It's never the same market twice

Plus don't worry: we held a vote

In this issue:

It’s never the same market twice

Don’t worry: we held a vote

The lenders of last resort

It’s never the same market twice

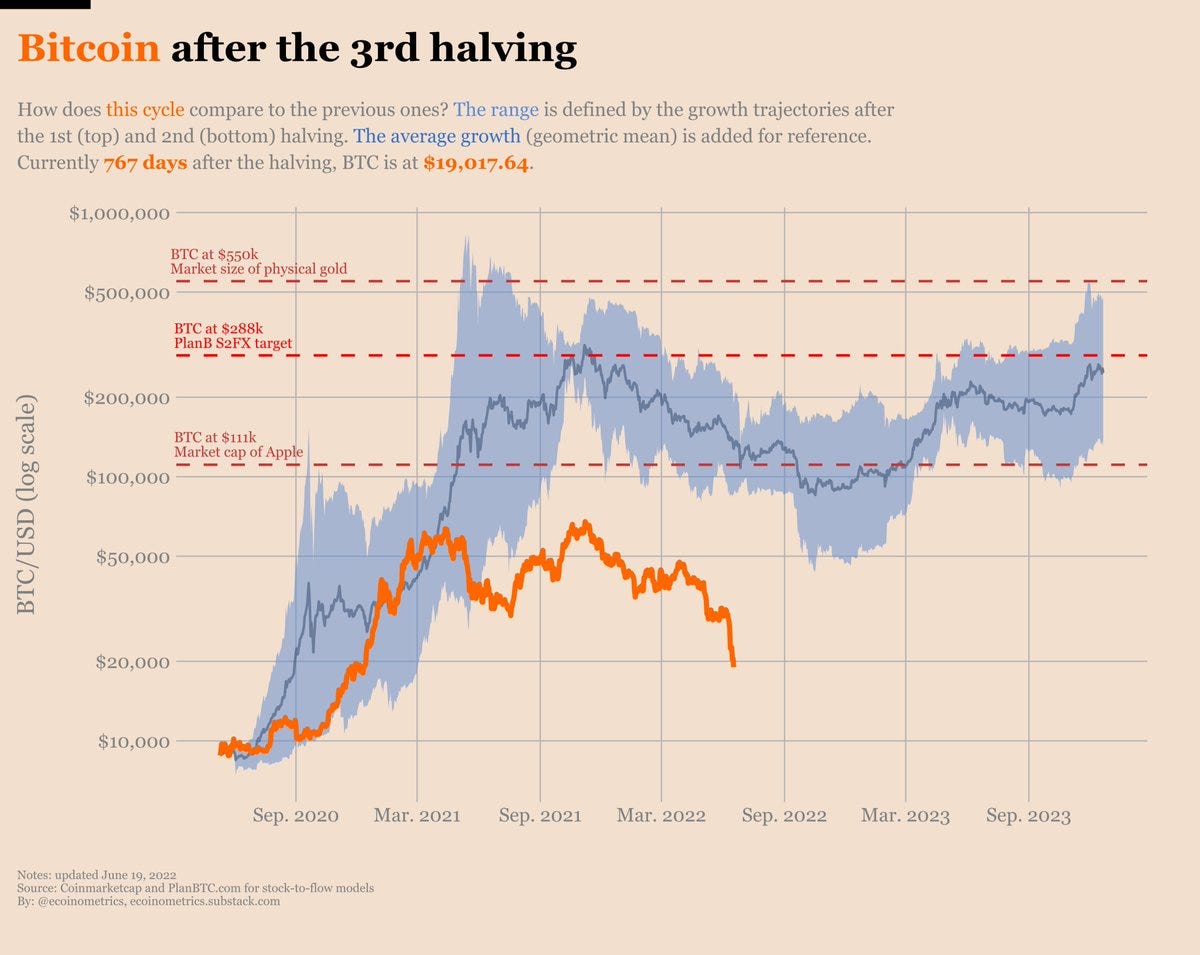

On Saturday the price of Bitcoin broke down sharply, dropping as low as ~$17.6k/BTC before stabilizing and climbing back to ~$20k/BTC at time of writing. ETH price followed a similar trajectory, dropping as low as $900 before climbing back to $1k/ at time of writing. The price of Bitcoin is below the 200-week moving average for only the fourth time in its history and this is the first time it has dropped (even briefly) below the previous all-time high. This cycle does not look like the others:1

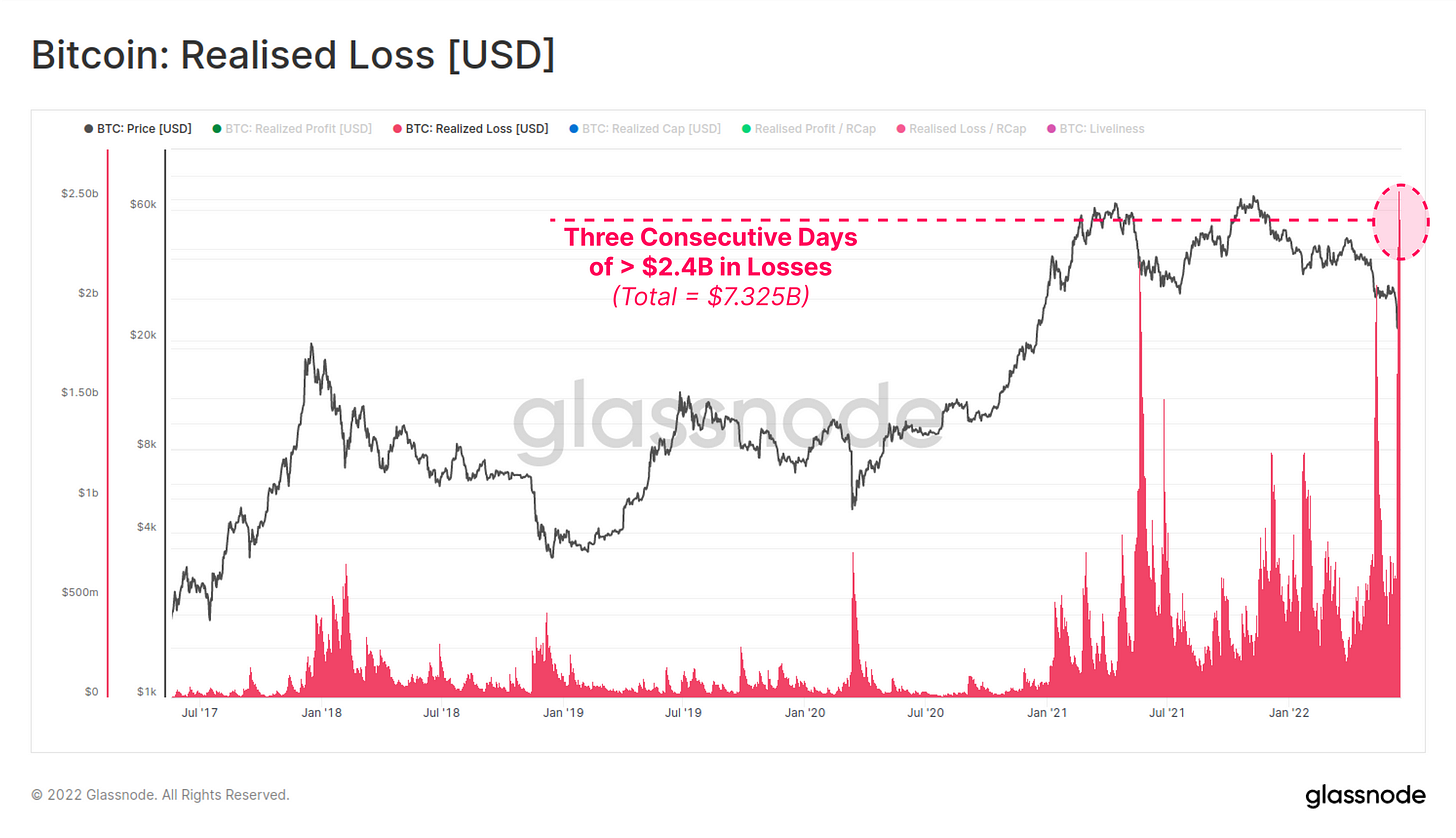

The drop shook the confidence of (some) long term holders, who collectively sold around ~178k bitcoin — including a number who bought in at the previous all time high of ~$69k/BTC in 2021. More than ~0.5M BTC changed hands, locking in the largest USD losses in Bitcoin history (~$7.3B):

Miners are also under pressure. The spot price of Bitcoin has fallen close to what is likely the effective marginal cost of production for many miners. Total mining power has fallen ~10% or so from the peak and miners have had to sell ~9k of the ~60k bitcoin they had accumulated in their collective treasuries.

If you are optimistic about the crypto markets you probably want to sell dollars and stablecoins for BTC/ETH. If you are bearish about the near-term but still a believer in crypto you might want to sell BTC/ETH but keep your money in stablecoins so it is easy to buy back into crypto when the market conditions change. If you really give up on crypto you will sell your BTC/ETH and stablecoins for actual dollars so you can take your money back to the traditional markets.

Right now the total market cap of stablecoins (~$155B) is larger than the market cap for Ethereum (~$139B), suggesting that even among those willing to commit their wealth to crypto markets most are still waiting in USD expecting more ETH price drops to come. The total market cap of stablecoins is also going down — roughly ~$30B worth of capital has exited the cryptocurrency ecosystem entirely.2

A common (and understandable!) question that I’ve been getting from readers is some variation on the theme of "is it over yet?" and the unsatisfying truth is that I don’t know but I doubt it. Capitulation is not a state of fear because fear implies hope. Capitulation is a state of disgust and boredom. If we have actually broken the cycle and are entering into a real bear market then I would expect a long, tedious grind down where underwater investors slowly abandon hope and walk away.

On the other hand, the sky seems dark right now with potential black swans. Inflation is at multi-decades high but the dollar is still getting stronger. The world’s largest exporters of food, fertilizer and energy are embargoed and at war. Bond markets are collapsing (especially in Japan). Trillions of dollars of US investor wealth has already evaporated, the largest destruction of American wealth in over forty years.

Trying to predict future movements from past prices is always a dicey proposition but it seems especially foolish now. My only sincere prediction is that something crazy will probably happen.

Don’t worry: we held a vote

Ethereum competitor and smart contract platform Solana has also been hit by the broader market malaise, marking a new all time Solan-low of ~$27/SOL last Wednesday, though it has since recovered and is currently trading at ~$34/SOL. That’s a pretty strong last week or two but it has still been a pretty tough market cycle for Solana overall:

Just as with Ethereum’s DeFi ecosystem, Solana has on-chain lending applications where you can deposit SOL as collateral and for USD-pegged stablecoin loans. The largest of these lending services on Solana is a DAO-led protocol called Solend.

Solend loans are effectively margin-long positions against SOL. As long as the price of SOL stays up the loan can be paid back whenever the investor desires — but if the price of SOL drops too low the collateral is automatically sold to pay back the loan and the investor is left with nothing. The process is a bit like a bank foreclosing on a home to pay back a delinquent mortgage.

Astute observers will notice that the price of SOL has gone (mostly) down. That means most of the loans Solend has made are underwater and at risk of liquidation. Liquidating a loan like this is risky for the lender. If the value of the collateral is falling too quickly they might not be able to sell it in time to avoid a loss. That’s basically what happened to the banks loaning money to Archegos Capital earlier this year. Archegos owned so much of the companies it had invested in that when banks tried to unwind those positions it crashed the market for those stocks.

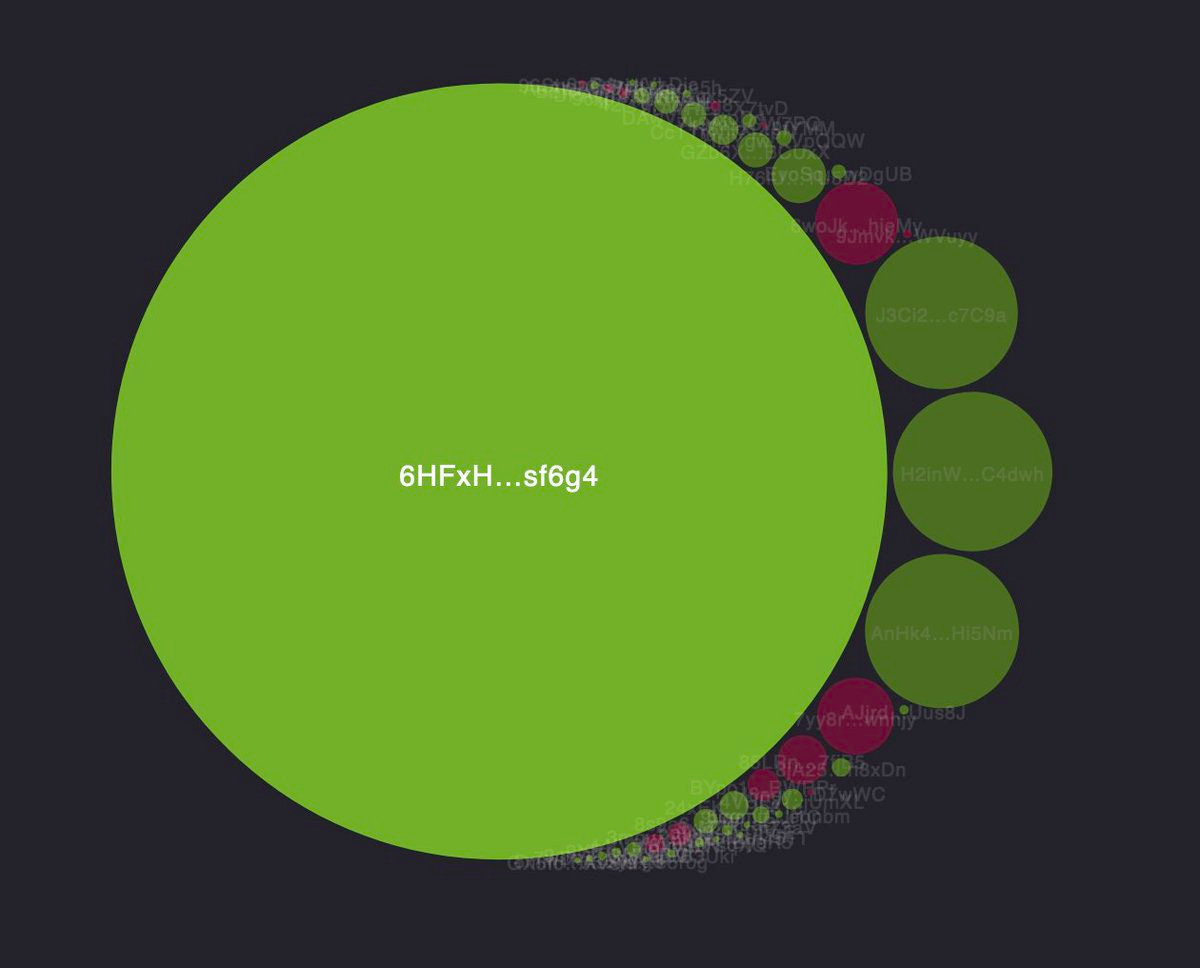

Centralized banks and exchanges have risk policies, account limits and insurance frameworks designed (with varying levels of success) to insulate themselves from the risks being taken by their counterparties but Solend is a bit more primitive. A single whale account deposited 5.7M SOL (~$170M) and borrowed ~$108M in stablecoins. This loan by itself represented ~95% of Solend collateral at the time, with a liquidation price of $22/SOL.3 The loan had also not been touched for several weeks, suggesting the owner either had incredible confidence and resolve or they were struggling to repay the loan and forced to take the risk.

If the loan was liquidated on-chain it would be ruinous for Solend and likely many other projects as well. The on-chain marketplaces where those coins would be sent for sale are not deep enough to handle that level of volume, prices would be completely obliterated. It’s unclear what the unfolding consequences for the ecosystem would be but they would probably be dire. In desperation the Solend team proposed a vote to seize control of the whale’s assets and sell them manually over the counter so as not to overwhelm the Solana DEX marketplaces.

That’s bad for a bunch of reasons. First, it is hard to see future customers getting excited about trusting a lending platform that occasionally holds votes about whether to seize your stuff. Second, it is very obviously illegal to seize people’s stuff even if you hold a vote first. The worst reason though is that the charade of "voting" made it painfully obvious how centralized Solend governance actually is. A single wallet provided the vast majority of votes, enough to secure 1% quorum by themselves. The rest of the votes were only useful for giving the first wallet plausible deniability.

For those keeping score at home that means ~$0.5M worth of governance assets successfully voted to seize ~$100M worth of user assets. Decentralization!

Other things happening right now:

The ongoing aftermath of Terra crashing into Celsius crashing into 3AC seems to be slowing down somewhat. We talked last issue about the concerns around BlockFi’s solvency, but on Tuesday they announced they had secured a $250M revolving credit term sheet with cryptocurrency exchange FTX, similar to the $200M and 15k BTC term sheet that Voyager Invest announced last week from Alameda Research.

The unprecedented downturn in Bitcoin trajectory has been hard on influencers like @100TrillionUSD who built their brand on optimistic projections like stock-to-flow, which I have written about before. For the record my personal favorite hopium-based model for future Bitcoin price (the 2014 rainbow graph) remains intact … for now.

Most of those exits have been from Tether (USDT) whose supply has shrunk ~20% in the last few weeks. Circle’s equivalent stablecoin USDC has increased in supply ~14% in that time. That makes sense because Tether has been cagey about their business arrangements for a long time, which suggests they take on more risk than a stablecoin probably should. It is during a market downturn like this when those kinds of risks blow up, although in fairness to Tether it has weathered many other downturns before this one.

The whale has since spread their debt across other lending platforms and the price of Solana is up ~30%, giving Solend the breathing room to pass another proposal reversing the emergency powers before ever actually exercising them.