How to domesticate Bitcoin

The fight to kill Bitcoin is over. The fight to control it has just begun.

Inside this issue:

How to domesticate Bitcoin

How to sell bitcoin to boomers

How to domesticate Bitcoin

Towards the end of February I wrote two posts (Has Bitcoin lost it's soul? and Who will watch the watchmen?) in response to a reader question about whether the rise of Bitcoin ETFs meant Bitcoin had been co-opted by Wall St. The second post was only available to paid subscribers at the time (I’ve taken down all my paywalls since) so if you haven’t had a chance to read it yet I encourage you to check it out.

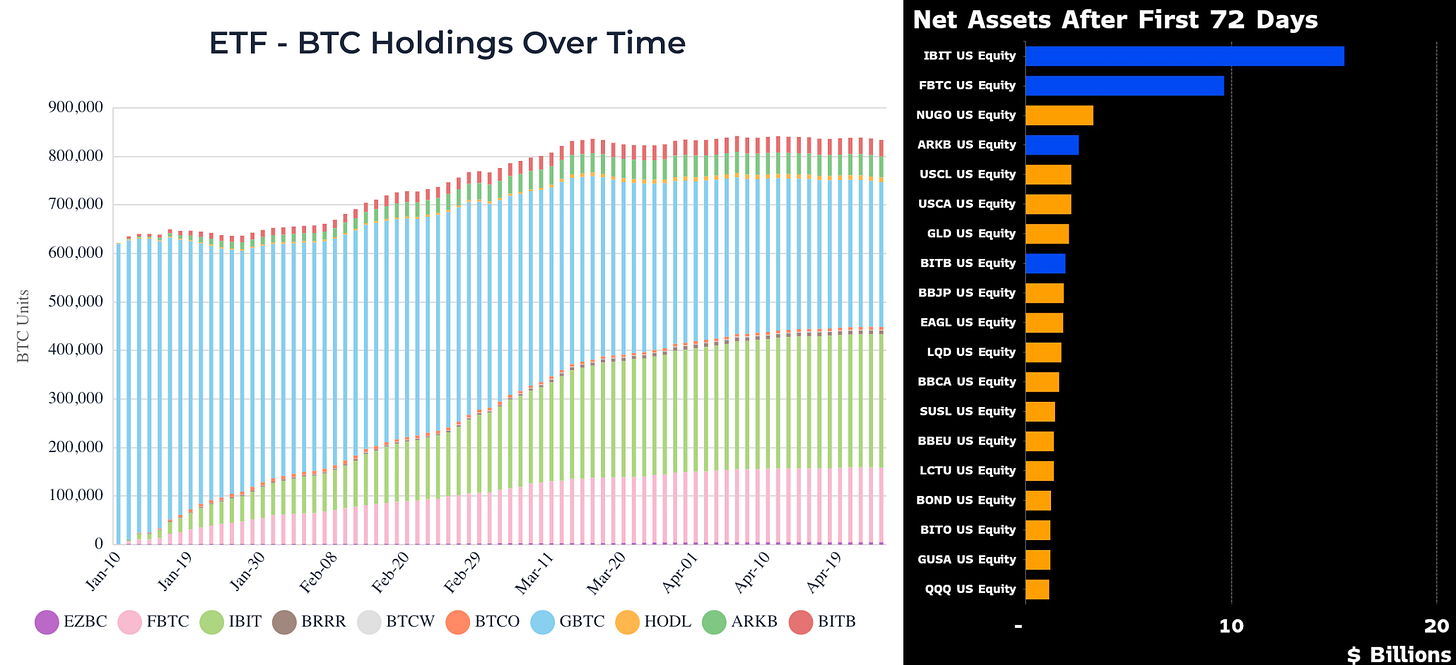

Since then Bitcoin ETF growth has slowed down. The Blackrock Bitcoin ETF ($IBIT) finished its 71 day streak of inflows (the #10 longest streak of positive flows in ETF history) and the total ETF holdings are stable at ~830k BTC (~4% of all Bitcoin). To be clear, this is still incredible growth: compared to other ETFs after their first 72 days Bitcoin ETFs are the first, second, fourth and eighth largest ever. By any reasonable standards Bitcoin ETFs have been an enormous success — but they do seem to have hit a plateau, at least for now.

In my opinion, the success of Bitcoin ETFs has pretty much cemented Bitcoin’s position as a legally recognized asset in America. Blackrock is the literal embodiment of establishment wealth and influence — Congress isn’t about to outlaw their most successful new line of business. Trying to explicitly ban Bitcoin in America is probably already politically impossible.

But that doesn’t mean the struggle over Bitcoin is over — if anything it’s the opposite. The more it becomes obvious the government can’t kill Bitcoin the more pressure there will be to do something to control it. The argument will move from a debate about whether Bitcoin should exist to a debate about who should be allowed to use it (and how). Critics will stop objecting to crypto as a category and start objecting to "unhosted wallets" and "illegal mixers." They can’t ban Bitcoin entirely anymore but they can still ban privacy and self-custody.

It is still very much possible to imagine a world where Bitcoin is allowed but only for compliant government services like banks. Ben Hunt calls this scenario Bitcoin!™:

In my dystopian vision, Bitcoin isn't banned or criminalized. Pfft. That's a rookie, weak State move. No, I see a future where everyone buys Bitcoin. Where you are encouraged to buy Bitcoin. Where Bitcoin is sold to you morning, noon and night. Where normie economists get on conference calls late at night because they're Bitcoin price-curious.

Except it's not really Bitcoin.

Instead, it’s Bitcoin!™ — a cartoon version of the OG Bitcoin, either a Wall Street-abstracted representation of the price of Bitcoin or a government-painted version of Bitcoin in Dayglo orange. Either way … Bitcoin!™ is trackable and traceable, fully KYC and AML and FBAR and SWIFT and every other US Treasury acronym compliant.

— Ben Hunt, In Praise of Bitcoin

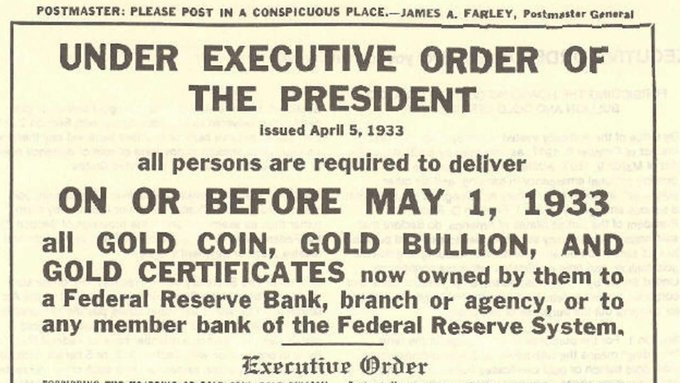

The simplest way to domesticate Bitcoin is to require anyone who uses it directly to participate in the financial surveillance state — and increasingly it seems like that is the approach governments are going to take. The EU just tightened anti-money laundering regulations for cryptocurrency. Last year Senator Warren proposed a bill that would classify every cryptocurrency wallet as a money services business. Earlier this month the SEC sent a Wells Notice to Consensys arguing that their self-custody wallet Metamask is an unregistered broker-dealer.1 The FBI has started arresting developers of privacy tools like Tornado Cash (ETH) and Samourai Wallet (BTC) for crimes like money laundering and unlicensed money transmitting.

Traditionally to be considered a money transmitter (or launderer) you actually have to control the money at some point in the process — but the government is not actually claiming that the Tornado Cash or Samourai Wallet developers ever controlled the money. The Tornado Cash developers were charged for operating the Tornado Cash relayer (a centralized service that coordinated users seeking to exchange privately with each other). The Samourai Wallet developers were charged for actually creating and broadcasting transactions on behalf of users (even though they did not have control of user funds).

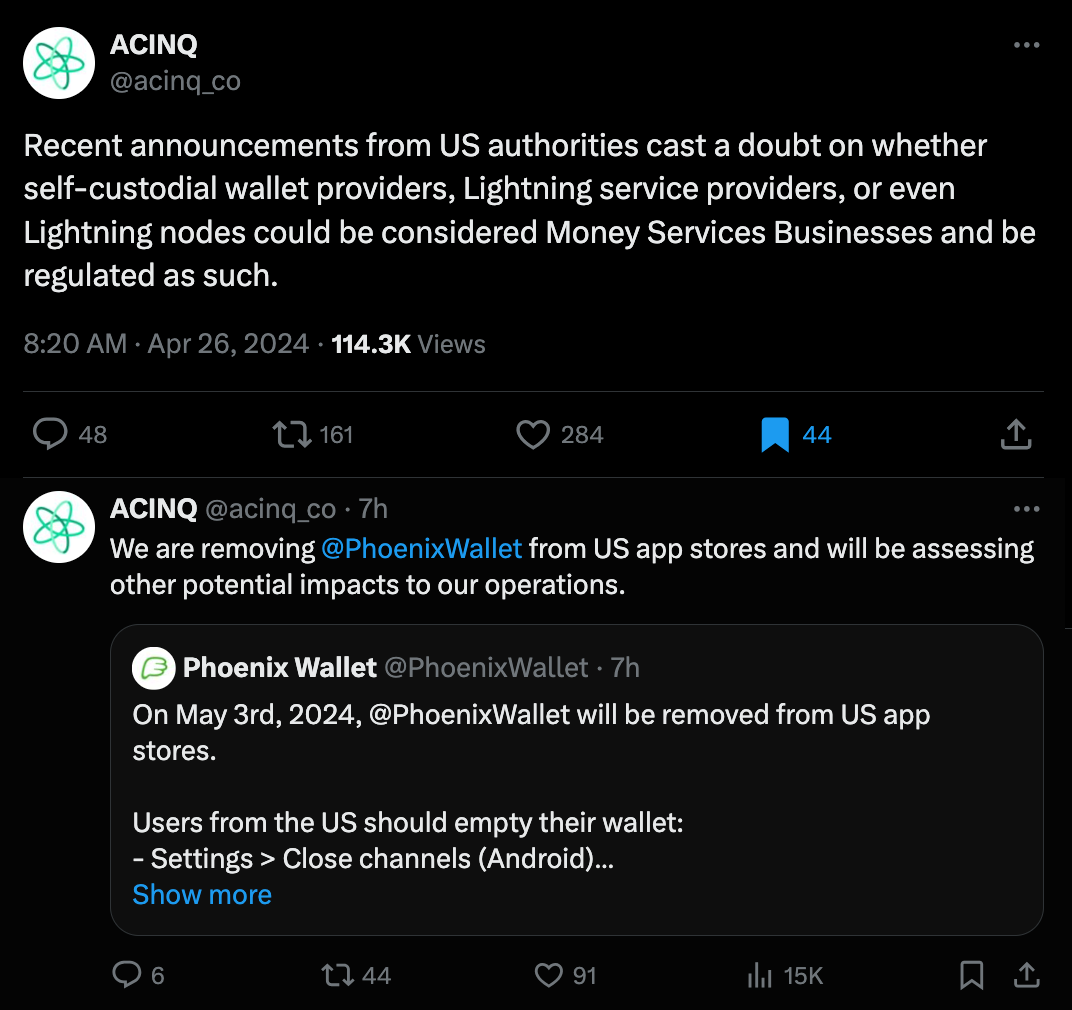

The goal here is to make it harder for people to use Bitcoin privately by making it more dangerous for developers to build the tools that make that possible to do — and it’s working. Already Wasabi Wallet (another Bitcoin privacy tool) has started blocking American users and the developers of the Phoenix lightning wallet have announced they are withdrawing from US app stores out of concern that all self-custodial services were under similar legal risk:

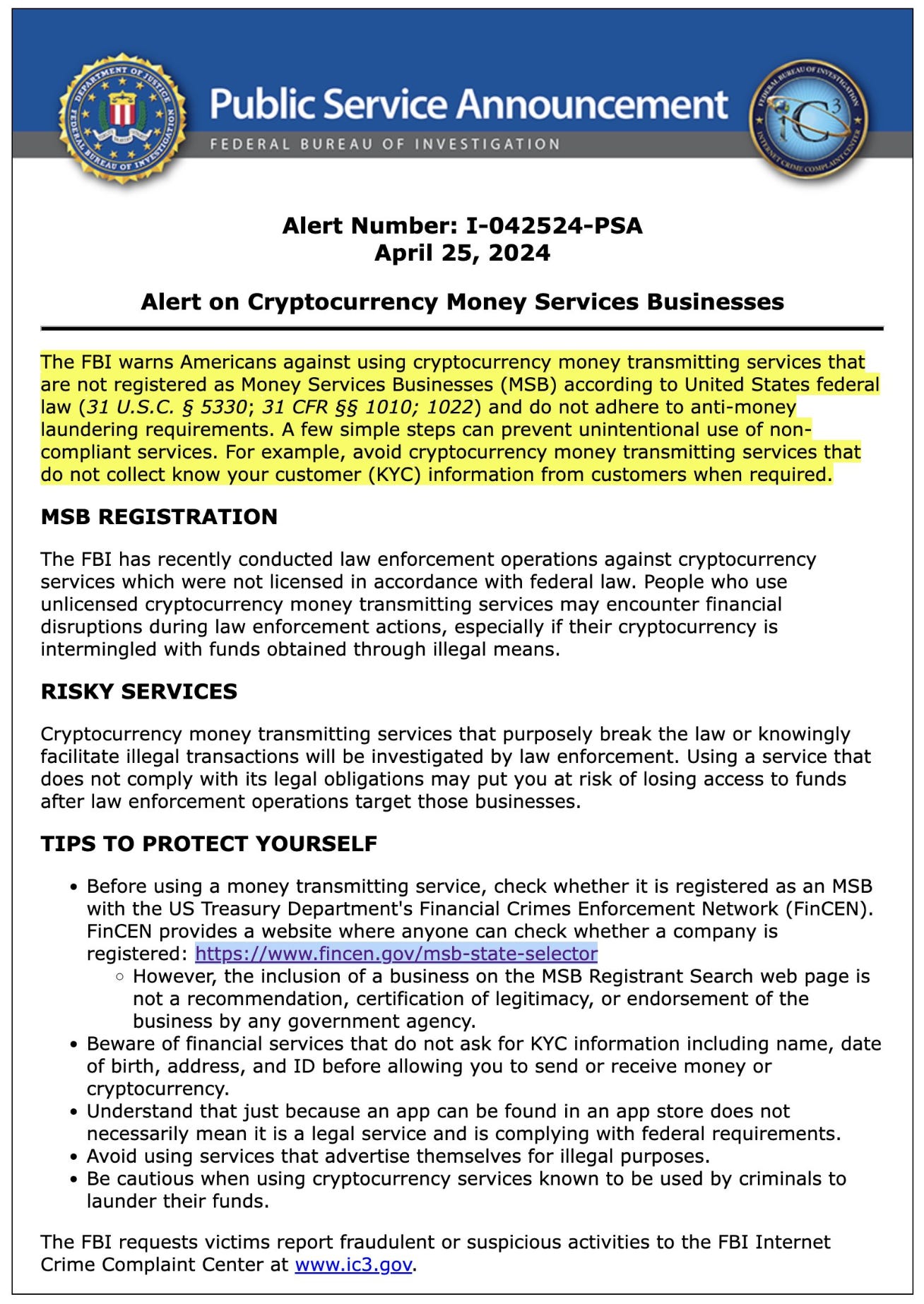

This isn’t a side-effect or an accident — it’s the point. That’s why the FBI just released a Public Service Announcement warning that Americans should "avoid cryptocurrency money transmitting services that do not collect know your customer (KYC) information from customers when required" or else they "may encounter financial disruptions during law enforcement actions." Do you know which cryptocurrency businesses are money transmitting services? The FBI recommends you stick with services that don’t offer privacy — just to be safe.

None of this is new — I’ve been writing about financial privacy since the beginning of Something Interesting. But it does seem like things are accelerating — and the stakes are still incredibly high. The modern law enforcement apparatus is built atop a regime of near total financial surveillance — the powers that be will fight to preserve it. The most recent flurry of government action is not the end of that fight. The fight to defend self-custody will never stop, just like the fight to defend encryption from government backdoors will never stop.

It would be naive to assume (as some do) that government pressure will stop at centralized mixers. They are clearly fighting to preserve the levels of visibility and control they have in the traditional financial system. I expect we will soon see proposals to extend KYC/AML reporting responsibilities to hardware wallet manufacturers, hosted node services, liquidity providers on Lightning, sidechain operators and any number of other tools that deliberately or incidentally create privacy for their users. The surveillance state will continue to expand until it is explicitly stopped and the only way to stop it is strong privacy technology.

Today, Bitcoin is a lifeline for the disenfranchised. It is a tool for activists and refugees worldwide. If we don’t develop a strong technological solution to using Bitcoin privately, it won’t make Bitcoin useless — but it will mean it is only useful to the powerful. The battle for Bitcoin is the battle for financial freedom. Don’t get complacent yet!

Other things happening right now:

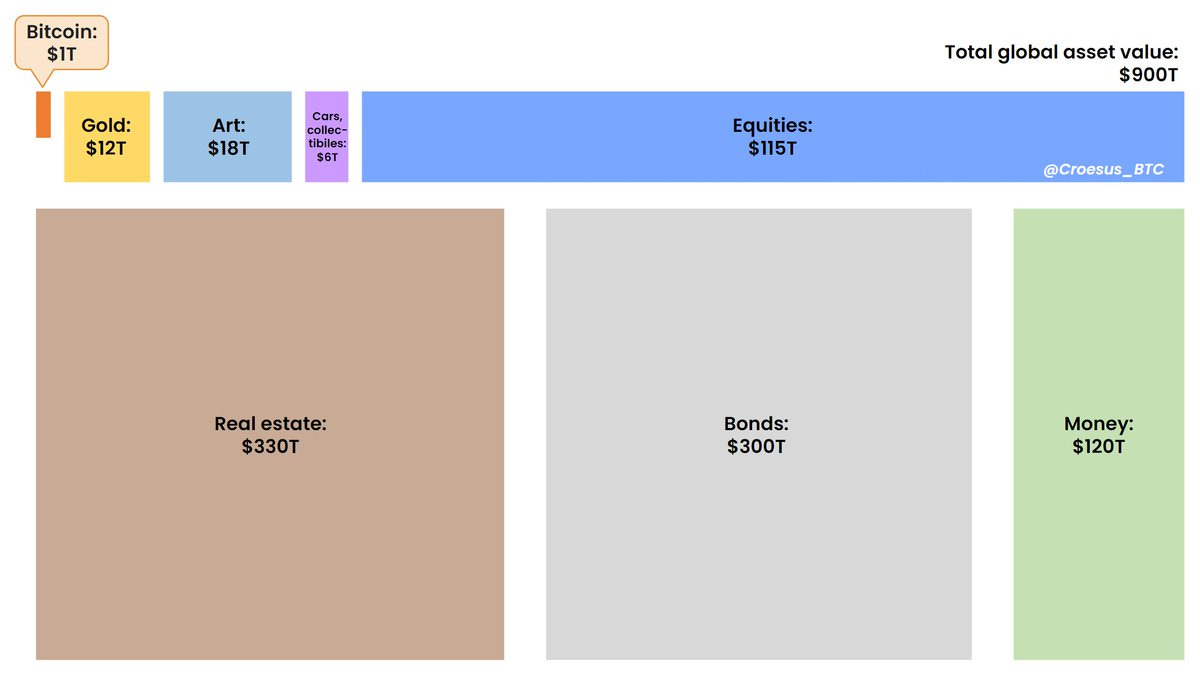

Here’s a quick reminder from Jesse Myers of Onramp Bitcoin that Bitcoin is still incredibly small and incredibly early on the scale of global investment:

If you were wondering how Bitcoin!™ would be advertised to normal mainstream investors the answer is, like this:

This information came out as part of a lawsuit Consensys has filed against the SEC.