The Panic of the Apes

Plus Something Interesting has no safeword

Inside this issue:

The Panic of the Apes

Something Interesting has no safeword (reader submitted)

If it walks like a scam and it quacks like a scam … (reader submitted)

The Panic of the Apes

Bureaucratic self-satire and ongoing disappointment Gary Gensler followed up his heroic prosecution of hardened kriminal Kim Kardashian with an investigation into whether Yuga Labs has violated federal securities laws in the sale of any of its NFTs or in the distribution of ApeCoin. This is an investigation not an action and a leak not an announcement — a leak that seems likely to have come from the SEC since Yuga Labs is free to discuss any investigations openly if they want.

First, a reminder that I own a handful of Yuga Labs NFTs. I don’t consider them investments, I consider them souvenirs. I received some ApeCoin and still hold some. I don’t have any particular plans to sell any of it but not because of an investment thesis. I just like playing crypto games.

In general I am inclined to agree with the broad assumption that most NFTs are probably just securities although the details I think are deceptively complicated. I am even more inclined to agree with that about DAO governance tokens which are fairly obviously just equity shares wearing an elaborate fake mustache. ApeCoin is a share of governance over a body of resources designed to maximize the value of ApeCoin. Looks like a stock to me. No objections.

What I *do* object to is offering no clear guidance to the industry about how to be compliant, waiting for Yuga Labs to become a multi-billion dollar success and then quietly blackmailing them by leaking stories to the public that are fairly clearly intended to tank the market value of Yuga Labs assets. Bored Ape NFTs themselves dropped ~5% after the Bloomberg story with the unnamed source was released but ApeCoin dropped ~18% before recovering somewhat.

Yuga Labs paid for quite a bit of legal advice and spent months on compliance before launching ApeCoin. It certainly seems like the SEC deliberately set them up to fail:

Yuga Labs made a good faith effort to comply but the SEC decided to use them instead as a cautionary example — basically the same strategy they used with Kim Kardashian. Neither of those two targets were particularly flagrant offenders or particularly harmful, but they were both famous. Rather than optimizing for investor safety Gensler’s SEC seems to be optimizing for Twitter likes.

As we’ve talked about before, the SEC is acting in bad faith. They should be providing guidance not selectively leaking investigations to scare markets like some kind of low-rent regulatory protection racket. "These are some innovative assets you have here," drawls Gensler in a threatening tone, "It would be a shame if someone had to protect investors from them …"

Something Interesting has no safeword

"My mom was asking me about the APY offered by Coinbase or Gemini on USDC or GUSD – are those generally 'safe'? They're giving out around ~8% but its with $$ coins and not BTC, so I'm not sure." — PM

Everyone’s appetite for risk is different so it is hard to say definitively whether a particular investment is "safe" or not — but a helpful thing to remember is that there is no such thing as a free lunch: if something pays yield, it comes with risk. Any time you think you have found risk free yield I promise you what you have found is just unobserved risk — and unobserved risk is by far the most dangerous kind.

When you deposit USDC on Coinbase (or GUSD on Gemini) you are loaning them money and they are using that money to do profitable things in DeFi. Stablecoin accounts are *not* FDIC insured, so if the company you deposited with goes bankrupt you are just another creditor zeroed out in the bankruptcy. The ~8% annual interest they are paying you is to compensate you for the risk that Coinbase (or Gemini) go bankrupt before you withdraw.

Only they aren’t really paying you ~8% interest because right now you can loan the US government money by buying short term treasuries that pay ~4% interest. The US government can create more dollars so they have effectively no chance of defaulting on their debt. That’s why the Treasury yield is sometimes called the risk free rate. In other words only about half of the ~8% interest is actually paying you for the incremental risk you are taking on by loaning money to Coinbase (or Gemini). The other half you could get for yourself while taking no risks.

I don’t think Coinbase or Gemini are especially close to bankruptcy. On the other hand, they both just had recent layoffs and are in the middle of a multiyear crypto bear cycle against one of the worst macro economic backdrops of my lifetime. Everyone’s risk appetite is different and Something Interesting does not offer legal, financial or fashion advice — but I would personally want to be paid more than ~4% to loan them money to gamble on DeFi.

If it walks like a scam and it quacks like a scam …

"Hey KF — what’s up with these NFTs I keep getting airdropped out of nowhere that have ~0.4 ETH offers on them that won’t complete?" — several readers

They are, as you probably suspected, a scam. The contract for these NFTs is coded in such a way that the offers always fail, so the attacker gets your attention but gets to keep their money. They are hoping you will be curious enough about the NFT to check out the description, which points to the website where their real scam lives. It’s almost like stuffing a flyer in your mailbox designed to look like a check.

Technically for the class of attacks that I am aware of right now there is no danger in trying to accept the offer on OpenSea — it will simply fail. But in general it is probably a good idea *not* to interact with crypto products you don’t know well, especially when they seem unexpectedly lucrative. It is a lot more likely that someone has discovered a new way to exploit you than that they are excited to give you money for no reason.

Other things happening right now:

We often think of the unbanked as being poor but it is also possible to lose access to the banking system not because you are an unprofitable customer but because you are politically untouchable. Case in point: JP Morgan Chase just cut ties with Kanye West and his sprawling business empire because of his recent anti-semitic rants. Fun Fact: JP Morgan never closed Jeffrey Epstein’s account.

A number of people affected by the TornadoCash dusting attacks are suing OFAC and the Treasury department over sanctioning of Tornado Cash and OFAC’s expectation that they fill out annual paperwork forever reaffirming they still are not criminals. It will be very interesting to watch the results of this lawsuit to see whether courts curtail the OFAC approach or ratify it.

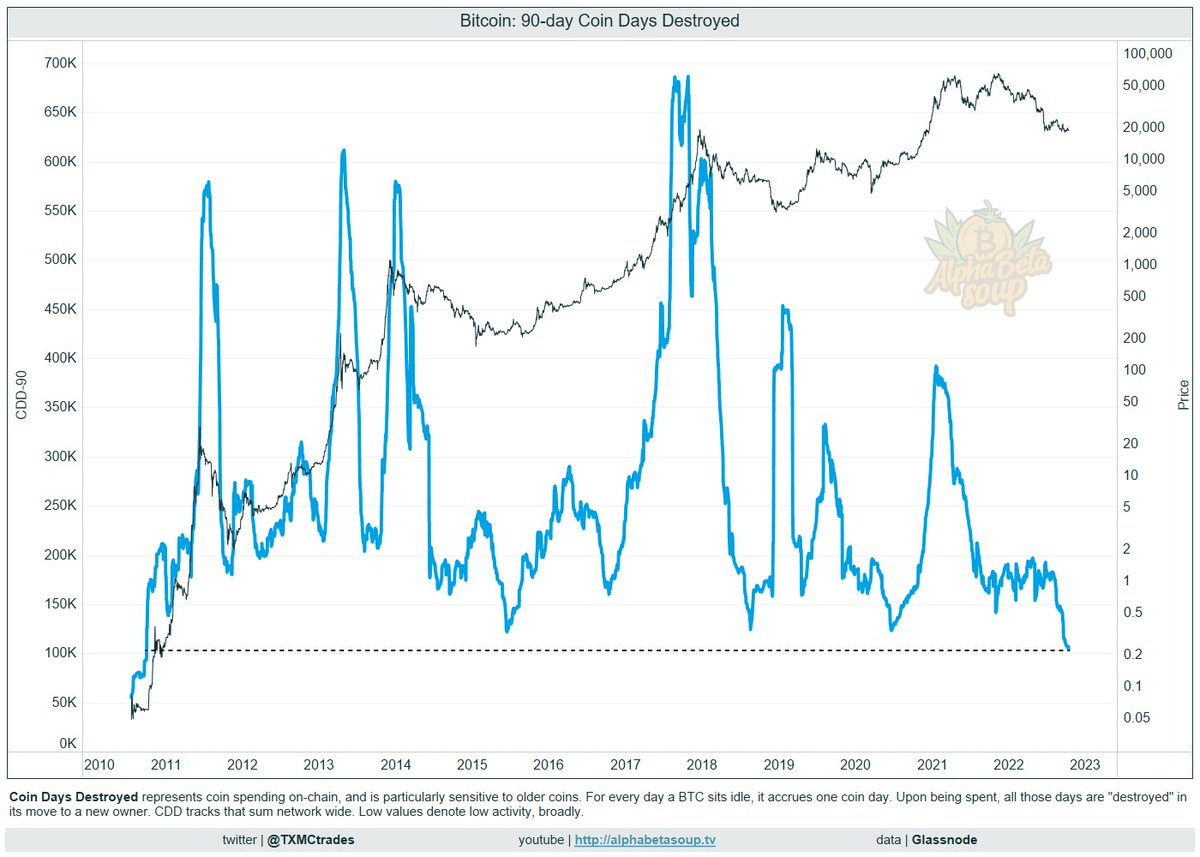

One way to measure Bitcoin activity levels is coin-days-destroyed: the total age of coins that move in a given time period. If days destroyed is high then lots of old coins are moving. If coin-days-destroyed is low then old coins are holding still and waiting. Right now coin-days-destroyed is down to levels not seen since 2010 and the very first days of price discovery for Bitcoin. The last time Bitcoin holders were this unwilling to sell it was barely possible to sell at all.

Senator Warren has written a letter to Texas grid manager ERCOT pressing them for details about the role of cryptocurrency mining on the struggling power grid. We’ve talked before about how cryptocurrency miners are actually helping to stabilize the Texas power grid but Warren’s goal here is more about building a reputation for being tough-on-crypto than anything to do with electricity production. I have also written to Senator Warren in the past about Bitcoin but no word back from her yet.

Presented without comment: