You can't outlaw an idea (even if you hate it)

Plus Bitcoin veterans aren't flinching and a short list of people who should be arrested

In this issue:

You can’t outlaw an idea (even if you hate it)

Bitcoin veterans aren’t flinching yet

In bird culture that is considered a dick move

A short list of people who should be arrested

You can’t outlaw an idea (even if you hate it)

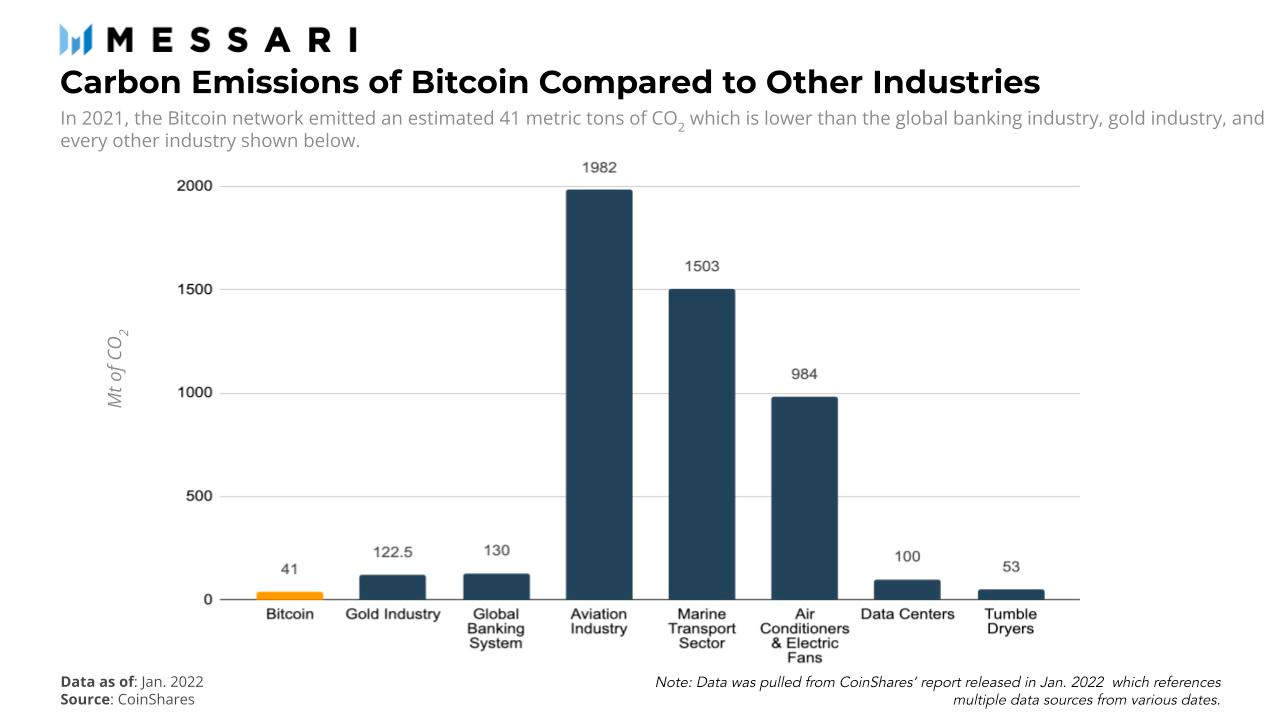

We first talked about SB6486D in May of last year when it passed the New York Assembly. Last Friday a modified form of the bill passed in the last few hours before the legislative session ended at midnight, officially placing a 2 year moratorium new proof-of-work mining operations in the state unless they are exclusively powered by renewable energy sources. I’ve written elsewhere about why Bitcoin uses energy and why we don’t need to fear that energy use — but even if you believe that Bitcoin is a serious environmental concern the law is a bad one.

First SB6486D doesn’t do anything at all to reduce the environmental footprint of cryptocurrency mining network. Proof-of-work mining is a global, competitive landscape. Mining capacity that would have been deployed to New York will simply redeploy elsewhere — and since New York has relatively clean energy that means the total carbon footprint of miners who are affected will probably go up. Cleaning up the Bitcoin network by pushing miners out of New York is like trying to stop teen pregnancies using abstinence only education.

Anti-crypto advocates market themselves as defending the environment but real environmentalists are more practical, which is why to finally pass the bill legislators had to reassign it from the Environmental Conservation Committee (which opposed the bill) to the Energy and Telecommunications Committee (which is chaired by one of the bill’s sponsors). If the goal of S6486D was environmental impact it would regulate power generation, not power use. The best way to reduce the use of coal power is to regulate coal power plants. Much simpler.

In practice, the real goal of the no-coiner lobby is not to make proof-of-work mining cleaner but to eliminate it entirely — which you can see in the recently failed efforts to ban Bitcoin mining in Norway where mining is already 100% renewable. Environmentalism isn’t the focus, it is just one of a laundry list of arguments that cryptocurrency critics rotate through as needed. To quote the "concerned.tech" letter we talked about on Friday:

Blockchain technologies facilitate few, if any, real-economy uses. On the other hand, the underlying crypto-assets have been the vehicle for unsound and highly volatile speculative investment schemes … threats to national security through money laundering and ransomware attacks, financial stability risks from high price volatility, speculation and susceptibility to run risk, massive climate emissions from the proof-of-work technology … and investor risk from large scale scams and other criminal financial activity.

The claim that Bitcoin comes at too high an environmental cost is just misdirection. Their real policy argument is that it shouldn’t be allowed to exist at all.

That points to the larger underlying issue with S6486D — the Supreme Court has held for decades now that software is a form of speech. Denying people the right to use electricity to perform proof-of-work is a violation of the 1st Amendment. If that sounds a bit abstract, imagine passing a similar rule limiting electricity access for email servers or porn websites. Imagine an environmental regulation saying certain ideas could only be printed on recycled paper.

Bitcoin veterans aren’t flinching yet

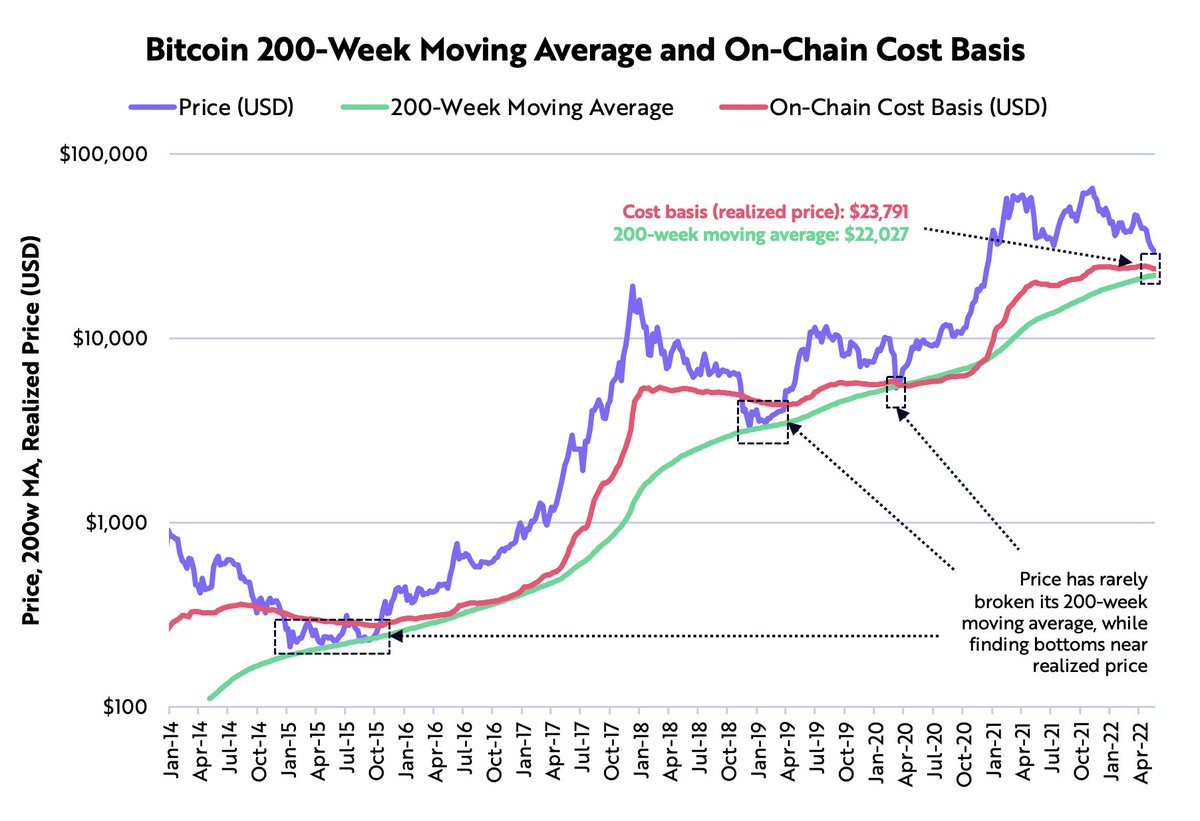

The price of Bitcoin fell every week for 9 consecutive weeks from the end of March through the end of May, the longest consecutive string of falling weekly closes in Bitcoin history. Bitcoin futures have been trading below the spot price of Bitcoin (implying that traders expect the price to fall further) for over six months now — also the longest such stretch in Bitcoin history.

At the tail end of that stretch came the collapse of Terra/Luna when the Luna Foundation Group (LFG) was forced to panic sell 80,000 Bitcoin in a failed attempt to defend the UST peg. The Terra/Luna debacle (which I wrote about in greater detail here and here) and the resulting shockwaves destroyed ~3% of the overall crypto market cap. Cryptocurrency exchanges experienced the largest spike of Bitcoin deposits ever (in USD terms) from investors rushing to sell.

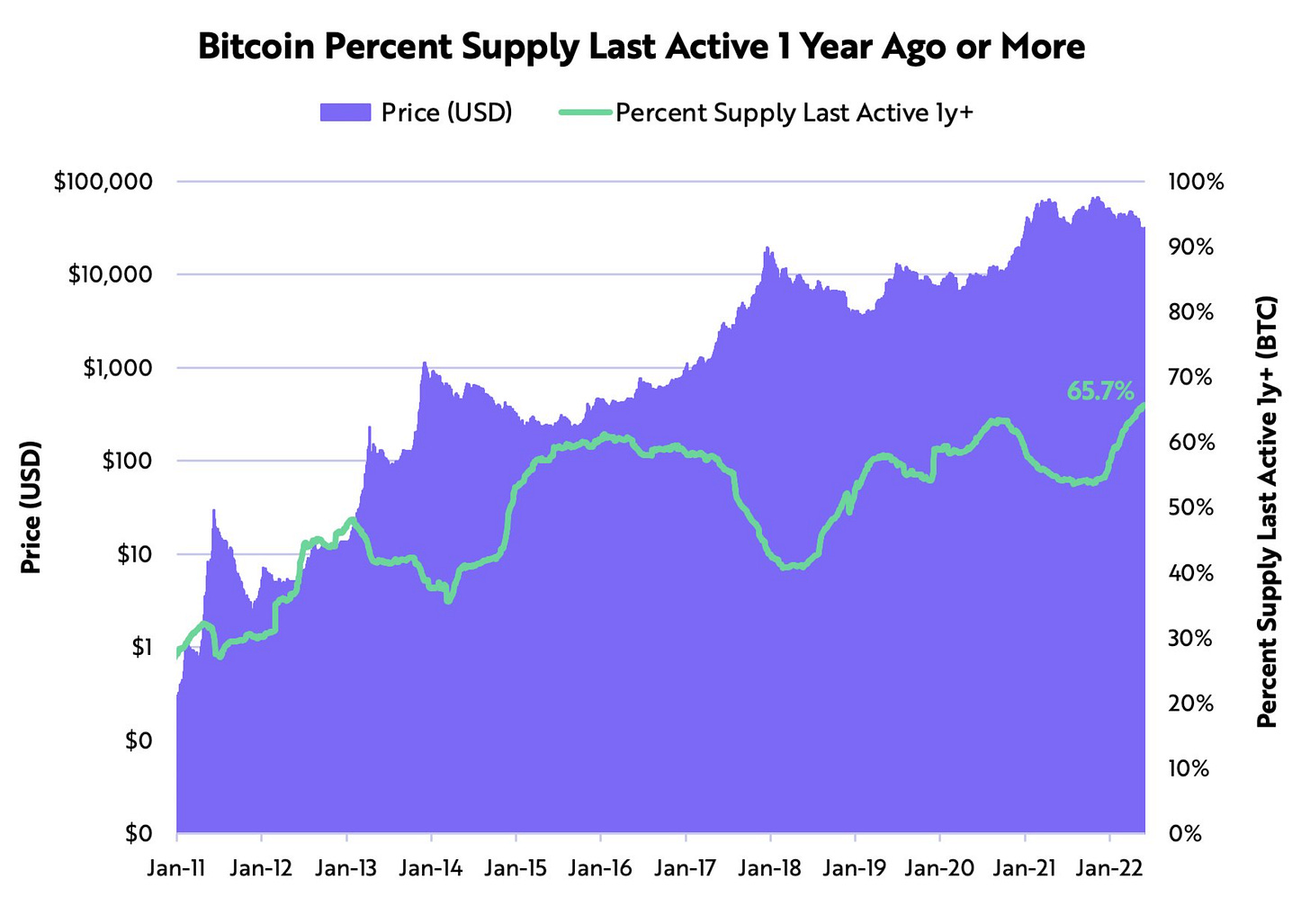

Most of these sellers were short term holders capitulating and selling to more convicted investors. As the graph at the top shows the percentage of bitcoin held for more than a year is ~2/3rds — an all time high. Bitcoin’s price is approaching its 200 week moving average. Historically that’s been a good buying opportunity — which is probably why long-term investors have been buying.

In bird culture that is considered a dick move

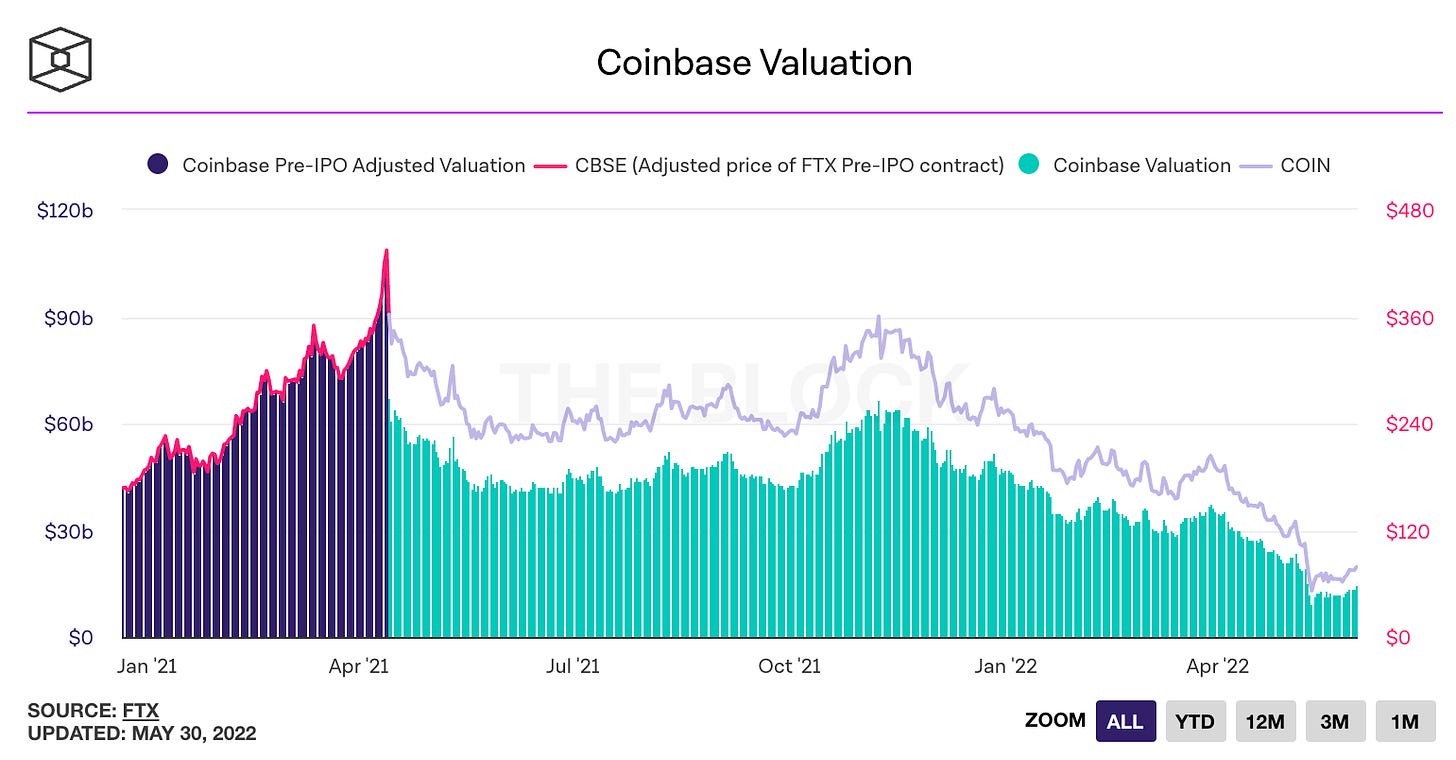

Earlier this month a wave of cryptocurrency exchanges (Gemini, Kraken, Robinhood, Bitso, ShapeShift, etc) all announced layoffs in response to falling revenues in the bear market. Coinbase did not announce any layoffs but it did announce a hiring freeze and did something that was arguably even more drastic: it rescinded a number of signed job offers to candidates they had hired but who had not yet started.

Even worse they sent an email only two weeks earlier with the promise "we will not be rescinding the offers of any employees." Oops. People probably quit their previous jobs for these offers. Some probably moved cities. Interns will lose the chance to get a summer internship. Some immigrants will probably lose their visas.1 In bird culture this is considered a dick move.

Other things happening right now:

Here is an interesting analysis of the Terra (UST) depeg. Most noteworthy in my opinion was this graph of outflows from Anchor. As the peg was failing small investors were actually depositing more (out of misguided loyalty or hope) while large depositors were racing to withdraw. Small retail investors were rushing in to help defend the peg and whales were stealing their lifeboats for exit liquidity. Very grim.

On Friday we talked about the arrest of Nate Chastain (former Head of Product for OpenSea) on charges of wire fraud and money laundering. Chastain’s crimes netted him ~19 ETH (~$60k at the time). There’s no question that what he did was wrong but honestly it feels insane that authorities have decided to prosecute him over other bad actors in the space. Here is a helpful list of people that deserve to be arrested more than Nate Chastain. If any readers knows anyone who works at the SEC, maybe help them subscribe to this newsletter!