How to loan yourself money in a pinch

Plus the limits and virtues of maximalism and the hubris of the SEC

In this issue:

How to loan yourself money in a pinch

If only Bitcoin was made of palladium

The limits and virtues of maximalism

There is no such thing as an unbiased portfolio

How to loan yourself money in a pinch

The saga of deleveraging continues to play out across the crypto landscape. Blockchain.com just announced a ~$270M loss in a failed loan to Three Arrows Capital (3AC). Venture fund DeFiance Capital is pursuing legal action against 3AC for the same reasons. According to the lawyers managing the 3AC liquidation the founders of 3AC are in hiding. I don’t blame them.

Genesis Trading passed along some unstated liabilities to their investors the Digital Capital Group (DCG).1 CoinFLEX announced their loss to Roger Ver was ~$84M, almost twice as much as initially estimated — mostly because in selling off his positions they had to tank the price of their own thinly traded FLEX token.

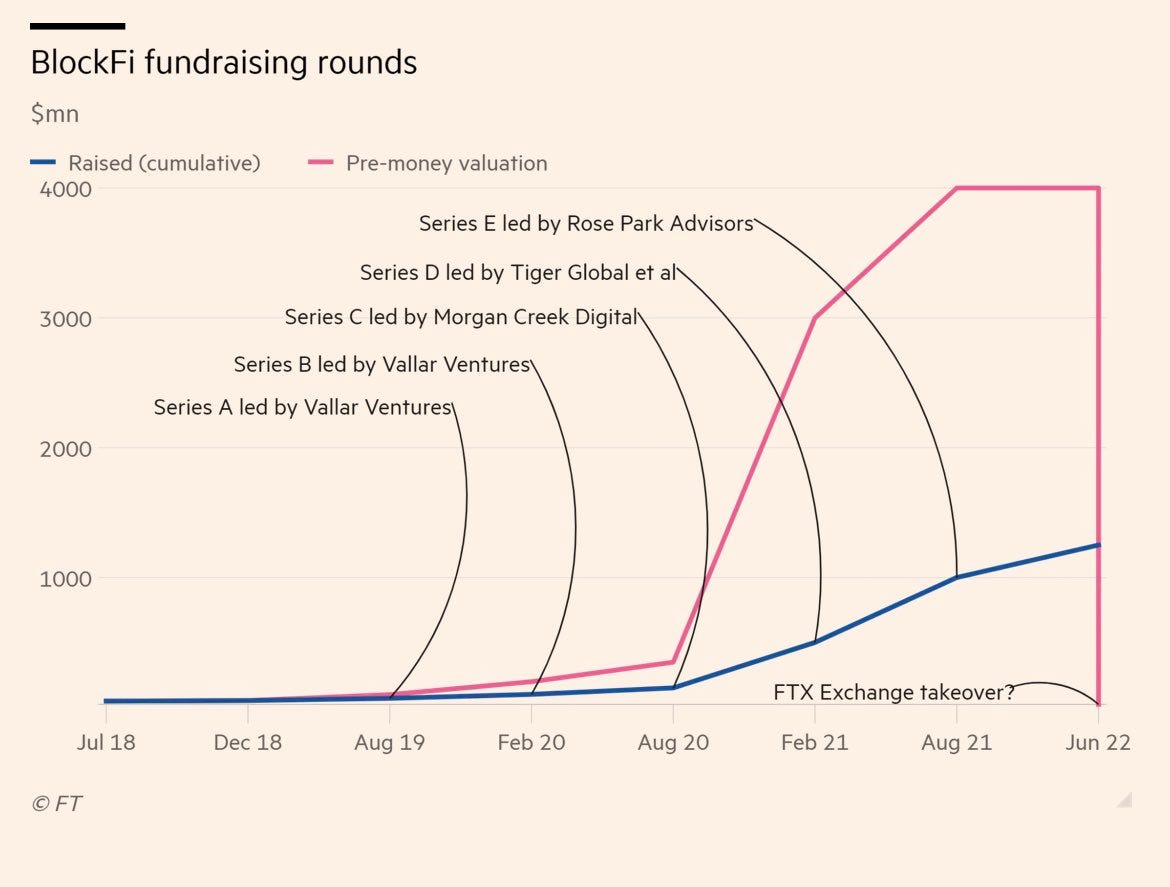

BlockFi announced the final terms of their bailout agreement with FTX which includes an option to acquire BlockFi for "up to $240M" based on performance rather than the $25-50M reported by CNBC last week. Assuming they hit those targets that’s ~10x better, but it still looks like this:

On Tuesday of last week Voyager Digital announced that it was filing for Chapter 11 bankruptcy. There are two ways to go bankrupt. One way is how Mt Gox went bankrupt — suddenly noticing you are out of money and you have no plan for how to deal with it. The other way to go bankrupt is how Voyager is doing it — by going to the court with an actual proposal for how much money is left and who should get it. That’s much better for Voyager customers in that they will get what remains of their funds much sooner — Mt. Gox customers are still waiting eight years later.

It is also much better for the rest of the market since the bankruptcy itself offers transparency into what is actually unfolding behind the scenes of the liquidity crisis. Voyager has enough assets to cover ~79% of their debts and plans to make up the difference with a combination of equity and residual claims on 3AC. In other words customers of Voyager will get most of their crypto back but will also become owners of Voyager and creditors of 3AC.

Slightly over half of the loans on Voyager’s books went to 3AC (hence the insolvency) but their second largest counterparty was Alameda Research — the same Alameda Research that offered Voyager $250M in emergency credit and also owns a 9.5% stake in Voyager’s equity. Alameda will take the same 20% haircut as Voyager customers on the loan and the equity they own will be zeroed out, but it bought Voyager time to unwind gracefully. Without that Voyager might have been forced to recall the loan to Alameda, which likely would have been even worse.

If this tangle of financial interdependency is confusing, you aren’t alone. The shadow banking system that has emerged around crypto is a snake eating its own tail. Even the founder of Binance is having trouble following.

If only Bitcoin was made of palladium

At the end of June the SEC (to no one’s surprise) formally denied Grayscale’s application to convert GBTC into a spot Bitcoin ETF. Grayscale immediately filed a lawsuit the next day seeking review of the decision. The SEC refused GBTC’s application on the grounds that Bitcoin is largely traded on unregulated marketplaces and therefore at risk of price manipulation — but on careful examination that logic starts to look pretty inconsistent. For one thing there are lots of ETFs that have no US regulated market (like index funds for foreign markets), highly volatile assets (like rare metals) or are incredibly thinly traded (like corporate bond ETFs).

The SEC has created a higher standard for Bitcoin ETFs and it hasn’t articulated a clear argument for why — but more importantly it isn’t clear that standard is even possible to fulfill. The SEC has approved a Bitcoin futures ETF in October of last year (we talked about it at the time) and the futures ETF uses the same reference price for Bitcoin that a spot ETF would — meaning it has all the same risks of manipulation.

The only substantive difference between the futures ETF and a spot ETF are that (a) a futures ETF is much more expensive and worse for long term investors and (b) futures are traded on SEC regulated exchanges but spot bitcoin is not. In other words the SEC seems to be refusing to approve any spot bitcoin ETF until it is given new authority to regulate bitcoin exchanges — effectively holding GBTC investors hostage and ransoming them off for new regulatory powers.

The SEC’s approach to cryptocurrency seems to be uniquely hostile. Congress is approaching cryptocurrency with cautious, bipartisan optimism. The Biden administration issued an executive order asking its agencies to "address the risks" but also "harness the benefits" of cryptocurrency. Meanwhile the SEC is expanding the definitions of 'exchange' and 'dealer,' doubling the size of its "Crypto Assets & Cyber Unit" enforcement team and denying spot ETF applications.

It seems likely that this expansive approach to SEC authority will run directly into the recent Supreme Court ruling limiting the authority of the EPA. Leveraging its existing regulatory authority to pursue authority in new domains is basically the SEC doing exactly what the Supreme Court ruled the EPA could not. One assumes they will eventually be dragged to court and told to knock it off.

I put together a short survey to better understand Something Interesting readers and what you are looking for in Something Interesting. The whole survey is only 10 questions long and you can skip every question except the first one. I am *already* grateful for your readership but I would *also* be grateful for your feedback!

Other things happening now:

Bitcoin Twitter discourse has been overtaken by discussion of Nic Carter’s apostasy from the cult of Bitcoin maximalism. I wrote a piece for paid subscribers about both the limits and virtues of maximalism but I took down the paywall because it felt strange to link to a paywalled post when debating with people on Twitter. "Toxic maximalism" is abrasive but harmless. The real predators in crypto are usually polite.

The United States Office of Government Ethics released a legal advisory that officially concludes existing de minimis exemptions do not apply to cryptocurrencies and so there is no amount of cryptocurrency small enough to not count as a conflict of interest: owning even a single satoshi (currently $0.000219) is disqualifying. In other words, literally any attempt by a government official to use a cryptocurrency before regulating it would be inherently unethical. That’s absurd — imagine a rule that said ethical traffic laws could only be designed by people who never drove. There is no such thing as an unbiased crypto portfolio — everyone decides how much to invest in crypto and everyone is potentially biased by that decision. Treating crypto as inherently sinful does nothing to prevent bias — if anything it ensures it.

The bankruptcy proceedings of the failed cryptocurrency exchange Mt. Gox are reaching a climactic moment as ~142k bitcoin (~$3B at time of writing) are about to be released to various creditors, mostly users of Mt. Gox at the time of the infamous hack. That’s only around ~20% of the ~700k bitcoin lost in the hack but the price of Bitcoin rose ~21x over that same timeframe. Presumably at least some of those coins will be immediately sold by former Mt. Gox users grateful for the chance to finally take their money and go.

In May of 2019 Facebook (now Meta but at the time still Facebook) announced a plan to launch a sovereign stablecoin (Libra) and accompanying wallet (Calibra). By July Zuckerberg was testifying in front of Congress and by February Libra (now Diem) was shuttered and Calibra (now Novi) was shedding executives. At the time I said, "I’m guessing Novi will stagger forward zombie-like for a few more years until it is eventually quietly cancelled. I’m not sure anyone will notice." I was wrong twice! Facebook cancelled Novi only a few months later and I actually did notice. Here’s a cake for the Novi team:

Digital Capital Group owns both Genesis Trading and the Grayscale Bitcoin Trust (GBTC) so most likely what Genesis did was give DCG both bitcoin denominated debt and GBTC denominated assets. Since DCG actually owns GBTC they are uniquely able to ignore the discount on secondary markets right now and treat GBTC as equivalent to the value of the bitcoin it represents. DCG can ignore the GBTC fees (since they are paying fees to themselves) and simply wait for GBTC to become an ETF or if they decide they don’t want to wait anymore they can dissolve GBTC and withdraw the bitcoin whenever they like. Moving GBTC shares from Genesis’s books to DCG’s books basically eliminates the loss that Genesis incurred when the GBTC premium collapsed.