$10,000 worth of privacy

How a WWII wartime provision is slowly strangling financial privacy today

Inside this issue:

$10,000 worth of privacy

Bankers & lawmakers agree: more banking laws are needed!

Donald Trump is selling NFTs (again)

$10,000 worth of privacy

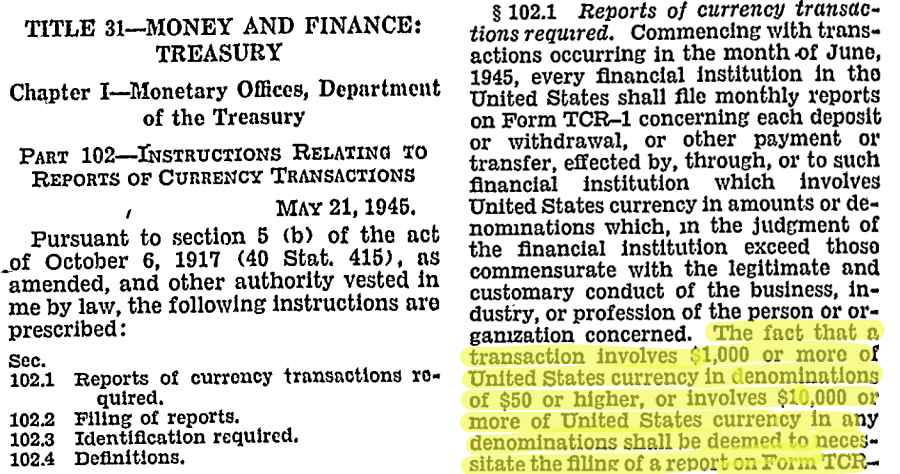

In May of 1945 (near the end of WWII) Secretary of the Treasury Henry Morgenthau instructed US banks to start filing reports on any 'unusual' transactions worth more than $10,000 USD. The guidance was a formalization and extension of how the banks were already cooperating with the Treasury to report violations of the Trading with the Enemy act of 1917. It was meant to function as a wartime measure to stop black markets from evading taxes and price controls. In 1945 $10,000 was the equivalent of roughly ~$170,000 today — enough to buy a modest house.

After WWII the reporting rules stayed in place and were used to prosecute tax evaders, narcotics dealers, foreign spies and organized crime. In 1970 congress passed the Bank Secrecy Act, which consolidated these rules and enshrined them in law. Banks were left with a single $10,000 limit for reporting on any transaction. At the time $10,000 was the equivalent of almost ~$80,000 today — enough to make a down payment on a modest home or to buy a new luxury car.

In 1945 when Secretary Morgenthau introduced the $10,000 limit the federal minimum wage was $0.40/hr and Congressional salaries at the time were also $10,000. Congress’ most recent update (in 2009) brought the minimum wage to $7.25/hr (~18x) and congressional salaries up to $174,000/year (~17x) but the bank reporting limit remains $10,000 — now enough to buy a ~five year old used car. Today’s thresholds are the equivalent of ~$583 in 1945 dollars and are still shrinking ~3-4% a year.