How to buy BlockFi at a discount

And why no one else wants to

In this issue:

How to buy BlockFi at a discount

Don’t blame us blame Roger Ver

How to restore confidence in the Zimbabwean dollar

Using a blockchain to fight war crimes

How to buy BlockFi at a discount

Bitcoin just finished its worst month of price performance ever, having fallen ~36% from ~$31.5k/BTC at the beginning of the month to ~$20k/BTC at time of writing. The ongoing failure of crypto lending institutions is continuing to unwind.

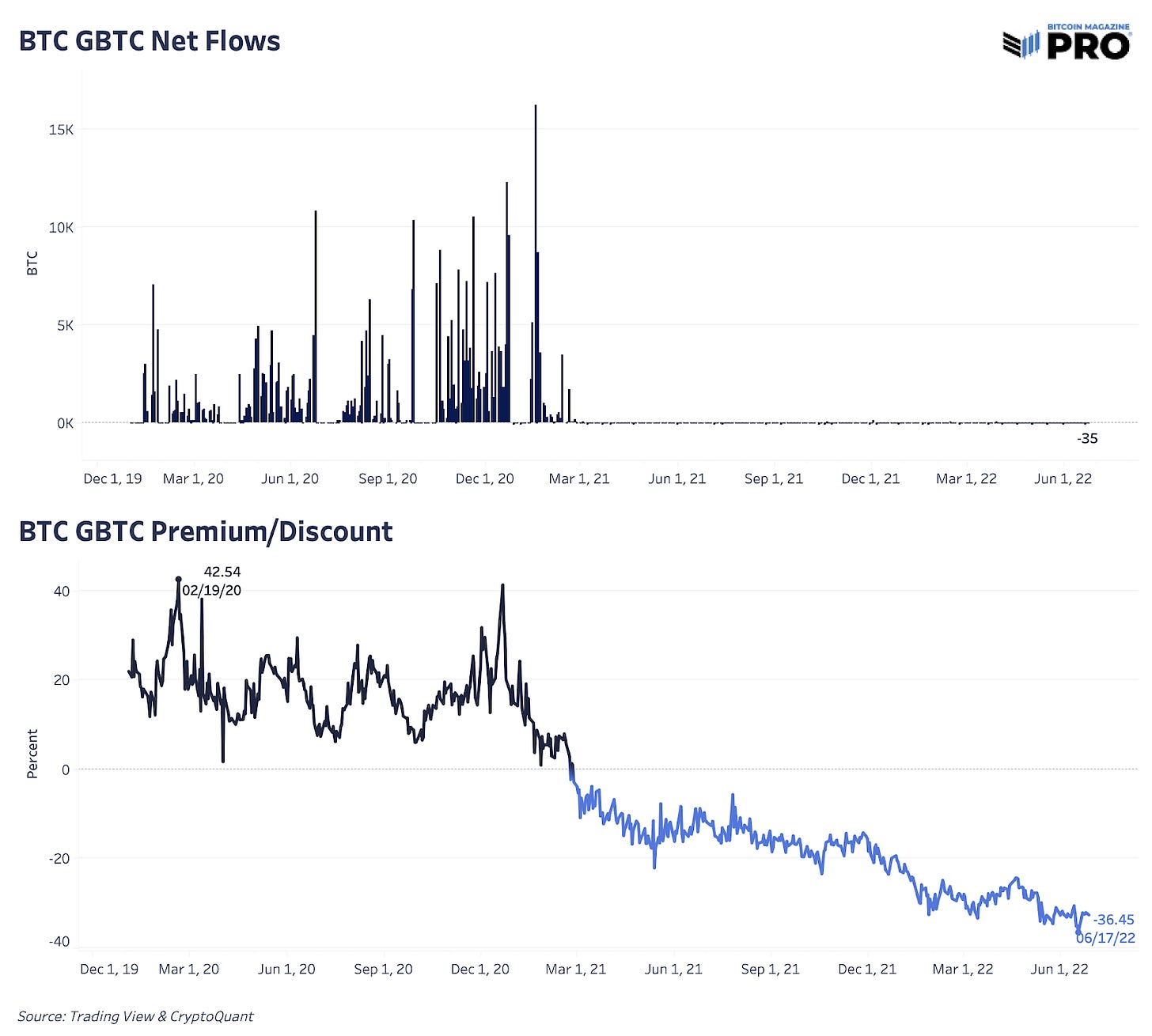

Market maker and lending firm Genesis Trading (who power Ledn and Gemini’s Earn products) is reportedly facing nine figure losses in failed loans to Babel Finance and Three Arrows Capital.1 The GBTC discount that we’ve written about a bunch recently reached an all time low of -36% below asset value, putting even more pressure on the firms (like BlockFi and 3AC) caught on the wrong side of that trade. Here’s what that has looked like over time:

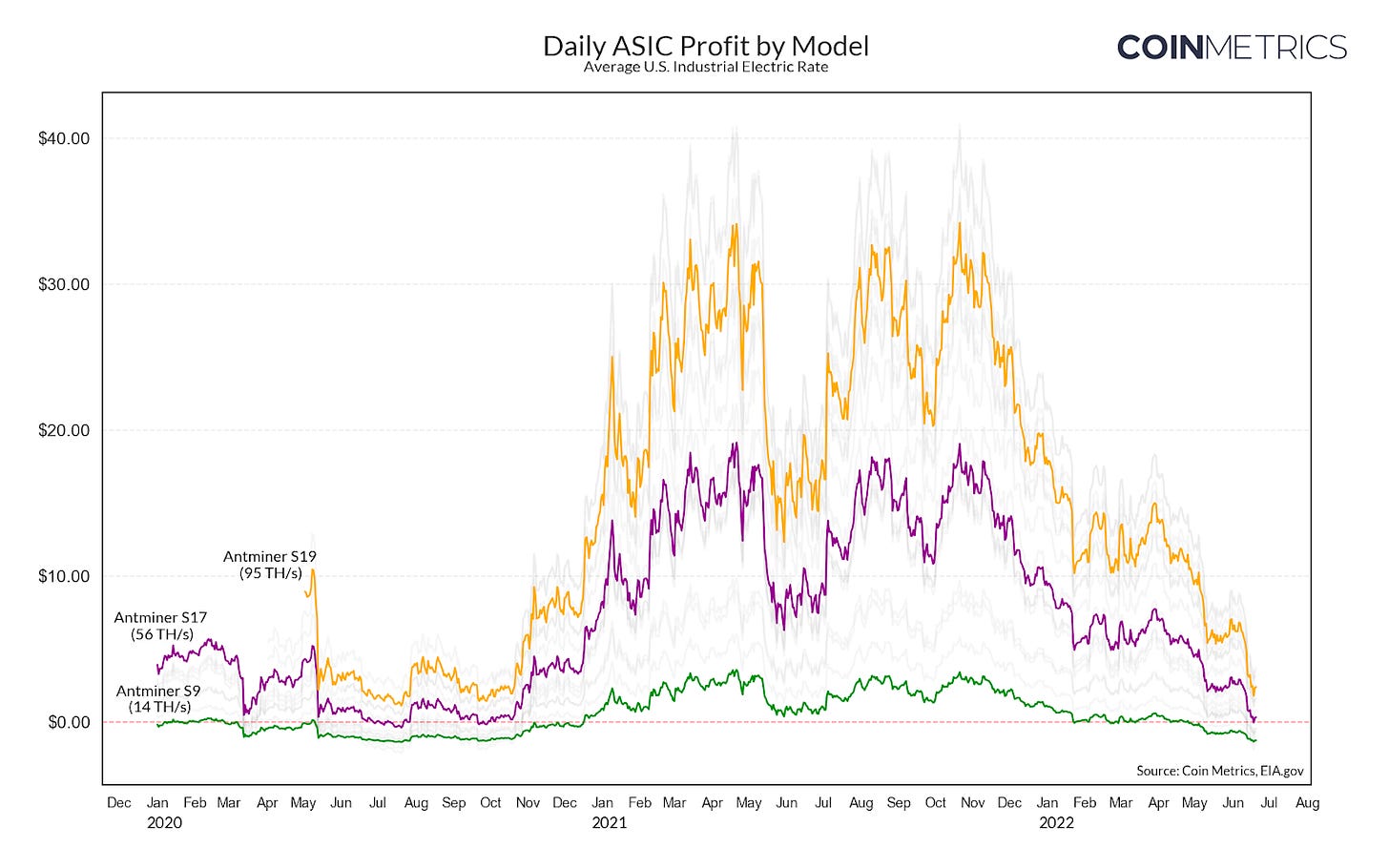

Bitcoin miners are also under strain. So far they’ve sold ~9k bitcoin (~$180M) out of their treasuries. The CEO and CFO of hosted mining company Compass Mining both abruptly resigned. According to CoinMetric’s estimates most US-based miners are barely above profitability, those with older equipment are already unprofitable. A lot of that equipment was bought with borrowed money (publicly traded miners carry ~$2B worth of debt), so some miners are also facing the threat of liquidation.

We talked in the last post about how BlockFi was frantically trying to raise money to stave off the collapse of the business — but they didn’t get any takers. Instead CNBC reports that BlockFi is selling itself to FTX for somewhere between $25-50M — more than 99% down from their Series E evaluation at $4.8B in 2021. CEO of BlockFi Zac Prince denies that but his denial is suspiciously specific to the price.

If BlockFi did accept such a drastically lower price that would imply that they probably had no choice — i.e. that they were already bankrupt and FTX was the only bidder. BlockFi already owed FTX ~$250M from an emergency line of credit they opened during the crisis, which means any other buyer besides FTX would have to pay back that ~$250M loan on top of the acquisition price. FTX can just forgive the debt to themselves.

FTX would likely be taking on a negative balance sheet from BlockFi even after forgiving their own loan so this isn’t really an asset sale. Instead FTX would be buying some combination of the brand, the employees, the customer lists and most importantly the regulatory coverage. BlockFi has already settled with the SEC over their investigation, making them one of the only companies in the space that has reasonable legal clarity about their loan products.

Apparently some combination of those things is worth ~$25-50M — or more precisely, $25-50M plus whatever amount of the ~$250M loan FTX could expect to recover from BlockFi minus whatever amount of bad debt remains on BlockFi’s balance sheet at time of acquisition. Not a great price! But it could be worse. FTX apparently considered making a similar offer to failed crypto lender Celsius Network but balked when they found a $2B deficit in the balance sheets. $25-50M looks terrible compared to $4.8B but it looks pretty good compared to -$2B!

Don’t blame us blame Roger Ver

Some of the stories coming out of the Great Deleveraging are interesting because of their scope and impact, but others are just interestingly petty. Particularly awkward is the dispute between Bitcoin Cash founder Roger Ver and lending platform CoinFLEX, which froze customer withdrawals a little over a week ago. CoinFLEX claims that Ver owes them ~$47M of USDC. Ver on the other hand denies it and claims that actually CoinFLEX owes him money. Probably neither of them have the money to give each other anyway.

Normally when someone defaults on a loan to a bank the bank loses money — but crypto companies are creative! Instead CoinFLEX took a page from the Bitfinex playbook and socialized the loss among its users instead by releasing a token called "Recovery Value USD" (rvUSD) pegged to the value of whatever funds they are able to recover by suing Ver.2 Passing along your losses to your customers isn’t really legal of course but it did seem to work out for Bitfinex for some reason.

Something Interesting is able to remain an independent, ad-free newsletter thanks to support from readers like you. Consider becoming a subscriber!

Other things happening right now:

The EU has finalized a set of proposals for regulating cryptocurrency that we first talked about back in July of last year. The final proposals will impose the so-called "travel rule" on cryptocurrency transfers between two regulated digital wallet providers — meaning that banks and exchanges will need to report the name and address of anyone their customers attempt to send money to but that ordinary citizens won’t be obligated to do the same.

Zimbabwe’s government estimates the country’s current annual inflation rate is roughly ~191.6%, but they have a plan! The central bank announced that the benchmark interest rate (currently the highest in the world) would more than double to ~190%. No doubt that will restore market confidence in the strength of the Zimbabwean dollar.

The Bitcoin blockchain is being used by activists in Ukraine to collect and preserve digital evidence of war crimes in Kharkiv. By recording a hash of the photographs (and other evidence) on the blockchain using OpenTimestamps they will be able to prove the photographs weren’t taken at some later date. The archives of evidence gathered are also stored in a decentralized way on Filecoin and Storj to make sure they remain available.

Here is an interesting story about Vibe Bio, a DAO that is organized around trying to raise funds to sponsor research into rare diseases. I am mostly not a believer in DAOs and I’m not sure this approach is actually viable, but it is certainly a worthy target and one thing that DAOs are quite well suited for is exploring new ways for a small, highly committed group to build new kinds of economic incentive alignment. I’ve heard dumber ideas.

In an amusing detail Genesis Trading is owned by the Digital Currency Group, Barry Silbert’s crypto-focused venture firm — which also owns CoinDesk the news outlet that broke the story about Genesis's losses.

Yes, the naming of rvUSD is a deliberate shot at Roger Ver.