Not your transaction fees, not your blockspace

There is no such thing as a 'legitimate' transaction.

Inside this issue:

JPEGs, on my Blockchain?! It’s more likely than you think!

Not your transaction fees, not your blockspace

No such thing as a 'legitimate' transaction

Is the NFT market coming to Bitcoin?

"Hope the year is off to a good start! I know you’re far more time constrained with the new role at Blockstream but would love to see your thoughts on the Ordinals debate in a blog post when you have some capacity. Despite being the most ‘boring’ crypto Bitcoin is still somehow endlessly fascinating!" — BCB

JPEGs, on my Blockchain?

It’s more likely than you think!

Bitcoin’s blockchain is, loosely, a kind of shared database that anyone can read from and anyone can write to. The main thing that you are supposed to use the Bitcoin database for is to send and receive Bitcoin — that’s the information it was designed to keep track of. But you could imagine lots of other information that it might be useful to store in a robust, neutral way.

Bitcoin itself is only aware of Bitcoin transactions but that leaves lots of flexibility for creative people to use it in unexpected ways: a bit like putting a doodle in the memo line of a check or embedding a secret number in your signature by varying the number of loops you put after the last letter.1 Storing data this way has never been an especially reasonable or practical thing to do, but as a rule crypto people are neither so in practice it has happened a lot. The early blockchain is full of pornographic images, quotes from Satoshi and Rick Astley lyrics. There is a passage from the bible in Block #666666 and a love note I wrote to my wife in Block #360665.

The fact that off-label use of the Bitcoin blockchain is possible has always been controversial. Using any of the limited blockspace is inherently denying someone else the chance to use it for themselves. Paying more for your transaction (whatever your motives) is a means of asserting that your transaction is more important than the transactions of others (whatever their motives). Any use of Bitcoin is a competition for an extremely limited resource and is therefore always a political act.

To many Bitcoiners adding "useless" data to the blockchain is a hostile attack on the network. More data on the blockchain means that it takes longer to spin up a node from scratch and more bandwidth to keep it in sync. Depending on the nature of the data it might also increase storage costs. Anything that makes a node more expensive to run makes the network less decentralized, hence adding unnecessary data to the blockchain is an attack on Bitcoin.

The controversy around non-financial data has simmered in the background of Bitcoin almost since the beginning — but recently it surged back to the surface when Casey Rodarmor announced mainnet support for ordinal inscriptions, a method of embedding arbitrary digital content into the witness input of a transaction and associating that content with a specific satoshi. The idea of embedding arbitrary data is not new but ordinal inscriptions differ from past methods in a few important ways.

First, the satoshi associated with an ordinal inscription can move from wallet to wallet and retain its association with the data. That means the data is 'tradable' — effectively transforming the satoshi into a Bitcoin-native NFT. Another important difference is that inscriptions use Taproot (which we’ve talked about a few times before). A loose but reasonable description of Taproot is that it enables a new class of cryptographic signature on Bitcoin that makes complicated signature schemes cheaper and more private. For reasons that are a bit too technical for this post (learn more here) that means that there is no limit to the size of the data in an inscription and the data is actually priced at a discount compared to normal transactions.

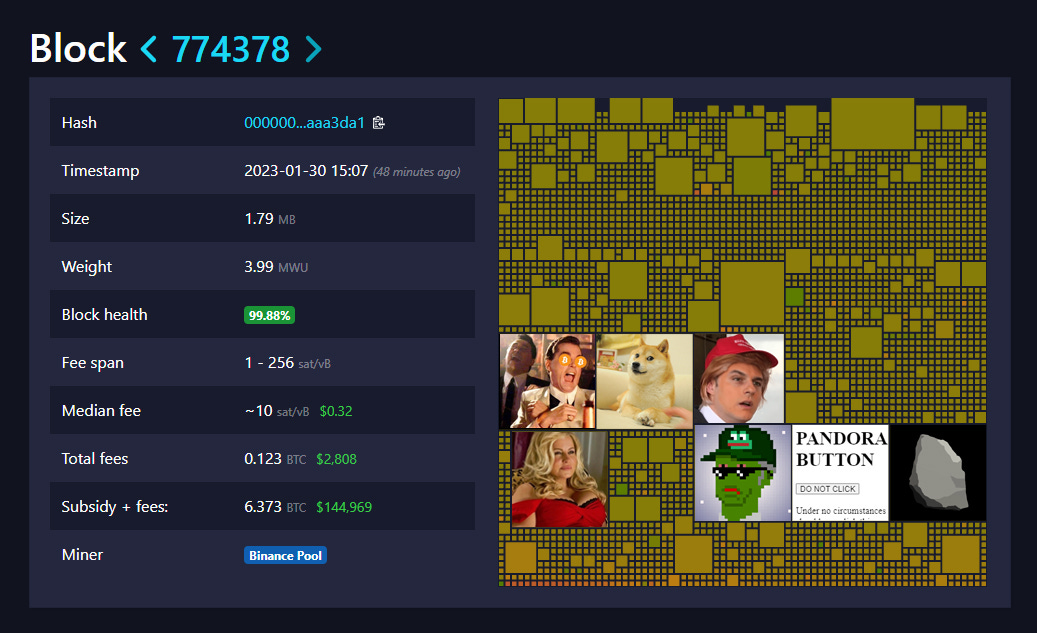

So you can, for example, stick entire jpegs into an inscription, which is mostly what people are using them to do:

These are in some sense "legitimate" Bitcoin transactions in that they fit all the formal criteria for inclusion in the blockchain and they pay the transaction fee needed to get included in the block. But they are also in some other sense not "legitimate" transactions in that they are gargantuan, inefficient and playfully pointless. Most of them are just silly.

To some Bitcoiners this is sincerely offensive — like graffiting a sacred monument or filling up the seats on a lifeboat with stuffed animals because you find it funny. I can appreciate why people are defensive about Bitcoin because I share the belief that it is profoundly sacred. But I also think it is robust and I think it is harder than it might seem to sort "legitimate" use from "illegitimate" and impossible to assign that responsibility to anyone while preserving Bitcoin’s unique properties.

I have seen two major arguments against ordinal inscriptions which are often presented together but are useful to discuss separately:

They are pointless and crowding out more important uses of the network.

They introduce potentially destabilizing incentives for mining consensus.

Let’s take them one by one.

Not your transaction fees, not your blockspace

Many Bitcoiners view NFTs as pointless, so their instinctive response to ordinal inscriptions is to view them as a waste of valuable resources that could be spent on more "valid" use cases. To me, that sounds suspiciously like the argument that no-coiners make about Bitcoin’s use of electricity: Bitcoin is pointless, so any use of electricity by Bitcoin is displacing other more "valid" use cases. Both groups are making the same mistake: assuming they would allocate limited resources more effectively than a free market.

Bitcoin miners have earned the right to spend electricity mining for bitcoin because they paid for that electricity on the open market. Anyone who thinks mining is wasting electricity is implicitly assuming they are wiser than the market. Similarly, bitcoin transactions have earned the right to consume blockspace because they paid for the blockspace on the open market. Anyone who thinks ordinals are wasting blockspace is implicitly assuming they are wiser than the market.

Perhaps they actually are wiser than the market, but even if there was a better allocation getting consensus on which uses of a scarce resource are 'most valid' is not a simple or obvious thing to do.

Is including a note in the OP_RETURN of an otherwise genuine transaction valid? What if the transaction is only for one satoshi? Are unspendable transactions to 1BitcoinEaterAddressDontSendf59kuE valid? What about an unspendable transaction to 1ThisIsAPoliticalMessagef59kuE? What about 1ThisIsADumbMemef59kuE?2 Are transactions to Satoshi’s addresses valid? What about transactions to addresses controlled by North Korea? What if a transaction is otherwise valid but foolishly constructed and inefficient?

Every decision about Bitcoin is political. If it was easy to build consensus around which use cases should be allowed and which should not there would be no need for a network like Bitcoin in the first place. Instead the consensus answer in Bitcoin is that anyone who pays for their ticket gets to ride. No higher authority is consulted beyond the transaction fee auction. Not your transaction fees, not your blockspace.

A subtlety here is that the type of data used by ordinal inscriptions isn’t charged at the same rate as the data used by normal transactions. You can make a principled argument that the real market intervention was actually the subsidy (introduced in the Segregated Witness upgrade) or removing the size limits (introduced in the Taproot upgrade). I’m more sympathetic here, but also less informed. The arguments for and against those decisions are over my head technically.

But it is important to distinguish between defining a valid transaction (e.g. introducing/removing limits/subsidies) and defining valid usage (i.e. censoring or subsidizing transactions based on their purpose or intent). The former is critical to the health of the network, the latter is deadly.

It is absolutely true that rich, frivolous assholes will clutter the network with garbage because they think it is fun and that sympathetic, vulnerable users will be priced out of a priceless tool as a result. I’m not trying to defend that outcome as righteous or good. But it isn’t a result of ordinal inscriptions specifically. It is a result of the fact that blockspace is sold at open auction to anyone who wants it. The only way to prevent "undesirable" use of the network is to take control of it and destroy the thing that made it valuable in the first place.

Bitcoin is for enemies! Expect your enemies to use it.

No such thing as a ‘legitimate’ transaction

The other argument against ordinal inscriptions and other kinds of 'arbitrary' data inclusion on the Blockchain is more subtle and less easily dismissed. It goes something like this: if people are using the blockchain for other non-transactive purposes it might create weird, erratic incentives for miners that interfere with or even overwhelm the incentives they have for normal Bitcoin operation.

Some of the concerns presented along these lines are just the same basic congestion/validity arguments discussed above, like worrying that NFT pump-and-dumps will clog up blocks and raise transaction prices. That’s fine, transaction prices are supposed to rise. If they don’t then Bitcoin has other, larger problems. No one should feel entitled to cheap transactions even if their purpose is noble and good.

But the more interesting take here is that non-financial data in Bitcoin transaction could destabilize the logic of consensus itself. The more the system contains economic value contained in arbitrary side data the harder it is to observe or understand the incentives at play.3 What if all these ordinal inscriptions accidentally encourage miners to start fighting over control of the most recent block instead of building on top of it? What if Bitcoin users start bribing miners off-network to include (or censor) particular transactions for some reason?

The worry that outside incentives might destabilize mining consensus is an extremely reasonable fear in my opinion, but I’m not as convinced that ordinal inscriptions particularly change the balance. They do make it possible to include a larger blob of data but they don’t make that an especially useful thing to do. For any practical use case it almost certainly makes more sense to store a hash of data on the blockchain and store the data itself somewhere cheaper and more practical. Depending on your point of view ordinals might be fun or interesting or pointless but they probably aren’t an important new economic tool.

It is also already impossible to contain the economic meaning of a transaction entirely within the network. Users with more urgency than they have funds available on-chain might bribe miners off-network to include otherwise uneconomic transactions — users often do something similar already to buy liquidity for new lightning channels. A miner might choose to prioritize a low-fee transaction over a high-fee transaction from the same address because they believe the high-fee transaction is a hacker and they think the PR value of intervening is greater than the forgone transaction fees. Users might use the blockchain to communicate asynchronously by sending a particular quantity to a particular address as a pre-arranged signal.

The idea that we can sort transactions into 'safe' and 'dangerous' is more sophisticated than the idea of sorting them into 'valid' and 'invalid' uses but it is ultimately flawed in a similar way. No one has the insight or authority to judge what a transaction means other than the users involved in the transaction themselves. The only way to keep Bitcoin safe is by cultivating the economic importance of sincere use of the network. There is no way to detect and censor 'insincere' activity. As far as the network is concerned convincing a miner to spend energy to include your transaction in a block is the only measure of sincerity.

Is the NFT market coming to Bitcoin?

To be honest, I doubt it. Ordinal inscriptions are interesting relative to previous novelty uses of Bitcoin but they don’t unlock anything particularly new for NFTs beyond the dubious affinity value of being "Bitcoin" NFTs. They don’t support collections, traits/rules/mechanics, on-chain markets or any of the other things that contemporary NFT projects in the Ethereum ecosystem are already exploring. I don’t see any reason to anticipate NFT enthusiasts migrating to Bitcoin or Bitcoin enthusiasts suddenly becoming excited about NFTs.

Personally I like NFTs and have a reasonably robust collection of my own but I don’t find ordinal inscriptions all that exciting yet. Perhaps new functionality will emerge to make it more interesting but as of now I expect ordinal inscriptions will naturally disappear on their own, either because the price of blockspace has risen or the novelty of putting JPEGs on the blockchain has worn off or both.

Other things happening right now:

I don’t agree with Jamie Dimon about Bitcoin but I do agree with Jamie Dimon that people should probably stop asking him about Bitcoin.

Presented without comment:

If you are interested in a bit more technical detail about how this has been done in the past I think this is a good overview to start with.

This isn’t really an abstract hypothetical — the largest Bitcoin transaction since 2016 is an ordinal inscription of one of Donald Trump’s NFTs.

You could make a reasonably interesting comparison to the MEV (or Miner Extractable Value) problem which we have talked about before.