A rare moment of optimism in crypto regulation

Plus a short story about unpredictable eggs and the NYTimes is worried about 2011

In this issue:

A rare moment of optimism in crypto regulation

How trustworthy is the NYTimes, really?

A short story about unpredictable eggs

Bitcoin is a tool for human freedom

A rare moment of optimism in crypto regulation

This week Senator Gillibrand (D-NY) and Senator Lummis (R-WY) unveiled the Responsible Financial Innovation Act, a comprehensive bill proposing a foundation for integrating the crypto-economy into the existing legal and regulatory framework. The bill is sweeping in scope, serious and bipartisan — it looks like legislation that was written to actually pass, not just grandstanding.

No policy proposal this broad is beyond critique but at first glance it seems like a thoughtful and reasonable approach to me. The bill as written enshrines a formal right to self custody into law and make transactions under $200 tax free, basically acknowledging the right to use cryptocurrencies as currency.

There are some wonky but important improvements. Deferring taxation from staking or mining rewards until gains are realized is a more consistent and sensible way to handle taxing miners, validators and anyone who is given an involuntary airdrop. There are new consumer protection provisions that forbid enterprises from commingling customer and business funds, or rehypothecating them.1 It also adds a lot of important clarity and legal definitions2 as well as a host of new reporting requirements for cryptocurrency enterprises.

The most interesting thing the bill does of course is define what makes a token a security (governed by the SEC) or a commodity (governed by the CFTC). In essence a token is a security if it represents: debt, equity, liquidation rights, entitlement to interest or dividends, profit or revenue sharing and any other financial interest in a business entity. A token that does none of those things (Bitcoin or Ethereum, for example) is considered an 'ancillary asset' and is effectively a commodity.

That’s great news for Bitcoin and Ethereum but pretty bad news for a lot of DeFi projects built around the idea of repackaging revenue flows in novel ways. As written the law would classify liquidity provision tokens, decentralized lending platforms and most governance tokens as securities. The law also doesn’t really consider decentralization in any serious way, which leaves behind some confusing questions.

At what point does a project become decentralized and who is accountable for the project up to that point? Who should be accountable for the reporting requirements for a decentralized exchange? If a DAO never incorporated are they a general partnership, where everyone with a token is sharing liability? Is it possible to make a truly decentralized financial application that no one is responsible for? These are unsatisfying open questions for fans of DeFi.

Still, I think this is a large, unambiguous step in the right direction overall. The bill is large enough that it will likely split into several smaller bills in order to wind through various congressional committees over the next year or so. In that time most of the specifics of the proposal will be negotiated and tweaked making it difficult to predict what the final provisions will actually look like. But the underlying intent of the bill is clearly positive: regulatory clarity, consumer protection, encouraging innovation. I’m cautiously optimistic!

How trustworthy is the NYTimes, really?

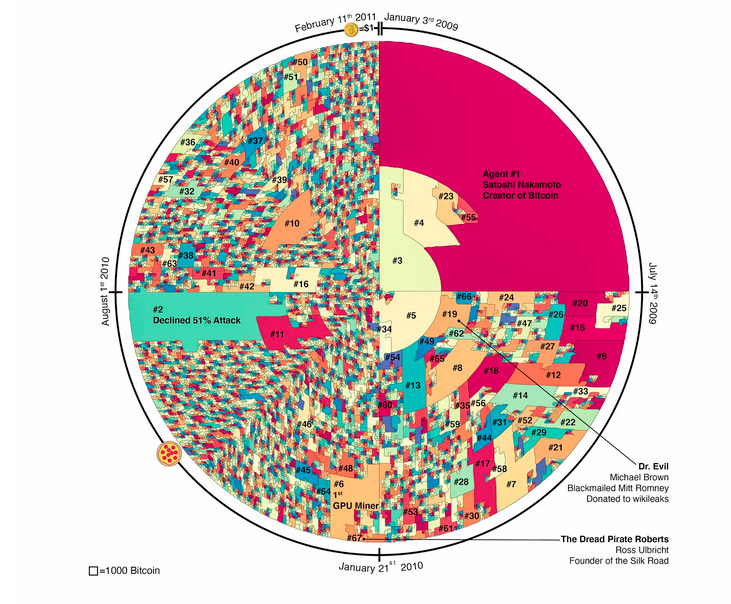

A new research paper was released this week that studies some data that leaked from early mining techniques to better understand the very early history of who was mining Bitcoin. In particular they focus on the era where Bitcoin was worth less than $1 USD and they identify the 64 largest miners of that period. They note in particular that at several points in that period there were miners who had amassed enough mining power to 51% the network but chose not to.3

That’s interesting, assuming you are a crypto nerd like me! But it honestly isn’t very meaningful. Bitcoin mining was non-competitive in the era before Bitcoin achieved commercial value. It makes sense that early adopters were more motivated by curiosity or ideology than greed — Bitcoin just wasn’t valuable enough yet to be worth exploiting in that way. The early days of the network were not decentralized — but that has always been obvious. This isn’t really new or newsworthy.

Unless you’re the New York Times! Then it’s literally a 4000 word cover story for the print edition under the headline, "How trustless is Bitcoin, really?"

Personally I think anyone buying Bitcoin in 2011 got a pretty good deal in retrospect, but maybe that’s just me. Anyway, here is an unrelated New York Times article from 1985 all about how no one actually needs a laptop computer.

Other things happening right now:

This lawsuit against cryptocurrency exchange Gemini from IRA Financial Trust (a retirement account company) is pretty wild. Apparently an attacker called in a fake kidnapping threat to distract the IRA office, stole the IRA master key from Gemini and used it to steal ~$37M worth of crypto and withdraw it without setting off any alarms at Gemini. The IRA is suing Gemini for not having enough safeguards and not properly explaining the security implications of the key, which was apparently being passed around unencrypted on multiple email threads. 🤦

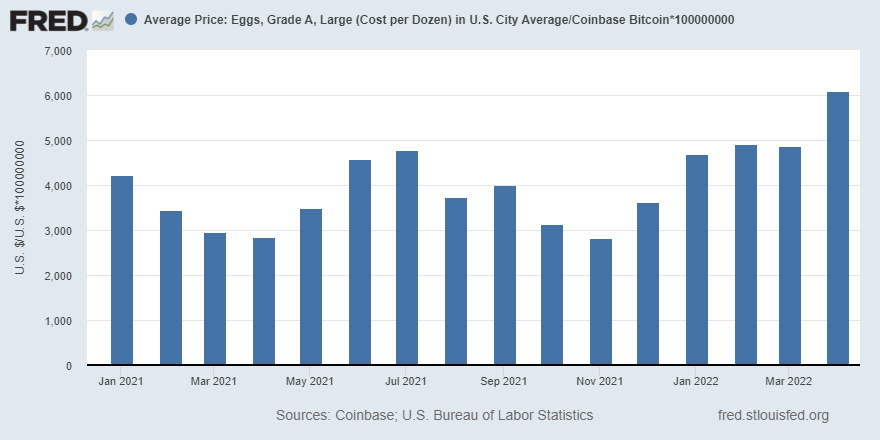

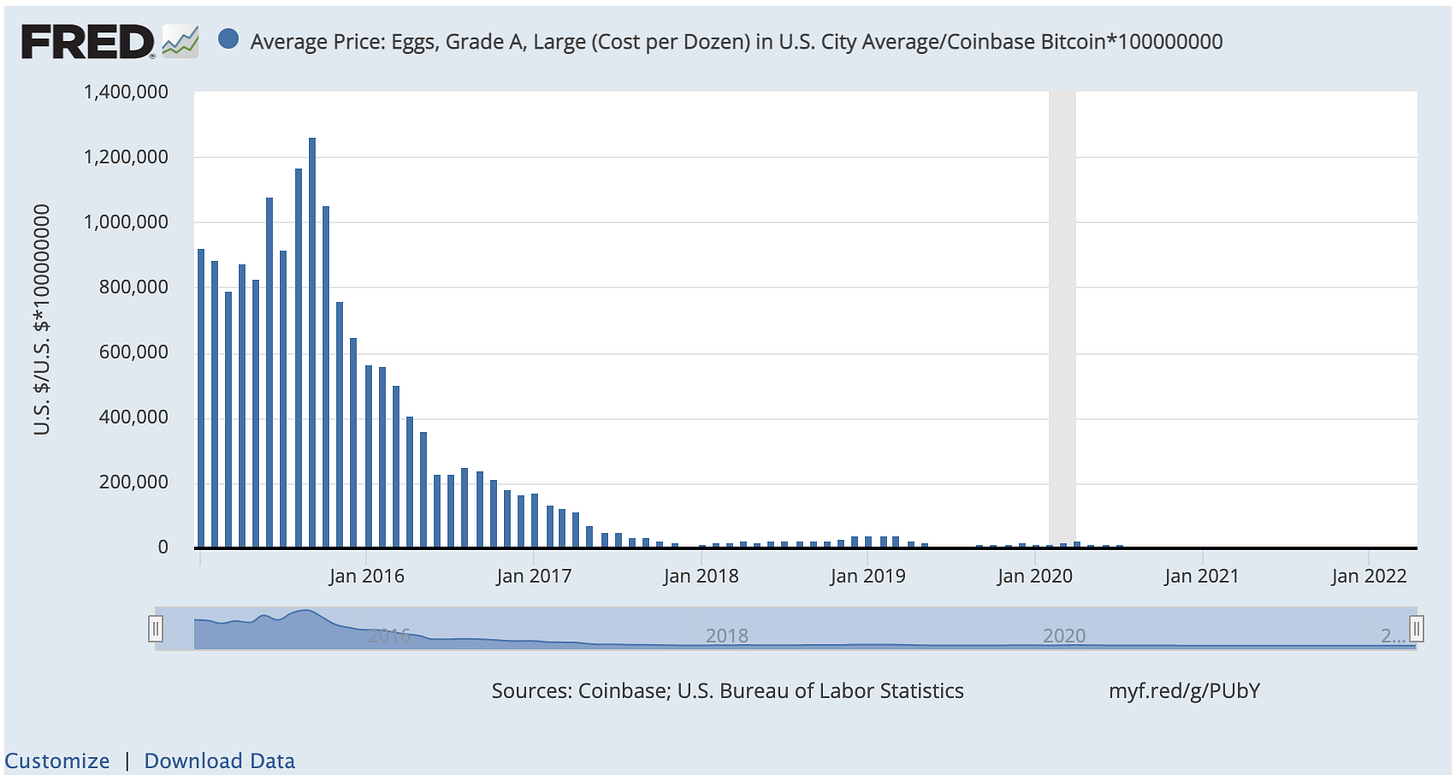

Here is a post from the St. Louis Fed featuring a graph of the price of eggs as an example of how bitcoin’s volatility makes it less useful as money, since it makes purchasing eggs less predictable:

And here is the exact same graph, zoomed out:

Last week I made fun of the open-letter published at concerned.tech by a group of concerned.trolls, which denounced the crypto industry and urged Congress to regulate it or perhaps outlaw it entirely. This week Alex Gladstein of the Human Rights Foundation published a counterpoint from a group of human rights activists at financialinclusion.tech, arguing that Bitcoin (and related projects) were important tools for freedom around the world.

Ethereum’s Merge to proof-of-stake is now live on the Ropsten test network. So far there have been no major disruptions to the testnet. There are two more major testnets that will launch before the mainnet Merge, which devs are currently estimating will happen in Q3 of 2022.

Rehypothecation is a fancy word for using the same asset as collateral in multiple loans. It’s the sort of thing that definitely sounds illegal but somehow isn’t.

A debate around the precise legal definition of the word broker arguably kicked off the debate that culminated in this piece of legislation.

A lot of the coverage implies these mining blocs were literally individual people, but that’s not necessarily the case. They could easily have been early versions of what would later become mining pools, where teams of miners pool their resources to smooth out the volatility of the rewards. The earliest public mining pool (slushpool) launched in December of 2010, so the timing is roughly right.