crashed the servers. In fairness to them I don’t know how they could have expected a surge of traffic just then. It seems to have worked out, though. Coinbase’s iOS app has since jumped to #1 in the App Store.

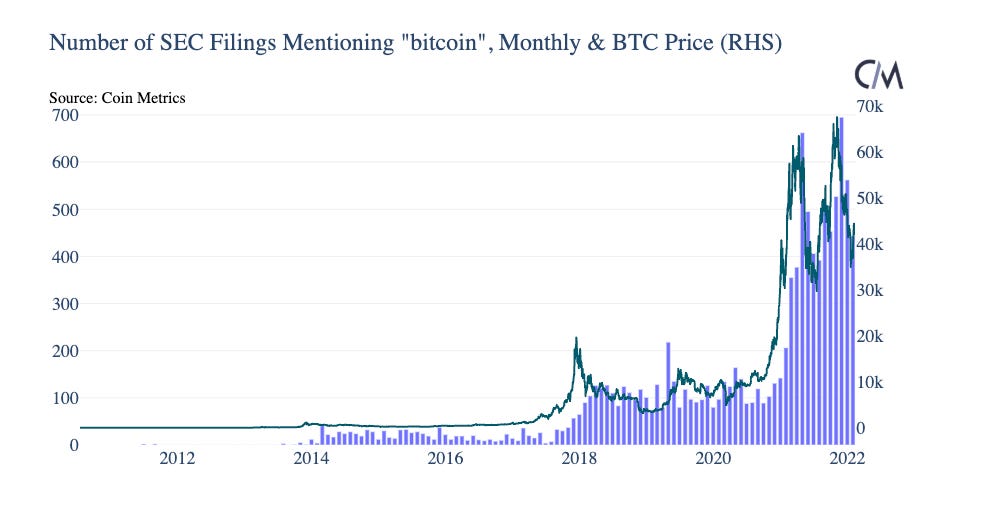

Here’s a fun graph showing that rising bitcoin prices are a leading indicator of companies mentioning "bitcoin" in their SEC filings. In other words surges in Bitcoin’s price cause companies to jump in, as opposed to companies jumping causing surges in Bitcoin’s price.

The predecessor to the Emergencies Act, the Wartime Measures Act, was invoked only three times: during WWI, WWII and by Peter Trudeau (Justin Trudeau’s father) during a political kidnapping and murder known as the October Crisis.