In this issue:

How to OFAC yourself

The counter-narrative against Proof of Work

Yo dawg I heard you liked centralized stablecoins

How to OFAC yourself

We’ve talked several times recently about the unprecedented Office of Foreign Asset Control (OFAC) decision to sanction the Tornado Cash smart contract directly. Whatever you think of the merits of Tornado Cash itself the ambiguity of the sanctions and how companies were expected to respond caused an enormous amount of chaos and consternation. On Tuesday OFAC published a series of FAQs intended to clarify key questions surrounding the sanctions.

The FAQ clarifies that yes, law abiding Americans are forbidden from using Tornado Cash for privacy even if they intend to use the money in law abiding ways. It does offer a path for Americans whose money was in Tornado Cash to apply for permission to access their money, as long as they "provide, at a minimum, all relevant information regarding these transactions with Tornado Cash, including the wallet addresses for the remitter and beneficiary." So Americans who were lawfully seeking privacy can have their money back! Provided they are willing to give up that pesky privacy.

The FAQ also acknowledges the dusting attack we talked about in Jimmy Fallon is a DPRK Operative, saying "OFAC is aware of reports following the designation of Tornado Cash that certain U.S. persons may have received unsolicited and nominal amounts of virtual currency or other virtual assets from Tornado Cash, a practice commonly referred to as “dusting.” Technically, OFAC’s regulations would apply to these transactions. To the extent, however, these “dusting” transactions have no other sanctions nexus besides Tornado Cash, OFAC will not prioritize enforcement against the delayed receipt of initial blocking reports and subsequent annual reports of blocked property from such U.S. persons."

So, yes, Jimmy Fallon is still a hardened criminal unless he processed the relevant OFAC blocking forms within 10 business days and then moved everything out of his existing wallet except the offending ETH and from now on files annual blocking reports forever. But OFAC promises not to "prioritize" prosecuting him. Probably best to "prioritize" getting those forms filed, just in case.

That’s a bit like making it possible for anyone to send a text message that forces the recipient to give up their phone number and file an annual report to the government forever or rely on the mercy of government prosecutors to overlook them. It isn’t exactly the traditional American approach to jurisprudence.

The FAQ does point out that it is legal to visit the Tornado Cash website and to "interact" with the open source code itself, such as by "copying the open-source code and making it available online for others to view, as well as discussing, teaching about, or including open-source code in written publications, such as textbooks" but it is notably silent on whether or not it is legal to redeploy that open-source code to a new functioning address.

It also doesn’t do much to clarify contagion within the ecosystem: if I sell an NFT on OpenSea and the buyer received a transaction from someone who was "dusted" with Tornado Cash ETH and never filed any paperwork — is my address now also tainted? Are OpenSea’s smart contract addresses tainted? Are the Tornado Cash sanctions effectively a doctrine of Original Sin, where everyone is born fallen and must pray for prosecutorial forgiveness?

Praise be and pass the annual forms.

The counter-narrative against Proof of Work

The successful completion of the Merge on Wednesday evening means the Ethereum network is now officially a proof-of-stake network, the largest of its kind. The update itself was almost eerily smooth, with no technical missteps and no unexpected attacks (so far). After the stochasticity of proof-of-work was eliminated blocks began arriving with clockwork precision. That means less congestion and lower fees — before the Merge around ~20% of blocks were full, after the Merge only ~10%.

New ETH issued also dropped as expected from ~4% to ±0% of the total supply.

Centralization among the proof-of-stake validators remains a concern. The two largest block producers (Lido and Coinbase) created ~42% of the first 1000 blocks between the two of them. The top 7 validators control ~2/3rds of the stake, more than enough to assert control of the network. In comparison the top 7 mining pools in Bitcoin control ~91% of the hashrate — but it’s not an apples-to-apples comparison because mining pools have almost no control over their hashrate but staking services have almost perfect control over their staked capital.

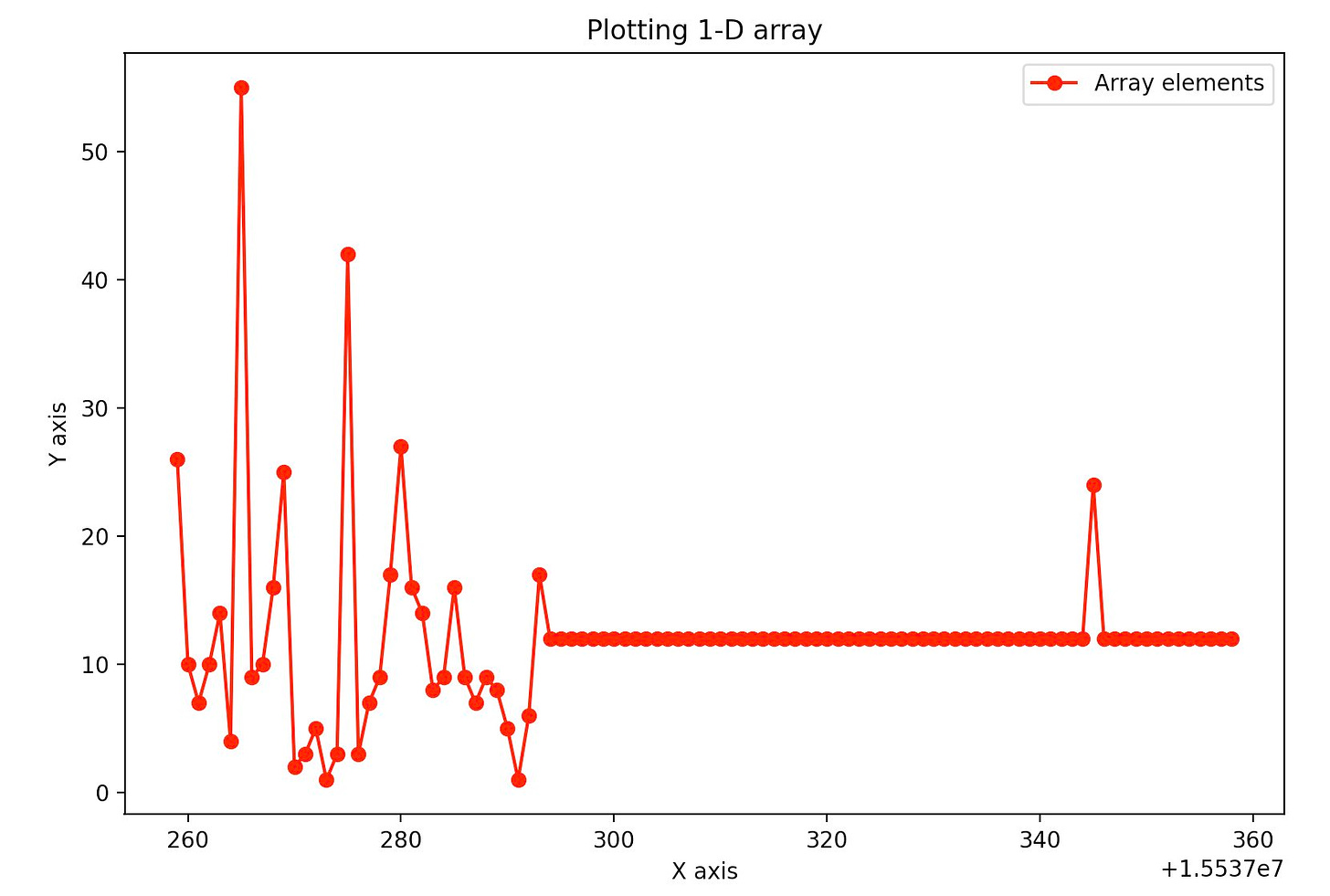

The ETHPoW fork bumbled its way through a series of avoidable technical errors and is currently trading at an anaemic $12/ETHW or ~0.8% of the price of ETH. The majority of Ethereum miners seem to have migrated to Ethereum Classic (~$33/ETC) an old fork of ETH from 2015 whose hashrate lurched cartoonishly upwards to never before seen levels of network activity.

The price of Ethereum itself fell ~16% from ~$1750 the day before the Merge to ~$1465 the day after, roughly the equivalent of ~7-8 years worth of staking rewards. That could imply there were more people interested in betting on people being excited about the Merge than there were people excited about the Merge — or maybe it means gloom about the macro economy overwhelmed any crypto-specific news. The prices of most major NFT projects have been pretty stable in ETH, which means dropping in USD price alongside the price of ETH itself.

Early signs of narrative momentum are already starting to show, however. Hours after the Merge was successful there were supportive announcements from the World Economic Forum and Greenpeace repeating the frustratingly catchy falsehood that proof-of-stake eliminates 99.95% of energy use.1 SEC Chairman Gary Gensler praised the energy-efficiency of Proof-of-Stake and predicted that pressure on Bitcoin's carbon footprint would likely increase.2 Talk has begun of taxing or possibly even outlawing "wasteful" proof-of-work mining. I expect these attacks will likely focus and intensify in the coming months.

Whatever you think of the merits of Bitcoin or proof-of-work mining, outlawing specific uses of energy is a dark path. We talked about the problems it creates back in June when New York was considering a mining ban. As I wrote back then, a tax on mining is an attack on freedom of speech:

Denying people the right to use electricity to perform proof-of-work is a violation of the 1st Amendment. If that sounds a bit abstract, imagine passing a similar rule limiting electricity access for email servers or porn websites. Imagine an environmental regulation saying certain ideas could only be printed on recycled paper.

Regulating Bitcoin miners as a means of controlling carbon is also completely backwards. Bitcoin mining doesn’t produce carbon. Carbon is produced by power generation, not power consumption. If Bitcoin miners were somehow erased from the grid the energy they used would simply be sold to data centers or aluminum smelters instead. Put another way, no power plants turned off this week because Ethereum switched to proof of stake. They just sold power to someone else.

The only energy that is produced exclusively for the Bitcoin network is stranded energy like curtailed renewables and flared methane, both situations which are unambiguously good for the environment. Regulating who is allowed to buy energy (or at what price) doesn’t protect the environment — it protects existing industries from having to compete over the price of power.

Other things happening right now:

We wrote recently about how MakerDAO is struggling with the pressures of centralization from being the largest single holder of USDC, Circle’s centrally backed USD stablecoin. Coinbase has proposed that MakerDAO deposit ~1/3 of their USDC (~$1.6B) in a yield bearing account with Coinbase. I guess if you aren’t worried about the centralizing effects of USDC there’s no real reason to worry about the centralizing effects of depositing it with Coinbase. Once you have one gun to your head a second doesn’t make much difference.

Presented without comment:

Proof of stake does reduce direct electricity usage but that is not the same as total energy usage, which is in turn not at all the same as total environmental impact. In practice proof of stake is actually much worse for the environment but the costs are less easily measured and so they are often treated as though they don’t exist.

Gensler also said that proof-of-stake currencies were likely securities under the Howey Test and would probably be subject to heightened SEC scrutiny, though he emphasized he was not speaking about any specific coin. I assume as he said he was making an exaggerated wink at the audience.